A battle rages for control of DeFi’s biggest protocol as stablecoins fight for liquidity. Million dollar bribes being paid for votes, enemies becoming alliances and an ultimate prize at stake. This article explores why CRV is so valuable and why it likely isn’t the best way to gain exposure to the Curve wars.

- The CRV Money Printer

- The Gauge & veCRV

- Stablecoin Liquidity Wars

- Convex Finance

- Too Many Tokens

- Bribes & Votium.app

- Redacted Cartel

- Gaining Exposure Options

- How I Gained Exposure To The Curve Wars 📺

- Risk Analysis

- Curve vs Uniswap

- Curve Star Wars

The CRV Money Printer

Curve is a decentralised exchange similar to Uniswap but with a linear price curve making it particularly effective for stablecoin liquidity pools. The exchange has grown to be the biggest protocol in DeFi with TVL in excess of $23 Billion USD.

Stablecoins rely on Curve to keep their tokens pegged to the US dollar. If a fund wanted to trade $10m USDT for USDC then they would likely use Curve because it provides instant liquidity and low slippage.

So when Abracadabra launched a new stablecoin called MIM the developers wanted to increase trading volumes and reinforce the peg to the USD. So how do they incentivise Curve liquidity?

Curve rewards liquidity providers with a combination of trading fees and CRV governance tokens. For MIM to incentivise their liquidity pool they need to control the flow of the CRV governance token to make it more attractive than other pools.

A set amount of CRV is distributed each day and Curve has a governance system to decide which pools receive those rewards. This is where the fight begins, to control the flow of CRV is to control the largest liquidity pools in the world.

The Gauge & veCRV

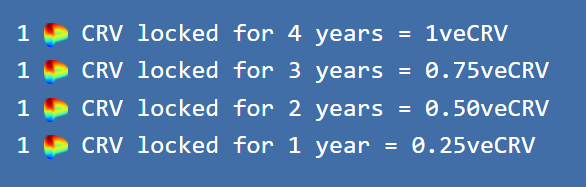

How much CRV rewards each pool gets is determined by the relative weight of the gauge. Holders of CRV need to luck up their CRV tokens for up to 4 years to gain veCRV (Vote Escrowed Curve) and be able to vote.

This locking of the governance token has a market benefit because it prevents it being sold on exchange. Around 50% of all CRV is currently locked with an average lock time of 3.64 years*.

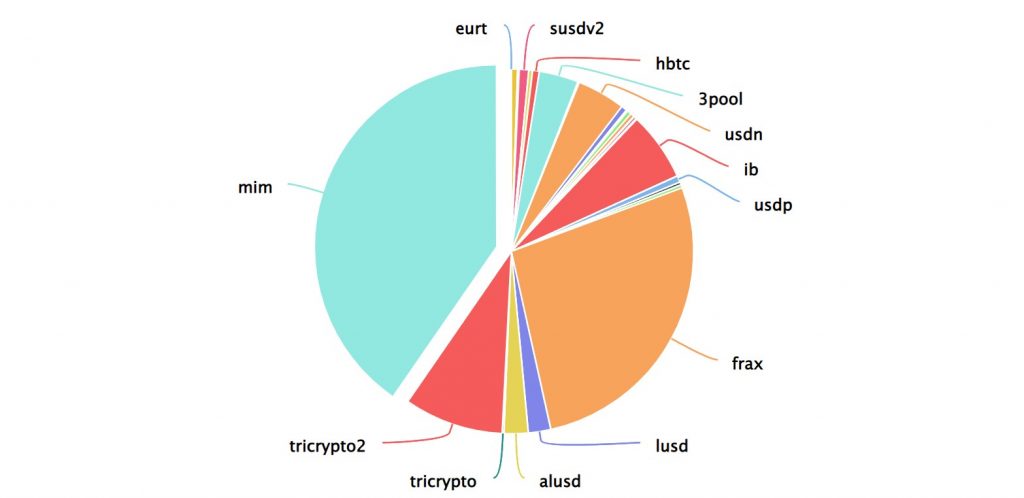

The gauge is currently distributing CRV as follows:

Stablecoin Liquidity Wars

The appetite for investment in yield bearing stablecoins is growing at an incredible pace. The interest rates are far higher than what is available in traditional finance and this is attracting larger funds and institutional money to DeFi.

