In June 2017 John Watkinson and Matt Hall released 10,000 avatars via an automated 24×24 pixel ‘punk’ character generator on the Ethereum network. These non fungible tokens were available to claim for free by anyone with an Ethereum wallet. Four years later and some of these cryptopunk NFT’s are selling for millions of dollars.

In this article, which I researched mainly to challenge my own scepticisms, I’ll discuss the various types of non fungible tokens, some history of past collectibles, opportunities in the space and my concerns with the liquidity and resale valuations of NFT’s.

- What are Non Fungible Tokens?

- Non Fungible Tokens Explained [Video]

- 5 Types of Non Fungible Tokens

- Collectibles & The Test of Time

- The Highest Value NFT’s

- NFT Funds & Fragmatisation

- Resale Value & Liquidity

- Conclusion | Would I Buy An NFT?

What are Non Fungible Tokens?

Non Fungible Token Definition

NFT’s are unique tokens deployed via a smart contract on a decentralised network or blockchain. Non fungible tokens are used to transfer ownership of metadata often representing digital art and collectibles.

Non Fungible Tokens Explained [Video]

A Short History Of Non Fungible Tokens

- June 2017 – CryptoPunks

Crypto punks used a precursor to the ERC721 smart contract. They are seen as seminal to everything that came later. - October 2017 – CryptoKitties

Released at ETH waterloo hackathon. The first NFT to gain traction and mainstream attention - March 2018 – Decentraland

Decentraland market place goes live allowing for secondary market sales - 2018 – OpenSea

Opensea and SuperRare marketplaces come out of beta and start gaining traction - December 2020 – Beeple

Beeple’s first drop auctions on Nifty Gateway - February 2021 – Music NFT’s

Various artists publish audio NFT’s including Steve Aoki and Kings of Leon - March 2021 – Christies Auction

Beeple’s “First 5000 Days” NFT sells for $69m USD at Christies.

How Do NFT’s Work?

NFT’s are fundamentally just smart contracts. A piece of code which represents data and can transfer ownership between accounts.

TECHNICAL DETAILS

The most common smart contract which is used for non fungible tokens is Ethereum’s ERC721. Every NFT that is minted will have a ownerOf() function to declare the address of the owner and a tokenMetadata() which provides data on what the NFT represents. Additional data can be stored off-chain and linked to with the tokenURI() function which links to a web address or IPFS location.

The ERC721 token standard is a base on which additional functionality can be built and developers may code in additional functions to increase utility. An updated version of the ERC721 was developed by Enjin, the ERC1155 token adds functionality for semi-fungible tokens and batch transfers among other improvements.

Many market places and NFT portals provide web based applications for creators to easily mint NFT artworks without ever interacting with the underlying code. A creator may take a jpg image, upload it to Opensea or Rarible and mint an NFT.

A creator must pay the transaction fee to mint an NFT which on Ethereum can currently cost between $50-100 USD. Lower cost alternative chains and layer 2 solutions do exist but the majority of valuable NFT works are currently stored on Ethereum.

5 Types of Non Fungible Tokens

The Future of Art

Art has been valuable and collectible for hundreds of years. Leonardo da Vinci’s Mona Lisa was painted in the early 16th century and it is considered priceless to the extent that it’s potential value at auction has an unknown upper bound. Every year people queue up at the Lourve in Paris and derive pleasure from viewing a seminal and extraordinary work of art.

In the future it’s possible, perhaps even probable, that art will move online. Pixels will replace paints and there will be a culture and wider acceptance of digital art. While there will always be artists working with oil on canvas it’s now possible to display digital art on a wall, in a digital gallery and perhaps most importantly on social media.

Artists can express creativity in new ways, using new tools to develop new ideas. Art work can be published, shared and distributed faster than ever before.

And yet digital art isn’t new. MacPaint was developed the same year I was born in 1983. Digital art has been possible but yet not valued or appreciated since it’s inception nearly 40 years ago. Today it is a controversial topic with the first NFT sale at Christie’s drawing headlines from mainstream media around the world. Can a JPG really be worth $69m USD? I guess that’s only something the bidders can decide.

The Metaverse

A metaverse is a shared digital space where users can interact and explore 3d worlds. My first experience of the metaverse was via Decentraland. I recently logged back in to see how it had developed over the last 3 years since my previous visit.

To me the technology still isn’t quite ready to make this enjoyable yet but I think playing in Decentraland is like glimpsing in to the future. It’s buggy, it takes longer to load than a Comodore64 tape and everything looks a little bit low-poly. Having said that it’s easy to see how this could be completely game changing in a ready player one type of way.

