Updated March 2020

What is a W8BEN form?

Officially a W8-BEN or W8-BEN-E form is a “Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting”

This essentially means if you are not a US resident but are working with US companies then you need to sign this form to declare your tax status. This means you likely pay tax in your own country and none should be deducted from US payments.

It can be broken down in to three parts:

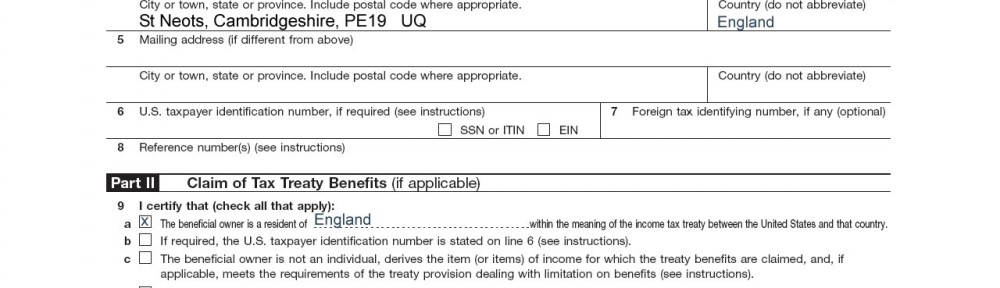

- Part 1. Identification of beneficial owner

This section includes basic name and address data as well as US taxpayer identification if applicable. - Part 2. Claim of Tax Treaty Benefits

This is where you’ll state your country of residence. Question 10 asks about special rates and conditions which can be left blank if you don’t know of any. - Part 3. Certification

Sign off and date the document, note you need to print name under the signature.

As of 2017 there are now two W8-BEN forms, one for individuals and one for businesses.

The form should be submitted to the company that you are working for or receiving payment from. It does not need to be submitted directly to the IRS.

Editing a PDF Document

The easiest way is to use an onine PDF editor. Currently as of March 2020 there are a number of free ones available:

https://www.pdfescape.com/windows/

You can also just search Google for one and scroll past the ads if the above aren’t working or have switched to a paid model.

The online PDF editor will let you add text and position it on the form then resave it again as a PDF. You can therefore complete the form and sign it electronically, then send it back to the requesting company.

If you have any issues there’s additional in depth instructions for each form on the IRS website but unless you have a special case it should be pretty straightforward.

Examples from original blog post

Here are some simple examples of how to complete a W8BEN form which some US networks require you to do before you can get paid.

The first is an example completed for a corporation registered outside the US (i.e. if you want to be paid into your companies bank account). The second is for an individual who wants to be paid into their personal account.

Corporation

Individual