Trading

-

Can ChatGPT & Keras Predict The Price Of Bitcoin

I get asked a lot if ChatGPT can be used for trading and I normally say “no, it’s a language model which isn’t designed to find market patterns in numerical price data”. ChatGPT works more like predictive text in a search engine or on your phone but what it is good at is writing code…

-

DeFi Whale Watching Tutorial & Code

Imagine if you could tap into the strategies of top investors and see where the smart money is allocating capital? Welcome to the world of DeFi whale watching, where tracking high net worth wallets can give you the edge and open up new Whale Watching Explained DeFi whale watching involves tracking the investments of “smart…

-

Crypto Market Thesis 2024

The crypto market has experienced significant recovery this year, with Bitcoin’s value surging from $16,500 to over $40,000. Growth was shadowed by increased regulatory scrutiny, particularly impacting centralized exchanges. The Bitcoin halving in April 2024 is poised to be a pivotal event, historically triggering market rallies. The potential January approval of Bitcoin spot ETFs could…

-

TradingView Pine Script Examples | Master Pine Script With 6 Real World Examples

TradingView’s Pine Script coding language has emerged as the leading tool for traders looking to craft custom indicators and strategies with accuracy and ease. In this Pine Script tutorial I’ll provide a practical gateway into the intricacies of this coding language, tailored with useful examples to get you started. Whether you’re a novice coder or…

-

GEAR Gearbox Protocol | DeFi Analysis Report

Gearbox Protocol introduces a framework for both passive lenders and active borrowers. It empowers traders with leverage that can be used to scale up trades and yield farming strategies on decentralized exchanges such as Unsiswap and Curve. With an emphasis on composable leverage, zero funding rates, and permissionless strategies, Gearbox Protocol is an compelling microcap…

-

How I Track Developer Activity For Crypto Projects

In this article I’m going to share how to track developer activity for crypto projects for fundamental analysis. James On YouTube Watch On YouTube: https://youtu.be/DTI7ELSA6CA |Subscribe Understanding the Crypto Development Ecosystem Cryptocurrencies like Bitcoin and Ethereum as well as the majority of blockchain projects are fundamentally software. They are applications that run on a decentralized…

-

eBTC How To Trade The Flippening

eBTC is an over-collateralized digital asset pegged to the price of Bitcoin which can be minted using stETH as collateral. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to eBTC at time of writing. Do your own research, not investment advice.…

-

MUX Protocol | DeFi Analysis Report

MUX is a decentralized trading platform offering slippage free trades and 100x leverage. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to MUX at time of writing. Do your own research, not investment advice. The first thing that jumps out about…

-

How I Built A Smart Money List On Twitter

X formerly known as Twitter includes two features which allows us to create a list of accounts from people that frontrun narratives and successful trades. tl;dr if you just want to see the final list it is here: https://twitter.com/i/lists/1712044491618545903 James On YouTube Watch On YouTube: https://youtu.be/4qYraarbsYs |Subscribe Step 1. Collecting Project Data My main focus…

-

Brine Finance | DeFi Analysis Report

Brine Finance is a decentralized orderbook exchange built on Starkware. They recently raised $16.5m at a valuation of $100m in a round led by Pantera Capital. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to Brine at time of writing. Do…

-

HyperLiquid | Decentralized Perpetual Futures Trading

Hyperliquid is a decentralized exchange that specializes in perpetual futures contracts. It’s seen modest growth through a difficult bear market and has a frontend remarkably similar to FTX. Let’s dive in. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to HyperLiquid…

-

VEGA DeFi Derivatives Protocol | DeFi Analysis Report 🔍

VEGA is a dedicated appChain built for decentralized derivatives such as futures and options contracts. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to VEGA at time of writing. Do your own research, not investment advice. Vega is a infrastructure layer…

-

ApeX Pro | DeFi Analysis Report

ApeX Pro is a non-custodial decentralized orderbook exchange which is part of the ByBit group. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to ApeX at time of writing. Do your own research, not investment advice. What Is ApeX Pro?…

-

Uniswap v4 Hooks

Hooks in Uniswap v4 are external contracts that execute specific actions at certain points during the execution of a liquidity pool. These hooks provide flexibility and customization options for developers to create additional features for liquidity pools. Uniswap v4 hooks can be used to: A 3rd party developer can write a solidity hook contract with…

