Cryptocurrency

-

Encrypting Private Keys in .env

It has become very normalised to store Ethereum private keys in plain text within .env files. While this is convenient, it’s a disaster waiting to happen when working in production with wallets that contain real funds. Today, I’ll show you a better way to manage your hot wallet keys using AES encryption. Full code for…

-

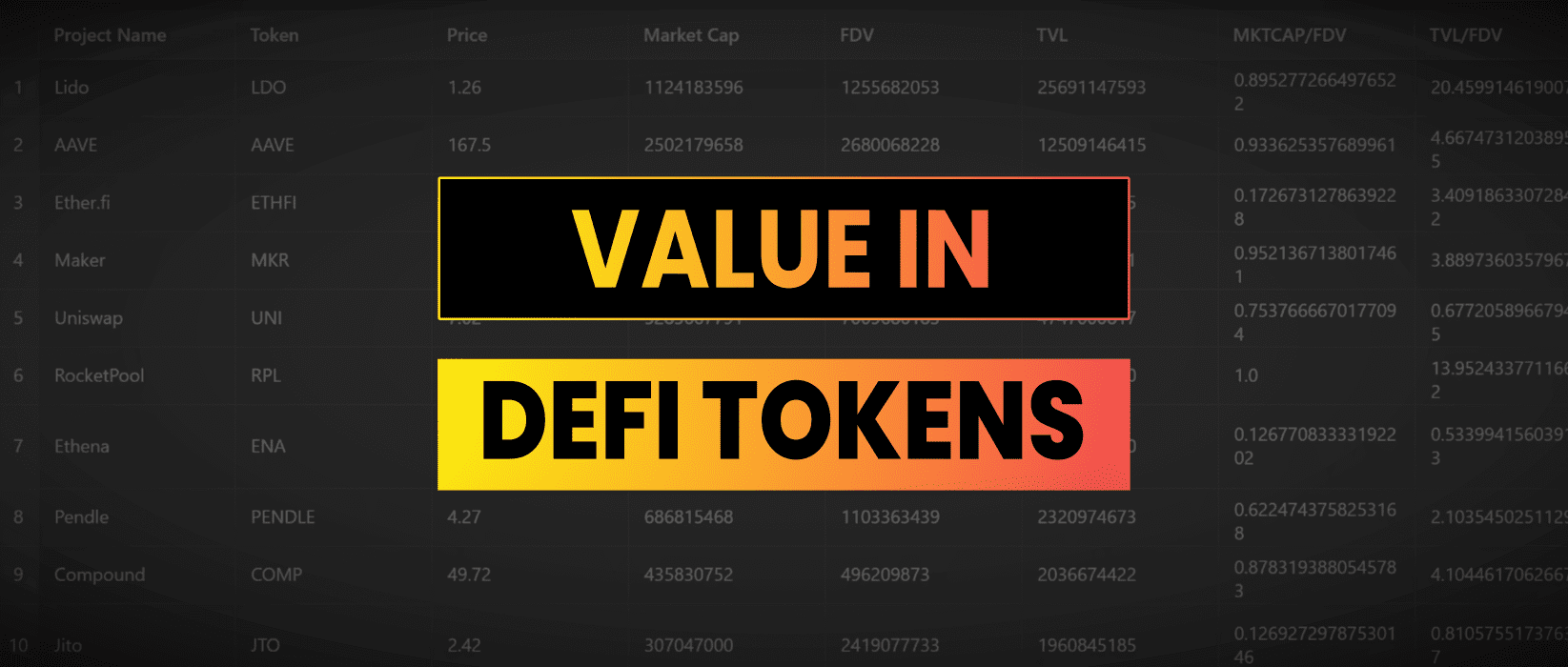

Value Investing In DeFi

For value investors the goal is to find assets priced below their intrinsic value, providing a margin of safety and potential for significant future growth. Could applying this principle to DeFi help identify underappreciated projects that are gaining significant traction. Let’s find out… Market Cap, TVL & FDV Market capitalization is the total value of…

-

Creating an UpOnly ERC20 Token

In this tutorial we are going to create a ponzi game in the form of an ERC20 token that has an internal marketplace function. The idea is to increase the price over time so that early buyers get to dump on late buyers at a higher price. The last buyer will have no liquidity to…

-

How To Check Token Balances Using Python

To check a wallet token balance on the Ethereum blockchain using Python you will need the following: Once we have our API key ready and Python installed we can install web3.py using the following command Now let’s create a file called balance.py and add the following code. Note the code is also available in the…

-

DeFi Whale Watching Tutorial & Code

Imagine if you could tap into the strategies of top investors and see where the smart money is allocating capital? Welcome to the world of DeFi whale watching, where tracking high net worth wallets can give you the edge and open up new Whale Watching Explained DeFi whale watching involves tracking the investments of “smart…

