Staking Ethereum has become a popular way for crypto investors to earn passive returns on their holdings. Liquid staking tokens like stETH make this process easily accessible. You can buy staking tokens and effortlessly enjoy the rewards of staking Ethereum without having to manage the technicalities of running a node.

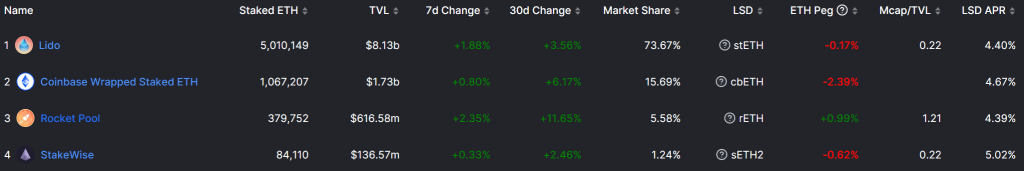

Lido Finance were first to market with their stETH product which has become a DeFi giant, with over $8 billion worth of ETH staked. But with emerging competitors like Rocket Pool’s rETH and Stakewise’s sETH2 the question on my mind is “Should I diversify my staked Ethereum position?”

- Video: How To Stake Ethereum

- How Liquid Staking Tokens Work

- Ethereum Staking Options

- How To Manage Risk When Staking

- Governance Token Growth

- Conclusion

Video: How To Stake Ethereum

How Liquid Staking Tokens Work

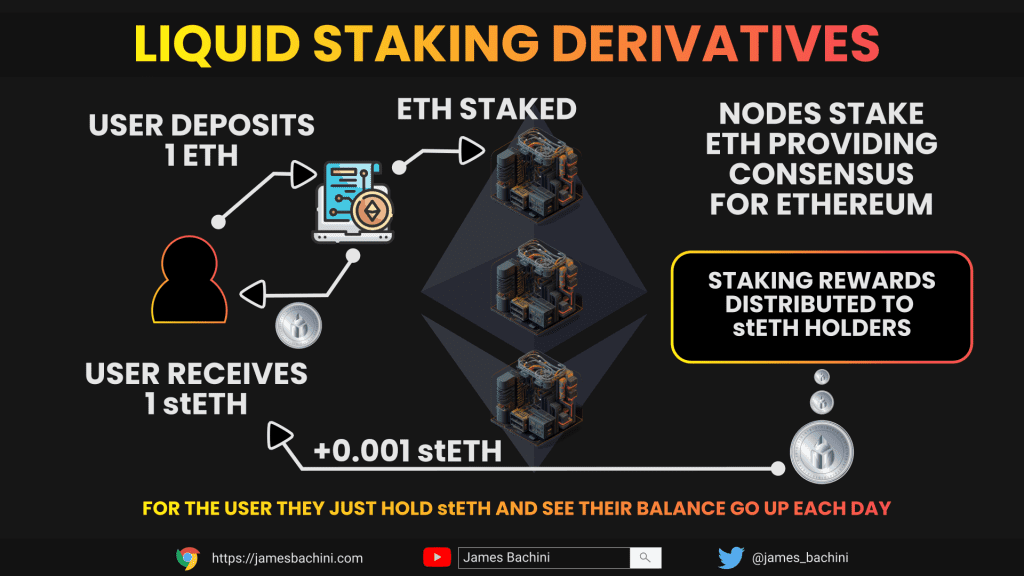

Liquid staking tokens like stETH, which we will use in this example, work by allowing users to deposit ETH into a smart contract and receive an equivalent amount of stETH. The stETH token is liquid, meaning it can be traded on decentralized exchanges such as Uniswap and Curve.

The primary reason for stETH is to provide a more accessible and liquid way to earn staking rewards on the Ethereum blockchain without having to lock up a minimum of 32 ETH and run a node. Operators charge 10% of the yield earned in exchange for doing the actual staking.

stETH also provides transparency, as its balance is updated daily based on the amount of ETH staked and the change in total stake. The users balance is a reflected percentage of the total amount. This means all a user has to do is exchange ETH for stETH and hold it in their wallet. Without doing anything else they will see their stETH balance going up each day.

