Investing

-

Structured Products DeFi

We all remember the 2008 financial crisis, a global upheaval sparked in part by complex structured products like collateralised debt obligations. These financial instruments are still widely used in traditional finance to manage risk and enhance returns. But what if we could reimagine these products in DeFi? In this article, we’ll explore how decentralised structured…

-

Building A Portfolio Tracker In Python

In this tutorial we will be building a digital asset portfolio tracking tool using python and the Coinbase API. You’ll need to install python and the following library to make requests. The code for this is open source on Github at: https://github.com/jamesbachini/Python-Portfolio-Tracker Put this in a file called portfolio.py or fork the repo above. Then…

-

Interest Rates, FOMC & Crypto

Ever wondered why crypto traders are obsessed with FOMC meetings and what the Federal Reserve are planning next? Interest rates set by the Fed impact the price of Bitcoin and other digital assets alongside stocks, shares and bonds. What if you could anticipate long-term price movements just by understanding a few macro economic principles? Let…

-

Frontrunning Crypto Catalysts For Fun & Profit

There is opportunity in crypto markets if you can get ahead of the next narrative and allocate capital prior to mass of market participants. Staying ahead of the curve often means keeping an eye on emerging trends and strategic moves that can significantly impact a project’s market perception and value. In this article I’m going…

-

LRTs | Liquid Restaking Tokens

I’ve previously discussed Eigenlayer and how restaking works but let’s look at what this will look like for the majority of users. Liquid Restaking Tokens are the equivalent of stETH for restaking where users can deposit assets to gain exposure to yield from restaking using a simple ERC20 token. This is a write up of…

-

Crypto Market Thesis 2024

The crypto market has experienced significant recovery this year, with Bitcoin’s value surging from $16,500 to over $40,000. Growth was shadowed by increased regulatory scrutiny, particularly impacting centralized exchanges. The Bitcoin halving in April 2024 is poised to be a pivotal event, historically triggering market rallies. The potential January approval of Bitcoin spot ETFs could…

-

TradingView Pine Script Examples | Master Pine Script With 6 Real World Examples

TradingView’s Pine Script coding language has emerged as the leading tool for traders looking to craft custom indicators and strategies with accuracy and ease. In this Pine Script tutorial I’ll provide a practical gateway into the intricacies of this coding language, tailored with useful examples to get you started. Whether you’re a novice coder or…

-

GEAR Gearbox Protocol | DeFi Analysis Report

Gearbox Protocol introduces a framework for both passive lenders and active borrowers. It empowers traders with leverage that can be used to scale up trades and yield farming strategies on decentralized exchanges such as Unsiswap and Curve. With an emphasis on composable leverage, zero funding rates, and permissionless strategies, Gearbox Protocol is an compelling microcap…

-

How I Track Developer Activity For Crypto Projects

In this article I’m going to share how to track developer activity for crypto projects for fundamental analysis. James On YouTube Watch On YouTube: https://youtu.be/DTI7ELSA6CA |Subscribe Understanding the Crypto Development Ecosystem Cryptocurrencies like Bitcoin and Ethereum as well as the majority of blockchain projects are fundamentally software. They are applications that run on a decentralized…

-

How I Built A Smart Money List On Twitter

X formerly known as Twitter includes two features which allows us to create a list of accounts from people that frontrun narratives and successful trades. tl;dr if you just want to see the final list it is here: https://twitter.com/i/lists/1712044491618545903 James On YouTube Watch On YouTube: https://youtu.be/4qYraarbsYs |Subscribe Step 1. Collecting Project Data My main focus…

-

Investing In Real World Assets Through DeFi

Real world assets (RWA) are tokenized digital forms of traditional finance assets. A centralized entity will raise capital by selling tokens and investing the proceeds in to an underlying asset or strategy. This has become particularly popular with bonds and treasuries due to recent rises in interest rates. The market leaders in this field by…

-

HyperLiquid | Decentralized Perpetual Futures Trading

Hyperliquid is a decentralized exchange that specializes in perpetual futures contracts. It’s seen modest growth through a difficult bear market and has a frontend remarkably similar to FTX. Let’s dive in. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to HyperLiquid…