-

Structured Products DeFi

We all remember the 2008 financial crisis, a global upheaval sparked in part by complex structured products like collateralised debt obligations. These financial instruments are still widely used in traditional finance to manage risk and enhance returns. But what if we could reimagine these products in DeFi? In this article, we’ll explore how decentralised structured…

-

Web3 vs Cloud Computing

Have you ever wondered if decentralised data storage can truly rival the convenience and efficiency of traditional cloud services like AWS? Web3 devs today face several significant challenges. On-chain data is currently slow, expensive, and often comes with a poor user experience. However, with the rapid advancements in technology, the future could look very different.…

-

Bitcoin Censorship Resistance

Imagine a world where your transactions are dependent on government approval. A central authority has the ability to cut off your right to trade for any reason they see fit. We aren’t far from this already and we’ve things like sanctions and freezing of assets by governments around the world. This primarily targets the banking…

-

Building A Portfolio Tracker In Python

In this tutorial we will be building a digital asset portfolio tracking tool using python and the Coinbase API. You’ll need to install python and the following library to make requests. The code for this is open source on Github at: https://github.com/jamesbachini/Python-Portfolio-Tracker Put this in a file called portfolio.py or fork the repo above. Then…

-

Apple Tap To Cash

Apple’s WWDC 2024 keynote unveiled Tap to Cash to simplify p2p payments, simply tap one iPhone to another to send money via Apple’s wallet. Why should you care about a minor tech upgrade from Apple? Because this one could be the first step towards a wider change in how we handle personal transactions. Dive in…

-

Interest Rates, FOMC & Crypto

Ever wondered why crypto traders are obsessed with FOMC meetings and what the Federal Reserve are planning next? Interest rates set by the Fed impact the price of Bitcoin and other digital assets alongside stocks, shares and bonds. What if you could anticipate long-term price movements just by understanding a few macro economic principles? Let…

-

Frontrunning Crypto Catalysts For Fun & Profit

There is opportunity in crypto markets if you can get ahead of the next narrative and allocate capital prior to mass of market participants. Staying ahead of the curve often means keeping an eye on emerging trends and strategic moves that can significantly impact a project’s market perception and value. In this article I’m going…

-

Ethena USDe | DeFi Analysis Report

Ethena Labs has introduced USDe, a synthetic dollar on the Ethereum blockchain. USDe is designed to be crypto native, stable and censorship resistant. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to Ethena or USDe at time of writing. Do your…

-

Starknet STRK Tokenomics

Starknet is a layer 2 zero knowledge rollup which uses a STARK cryptographic proof and Cairo based smart contracts. A few days ago they released the STRK token and in this article I’ll dive in to the tokenomics. Currently at time of writing the token trades at $1.91 and has a $1.39 billion dollar circulating…

-

How To Create ERC404 Tokens Solidity Tutorial

An ERC404 token is a digital asset that combines the characteristics of ERC20 fungible tokens and ERC721 non-fungible tokens (aka NFT’s) to enable fractional ownership of an NFT. In essence, ERC404 tokens represent divisible parts of an NFT, allowing multiple individuals to own shares of a single NFT. This approach is designed to enhance the…

-

Aggregated Blockchains and Polygon’s Agglayer

Polygon is gearing up to launch its AggLayer v1 mainnet with an event later today at 14:00 UTC Feb 23rd “Aggregation Day 2024”. In this article I’ll look at what aggregated blockchains are and how Polygon’s Agglayer works. What Are Aggregated Blockchains? The idea of aggregated Blockchains is to facilitate developers in bridging different blockchains…

-

LRTs | Liquid Restaking Tokens

I’ve previously discussed Eigenlayer and how restaking works but let’s look at what this will look like for the majority of users. Liquid Restaking Tokens are the equivalent of stETH for restaking where users can deposit assets to gain exposure to yield from restaking using a simple ERC20 token. This is a write up of…

-

Crypto Market Thesis 2024

The crypto market has experienced significant recovery this year, with Bitcoin’s value surging from $16,500 to over $40,000. Growth was shadowed by increased regulatory scrutiny, particularly impacting centralized exchanges. The Bitcoin halving in April 2024 is poised to be a pivotal event, historically triggering market rallies. The potential January approval of Bitcoin spot ETFs could…

-

ATOM Cosmos Analysis | A Deep Dive Into The Cosmos Ecosystem

This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to ATOM at time of writing. Do your own research, not investment advice. What Is Cosmos Cosmos is a decentralized layer zero network of independent blockchains, designed to enable scalability and interoperability between…

-

GEAR Gearbox Protocol | DeFi Analysis Report

Gearbox Protocol introduces a framework for both passive lenders and active borrowers. It empowers traders with leverage that can be used to scale up trades and yield farming strategies on decentralized exchanges such as Unsiswap and Curve. With an emphasis on composable leverage, zero funding rates, and permissionless strategies, Gearbox Protocol is an compelling microcap…