We communicate more online than offline already and this could be the next stage of that development. Imagine if during the Covid lockdown you could meet up with friends in a virtual cafe or pub. Talk trash and make jokes just like you would in real life without having to get dolled up for a night out.

MMORPG’s like World of Warcraft have proven market demand for this type of product. A leak in 2020 suggested that World of Warcraft had between 1.7m and 3.4m monthly users. The metaverse will likely attract a different demographic but the appeal wont be too dissimilar.

In the next ten years we could see a metaverse project go viral and take off in the same way social media platforms did in the past. Perhaps it could be a tipping point for virtual reality and VR headsets in which case gamers will probably lead the movement.

Tech wise I believe the current limitations are based on 3d rendering within a web browser and any developments in this space are worth watching. There’s a chance that Decentraland and other existing metaverses are built on frameworks that will never meet users expectations. I believe there’s a chance something else will come along that is ten times better and provides an addictively good metaverse experience.

If someone does get this right then it could become the most valuable asset in the world. Facebook is one of the most valuable US tech companies and the metaverse is far more immersive and disruptive than social media.

However back to NFT’s and the reason I logged in to Decentraland while doing this research was two fold.

- They sell digital land as NFT’s which has been slowly increasing in value recently. You can actually build 3d models and “deploy” them to your land. Some people have used their land to build casinos in which you can gamble cryptocurrency.

- In the screenshot above you can see a NFT hallway which provides a virtual gallery of NFT art work. I enjoyed walking around the various galleries and checking out NFT art. Will I be rushing back to do it again? Perhaps in another three years.

Visiting a virtual gallery in a virtual reality metaverse to view digital art may seem a long way off but the technology is there, it just needs refining.

In Game Tokens & Items

If we are going to be interacting in a metaverse then we are probably going to want to look our best and decentraland has a marketplace for custom apparel.

Entire industries have been created via freemium games selling in-game items and credits. NFT’s can take this further by decentralising that value. Providing true ownership of the item in the hands of the purchaser rather than a database entry on a centralised server.

Transaction costs currently make this unviable on Ethereum but with ETHv2.0 increasing capacity and reducing fees it could be an opportunity for game developers to leverage NFT’s to create value in their games.

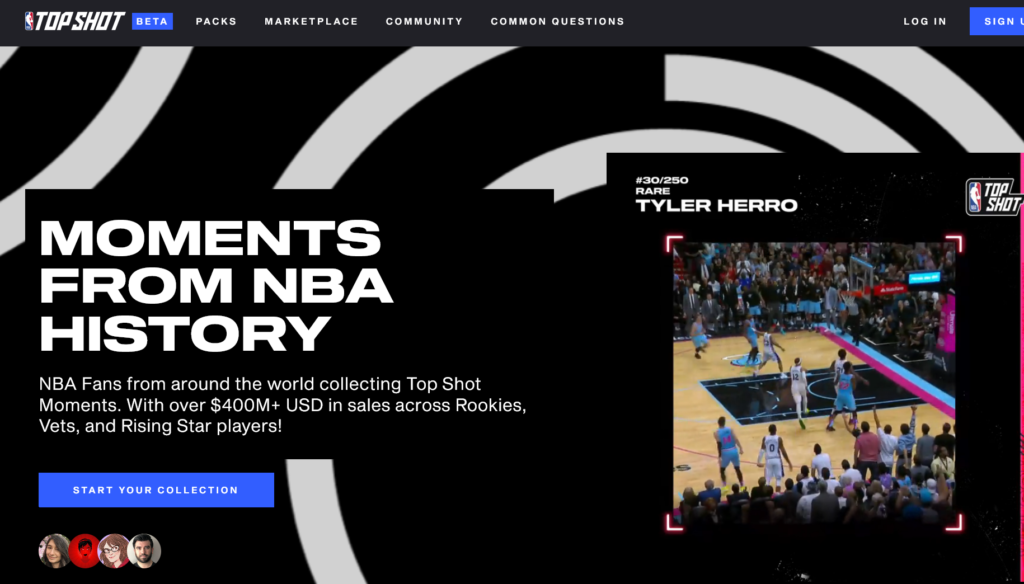

Digital Trading Cards

If I had to pick one project that was absolutely smashing it in the NFT space it would be NBA top shots. Their digital trading cards have sold more than $400m USD in Q1 2021.

NBA Top Shots got around the cost of transaction fees problem by setting up their own walled blockchain with tokenomics. Fully decentralised it is not, viable and popular it certainly is.