Tether (USDT) and Circle (USDC) are centralised stablecoins where a company accepts US dollars and provides a token based on wavering trust that it can always be redeemed. Decentralised stablecoins such as DAI, MIM and FRAX aim to maintain a peg to the US dollar through a lending protocol which locks up assets in return for being able to mint the stablecoin.

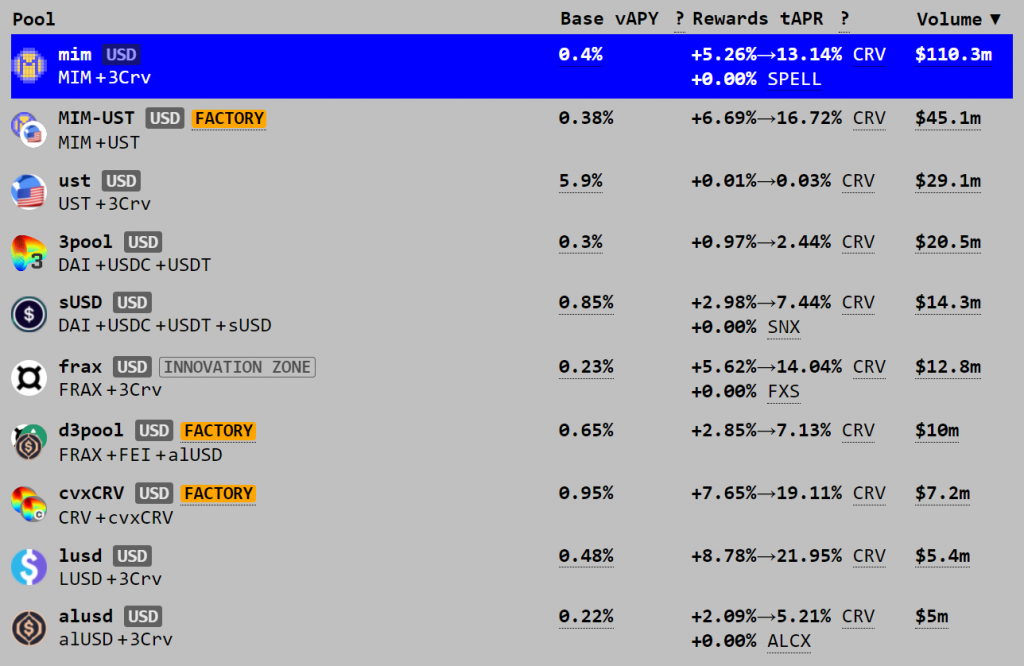

Here are the top liquidity pools by trading volume currently on Curve.

You can see different pools are being incentivised with varying amounts of CRV rewards boosting the APR’s for liquidity providers.

If a hedge fund wants to gain some of that yield they have to go buy/mint the stablecoins from the company/protocol and the deposit them into the pool.

The higher the APR’s the more money flows in to the stablecoin pools and the total TVL on Curve now exceeds $23B. This is the market dynamic that fuels the Curve Wars but it get’s more interesting and complex.

Convex Finance

Around the same time that Coinbase was listing it’s IPO a group of developers saw this competitive environment emerging. They launched Convex Finance which incentivised holders of CRV to stake them on their “Boosted Curve Staking” platform.

The Catch: Staking CRV tokens to get cvxCRV is a one way process. They can never be unstaked. Users can only trade them back to CRV using the incentivised CRV + cvxCRV liquidity pool on Curve. 🤯

Convex was phenomenally successful and they now control over 50% of the total supply of the Curve governance tokens.

This didn’t however stop the war. It just shifted the battlefield as attention turned to controlling the Convex Protocol.

Too Many Tokens

At this point the number of tokens can get confusing so I think it makes sense to put a table together to explain what each of them mean.

| Protocol | Ticker | Description |

|---|---|---|

| Curve | CRV | Curve Incentive Token |

| Curve | veCRV | Vote Escrowed Curve Voting Token |

| Convex | CVX | Convex Incentive Token |

| Convex | cvxCRV | Curve Locked On Convex |

| Convex | vlCVX | Vote Locked Convex Voting Token |

Convex’s dominant control of Curve’s gauges are governed by a delegated voting system where Convex users lock up their CVX (only for 16 weeks) and appoint an address to vote on their behalf.