-

ApeX Pro | DeFi Analysis Report

ApeX Pro is a non-custodial decentralized orderbook exchange which is part of the ByBit group. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to ApeX at time of writing. Do your own research, not investment advice. What Is ApeX Pro?…

-

Calculating The Intrinsic Value Of Bitcoin & Ethereum

Calculating the intrinsic value of Bitcoin, Ethereum and other digital assets is challenging due to its intangible nature. In this analysis I’m going to discuss common methods of calculating intrinsic value and then create a model using a combination of the methods. tl;dr based on the models described below: Methods Of Calculating Intrinsic Value Store…

-

Spark Protocol sDAI | DeFi Analysis Report

Does earning 8% on your DAI stablecoin holdings sound too good to be true? Let’s take a look at how Spark Protocol is offering this APR using MarkerDAO’s Enhanced Dai Savings Rate system. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any…

-

Value Averaging vs Dollar Cost Averaging

One of the most recognized techniques for investing is dollar cost averaging. A process where you invest equal amounts over set periods i.e. $100/month. A less well known strategy is value averaging which when compared across multiple markets and time frames is more effective. In this article I discuss the concept of value averaging, the…

-

ETHx Stader Labs | DeFi Analysis Report

ETHx from Stader Labs is a solution committed to decentralization and keeping Ethereum accessible, reliable, and rewarding. Having just launched ETH stakers earn 1.5x staking rewards and $800,000 in DeFi incentives across various protocols for the first month. This is a write up of my internal research notes, this is not a sponsored post and…

-

Conic Finance | DeFi Analysis Report

The latest development in the Curve Wars is the establishment of a new player. Conic Finance is gaining traction and becoming a significant player in the stable swap ecosystem. This is a write up of my internal research notes, this is not a sponsored post and I do not have any allocations at time of…

-

XRP Legal Case | What It Means For Developers

In this article I’m going to be breaking down the document filed by judge Torres yesterday and consider what it means to developers working in the blockchain and web3 space. Highlights From The Ruling The full document is available here:https://www.nysd.uscourts.gov/sites/default/files/2023-07/SEC%20vs%20Ripple%207-13-23.pdf I’ve picked out some highlights Programmatic SalesHaving considered the economic reality of the Programmatic Sales,…

-

3 Ways To Raise Web3 Funding

In this article I’ll explore 3 ways in which you can raise funds for your project with web3 products. Membership NFT A NFT is a non-fungible token, they are often represented as a unique image which can contain additional rights such as: To execute a NFT drop, the following steps can be taken: If any…

-

Raft Finance | DeFi Analysis Report

This DeFi analysis report for Raft Finance follows up on my analysis and investment in Lybra Finance. This is a write up of my internal research notes, this is not a sponsored post and I do not have any allocations at time of writing to Raft or the R stablecoin. Do your own research, not…

-

Lybra Finance | DeFi Analysis Report

Lybra Finance allows stETH stakers to mint the eUSD stablecoin which has a 7.2% APY. This is a write up of my internal research notes, this is not a sponsored post however I have purchased an allocation of LBR Lybra Finance’s governance token in my personal portfolio. Do your own research, not investment advice. Update…

-

Raising Funds For Your Blockchain Project

For founders looking to raise capital there are a number of options which we will explore in this article. Private Round A private round is where a founder will outreach and pitch their concept to investors in the space. For raises under $100k angel investors can provide initial funding to get a project started. For…

-

Alchemix Self-Repaying Loans

Imagine a financial system where your loans automatically pay themselves off, interest-free and without the need for monthly repayments. Alchemix is a synthetic asset protocol run by community DAO. This is a write up of my research notes and is not sponsored in any way. I currently at time of writing have no stake in…

-

Trading The Lifecycle Of Crypto Narratives

The blockchain sector moves fast and attention shifts rapidly as crypto narratives emerge inflating valuations for sub-sectors before moving on to the next big thing. In this article I’m going to outlay my research into the lifecycle of crypto narratives to explore how we can best position our portfolios and allocate funds in a +EV…

