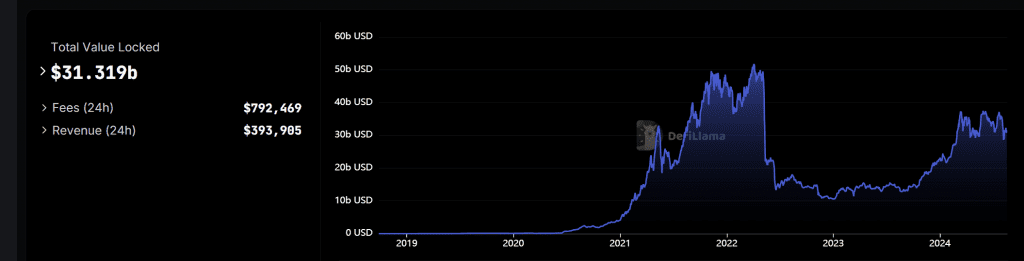

Decentralized finance has opened up many possibilities for holders of digital assets. One of the products which has gained traction over the last few years has been over-collateralized lending which is now a $30+ billion dollar industry.

In this article I’m going to look at how over-collateralized lending works, why would someone want to do it and deep dive into some of the leading protocols.

Basic Mechanics of Over-Collateralized Lending

Over-collateralized lending in DeFi involves depositing a certain amount of cryptocurrency as collateral to borrow another asset. The collateral must be more valuable than the borrowed amount, typically by a margin dictated by the lending protocol. This over-collateralization serves as a security measure to protect lenders from the volatility of the collateralized assets.

- Collateral Deposit The borrower deposits an asset, such as Ethereum (ETH), into a lending platform. This collateral is locked in a smart contract.

- Loan Issuance Based on the collateral value, the borrower can take out a loan in another asset, often a stablecoin like DAI or USDC. The loan to value ratio typically determines the maximum borrowing amount, with common ratios ranging between 50% and 80%.

- Collateral Monitoring The platform continuously monitors the collateral’s value. If the value drops below a certain threshold due to market volatility, the borrower needs to add more collateral or risk liquidation.

- Repayment The borrower can repay the loan at any time, along with any accrued interest. Upon repayment, the collateral is returned to the borrower.

- Liquidation If the collateral value falls too low and the borrower fails to meet a margin call, the platform may liquidate the collateral to cover the loan, protecting the lender’s funds.

Why Lend ETH to Borrow Stablecoins

Lending ETH to borrow stablecoins is a popular strategy in DeFi for several reasons, including tax advantages, the opportunity to maintain ETH exposure, and the use of stablecoins for various purposes.

1. Tax Advantages

In many jurisdictions, selling cryptocurrency like ETH is considered a taxable event, potentially triggering capital gains tax. However, by using ETH as collateral to borrow stablecoins, individuals can access liquidity without selling their ETH, thereby deferring capital gains taxes. This strategy allows users to unlock the value of their ETH without triggering a taxable event.

2. Maintaining Exposure

Holders of volatile assets may be bullish on the long term value. For example some sadistic degen may hold ETH and prefer not to sell it, even when they need liquidity. By lending ETH to borrow stablecoins, users can retain exposure to potential price appreciation while simultaneously accessing stablecoins for spending, investing, or earning yield in DeFi.

3. Expenses and Investments

Stablecoins, typically pegged to fiat currencies like the US dollar, provide a stable medium of exchange, making them ideal for everyday expenses, savings, or further investment in DeFi protocols. Borrowing stablecoins against ETH allows users to leverage their holdings without selling them, using the borrowed funds for various purposes such as making purchases, investing in yield farming, or diversifying into other assets.

Leading Lending Platforms

Several platforms have emerged as leaders in the DeFi lending space, offering robust systems for over-collateralized lending. This section discusses three of the most prominent: AAVE, MakerDAO, and Spark.

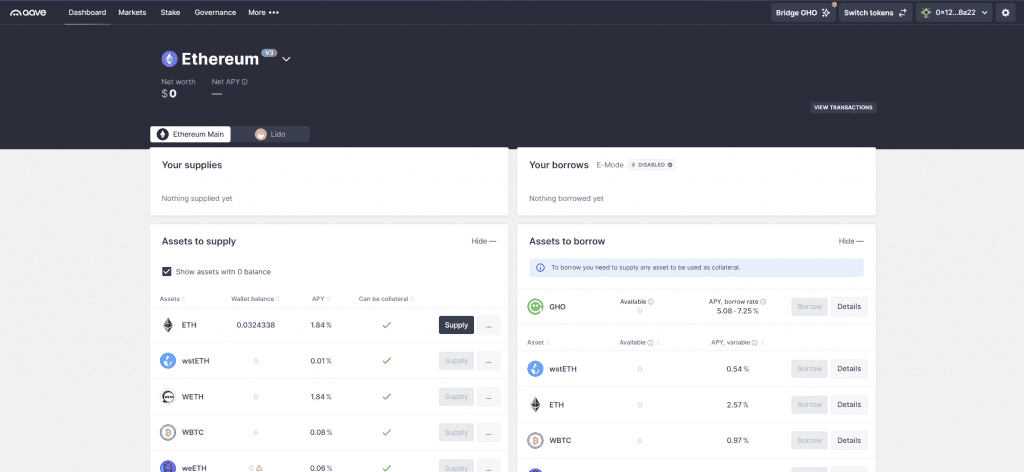

AAVE

AAVE is a decentralized lending platform that allows users to borrow assets against their cryptocurrency holdings. It is known for its wide range of supported assets, flexible borrowing terms, and innovative features like flash loans and variable interest rates.