-

crvUSD Curve Stable | DeFi Analysis Report

Curve finance recently launched their own stablecoin crvUSD. I was lucky enough to meet one of the developers working on crvUSD at ethDenver and have been impressed with the product and how it has been rolled out. It is an algorithmic stablecoin with massive potential backed by one of the biggest names in DeFi, let’s…

-

FTX 2.0 ReLaunch

FTX 2.0 is a proposed relaunch of the cryptocurrency exchange FTX.com, which filed for bankruptcy in November 2022. The FTX exchange was a profitable business, earning a small percentage from trading fees. However depositors funds were used to cover up losses from partner trading firm Alameda Research. Alameda also provided market maker services across all…

-

Lybra Finance | DeFi Analysis Report

Lybra Finance allows stETH stakers to mint the eUSD stablecoin which has a 7.2% APY. This is a write up of my internal research notes, this is not a sponsored post however I have purchased an allocation of LBR Lybra Finance’s governance token in my personal portfolio. Do your own research, not investment advice. Update…

-

Uniswap Market Maker Bot | Managing Token Liquidity On Uniswap

In this tutorial I am going to go through how I built a market maker bot to manage liquidity on Uniswap v3 for a token pair. The idea is to create a automated trading bot which buys tokens when price falls below a base line value and sells tokens when price is above the base…

-

Trading The Lifecycle Of Crypto Narratives

The blockchain sector moves fast and attention shifts rapidly as crypto narratives emerge inflating valuations for sub-sectors before moving on to the next big thing. In this article I’m going to outlay my research into the lifecycle of crypto narratives to explore how we can best position our portfolios and allocate funds in a +EV…

-

Defending Against Sandwich Attacks and MEV | A Guide to Flashbots Protect

By using a private mempool such as Flashbots protect, Ethereum users can protect themselves against MEV (maximum extractable value) including sandwich attacks. It doesn’t cost anything to use and is easy to setup with existing digital wallets, such as Metamask. Sandwich Attack Protection MEV refers to the potential profit that miners can extract from the…

-

What is Pepe | A Memecoin Story

The Pepe memecoin is a cryptocurrency based on the Pepe the Frog meme, which originated on the imageboard website 4chan in 2005. The meme gained mainstream popularity in 2016 when it was adopted by supporters of then-presidential candidate Donald Trump. PepeToken is an ERC20 token on the Ethereum blockchain. It is widely traded across many…

-

Technical Analysis For Crypto Degenerates

For cynics technical analysis is seen as astrology for middle aged white guys for others it is the holy grail, which when mastered, inevitably leads to trading success. The truth is somewhere in the middle, it is undeniable that price action reacts more at some levels than others. It’s important for anyone involved in investing…

-

DeFi Futures – GMX vs DyDx

Trading DeFi Futures products on decentralized exchanges such as GMX and DyDx has never been easier. The user experience is getting close to on par with centralized exchanges. Liquidity however, not so much… In this article we will look at how DeFi futures work, the market opportunity for decentralized futures exchanges and the two most…

-

Crypto Market Thesis 2023

Once viewed as a fringe market for tech-savvy libertarians, the crypto market has grown exponentially in recent years and is now being recognized as a legitimate asset class by mainstream investors. As we move into 2023, the crypto market is at a crucial juncture, with the potential to continue its explosive growth or face regulatory…

-

Trading The Merge

Once or twice a year the crypto markets align to provide exceptional trading volumes and volatility. I believe the Ethereum merge will presents one such opportunity for low time frame system trading. James On YouTube Watch On YouTube: https://youtu.be/3ltpF4UGir4 |Subscribe About The Ethereum Merge The merge is happening in just a few days. This is…

-

GameFi 2.0 | Sustainable Tokenomics & Business Models

GameFi utilises digital assets such as cryptocurrency tokens and NFT’s to create internal economies within games. In this article I look at how tokenomics can be designed to create sustainable business models for gamers, investors and developers. James On YouTube Watch On YouTube: https://youtu.be/Ul_Mza9IyYE |Subscribe GameFi 1.0 Play2Earn Growing up I played computer games on…

-

Bear Markets | How Human Psychology Works Against Us

Is loss aversion causing long-term underperformance in our portfolios? In bear markets I find it harder to rebalance my portfolio and allocate capital to riskier investments. This creates an unintentional de-risking in bear markets where there is a better long-term risk to reward. James On YouTube Watch On YouTube: https://youtu.be/6F1Cpk14stE |Subscribe Not a financial advisor,…

-

Blood in the streets for crypto markets

A year ago I outlined my 60/40 digital asset portfolio which was 60% crypto and 40% USD stablecoins. One of the biggest benefits to this portfolio is that during market downturns it leaves you with capital to deploy. Today has been one of the most chaotic days in crypto markets ever and I’m going to…

-

Which Token Will Coinbase List Next?