-

How I Track Developer Activity For Crypto Projects

In this article I’m going to share how to track developer activity for crypto projects for fundamental analysis. James On YouTube Watch On YouTube: https://youtu.be/DTI7ELSA6CA |Subscribe Understanding the Crypto Development Ecosystem Cryptocurrencies like Bitcoin and Ethereum as well as the majority of blockchain projects are fundamentally software. They are applications that run on a decentralized…

-

eBTC How To Trade The Flippening

eBTC is an over-collateralized digital asset pegged to the price of Bitcoin which can be minted using stETH as collateral. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to eBTC at time of writing. Do your own research, not investment advice.…

-

MUX Protocol | DeFi Analysis Report

MUX is a decentralized trading platform offering slippage free trades and 100x leverage. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to MUX at time of writing. Do your own research, not investment advice. The first thing that jumps out about…

-

How I Built A Smart Money List On Twitter

X formerly known as Twitter includes two features which allows us to create a list of accounts from people that frontrun narratives and successful trades. tl;dr if you just want to see the final list it is here: https://twitter.com/i/lists/1712044491618545903 James On YouTube Watch On YouTube: https://youtu.be/4qYraarbsYs |Subscribe Step 1. Collecting Project Data My main focus…

-

Investing In Real World Assets Through DeFi

Real world assets (RWA) are tokenized digital forms of traditional finance assets. A centralized entity will raise capital by selling tokens and investing the proceeds in to an underlying asset or strategy. This has become particularly popular with bonds and treasuries due to recent rises in interest rates. The market leaders in this field by…

-

HyperLiquid | Decentralized Perpetual Futures Trading

Hyperliquid is a decentralized exchange that specializes in perpetual futures contracts. It’s seen modest growth through a difficult bear market and has a frontend remarkably similar to FTX. Let’s dive in. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to HyperLiquid…

-

Understanding RFQ in Crypto | Request For Quote Systems

Uniswap recently announced they are developing an RFQ (request for quote) system that will change the way we swap digital assets. In this article we will look at RFQ in crypto and how it works. How RFQ Works RFQ works when a buyer invites sellers to bid on specific amount of an asset. The buyer…

-

ApeX Pro | DeFi Analysis Report

ApeX Pro is a non-custodial decentralized orderbook exchange which is part of the ByBit group. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to ApeX at time of writing. Do your own research, not investment advice. What Is ApeX Pro?…

-

Calculating The Intrinsic Value Of Bitcoin & Ethereum

Calculating the intrinsic value of Bitcoin, Ethereum and other digital assets is challenging due to its intangible nature. In this analysis I’m going to discuss common methods of calculating intrinsic value and then create a model using a combination of the methods. tl;dr based on the models described below: Methods Of Calculating Intrinsic Value Store…

-

Chainlink CCIP | Cross-Chain Interoperability Protocol

From all the announcements at ETHcc, the release of Chainlink CCIP as a direct competitor to LayerZero for cross-chain communications and bridging technology, is perhaps the most interesting. The inherent security risks associated with bridging technology means that Chainlink are in a good position to leverage their brand and security record to gain traction in…

-

Biggest Misconceptions About Crypto User Demographics

Due to my blog and YouTube channel I get detailed analytics on crypto user demographics. In this article I’ve compared my own data with other accounts, studies and published demographic information. My Demographic Data Here are some screenshots from Google Analytics and YouTube. My content is almost solely focused on blockchain, web3, crypto. This data…

-

Spark Protocol sDAI | DeFi Analysis Report

Does earning 8% on your DAI stablecoin holdings sound too good to be true? Let’s take a look at how Spark Protocol is offering this APR using MarkerDAO’s Enhanced Dai Savings Rate system. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any…

-

Value Averaging vs Dollar Cost Averaging

One of the most recognized techniques for investing is dollar cost averaging. A process where you invest equal amounts over set periods i.e. $100/month. A less well known strategy is value averaging which when compared across multiple markets and time frames is more effective. In this article I discuss the concept of value averaging, the…

-

A Close Look at PYUSD | Implications Of The PayPal Stablecoin

In August 2023 Paypal unveiled their new stablecoin, an ERC20 token built on Ethereum. The code is open source, the contract is verified on Etherscan, it’s a real token which is going to be available to Paypal’s 435m users. What Is pyUSD & How Does It Work The Paypal stablecoin was developed in partnership with…

-

Crypto Travel Rule | Creating A Surveillance State

From the 1st September 2023 the crypto travel rule will come into force in the UK, the EU is holding a grace period with plans to bring it in towards the end of 2024 and it’s already in place in the US, Canada and other parts of the globe. What Is The Crypto Travel Rule…

-

Card Payments For Crypto With Wert

One of the challenges cryptocurrency projects face is the seamless integration of traditional payment systems, such as credit/debit card payments, into their crypto based ecosystems. The issue derives from the potential for fraud because card payments can be reversed long after the transaction has taken place, while crypto transactions are immutable. This is a write…

-

How Many People Own Bitcoin & Ethereum?