Bribes & Votium.app

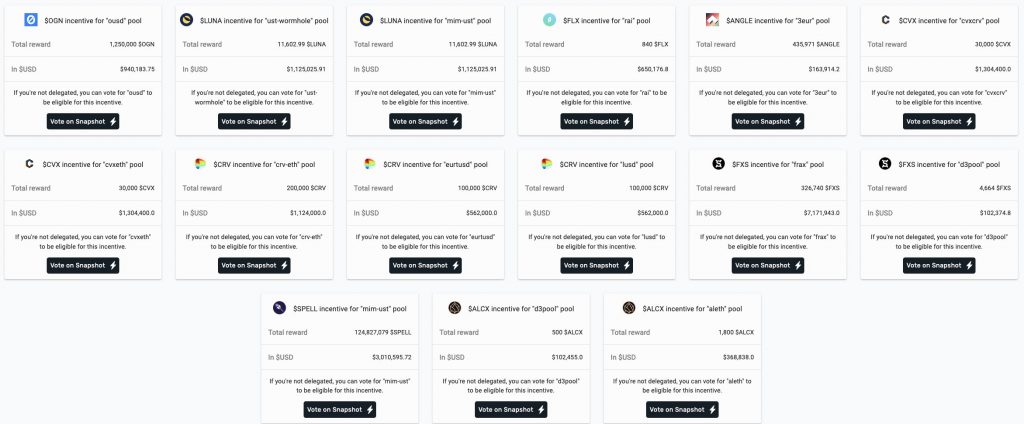

The most popular delegate is another DeFi protocol called Votium. The point of Votium is to accept bribes for votes and redirect those funds to the Convex users that delegated the responsibility to them.

Again this is big business and in a single week we saw over $18m paid in bribes via the Votium application.

So this is where it ends with lucrative bribes for CVX votes on CRV incentives? Nope.

Redacted Cartel

“[REDACTED] Cartel is a yield-aggregator’s yield-aggregator. It’s the uber-Convex. It is perhaps the monster sitting on the other side of the event horizon” – From the official docs*

As you can probably tell Redacted Cartel isn’t marketing itself to institutional investors. The idea behind it however is quite compelling.

Imagine being able to combine some of the rebasing tokenomics made popular by Olympus DAO with the demand for votes created by the curve wars. Redacted forked OHM and modified it to incentivise the staking of Curve and Convex tokens.

It’s early days and the protocol has just launched in December however it already has a $300m market cap and controls more than 10% of the Curve gauge. One area of concern is that the treasure funds are all held in a manual multisig wallet* which adds a risk factor based on trust in developers.

Redacted’s BTRFLY token is beyond my appetite for risk but it’s worth investigating none the less as it has the potential to further disrupt the curve wars.

Gaining Exposure Options

Direct exposure to the curve wars could be gained by purchasing CRV on Binance. However CRV is a farm token that is being distributed to liquidity providers. The supply is being sucked up and it’s outperforming ETH currently however holding CRV alone doesn’t provide any upside from bribes, convex or staking incentives.

For my portfolio I wanted to gain exposure to the demand for Curve and Convex with minimal risk. I value liquidity and didn’t want to lock funds for years at a time.

There are two options on Convex to do this.

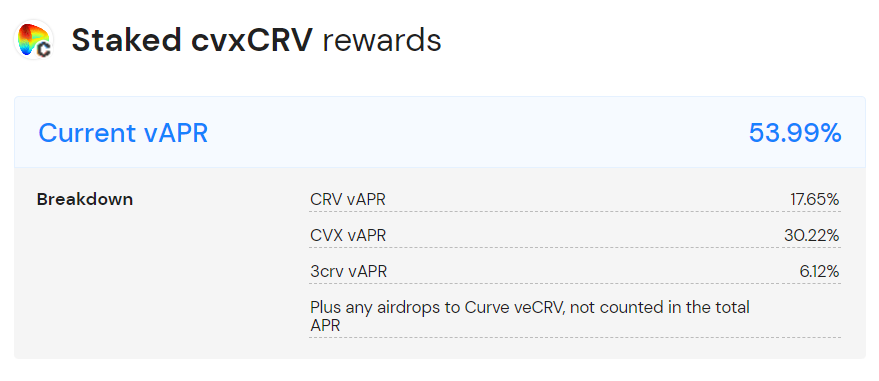

Buying & Staking The cvxCRV Token

This currently provides a 54% variable APR dependent on trading fees.