Coinbase has come under criticism for insider trading which has led them to open up about what tokens they are considering listing in the future. In this article we will look at the opportunity this brings alongside an analysis of all 50 projects. We will end by looking at how we can identify and track…

-

Why The PoS Basis Trade Will Generate $100B TVL

Proof of stake revenue provides a new opportunity for investors and funds to collect double digit APR’s on a PoS basis trade pegged to the USD. A basis trade (aka cash and carry) involves buying an asset and then short selling the same futures contract. Traditionally this has been to collect the funding premium on…

-

The Rise Of DyDx And Decentralized Trading

In May 2016 Bitmex launched the XBTUSD market, a perpetual futures contract which simplified traders ability to bet on the price of Bitcoin going up or down. Today perps are traded on the major exchanges at higher volumes than the underlying spot assets. DyDx took this concept and packaged it in to a decentralized trading…

-

Introduction To DEX Arbitrage | Intermediate Solidity Tutorial

This Solidity tutorial will provide an introduction to DEX arbitrage with real, working, profitable open-source code. Solidity developers have the ability batch multiple swaps together and if they are not profitable revert the entire transaction only paying the transaction fee. The creation of EVM blockchains which have low transaction fees has created a playground for…

-

How To Trade Crypto | Ultimate Guide To Trading Bitcoin, Ethereum & Altcoins

This ultimate “How To Trade Crypto” guide is provided for educational purposes. I am not a financial advisor, not financial advice. The vast majority of active trading in crypto markets is done on centralized exchanges such as Binance and FTX. The high volumes on perpetual futures on both exchanges has proven the demand for leveraged…

-

When Will Ethereum 2.0 Launch & The Triple Halving Event

Ethereum 2.0 is the biggest update that the crypto sector has ever seen. A series of rollouts will include a migration to proof of stake, sharding and the highly anticipated triple halving event. This article will discuss the roadmap for these rollouts, what changes each update will implement and the possible effects. Ethereum 2.0 Roadmap…

-

Synthetic Assets | A Regulatory Nightmare

This article is derived from a chapter in the free eBook explaining DeFi technologies:DeFi Demystified | An Introduction To Decentralized Finance Synthetic assets are a form of derivative product in decentralised finance. Synths are created which follow the price of an underlying asset. For example sTSLA will follow the stock price of Tesla and can…

-

The Rise Of Automated Market Makers

This article is derived from a chapter in the free eBook explaining DeFi technologies:DeFi Demystified | An Introduction To Decentralized Finance In late 2017 all the tokens were on Ethereum and it made sense that someone would eventually build a decentralised digital asset exchange. The first popular one was called IDEX and it followed the…

-

Understanding Squeeth | A Token To Track ETH² From Opyn

Squared ETH or Squeeth is a perpetual options protocol that provides unlimited upside leverage with no liquidations on long positions. Squeeth isn’t just a tool for traders, it can be used as a hedge for liquidity providers on Uniswap and it can provide a funding rate yield in sideways markets. This article starts at the…

-

Aurora | Near Protocol’s Explosive EVM Blockchain

Money flows in and out of DeFi ecosystems like the changing of the tide. In 2021 fifteen different blockchains exceeded one billion us dollars in total value locked. The early adopters who stay ahead of the money flow tend to make the highest returns. Aurora looks set to become another billion dollar DeFi ecosystem. This…

-

The Truth About Where Yield Comes From In DeFi

Interest rates in traditional banks are 0.1%, have you ever wondered how DeFi yield farmers are getting 20-100% yields on their digital assets? Is it sustainable wealth creation or a giant ponzi that risks collapsing in on itself. That’s the question we are going to explore in this article looking at where yield comes from…

-

How To Make Cross Chain Transfers With Multichain

I’ve seen Anyswap popping up more and more in on-chain analytics reports as it’s grown to be a six billion dollar protocol by TVL. The platform just rebranded to Multichain and its fast becoming the market leader in cross chain bridges. If you want to transfer USDC from Ethereum to Polygon or Fantom or another…