-

Technical Analysis For Crypto Degenerates

For cynics technical analysis is seen as astrology for middle aged white guys for others it is the holy grail, which when mastered, inevitably leads to trading success. The truth is somewhere in the middle, it is undeniable that price action reacts more at some levels than others. It’s important for anyone involved in investing…

-

Web3 Investment Thesis

This Web3 investment thesis covers the potential disruption from decentralized permissionless computing. As blockchains scale it’s going to be possible to use smart contracts to enable users to store their own data creating the opportunity for a new era of decentralized applications. Web3 Disrupting Data Web3 disrupts the way we store data online by using…

-

Private Funding vs Public Funding Rounds | How To Raise Capital In Crypto

Since the 2018 ICO bust, venture capital funding has become the primary avenue for blockchain startups to raise money. This comes with pros & cons which we will explore in this article alongside how raising capital works in the blockchain sector. How Private Funding Rounds Work During a private funding round the founders of a…

-

ETHDenver | Thoughts & Takeaways From The Biggest US Blockchain Conference

This article is aimed at providing an overview summary of what was talked about at ETHDenver and some of the things I picked up while being there. Buzz Word Bingo I took the schedule and ran through how many talks there were on each of these subjects. Buzz Word No. Of Talks Zero Knowledge 18…

-

How To Stake Ethereum | Earn More Yield With Ethereum Staking

Staking Ethereum has become a popular way for crypto investors to earn passive returns on their holdings. Liquid staking tokens like stETH make this process easily accessible. You can buy staking tokens and effortlessly enjoy the rewards of staking Ethereum without having to manage the technicalities of running a node. Lido Finance were first to…

-

FTX Collapse Explained | The Story Of Scam Bankrun Fraud

In November 2022 the world’s second largest cryptocurrency exchange FTX collapsed, stopped withdrawals and filed for bankruptcy. The stories of the last week are so far-fetched they deserve a Netflix documentary. Here we will look at how FTX was able to defraud the crypto industry of somewhere in the region of $10 Billion US dollars.…

-

SAFT Template | Simple Agreement Future Tokens

Below I’ve shared an example SAFT legal agreement and a smart contract which can be used to lock up tokens. James On YouTube Watch On YouTube: https://youtu.be/hpsegda6gvo |Subscribe What Is A SAFT? A SAFT is a simple agreement for future tokens. It is used primarily for blockchain projects to sell tokens at an early stage…

-

Trading The Merge

Once or twice a year the crypto markets align to provide exceptional trading volumes and volatility. I believe the Ethereum merge will presents one such opportunity for low time frame system trading. James On YouTube Watch On YouTube: https://youtu.be/3ltpF4UGir4 |Subscribe About The Ethereum Merge The merge is happening in just a few days. This is…

-

Bear Markets | How Human Psychology Works Against Us

Is loss aversion causing long-term underperformance in our portfolios? In bear markets I find it harder to rebalance my portfolio and allocate capital to riskier investments. This creates an unintentional de-risking in bear markets where there is a better long-term risk to reward. James On YouTube Watch On YouTube: https://youtu.be/6F1Cpk14stE |Subscribe Not a financial advisor,…

-

Blood in the streets for crypto markets

A year ago I outlined my 60/40 digital asset portfolio which was 60% crypto and 40% USD stablecoins. One of the biggest benefits to this portfolio is that during market downturns it leaves you with capital to deploy. Today has been one of the most chaotic days in crypto markets ever and I’m going to…

-

Why The PoS Basis Trade Will Generate $100B TVL

Proof of stake revenue provides a new opportunity for investors and funds to collect double digit APR’s on a PoS basis trade pegged to the USD. A basis trade (aka cash and carry) involves buying an asset and then short selling the same futures contract. Traditionally this has been to collect the funding premium on…

-

3 Yield Farming Stablecoin Strategies

Yield farming stablecoin strategies provide high returns on low volatility digital assets. In this article I explore three ways to generate yield on USD stablecoin holdings. For an introduction on what stablecoins are and the different stablecoins compared see this article: https://jamesbachini.com/stablecoins/ Note that stablecoin farming strategies are changing all the time and this article…

