Brine Finance is a decentralized orderbook exchange built on Starkware. They recently raised $16.5m at a valuation of $100m in a round led by Pantera Capital.

This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to Brine at time of writing. Do your own research, not investment advice.

Brine is a cross-chain orderbook DEX offering low trading fees and gas free transactions. They currently have $750k in TVL which has seen modest growth since launch in summer 2023.

The founding team is based out of India and there are 24 employees currently listed on Linkedin.

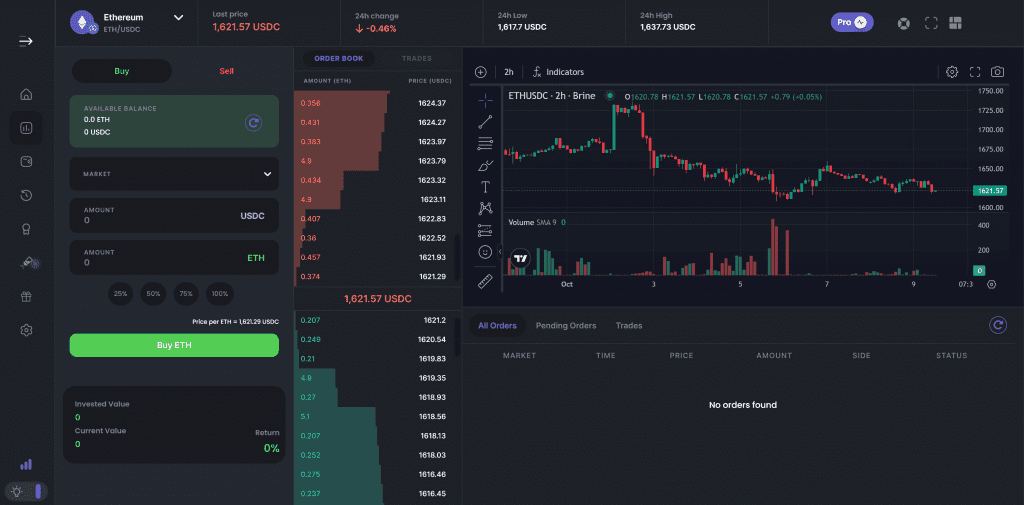

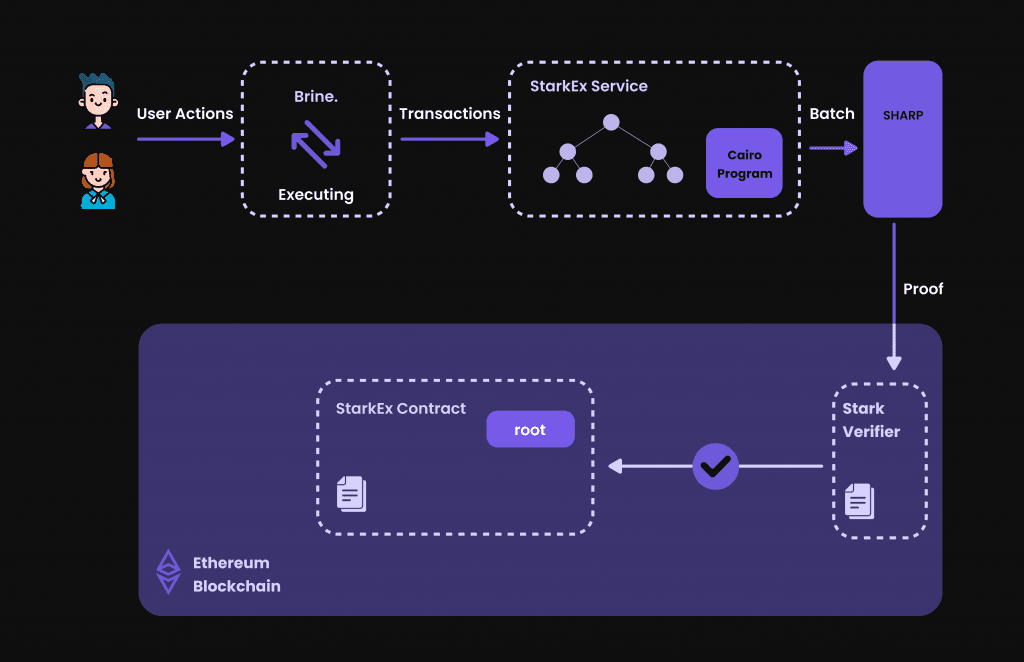

While Brine is advertised as a decentralized exchange it actually uses a hybrid model with wallet data, orderbooks, trades and transactions stored and processed off-chain.

A batch processor sends the transactions to a Cairo prover which then sends it to the Stark verifier which then pushes a state update to user balances on L1.

Users can deposit funds into the exchange on Ethereum mainnet and Polygon networks. The exchange currently lists two markets for Bitcoin and Ethereum against the USDC stablecoin. There is a rest API which users can interact with for programmatic trading.

In my opinion the architecture stretches what could be considered a decentralized exchange and the code isn’t open sourced.

The funding round is an incredible achievement given market conditions and somewhat surprising considering the $100m valuation and lack of traction. I fact checked it and Brine is listed in Pantera’s portfolio, they must see something special in the team and architecture.

The community is affectionately known as Brinerds and there is currently a trading competition for $2000 USDC live on the ETH/USDC market.

It will be interesting to see how development progresses and if that $16.5m USD can be put to good use to attract users, trading volumes and liquidity.