Ethereum Staking Options

I’m going to mainly focus on the four largest liquid staking derivatives in stETH, cbETH, rETH and sETH2. However home staking has also become a very viable option and deserves mentioning alongside some of the newer protocols that are gaining traction in the space

Lido Finance stETH

Lido’s stETH is the original and still most popular liquid staking derivative. It works via a rebalancing mechanism where the users balance increases as staking rewards come in. This makes it widely unsuitable for liquidity providing which is why there is often more liquidity for wstETH (wrapped stETH) on DeX’s like Uniswap.

There are a few different ways to obtain stETH:

- Deposit ETH directly to the contract via the platform at https://lido.fi

- Purchase via a DeX or aggregator like 1inch to get the best deal

It’s worth checking on 1inch to see if stETH is available at cheaper than the 1:1 peg. Towards the end of last year the FUD and selling from FTX caused a depeg event where the token was trading at 0.95 ETH.

This brings up an important point about all liquid staking derivatives. Staked Ethereum isn’t currently available to withdraw so if you want to exchange stETH back to ETH you are at the mercy of the secondary markets which are not guaranteed to trade 1:1. Note that this will change after the Shanghai update which is planned for March this year.

Coinbase cbETH

Coinbase is offering its customers a way to trade their staked ETH through the creation of Coinbase Wrapped Staked ETH (cbETH), an ERC20 token that represents their locked staked ETH.

Holders of cbETH can withdraw and trade the tokens off the Coinbase platform and the price of cbETH may differ from ETH over time due to accrued staking interest. Customers can unwrap their cbETH to receive the underlying ETH2 at a conversion rate that grows over time.

Unfortunately cbETH isn’t an option for me as it’s not available in the UK. It probably shouldn’t be an option for you either as they charge a 25% fee on the staking returns.

Great to see all the FCA are doing to help London become the future capital of Fintech in Europe

Rocket Pool rETH

Thank you to Bill Saunders who took the time to explain the Rocket Pool ecosystem and validator requirements. I went into the conversation with an interest in diversifying my stETH position and came out of it knowing I’m going to end up going down the route of running my own node at some point.

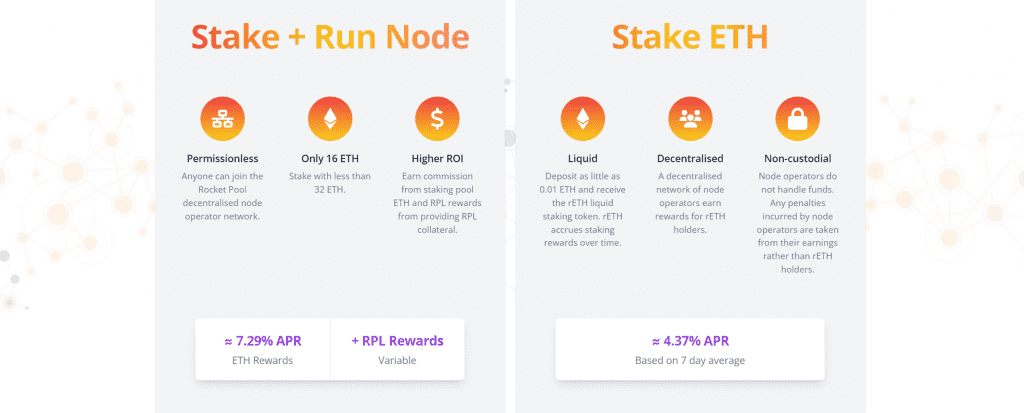

Rocket Pool is a decentralized staking platform for Ethereum. A node operator can setup a validator with 16 ETH and offer the remaining 16 ETH capacity to an investor. The investor will be given an amount of rETH equal to the value they contributed. Note that staking rewards accrue in the value of rETH rather than the increasing supply like with stETH, so rETH is constantly going up in value relative to ETH. At time of writing 1 rETH is worth 1.05 ETH.

The node operator does not receive rETH on their side but earns staking fees on their holdings and also a fee for running the node from the investor. In addition to this they can stake 10-150% of the ETH value in the RPL governance token to earn a share of the RPL token distribution.

The creation, withdrawing, and rewards delegation are handled by Rocket Pool’s permissionless smart contracts, making it a decentralized system. Stakers deposit ETH into the deposit pool and receive an ERC20 token called rETH in return. The value of rETH is determined by the rewards earned by Rocket Pool node operators.