No one can provide an exact answer to “how many people own Bitcoin” or “how many people own Ethereum” because a single user can have multiple anonymous addresses on the network. We can however analyse the data available in block explorers, company reports and research posts to make an estimate. tl;dr estimates based on the…

-

Hop Exchange | DeFi Analysis Report

Hop Exchange is a bridging protocol that facilitates cross-chain token transfers by utilizing a network of bonders. I first heard it mentioned in a keynote by Vitalik at ethGlobal Waterloo. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to Hop…

-

ETHx Stader Labs | DeFi Analysis Report

ETHx from Stader Labs is a solution committed to decentralization and keeping Ethereum accessible, reliable, and rewarding. Having just launched ETH stakers earn 1.5x staking rewards and $800,000 in DeFi incentives across various protocols for the first month. This is a write up of my internal research notes, this is not a sponsored post and…

-

Conic Finance | DeFi Analysis Report

The latest development in the Curve Wars is the establishment of a new player. Conic Finance is gaining traction and becoming a significant player in the stable swap ecosystem. This is a write up of my internal research notes, this is not a sponsored post and I do not have any allocations at time of…

-

XRP Legal Case | What It Means For Developers

In this article I’m going to be breaking down the document filed by judge Torres yesterday and consider what it means to developers working in the blockchain and web3 space. Highlights From The Ruling The full document is available here:https://www.nysd.uscourts.gov/sites/default/files/2023-07/SEC%20vs%20Ripple%207-13-23.pdf I’ve picked out some highlights Programmatic SalesHaving considered the economic reality of the Programmatic Sales,…

-

Uniswap v4 Hooks

Hooks in Uniswap v4 are external contracts that execute specific actions at certain points during the execution of a liquidity pool. These hooks provide flexibility and customization options for developers to create additional features for liquidity pools. Uniswap v4 hooks can be used to: A 3rd party developer can write a solidity hook contract with…

-

crvUSD Curve Stable | DeFi Analysis Report

Curve finance recently launched their own stablecoin crvUSD. I was lucky enough to meet one of the developers working on crvUSD at ethDenver and have been impressed with the product and how it has been rolled out. It is an algorithmic stablecoin with massive potential backed by one of the biggest names in DeFi, let’s…

-

3 Ways To Raise Web3 Funding

In this article I’ll explore 3 ways in which you can raise funds for your project with web3 products. Membership NFT A NFT is a non-fungible token, they are often represented as a unique image which can contain additional rights such as: To execute a NFT drop, the following steps can be taken: If any…

-

FTX 2.0 ReLaunch

FTX 2.0 is a proposed relaunch of the cryptocurrency exchange FTX.com, which filed for bankruptcy in November 2022. The FTX exchange was a profitable business, earning a small percentage from trading fees. However depositors funds were used to cover up losses from partner trading firm Alameda Research. Alameda also provided market maker services across all…

-

Raft Finance | DeFi Analysis Report

This DeFi analysis report for Raft Finance follows up on my analysis and investment in Lybra Finance. This is a write up of my internal research notes, this is not a sponsored post and I do not have any allocations at time of writing to Raft or the R stablecoin. Do your own research, not…

-

Can London Become A Crypto Hub?

Earlier this week one of Silicon Valley’s largest VC firms Andreessen Horowitz announced it would be opening an office in London for their a16zCrypto arm. In this article we will look at how well positioned the UK is relative to the rest of the world to become a fintech capital and hub for the blockchain…

-

Lybra Finance | DeFi Analysis Report

Lybra Finance allows stETH stakers to mint the eUSD stablecoin which has a 7.2% APY. This is a write up of my internal research notes, this is not a sponsored post however I have purchased an allocation of LBR Lybra Finance’s governance token in my personal portfolio. Do your own research, not investment advice. Update…

-

Raising Funds For Your Blockchain Project

For founders looking to raise capital there are a number of options which we will explore in this article. Private Round A private round is where a founder will outreach and pitch their concept to investors in the space. For raises under $100k angel investors can provide initial funding to get a project started. For…

-

Prisma Finance | acUSD an LST backed stablecoin

Prisma Finance is a DeFi project that aims to maximize the potential of Ethereum liquid staking tokens (LSTs). It introduces a stablecoin called acUSD, which is over collateralized by liquid staking tokens. The stablecoin is designed to be capital-efficient and offers additional incentives through integration with Curve and Convex Finance. This is a write up…

-

Assessing Smart Contract Security Auditors

A smart contract audit can cost anything from $5,000-$250,000 USD. Within this range there is a wide range of services, some offer better value for money than others. In this article I will go through the options for founders looking to hire an auditor and some of the checks you can do to ensure you…