-

Curve Wars | The Best Way To Gain Exposure To The Curve Wars

A battle rages for control of DeFi’s biggest protocol as stablecoins fight for liquidity. Million dollar bribes being paid for votes, enemies becoming alliances and an ultimate prize at stake. This article explores why CRV is so valuable and why it likely isn’t the best way to gain exposure to the Curve wars. The CRV…

-

Crypto Market Thesis 2022 & Current Portfolio Holdings

This article outlines my thoughts and predictions for crypto markets heading in to 2022. At the end of the article I share my allocations and plans for this year. Crypto Market Thesis Video James On YouTube Watch On YouTube: https://youtu.be/ogBcbwuasWw Bitcoin Market Outlook Crypto markets have cooled off significantly since summer 2021 but expectations are…

-

Crypto Market Volatility | List Of 100 Altcoin Betas Relative To Bitcoin

In this study we are looking at crypto market volatility and how different altcoins markets move relative to Bitcoin. For example if Bitcoin moves up or down 1% Solana will roughly move double that amount for various reasons discussed below. Crypto Market Volatility List FTX Market Beta Volume BTC-PERP 1.01 $4609m ETH-PERP 1.29 $4471m SOL-PERP…

-

How To Create A TradingView Indicator | Easy Pinescript 5 Tutorial

In this Pinescript tutorial we will build out a simple TradingView indicator using the latest version of Pinescript v5. TradingView Indicator Tutorial This video goes through the Tradingview indicator tutorial with more details and code snippets available in the article below. James On YouTube Watch On YouTube: https://youtu.be/gWw6Hv3CuBU Getting Started With Indicators TradingView indicators are…

-

DeFi Risk | A Framework For Assessing & Managing Risk in DeFi

The high yields available in decentralised finance come with a downside. DeFi risk is real and if you are participating in the markets then you should know how to assess and manage that risk. By building a risk assessment framework for yield farms and DeFi opportunities we can better assess fair value and allocate capital…

-

How To Short Sell Crypto

Short selling the best asset class of the the last 10 years is a risky venture at the best of times. However there are situations where it can be profitable to get the shorts in while markets or individual token valuations are crashing. In this article I’ll be explaining how to short sell crypto such…

-

Crypto Research | Due Diligence & How To Find The Next 10x Token 🧐

When market conditions are right there are abundant opportunities in seeking out high quality and early stage crypto projects. In this post I’ll walk-through my crypto research process from screening and researching crypto projects to due diligence and tokenomics. An Introduction To Crypto Research James On YouTube Where To Find New Crypto Projects Being early…

-

Impermanent Loss Calculator | How To Calculate And Mitigate DeFi’s Biggest Risk

Impermanent Loss Calculator Enter the quantities for the two assets in a full-range liquidity pool and a future price ratio to find out what the impermanent loss would be: Base Asset Qty: Token Asset Qty: Future Price Ratio: Calculate How Impermanent Loss Is Calculated In this article we will look at what impermanent loss is,…

-

Bitcoin ETF | Why A Bitcoin ETF Changes Everything

On Tuesday 3rd August the head of the SEC gave the clearest signal yet that they are readying for the approval of the growing list of Bitcoin ETF products awaiting regulatory approval. “I look forward to the staff’s review of such filings, particularly if those are limited to these CME-traded Bitcoin futures” Gary Gensler @…