-

How To Trade Crypto | Ultimate Guide To Trading Bitcoin, Ethereum & Altcoins

This ultimate “How To Trade Crypto” guide is provided for educational purposes. I am not a financial advisor, not financial advice. The vast majority of active trading in crypto markets is done on centralized exchanges such as Binance and FTX. The high volumes on perpetual futures on both exchanges has proven the demand for leveraged…

-

How To Automate Yield Farming | Harvesting Rewards With A Quick & Dirty Script

Connect wallet, click button, confirm transaction. It gets old pretty quick, especially when you need to do it daily to compound returns. This tutorial takes you through the process of using a block explorer to find functions, calling those functions from a script and then executing to harvest and stake reward tokens. The aim is…

-

When Will Ethereum 2.0 Launch & The Triple Halving Event

Ethereum 2.0 is the biggest update that the crypto sector has ever seen. A series of rollouts will include a migration to proof of stake, sharding and the highly anticipated triple halving event. This article will discuss the roadmap for these rollouts, what changes each update will implement and the possible effects. Ethereum 2.0 Roadmap…

-

Aurora | Near Protocol’s Explosive EVM Blockchain

Money flows in and out of DeFi ecosystems like the changing of the tide. In 2021 fifteen different blockchains exceeded one billion us dollars in total value locked. The early adopters who stay ahead of the money flow tend to make the highest returns. Aurora looks set to become another billion dollar DeFi ecosystem. This…

-

The Truth About Where Yield Comes From In DeFi

Interest rates in traditional banks are 0.1%, have you ever wondered how DeFi yield farmers are getting 20-100% yields on their digital assets? Is it sustainable wealth creation or a giant ponzi that risks collapsing in on itself. That’s the question we are going to explore in this article looking at where yield comes from…

-

How To Make Cross Chain Transfers With Multichain

I’ve seen Anyswap popping up more and more in on-chain analytics reports as it’s grown to be a six billion dollar protocol by TVL. The platform just rebranded to Multichain and its fast becoming the market leader in cross chain bridges. If you want to transfer USDC from Ethereum to Polygon or Fantom or another…

-

Curve Wars | The Best Way To Gain Exposure To The Curve Wars

A battle rages for control of DeFi’s biggest protocol as stablecoins fight for liquidity. Million dollar bribes being paid for votes, enemies becoming alliances and an ultimate prize at stake. This article explores why CRV is so valuable and why it likely isn’t the best way to gain exposure to the Curve wars. The CRV…

-

Crypto Market Thesis 2022 & Current Portfolio Holdings

This article outlines my thoughts and predictions for crypto markets heading in to 2022. At the end of the article I share my allocations and plans for this year. Crypto Market Thesis Video James On YouTube Watch On YouTube: https://youtu.be/ogBcbwuasWw Bitcoin Market Outlook Crypto markets have cooled off significantly since summer 2021 but expectations are…

-

DeFi Risk | A Framework For Assessing & Managing Risk in DeFi

The high yields available in decentralised finance come with a downside. DeFi risk is real and if you are participating in the markets then you should know how to assess and manage that risk. By building a risk assessment framework for yield farms and DeFi opportunities we can better assess fair value and allocate capital…

-

How To Stake Ethereum, Luna or Solana| LIDO Staking Tutorial

As Ethereum moves to a proof of work network it opens up the possibility to stake our assets to gain a yield. We can do this by running our own validator node on the network… or we can use a liquid staking platform. In this lido staking tutorial I’m going to look at the LIDO…

-

Crypto Research | Due Diligence & How To Find The Next 10x Token 🧐

When market conditions are right there are abundant opportunities in seeking out high quality and early stage crypto projects. In this post I’ll walk-through my crypto research process from screening and researching crypto projects to due diligence and tokenomics. An Introduction To Crypto Research James On YouTube Where To Find New Crypto Projects Being early…