-

Proposer Builder Separation

Proposer Builder Separation (PBS) is an Ethereum concept that aims to reduce relay centralization and redirect a proportion of MEV to validators staking Ethereum. In the current Ethereum network, validators are responsible for both proposing and building blocks. They are incentivised to coordinate with 3rd party MEV protocols which order the transactions in the blocks.…

-

Alchemix Self-Repaying Loans

Imagine a financial system where your loans automatically pay themselves off, interest-free and without the need for monthly repayments. Alchemix is a synthetic asset protocol run by community DAO. This is a write up of my research notes and is not sponsored in any way. I currently at time of writing have no stake in…

-

Gnosis Safe | The Most Secure Multisig Wallet For Your Crypto

Gnosis Safe multisig wallets are used by institutions and individuals to hold some of the largest quantities of funds on the Ethereum network. The free to use wallet includes multisignature functionality for enhanced security and control over digital assets. It is developed by Gnosis, a blockchain technology company based out of Switzerland and Germany, known…

-

Ethereum Improvement Proposal | How To Submit An EIP

Submitting an Ethereum Improvement Proposal (EIP) is a straightforward process that allows you to contribute your ideas and suggestions to the Ethereum community. Here’s a step-by-step guide on how to submit an EIP: What Is An Ethereum Improvement Proposal An Ethereum Improvement Proposal (EIP) is a formal document that provides technical specifications and rationales for…

-

How Wrapped Tokens Like wETH & wBTC Work

In this article we will look at how different wrapped tokens work and where the underlying collateral is stored. What Are Wrapped Tokens? Wrapped tokens are generally ERC20 tokens that represents another underlying asset, typically a cryptocurrency or real world asset. The purpose of wrapping a token is to enable its use within the DeFi…

-

Snapshot | Gasless Voting for Decentralized Communities

In decentralized communities voting plays a crucial role in governance and development of roadmaps. Snapshot is disrupting the traditional DAO voting model with a gas free voting platform. This is not a sponsored post and I have no stake in Snapshot, I do however like to use and promote open source tools which enable decentralized…

-

Is My Token A Security? The Howey Test For Digital Assets

The SEC & Securities Regulations The Securities and Exchange Commission (SEC) is an independent agency of the United States federal government that is responsible for regulating securities and protecting investors. In practice they have done more to protect Wall Steet financial institutions than they have ever done for individual investors. The SEC regulates securities through…

-

Uniswap Market Maker Bot | Managing Token Liquidity On Uniswap

In this tutorial I am going to go through how I built a market maker bot to manage liquidity on Uniswap v3 for a token pair. The idea is to create a automated trading bot which buys tokens when price falls below a base line value and sells tokens when price is above the base…

-

Trading The Lifecycle Of Crypto Narratives

The blockchain sector moves fast and attention shifts rapidly as crypto narratives emerge inflating valuations for sub-sectors before moving on to the next big thing. In this article I’m going to outlay my research into the lifecycle of crypto narratives to explore how we can best position our portfolios and allocate funds in a +EV…

-

How To Create A BRC20 Bitcoin Token

In this tutorial we will create our own BRC20 token on the Bitcoin network. James On YouTube Watch On YouTube: https://youtu.be/6eTN2fVd4Pw |Subscribe What are BRC20 Tokens? BRC20 tokens are created using the Bitcoin Ordinals protocol. The Ordinals protocol is a set of rules that govern how inscriptions are created, transferred and managed. Bitcoin and the…

-

Taproot Explained | Beneficial For Bitcoin?

The Taproot Bitcoin upgrade was activated on November 14th 2021. It was designed to improve privacy, efficiency and the network’s ability to process custom logic. The upgrade inadvertently made it possible to link metadata to Bitcoin transactions. By using ordinal theory it is possible to inscribe each satoshi (lowest denomination of Bitcoin) with a corresponding…

-

How To Create Your Own Memecoin With Solidity and Uniswap

In this tutorial we will be creating a permissionless, ERC20 memecoin and deploying it with a Uniswap v3 liquidity pool so users can buy it on the decentralized exchange. This tutorial is for demonstration purposes, don’t speculate on memecoins. James On YouTube Watch On YouTube: https://youtu.be/-bVzqtIa0bc |Subscribe The full source code for this is at:…

-

What is Pepe | A Memecoin Story

The Pepe memecoin is a cryptocurrency based on the Pepe the Frog meme, which originated on the imageboard website 4chan in 2005. The meme gained mainstream popularity in 2016 when it was adopted by supporters of then-presidential candidate Donald Trump. PepeToken is an ERC20 token on the Ethereum blockchain. It is widely traded across many…

-

Will Quantum Computing Break Bitcoin?