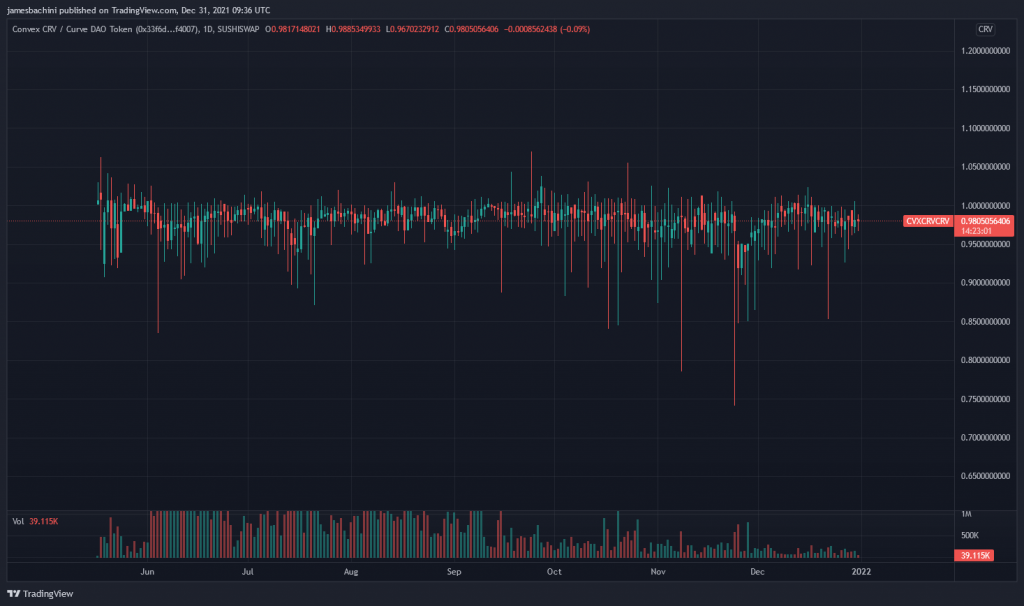

cvxCRV tokens can be traded openly on Sushiswap where there is a $5m liquidity pool. For larger amounts it may be beneficial to purchase CRV and stake or trade against the larger liquidity pool on Curve for CRV-cvxCRV.

This however doesn’t provide direct access to the bribe incentives.

Buy CVX & Delegate To Votium

This strategy is a lot more involved as tokens are locked for 16 week periods at a time and there are a number of transactions on Ethereum layer 1 to claim fees, bribes and lock tokens.

I did some rough calculations and at current gas fees transactional costs are going to equate to around $2000 USD / Year.

The yield on this strategy is really hard to predict as each round of bribes is different and returns are volatile. I’d expect it to outperform the staked cvxCRV strategy but only for amounts greater than $50,000 USD. It’s also more involved and is going to take a bit of work to manage.

How I Gained Exposure To The Curve Wars

I decided that the best option for my portfolio was to use a passive limit order bid bot on Binance to start buying up CRV. Then I modified a Sushiswap trading bot to execute trades on CRV-cvxCRV when price falls below a set level. cvxCRV tokens are then staked to earn the 54% APR and airdrops discussed above. Roll the camera…

There was at least one other bot trading this market on Sushi at the time and whenever price dropped it was taking all the liquidity and pushing it back up. I ended up getting filled at a decent average price which provided a margin of safety.

To close the position I’ll need to reverse the process and unstake the tokens on Convex, trade them back to CRV on Sushi and then trade that for USD or ETH. Trading the other way might be better value on the CRV-cvxCRV pool on Curve.

Risk Analysis

Curve is popular because it’s deemed a safe venue for assets. This is critical to the protocol and investment thesis.