-

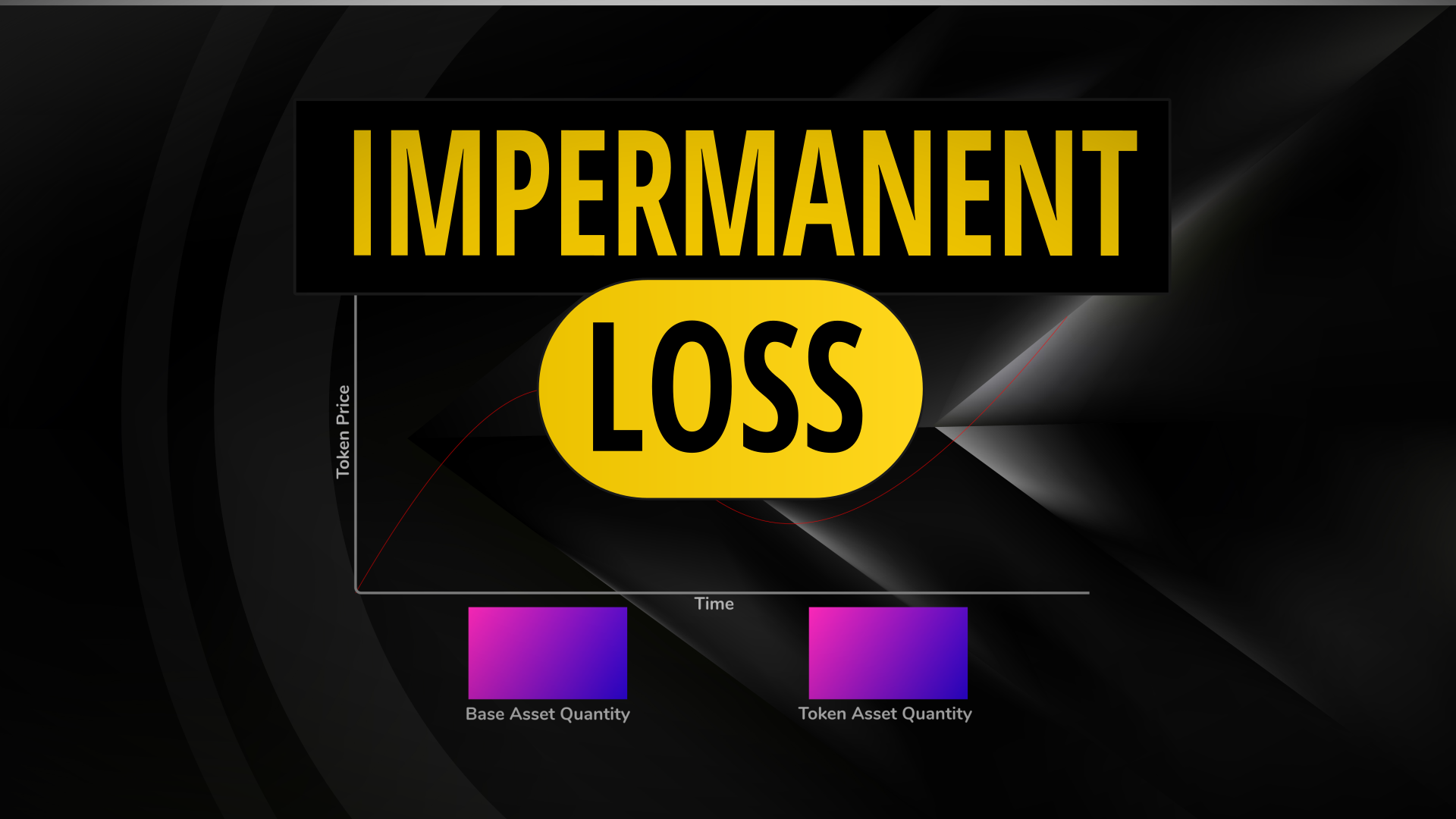

Impermanent Loss Calculator | How To Calculate And Mitigate DeFi’s Biggest Risk

Impermanent Loss Calculator Enter the quantities for the two assets in a full-range liquidity pool and a future price ratio to find out what the impermanent loss would be: Base Asset Qty: Token Asset Qty: Future Price Ratio: Calculate How Impermanent Loss Is Calculated In this article we will look at what impermanent loss is,…