Quantum computing has the potential to transform the way we solve complex problems in various fields, including cryptography. It offers a unique approach to problem solving that can break certain cryptographic algorithms and create new opportunities for cryptography. Bitcoin uses a combination of SHA256 hash functions and secp256k1 elliptic curve (ECDSA) cryptography to secure transactions.…

-

Technical Analysis For Crypto Degenerates

For cynics technical analysis is seen as astrology for middle aged white guys for others it is the holy grail, which when mastered, inevitably leads to trading success. The truth is somewhere in the middle, it is undeniable that price action reacts more at some levels than others. It’s important for anyone involved in investing…

-

Asymmetric Cryptography Explained

Asymmetric cryptography uses different keys for encrypting and decrypting data. The key used for encryption is called the public key, and the key used for decryption is called the private key. Asymmetric cryptography schemes are used for secure communication over insecure channels, such as the internet. It is used in blockchain networks for users to…

-

Frax Finance | DeFi Analysis Report

Frax is a growing ecosystem of DeFi products built on Ethereum. This is a write up of my internal research notes, this is not a sponsored post and I have no stake currently in Frax or FXS. What Is Frax? Founded in 2019 by Jason Huan, Sam Kazemian & Travis Moore. Frax has a legal…

-

Monolithic vs Polylithic Blockchains

Bitcoin is a monolithic blockchain, consensus is achieved on a single chain where all state data is stored. The Cosmos ecosystem is an example of a polylithic chain where there are multiple sub-chains running under a single consensus client. Monolithic Blockchains Monolithic blockchains are single-chain protocols where all functionalities including programmability through smart contracts, consensus…

-

Web3 Investment Thesis

This Web3 investment thesis covers the potential disruption from decentralized permissionless computing. As blockchains scale it’s going to be possible to use smart contracts to enable users to store their own data creating the opportunity for a new era of decentralized applications. Web3 Disrupting Data Web3 disrupts the way we store data online by using…

-

DeFi Futures – GMX vs DyDx

Trading DeFi Futures products on decentralized exchanges such as GMX and DyDx has never been easier. The user experience is getting close to on par with centralized exchanges. Liquidity however, not so much… In this article we will look at how DeFi futures work, the market opportunity for decentralized futures exchanges and the two most…

-

Bitcoin Ordinals

Bitcoin ordinals are a means of creating NFTs by attaching data such as images, videos, and more to an individual satoshi on the base Bitcoin blockchain. They use an arbitrary but logical ordering system called ordinal theory to give each individual Bitcoin satoshi a unique non-fungible reference. What Are Bitcoin Ordinals? Bitcoin ordinals, also known…

-

EigenLayer | DeFi Analysis Report

EigenLayer is a protocol which allows Ethereum stakers to restake their ETH. This is a write up of my internal research notes, this is not a sponsored post and I have no stake currently in EigenLayer. EigenLayer is being developed by EigenLabs which is headed by CEO Sreeram Kannan. Sreeram has an academic background and…

-

Renegade Dark Pool DEX

Renegade is a new type of decentralized exchange that utilizes a dark pool to provide MEV resistant private transactions. This is a write up of my personal research, is not a sponsored post and I currently hold no stake in Renegade. What Is Renegade? The Renegade whitepaper was authored by Christopher Bender and Joseph Kraut.…

-

ERC20 Carbon Credits | Creating A Depleting Token

Carbon credits are used to tokenise finances put towards carbon offsetting. On-chain products often have a purchase and burn mechanism where a user must first purchase the token on a DEX and then manually execute a transaction to burn the token. I had the idea to create a automatically depleting token which you just hold…

-

zkEVM | Are Zero-Knowledge Rollups The Future Of Ethereum Or A Ticking Time Bomb?

zkEVM is a zero knowledge Ethereum virtual machine, credited as being “the ultimate solution to Ethereum scaling” The Ethereum ecosystem continues to grow alongside concerns around its scalability and privacy. A new technology currently being rolled out aims to address these issues through the implementation of zero-knowledge rollups. In this article, we’ll take a closer…

-

How To Stake Ethereum | Earn More Yield With Ethereum Staking

Staking Ethereum has become a popular way for crypto investors to earn passive returns on their holdings. Liquid staking tokens like stETH make this process easily accessible. You can buy staking tokens and effortlessly enjoy the rewards of staking Ethereum without having to manage the technicalities of running a node. Lido Finance were first to…

-

Crypto Market Thesis 2023

Once viewed as a fringe market for tech-savvy libertarians, the crypto market has grown exponentially in recent years and is now being recognized as a legitimate asset class by mainstream investors. As we move into 2023, the crypto market is at a crucial juncture, with the potential to continue its explosive growth or face regulatory…

-

Mean Finance | How To DCA With DeFi

Mean Finance is a DeFi protocol that enables users to dollar cost average (DCA) into a position for an ERC-20 token. In this article we will look at why dollar cost averaging is useful and how Mean Finance works. Why Dollar Cost Average Dollar cost averaging is an investment strategy that simply breaks a entry…

-

RAILGUN 2.0 | ZK Privacy Protocol

Railgun just announced the launch of version 2.0 this week and in this article we are going to explore the zero knowledge wallet and discuss why privacy protocols are important. In August 2022 Alexey Pertsev was arrested and he has been imprisoned without trial ever since. He was a developer on a ZK mixer called…