Historic & Seminal

This is the area which I am most interested in. If we look ten years in to the future and take a guess at what will still be valuable it is likely to be the top 1% of digital art created BB (Before Beeple).

Crypto punks would fit in to this category. They were seminal to everything that came later. There were only 10,000 ever made and they have gained somewhat of a cult following by Ethereum OG’s and maximalists who use them for social media avatars.

Then there’s the peculiar case of Crypto Kitties which was the first NFT project to gain traction all the way back in 2017 but somehow hasn’t gained the hype other projects have in the most recent bull cycle.

Beeple’s own work I believe will also be valuable long in to the future. Whether you appreciate it for it’s artistic value or not it certainly wont be forgotten in the next decade. If NFT art takes off he will be seen as one of the forefathers.

Hash masks is another project with limited supply and potentially historic value. Their community driven art project is limited to 16,384 pieces which accrue name changing tokens for their holders.

Collectibles & The Test of Time

I grew up with two brothers and my Dad used to promise us that in his inheritance one of us would get the jewlery, one of us would get his car and one of us would get the stamp collection. At the time I wanted the stamps because it contained the rare “penny black” which was the most sort after and famous stamp ever.

I don’t know about exact valuations but at the time I would guess he valued these stamps at least £20k to make them worth putting in a will. Today you can buy a penny black on eBay for £50. No one collects stamps any more so they aren’t valuable.

eBay provides another interesting example, at one point in the late 1990’s 10% of eBay’s total sales was from the flipping of Beanie Babies and prices were extraordinary. A 1st edition Princess Diana Beanie Baby was sold for $400,000 USD. Today the market for six figure cuddly toys has largely disappeared.

But some things do hold value. Art we’ve already discussed. What about Fabergé Eggs do they hold real artistic value or are they purely a collectible? Vintage cars appreciate very well and have done so for many decades. Here’s my particular favourite, an Austin Heally 3000, which I considered purchasing probably 15 years ago at a price of around £30,000 GBP. Today they are worth at least double that.

Rare guitars such as Pre-CBS Fenders hold their value very well too. I think the emerging pattern is that things that hold utility hold value. Collectibles that have little utility and are in a hype cycle do not. If you can use it to either knock out a tune or drive around looking like a movie star then it’s valuable. Limited supply also seems to play a big part in the future pricing. Stamps weren’t that rare it seems but only 69 Fabergé Eggs were ever made making the latter more precious.

Where do NFT’s lie on this paradigm? That depends and varies from project to project. Land in a metaverse currently has no utility but if the game becomes popular it could become incredibly valuable. If people stop playing the game then the value of the digital land goes back to zero. The current value is based on future expectations of utility.

Potentially historical pieces of artwork that set in motion a new wave of digital art are only valuable if the NFT space and digital art in general moves on to engage a mainstream audience outside of the crypto space in the long-term.

The Highest Value NFT’s

As discussed I think the biggest investment opportunity is for the top 1% of NFT art and collectibles. Passive investors with a medium to long term timeframe for holding should be looking for work that will be valuable and recognised long in to the future. Any oil painting from the 1500’s is valuable but an oil painting by Leonardo Da Vinci is priceless.

Here’s are the three NFT’s that I think provide the highest possibility of holding long term value for investors.

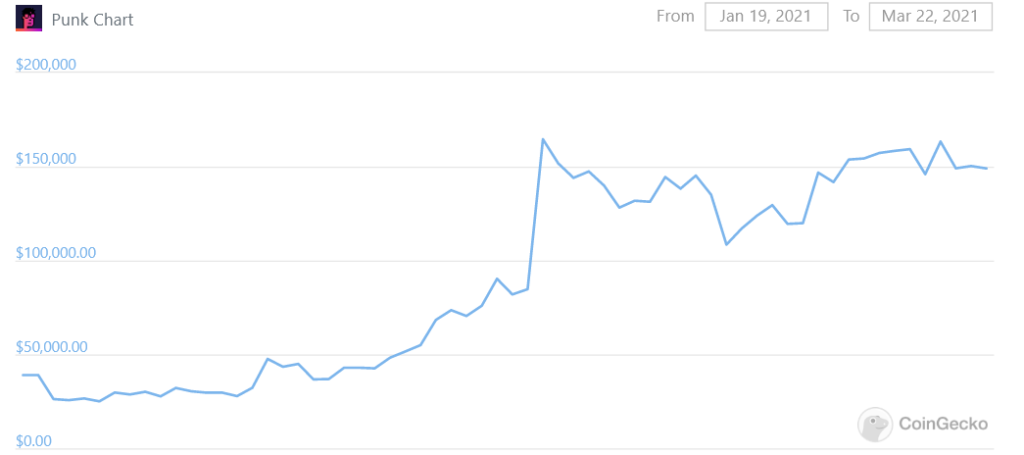

CryptoPunks

Available via larvalabs with wrapped punks available on opensea. The wrapping process is required to make them compatible with more modern NFT smart contracts and applications.