-

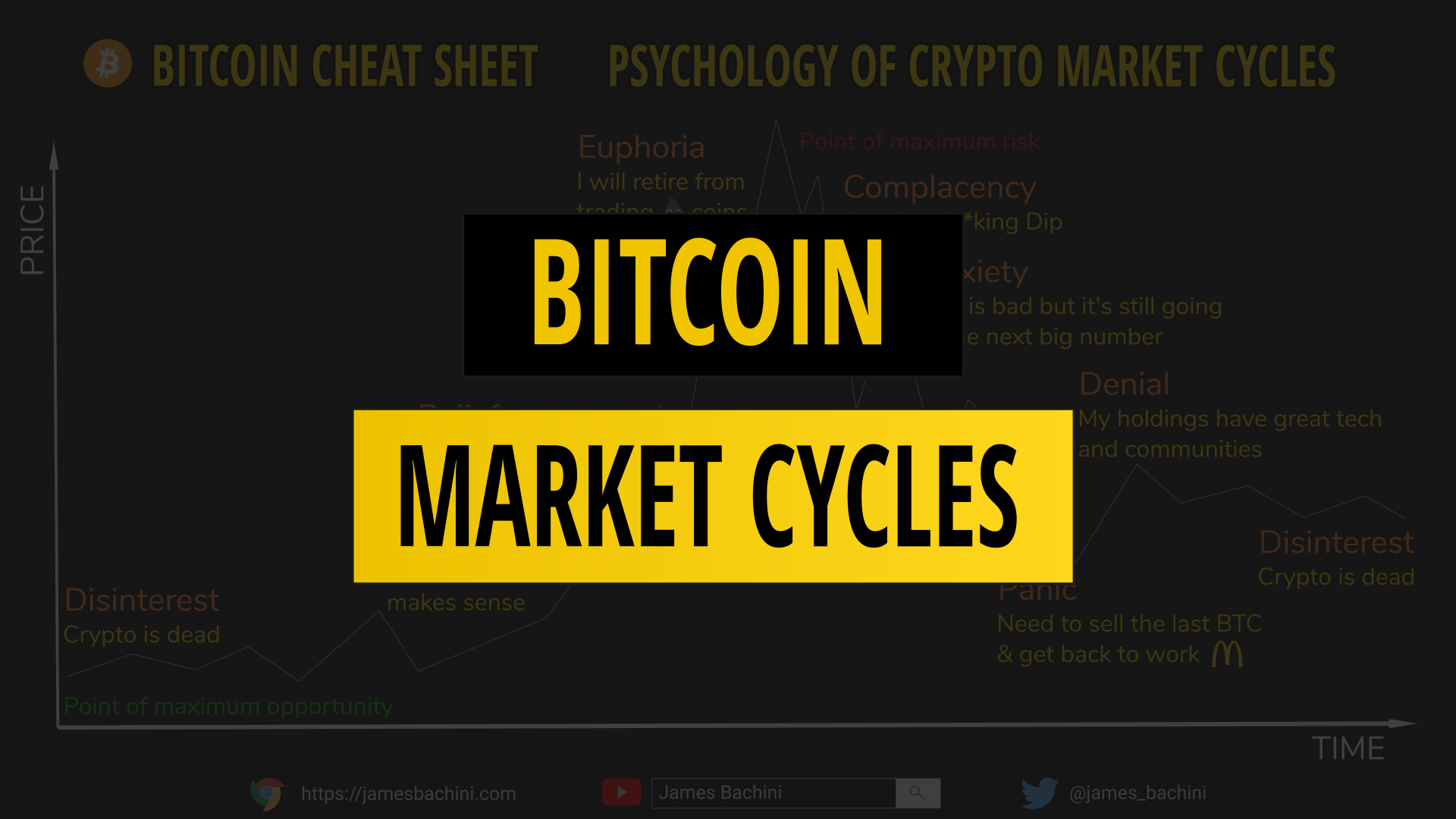

Bitcoin Market Cycle | How To Navigate Crypto Market Cycles 📈

The Bitcoin market cycle is volatile and emotionally challenging for investors but both Bitcoin and the wider crypto sector follow familiar cycle dynamics to other markets. Prophecy Was Given To Fools While I’ve never found a way to predict what the market will do next it’s both useful and fairly easy to understand where you…

-

Bitcoin vs Ethereum | Everything You Need To Know About BTC & ETH

The Bitcoin vs Ethereum debate is passionately argued by maximalists for both sides. This article and video explains the fundamental differences in how they work, what makes them unique and why Ethereum carries more risk and potential reward. Bitcoin vs Ethereum [Video] James On YouTube Fundamental Differences In 2008 an anonymous developer using the pseudonym…

-

Bit.com Review | A New Crypto Exchange

In this Bit.com review I’ll take a first look at a new exchange from the co-founder of Matrixport and Bitmain. Bit.com Review & Demo [Video] James On YouTube Who Are Bit.com? Bit.com is a new exchange registered in the Seychelles offering spot, futures and options markets for digital assets. The chairman is Jihan Wu who…

-

Crypto Portfolio | What I’m Hodling & Why In 2021

In this article I’ll go through my crypto portfolio and explain why I’m holding each of the digital assets. I’ll also be discussing the principles behind the portfolio and how I manage it. The Crypto Portfolio 2021 This is what my crypto portfolio looks like as of July 2021. I’m not a financial advisor, not…

-

Order Execution Strategy Tests 📋

In this article I’m going to test different methods to find the best order execution strategy for buying and selling cryptocurrency. I’m going to define a test to enter and exit a delta neutral position, write trading bot code for each strategy in NodeJS and execute each on an isolated exchange sub-account to see which…