As the rewards accumulate over time, the value of rETH increases relative to ETH, and can be traded back for ETH directly with Rocket Pool, or used in DeFi applications like trading or lending.

Rocket Pool offers a more decentralized product at the cost of scalability which is much slower and currently bottlenecked because of the reliance on 3rd parties to run the nodes. Rocket Pool currently has less than 10% of the TVL of Lido Finance but I believe this is likely to change. As Bill pointed out the 16 ETH requirement for node operators is being dropped to 8 ETH which opens it up to more validators but also expands the capacity of the network considerably.

For example a validator currently running a single node with 16 ETH staked provides 16 ETH of capacity to investors. After the update he will be able to run two nodes with 8 ETH in each, this provides 48 ETH of capacity to investors. It’s been suggested that it may be possible to drop the operator requirement down to 4 or even 2 ETH in the future which would provide considerable additional capacity.

This combined with the continued integration of rETH in to Ethereum’s DeFi ecosystem, Aave are currently adding it as collateral enabling it to be used to create leveraged positions, makes me very bullish on the growth prospects of Rocket Pool in capturing significantly more market share in the future.

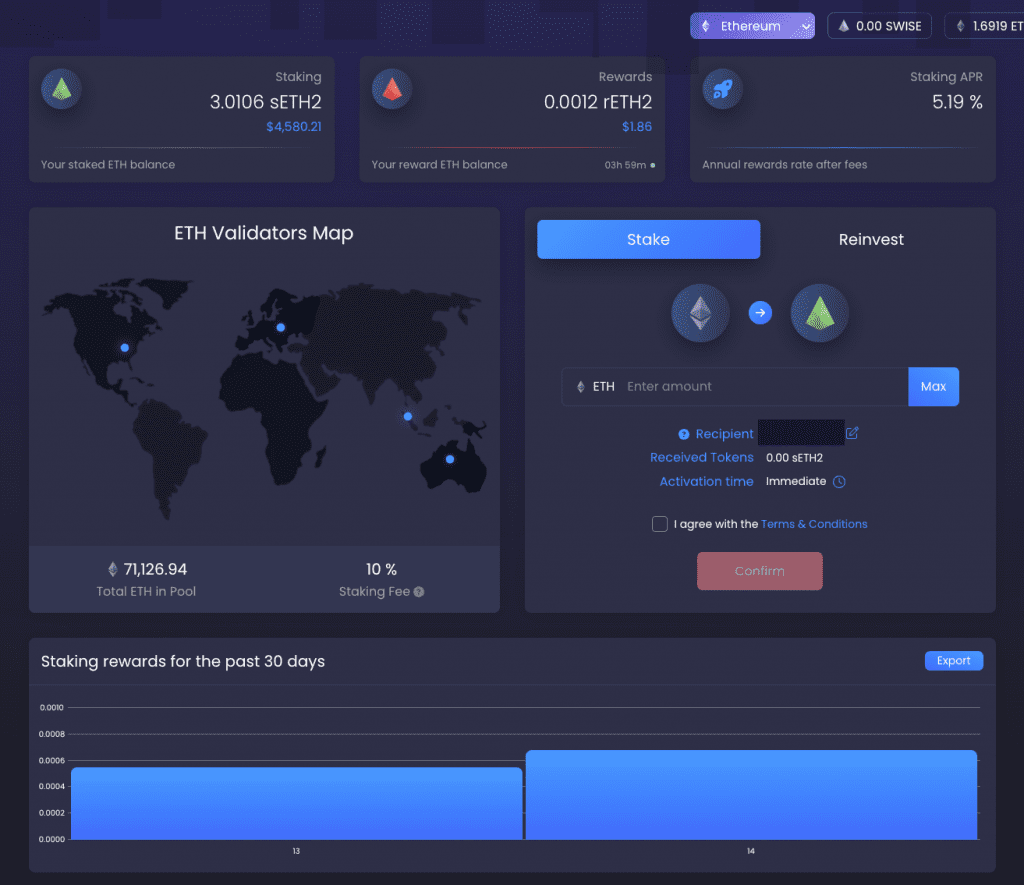

Stakewise sETH2

StakeWise Pool collects ETH from multiple users, creates a new validator for every 32 ETH, and shares rewards proportionally. StakeWise tokenizes deposits and rewards as sETH2 (staking ETH) & rETH2 (reward ETH). Infrastructure is maintained through automatic scaling of cloud servers and validator management.