- Collateralization: AAVE requires users to over-collateralize their loans. The platform supports a variety of assets as collateral, including ETH, BTC, and stablecoins.

- Borrowing Options: Users can borrow multiple assets, including stablecoins, with different interest rate models, either stable or variable.

- Unique Features: AAVE offers flash loans, which allow users to borrow assets without collateral, provided the loan is repaid within the same transaction. This feature is widely used for arbitrage and other advanced DeFi strategies.

AAVE Documentation https://docs.aave.com/

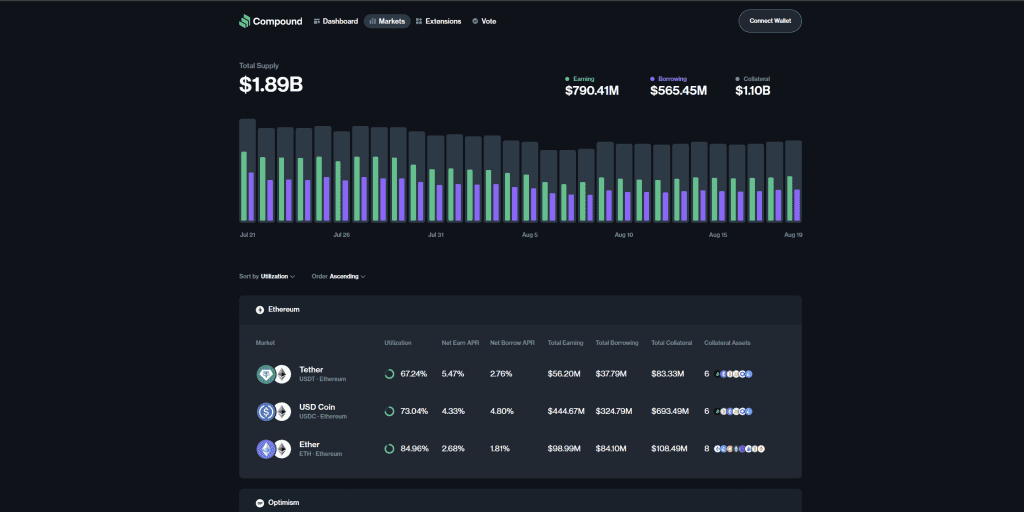

Compound finance

Compound Finance is a pioneer of over-collateralized lending in DeFi, they kicked off the original DeFi summer when they released their COMP governance token.

Compound allows users to earn interest on their cryptocurrency deposits or borrow assets against their holdings. Users deposit cryptocurrencies into liquidity pools, which are then available for others to borrow. In return, depositors receive interest, which accrues in real time. Borrowers must provide collateral that exceeds the value of the loan to secure their position, ensuring the system’s stability. Interest rates on Compound are determined algorithmically based on supply and demand for each asset in the pool.

Compound Finance Documentation https://docs.compound.finance/

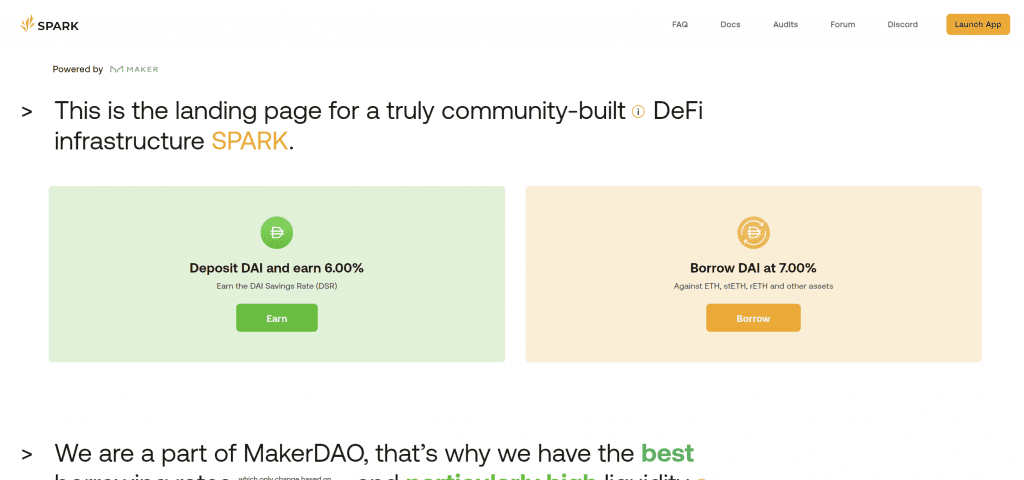

Spark

Spark is part of MakerDAO and has quickly gained attention for its simple approach to lending and borrowing.

- Collateralization: Similar to AAVE and MakerDAO, Spark requires over-collateralization but offers more flexible collateral types and ratios.

- Unique Features: Spark aims to improve the user experience by offering dynamic interest rates and integrating advanced analytics for borrowers to optimize their collateral management.

- Community Governance: Spark places a strong emphasis on community governance, allowing users to participate in decision-making processes related to platform upgrades and new features.

Spark Protocol https://sparkdefi.com/docs

Over-collateralized lending in DeFi represents a powerful tool for unlocking liquidity, enabling users to access funds without selling their assets. By lending volatile assets to borrow stablecoins, users can take advantage of tax benefits, maintain their exposure, and utilize stablecoins for various purposes.

As DeFi evolves, over-collateralized lending is likely to remain a cornerstone of the ecosystem, providing users with a secure and flexible means of accessing liquidity while maintaining control over their assets.