-

Huobi Exchange Review

Huobi is the second largest crypto exchange in the world by trading volume. In this article I am going to undertake a comprehensive Huobi exchange review looking at trading, fees, HECO and the HT Token. Who is Huobi? Huobi Group was founded in 2013 by Leon Li. Huobi was originally based in Beijing and now…

-

60/40 Crypto Portfolio | The Worlds Most Boringly Effective Cryptocurrency Portfolio

The 60/40 crypto portfolio is a modern version of the stocks and bonds retirement portfolio that has been around for over 70 years. The idea behind a 60/40 portfolio is to allocate 60% of an investment portfolio to high risk assets (stocks or cryptocurrency) and 40% to a yield producing low risk asset (bonds or…

-

Uniswap V3 Trading Bot 🦄

In this tutorial I’ll be explaining how I built Uniswap v3 trading bot in preparation for arbitrage opportunities. We will be looking at why Uniswap v3 is important and how concentrated liquidity pools provide new features such as range orders. I’ll then show how I built and tested the trading bot prior to Uniswap v3…

-

Twitter Trading Bot | Elon + DOGE = Profit

In this article I’ll share how I built a Twitter trading bot to trade a cryptocurrency called DOGE every time Elon Musk tweeted something mentioning it. I’ll be using NodeJS to query the Twitter API and then executing trades on FTX. Building A Twitter Trading Bot Video James On YouTube The “Elon Effect” Opportunity Anything…

-

Sharpe Ratio Explained | How To Calculate Risk Adjusted Returns

In this article we look at how to calculate risk adjusted returns using the sharpe ratio. We look at some modern examples which you can try using the share ratio calculator. Sharpe Ratio Calculator This calculator uses the simplified Sharpe ratio as discussed here. Possibilities Success Chances: % Return: $ Break Even Chances: % Return:…