They have had a number of audits including one from Quantstamp in the last 12 months and also have an open and ongoing bug bounty program with immuneFi.

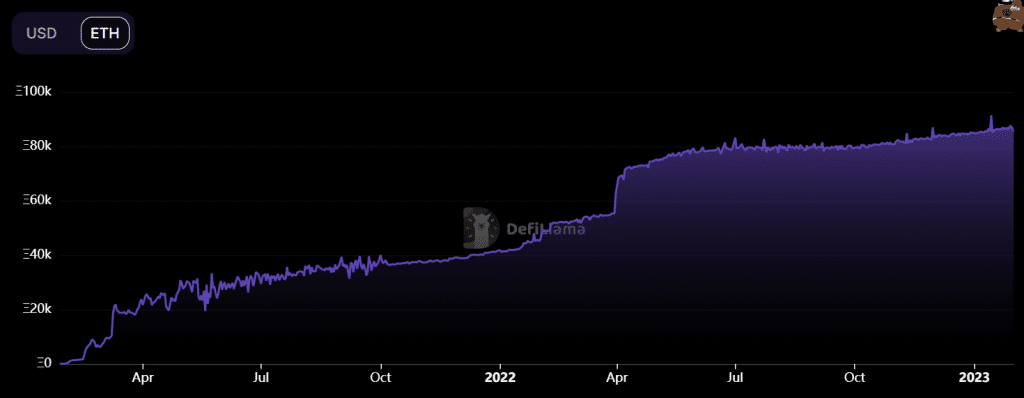

Stakewise have a TVL of $130m USD at time of writing and in ETH terms we are seeing steady growth

Staking At Home

I’m becoming more convinced that this is something I want to get involved with the more I research it so I asked Nick Nelson and Marceau about their experiences with staking from home and how best to get started.

Nick prefers solo staking and pointed out that it’s possible to run multiple validators from a single hardware device. A good quality 2TB SSD is important and opening up external firewall ports on the router is optional. Nick recommended this resource as a starting point for solo staking: https://www.coincashew.com/coins/overview-eth/guide-or-how-to-setup-a-validator-on-eth2-mainnet

With MEV the APR rewards he was getting from solo staking was 6.6% although there is some variance based on the “MEV lottery”.

Marceau prefers running Rocket Pool nodes. Here is the conversation:

It’s a fun rabbit hole to go down. In all honesty it’s fairly rewarding and a fun hobby if you like to tinker with tech.

Main question is how much hassle is it to run a node from home?

It can largely be as easy or hard as you make it. Most setups are easy. Set and forget. I’m guessing this is what you’re looking for. If you wanted to build something at scale that is reasonably resistant to things like internet downtime or power outages it gets a little harder.

For the most part you’ll be setting up a dedicated computer to run staking, and then making sure it stays online. You can easily set up alerts that will let you know if something goes wrong.

It’s probably ~6 hours to setup initially and then a couple of hours a month to monitor / update / support it. We have plenty of strictly non-technical people who are running nodes. It’s pretty accessible.

You can get going with ~$400-$800 computer hardware.

Have you seen any issues with internet connectivity i.e. Is my girlfriend going to get mad at me because Netflix keeps buffering?

You can expect that a node will consume about 10mbps down and up. So the answer depends on your internet connection. If you have something like DSL at 10-20mbps you may see some throttling. Most people have more than this and it isn’t usually a problem, but you might need to upgrade internet depending on what you have.

Do you have any advice for someone looking into setting up their own node for Rocket Pool staking?

The docs are really good. It’s honestly just copy and paste. https://docs.rocketpool.net

The community is also very supportive if you get stuck or have any questions. Check out the discord. It’s fairly vibrant.

Other Staking Options

Liquidity Provider – LPing is hard with staked tokens because often you need to use a wrapper to ensure staking rewards still go through to the holder. There are some interesting strategies on BeefyFinance which make use of the eth-wsteth pool on Curve. I’m not sure if the additional layers of risk make up for minimal increases in yield.