-

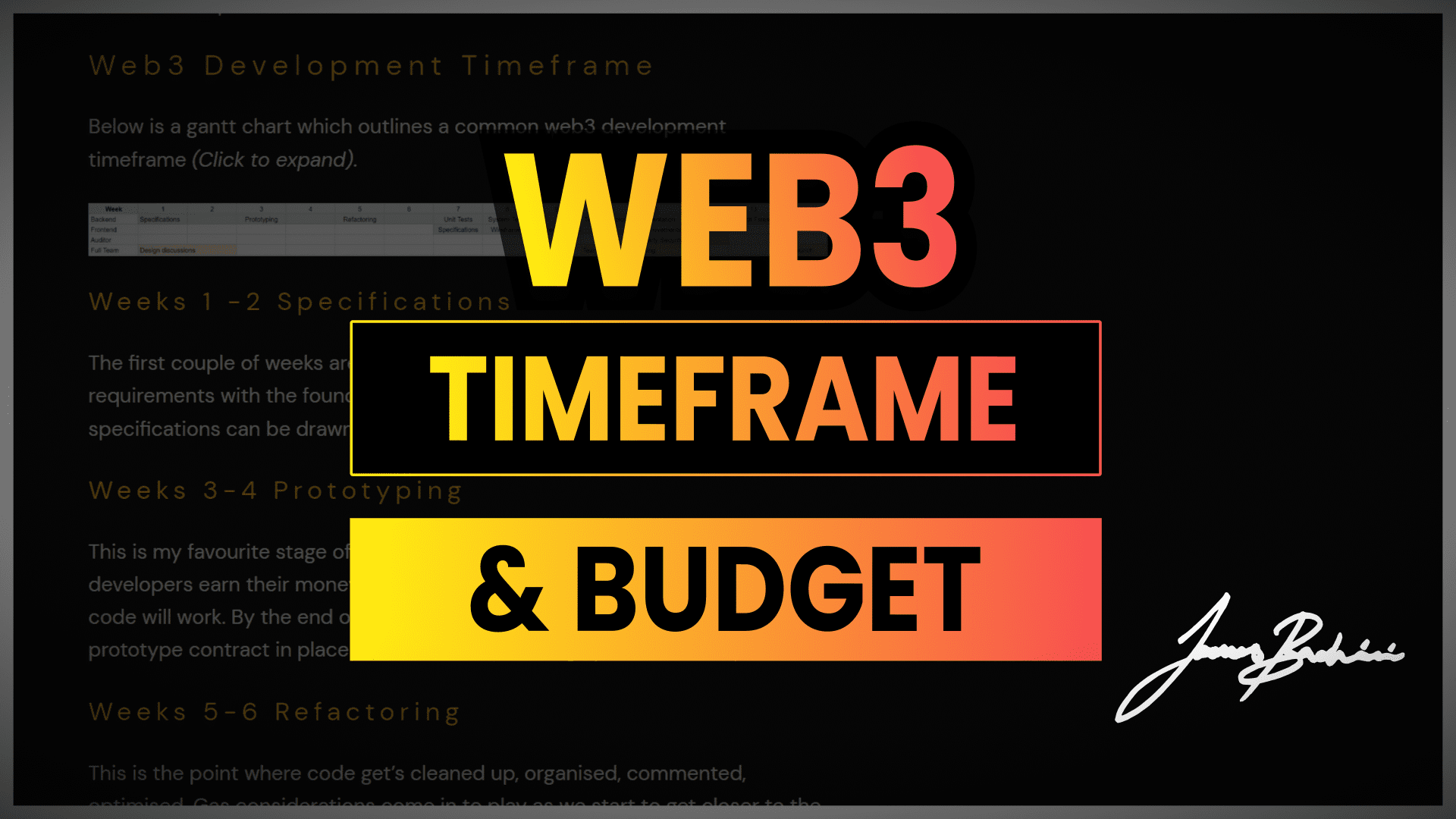

Timeframe & Budgets For Web3 Development

In this article I’m going to provide a timeframe, gantt chart and budget costs for web3 development projects. This assumes a medium sized project for something like a new, innovative DeFi protocol consisting of 5-10 interconnected smart contracts and around 1000 lines of code plus an external audit and dApp frontend. If you are just…

-

FTX Collapse Explained | The Story Of Scam Bankrun Fraud

In November 2022 the world’s second largest cryptocurrency exchange FTX collapsed, stopped withdrawals and filed for bankruptcy. The stories of the last week are so far-fetched they deserve a Netflix documentary. Here we will look at how FTX was able to defraud the crypto industry of somewhere in the region of $10 Billion US dollars.…