-

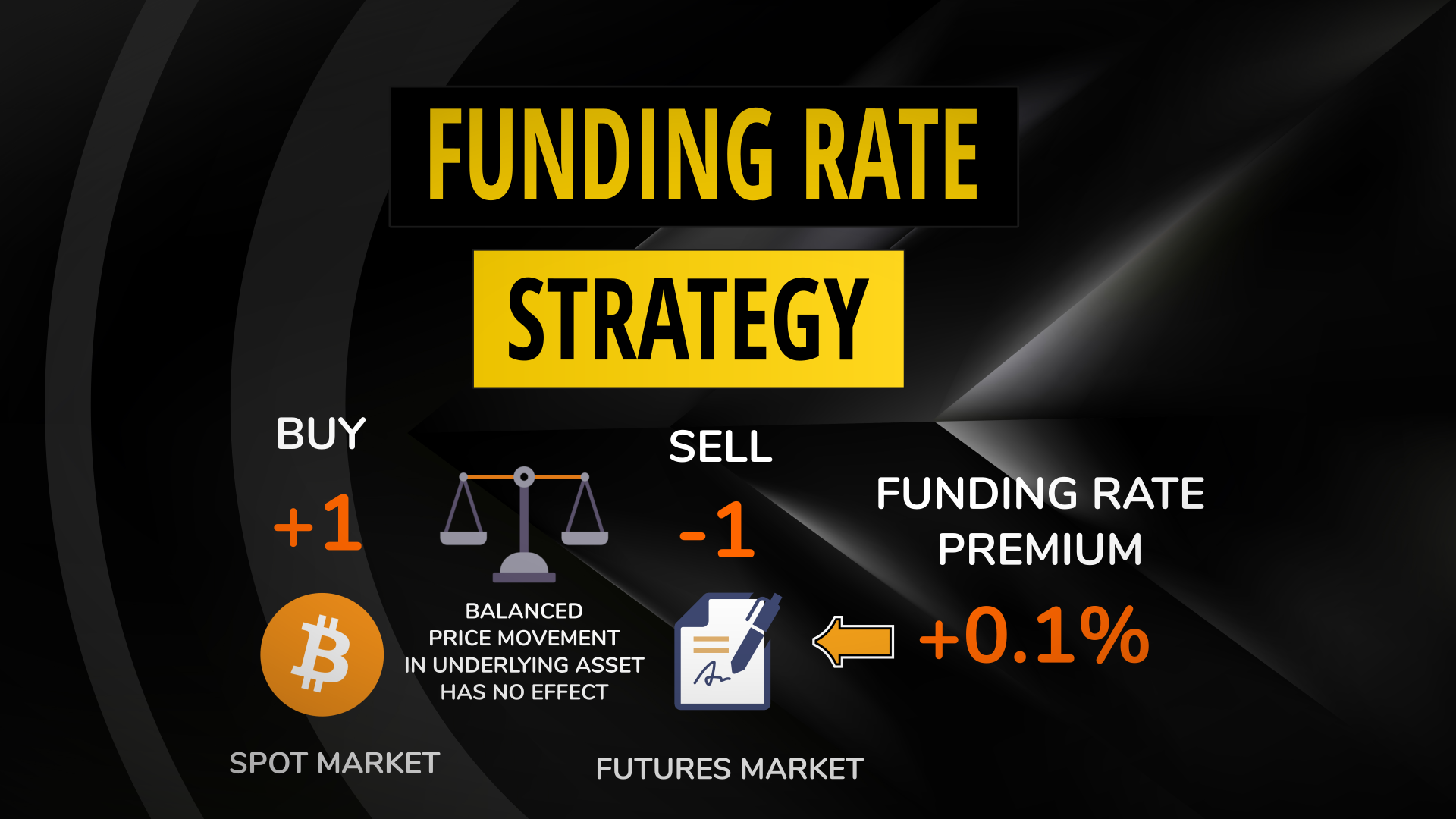

Futures Funding Rate Strategy | Using Binance & FTX To Arbitrage Funding Rates

In this article I’ll be executing a cash and carry trade purchasing a crypto asset on spot markets and short selling a futures contract for the same asset to collect funding rate fees. Understanding Futures Contracts A futures contract tracks the price of an underlying asset. It allows active traders to take out a long…

-

Pine Script Tutorial | How To Develop Real Trading Strategies On TradingView

In this pine script tutorial I’ll be showing you how to get started with TradingView scripting for technical analysis and trading strategy development. We will start by looking at how pine script works and a simple example. From there we will move on to inputs and indicators before creating a complete trading strategy using pine…

-

DeFi Passive Income | How To Generate Yield On Crypto Assets

This ultimate how to guide will show you how to earn a passive income on your crypto holdings. We will start by looking at different types of DeFi passive income and how it works. Then I’ll explain how liquidity providers earn transaction fees and explore market leaders including Uniswap, Pancake Swap, Pangolin and Raydium. Finally…