Frax frxETH – Recently launched and growing fast thanks to the popularity of the Frax ecosystem.

ANKR – Will probably look at these in a separate post as a way to gain exposure to BNBchain (Binance).

Index Coop dsETH – A index fund token containing stETH, rETH and sETH2, more information here: https://indexcoop.com/blog/understanding-the-diversified-staked-eth-index-dseth

How To Manage Risk When Staking

For most users I think the three products to consider are stETH, rETH and sETH2. Coinbase has excessive fees while other liquid staking tokens might just be a bit too new and small cap for me to trust over the larger more established products.

I believe a staked Ethereum position will outperform most other asset classes over the next 10-20 years so managing the risk on that position is going to be important. Rocket Pool offers diversification over a single provider and I appreciate their goal of decentralizing the staking ecosystem on Ethereum.

The balance that I have in stETH I plan to partially liquidate after the Shanghai update goes live (staking withdrawals) which will allow me to reposition a portion of those funds in to Rocket Pools products. The reason for the wait is that stETH is currently trading on secondary markets at a discount while rETH is trading at a premium.

I’m currently sitting on the fence but think I’ll likely end up running a node either from home or via a remote server to get the best return from my holdings.

For solo staking it will be important to follow good server security practices, particularly in regards to storing and using SSH keys. Staked funds can be protected via a contract wallet which specifies a specific withdrawal address. The staking server uses this contract hot wallet which has a high risk of theft but even if someone accesses your server they can only withdraw funds to your specified withdrawal address which could be a separate hardware wallet or cold storage.

Governance Token Growth

At time of writing I currently hold LDO and it’s been one of my best performing assets over the last 12 months. I think there is a clear path for Rocket Pool to eat in to Lido’s market share and also grow with the greater Ethereum staking opportunity.

Update: 6th February 2023 – I also took a position in RPL the native governance token of Rocket Pool

The nature of Rocket Pools decentralized product encourages individual node operators leading to a very engaged community and greater decentralization. This is clear from the average amount of ETH staked per node operator which is 112 for Rocket Pool, 170,000 for Lido and over 1,000,000 for Coinbase. I believe more validators run by smaller stakers is better for Ethereum and reduces single points of failure, Rocket Pool is contributing to this goal.

So let’s look at the RPL governance token…

RPL Tokenomics

The RPL token is designed to incentivize key players in the RPL ecosystem primarily the node operators. This incentivization comes in the form of perpetual inflation, currently set at 5% per year. This inflation will be divided between node operators 70%, oracle DAO members 15%, and the protocol DAO treasury 15%.

The rewards are paid out to the node operators that can stake between 10-150% of the value of their ETH deposits in RPL tokens. So a node operator has to buy some RPL to start with as collateral when starting up a node. The rewards are divided equally to all node operators that are staking the RPL token.

Currently the APR on the RPL staking is 9.98% which is higher than the amount earned on the ETH side which for node operators is currently 7.29%. For node operators RPL is a very attractive proposition because they are in a better position to benefit from the inflationary supply than a speculator trading on exchange.

There are some very interesting ideas on VVander’s blog about RPL tokenomics. I agree the inflationary supply @ 5% a year seems unlikely to compare to the potential growth in terms of ETH staking capacity. Rocket Pool should be able to 10x it’s TVL over the next 3 years and I expect this growth to be reflected in the token valuation both against ETH and the USD.

Conclusion

I set out down this rabbit hole to find out if I should diversify my stETH with a basket of other liquid staking tokens. The answer to that question I believe is yes, there are other tokens which have established themselves and are fit for the portfolio.

The one that interests me the most is rETH from Rocket Pool however now might not be the best time to diversify due to the premium that this asset is trading at against the discount on Lido’s stETH. After the Shanghai update and Rocket Pools efforts to increase capacity we should see both these assets align more closely to their underlying staked Ethereum valuation.

Over the course of researching this topic and writing this blog post I’ve become interested in running my own node and setting up a Rocket Pool validator. I’m not sure if this is something I’ll do on a VPS, cloud server or a local device but if I do go ahead with it I’ll write up my experience here in due course. What could go wrong?!

Thank you to Bill, Nick & Marceau who helped with the research for this piece.