-

POAP vs NFT | A Guide With Examples

In this article we will look at what POAPs are and how their technology is built on top of NFT standards. We will also look at how to create simple POAPs and NFTs. In the conclusion I’ve put together some thoughts on why I think POAPs should only be used for fun and not for…

-

SAFT Template | Simple Agreement Future Tokens

Below I’ve shared an example SAFT legal agreement and a smart contract which can be used to lock up tokens. James On YouTube Watch On YouTube: https://youtu.be/hpsegda6gvo |Subscribe What Is A SAFT? A SAFT is a simple agreement for future tokens. It is used primarily for blockchain projects to sell tokens at an early stage…

-

Ethereum DevCon Bogotá Write Up

In this post I’m going to try to summarise some of the most interesting talks at from DevCon 2022. Here’s a video summary about the key takeaways from the conference. James On YouTube Watch On YouTube: https://youtu.be/kgiAV7z1fwo |Subscribe The main topics for this years event were: One of the best things about the event is…

-

Solidity Token Factory Contract Walkthrough

A token factory contract is used to deploy tokens from a parent contract within Solidity. In this simple example we will be deploying an ERC20 token from our factory contract. James On YouTube Watch On YouTube: https://youtu.be/MY9SoGPGVoo |Subscribe Full source code below and on Github: https://github.com/jamesbachini/Token-Factory-Tutorial We start with a standard ERC20 token using the…

-

The State Of CBDC Central Bank Digital Currency

Nation states across the world are exploring CBDC’s (central bank digital currency). Many governments including France, Canada, Saudi Arabia & China have pilot schemes already in place. The US dollar is the global reserve currency, it’s used throughout the world as a base asset and more recently as a political weapon in the form of…

-

Twitter Crypto Ads | Blockchain Advertising Is Live On Twitter

Twitter crypto ads are live after the platform unofficially relaxed its ban on advertising crypto products. Perhaps due to the Elon bid there seem to be more ads showing up and less stringent controls on ad quality. This opens up an opportunity for companies in the sector to use the platform for growth. In this…

-

Dune Analytics Tutorial | How To Create A Dune Analytics Dashboard

In this Dune Analytics Tutorial we will look at how the platform works and get up to speed with creating our own queries, visualisations and dashboards to analyse and present blockchain data. Queries, Visualisations & Dashboards Dune Analytics dashboards are built using a 3 step process. First we make SQL queries to pull data into…

-

Zero Knowledge Proof | How ZKP Works In Blockchain Applications

Zero knowledge proofs offer a method for developers to prove data validity or knowledge of data without revealing the data or additional information about the prover. Zero knowledge proofs are becoming widely used in blockchain applications from smart contracts like Tornado Cash to ZKrollups which are layer 2 blockchains on top of Ethereum. In this…

-

GameFi 2.0 | Sustainable Tokenomics & Business Models

GameFi utilises digital assets such as cryptocurrency tokens and NFT’s to create internal economies within games. In this article I look at how tokenomics can be designed to create sustainable business models for gamers, investors and developers. James On YouTube Watch On YouTube: https://youtu.be/Ul_Mza9IyYE |Subscribe GameFi 1.0 Play2Earn Growing up I played computer games on…

-

Bear Markets | How Human Psychology Works Against Us

Is loss aversion causing long-term underperformance in our portfolios? In bear markets I find it harder to rebalance my portfolio and allocate capital to riskier investments. This creates an unintentional de-risking in bear markets where there is a better long-term risk to reward. James On YouTube Watch On YouTube: https://youtu.be/6F1Cpk14stE |Subscribe Not a financial advisor,…

-

SBTs 👻 | Soulbound Token Solidity Example

Soulbound tokens are non-transferable digital assets. The core concept is storing on-chain data directly relating to a specific address. This is nothing new but there is potential for a ERC SBT contract to provide a industry standard for how we manage user data. James On YouTube Watch On YouTube: https://youtu.be/yCHeHI8hUY8 |Subscribe Ethereum gas costs make…

-

Blood in the streets for crypto markets

A year ago I outlined my 60/40 digital asset portfolio which was 60% crypto and 40% USD stablecoins. One of the biggest benefits to this portfolio is that during market downturns it leaves you with capital to deploy. Today has been one of the most chaotic days in crypto markets ever and I’m going to…

-

Foundry Tutorial | How To Debug & Deploy Solidity Smart Contracts

Foundry is a Solidity Framework for building, testing, fuzzing, debugging and deploying Solidity smart contracts. In this Foundry tutorial we will cover the following: Introduction To Foundry [Video] James On YouTube Watch On YouTube: https://youtu.be/VhaP9kYvlOA |Subscribe Smart contracts are most often written in Solidity but tested and deployed using Javascript frameworks such as Truffle or…

-

Which Token Will Coinbase List Next?

Coinbase has come under criticism for insider trading which has led them to open up about what tokens they are considering listing in the future. In this article we will look at the opportunity this brings alongside an analysis of all 50 projects. We will end by looking at how we can identify and track…