The smart contracts have been deployed since August 2020 so in DeFi terms it’s Lindy. The contracts have been audited and analysed by some of the brightest minds in the industry. It’s impossible to rule out smart contract risk but Curve is at the top end of the ecosystem in terms of trust in the code.

Convex adds another layer of smart contracts on top of this which are less mature. There was a pre-launch audit carried out by Mixbytes but it would be nice to see more recent audits undertaken.

https://github.com/mixbytes/audits_public/tree/master/Convex%20Platform

The co-founder of Curve is Michael Egorov who was also founder of NuCypher in 2015. Convex is run by anonymous developers but with the support of Curve. Curve community managers stated that “Curve will be supporting Convex and they have reviewed the codes of Convex”. At this point it seems a rug pull is unlikely just because it would have happened already.

Liquidity on the cvxCRV token is somewhat of a concern due to the irreversible staking mechanism. Currently the CRV-cvxCRV pool on Curve has 19m CRV tokens available or roughly $100m USD. The price is 0.9777 and this would fall lower if there was ever an event that caused a loss of confidence in Convex and a run on the liquidity pool. $100m is a lot but not when there’s $19B locked in the protocol. If something goes wrong then the position will likely become illiquid very quickly and without a trading bot monitoring the liquidity pools it will be very hard to pull capital before everyone else.

cvxCRV has traded at a 25% discount in the past. I would love to see an opportunity to buy at those prices again but probably so would everyone else and it gets arbitraged away pretty quick.

Curve vs Uniswap

I am still shocked that Uniswap v3 didn’t release a more competitive product for stable pairs. They provided multiple fee structures which helped somewhat but how much more effort would it take to add an option for a more linear price curve. In defence most of the criticism around v3 has been that it’s too complex which is likely why they opted not to add more complexities and options for pool creators.

There is a chance that the next version of Uniswap or an a competitor like Sushiswap will release a competitive product in this area and this is a risk but it’s also an opportunity for Curve.

Curve v2 is believed to be in development and it’s going to be a direct competitor to Uniswap. A whitepaper detailing the technology is available here:

https://curve.fi/files/crypto-pools-paper.pdf

The idea is to use a price oracle to concentrate liquidity automatically so liquidity providers don’t have to manually update their positions.

Uniswap v3 improved on Uniswap v2 by concentrating liquidity positions making capital more efficent but this needs to be done manually or via a bot to keep the position “in range”. Curve’s proposal uses a price oracle to automatically follow the price (assumedly across centralised exchanges and other marketplaces) concentrating liquidity and tightening capital efficiency in the process.

There’s a fair chance that Curve could be about to disrupt the entire AMM market. One thing to note is that Uniswap gets a lot of volume from the long tail of low market cap tokens that don’t have a centralised exchange listing yet. To my understanding Curve v2 will focus on the larger, established markets where dependent oracles are available.

So for the latest hot new microcap tokens people will still probably use Uniswap or Pancakeswap however for the majors this could be game changing. If Curve gets this right and attracts liquidity then it could become considerably more efficient to trade the top 20 tokens and wrapped coins on Curve rather than on centralised exchanges for large orders.

Curve Star Wars

If Curve v2 becomes more cost effective for trading BTC/USD than centralised exchanges more trading volume will move off-chain which will attract more liquidity in a vicious circle of growth. This could also lead to more Bitcoin being wrapped into wBTC and renBTC and moving on to Ethereum in a search for yield.

If this does happen then the vast pools of capital could become the ultimate backbone of DeFi. The next obvious step would be to build derivative products and vaults on top of Curve v2’s liquidity pools. Perpetual futures contracts, options protocols and yield farming vaults.

The one key issue is that all of this is on layer 1 and it’s becoming more expensive to use. I think we will eventually see trading platforms operating on layer 2’s where transaction costs are low for end users with back-end bridges back to L1 to balance the books. Imagine a trading platform on Arbitrum or ZKsync with a great UX which provides capital efficiency by tapping into Curve v2 on layer 1. Trades across the platform are balanced and any exposure left over is hedged using Curve to provide users lower funding rates.

This is likely a long way off and the bridging and cross-chain data communications isn’t in place yet to make it viable. However it provides one possible future scenario where the Curve becomes the critical liquidity engine for decentralised finance.