-

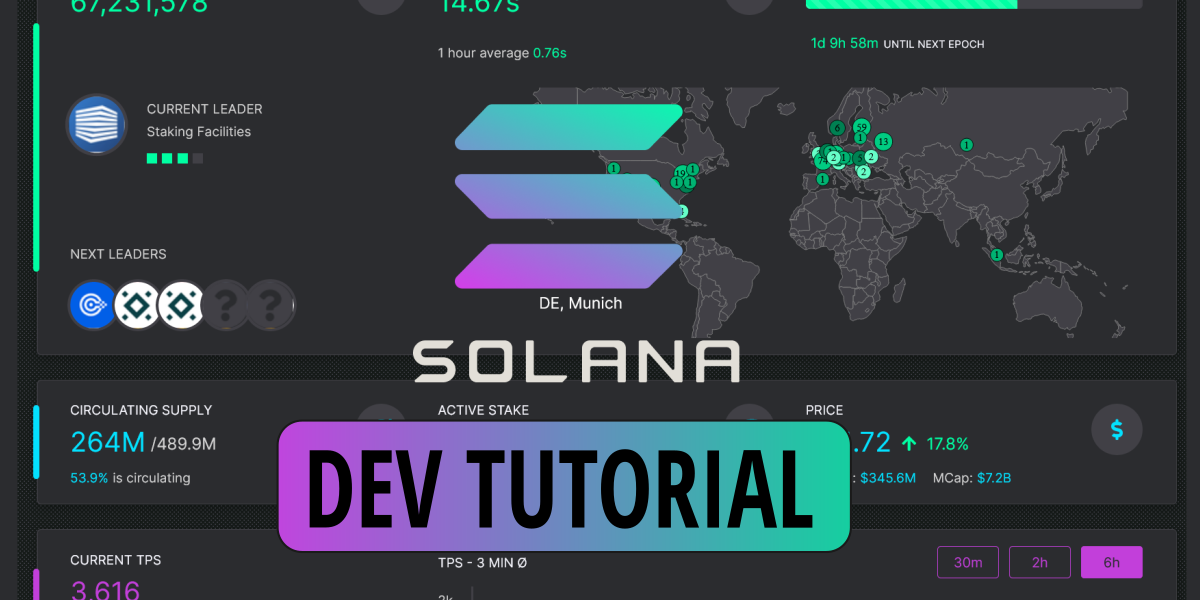

Solana Tutorial | Building Smart Contracts & dApps For The Solana Hackathon

This Solana tutorial goes through a step by step process of setting up a development environment for Solana, writing and deploying smart contracts and my experiences with entering the Solana Hackathon. Getting Started With Solana Solana is a high performance modern blockchain with impressive throughput capabilities. It can handle 50,000 transactions per second which makes…

-

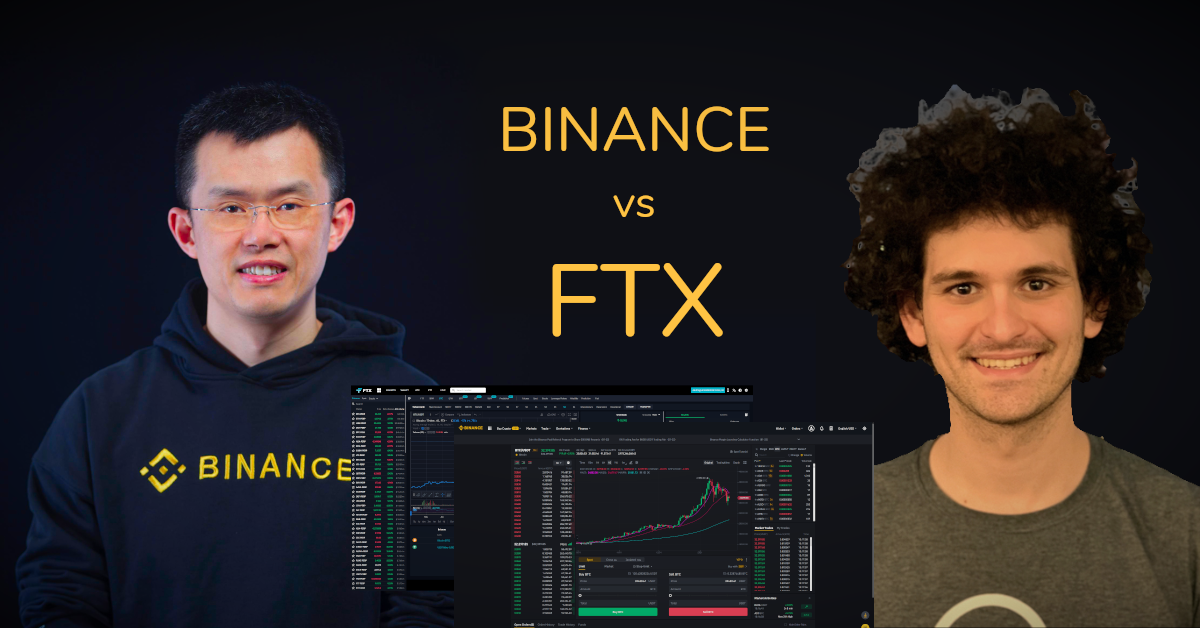

Binance vs FTX | Which Is The Best Crypto Exchange?

Update November 2022. Binance is the best exchange. In this article I’ll explore the differences between Binance vs FTX to find out what each offers and which you should be using. I’ll be assessing a number of factors such as markets, liquidity, security, fees, user interface and API’s. Binance vs FTX [Video] James On YouTube…

-

![Separating Signal From Noise on WallStreetBets [Niche Website]](data:image/gif;base64,R0lGODlhAQABAAAAACH5BAEKAAEALAAAAAABAAEAAAICTAEAOw==)

Separating Signal From Noise on WallStreetBets [Niche Website]

This case study looks at how I went about building a one page website around the trending WallStreetBets community. Creating A Niche Website To Filter WallStreetBets [Video] The Problem & A Simple Solution Starting With A Script Lean Methodology For Niche Websites Marketing A Niche Website Niche Website Monetisation & Financials Conclusion Creating A Niche…

![Separating Signal From Noise on WallStreetBets [Niche Website]](https://jamesbachini.com/wp-content/uploads/2021/02/social-card-1.png)