Prices range from $37,000 to $7.5m

These have become highly sort after in the most recent bull cycle. I think part of the reason behind that is because a lot of the developers.eth on twitter and discord started using them for avatars. This combined with the narrative that they pre-dated the ERC721 contract and influenced later developments has pushed the prices right up.

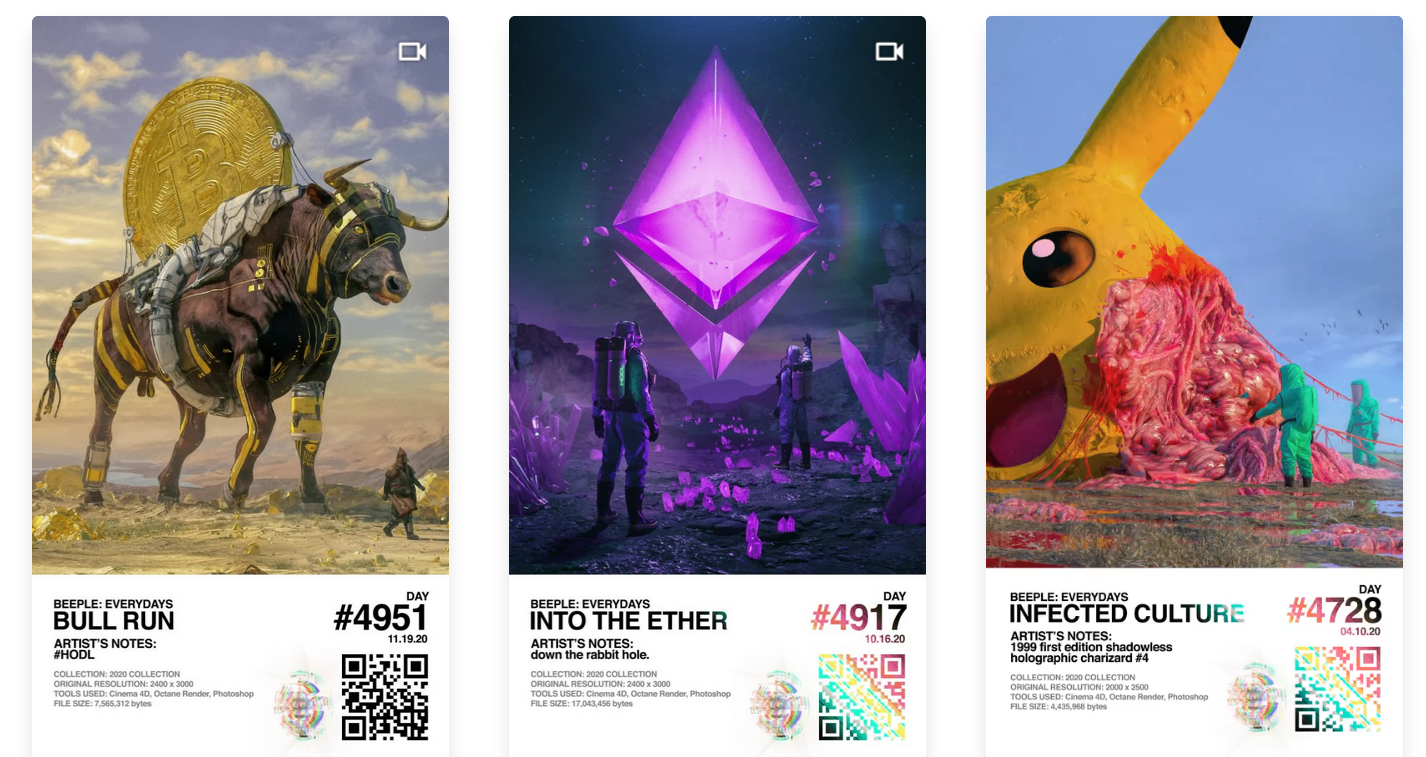

Beeples

Originally dropped on nifty gateway and also available on secondary marketplaces like opensea.

Price range from $150,000 to $69m

There are different collections with “the first drop” being the most collectible. The 2020 collection was dropped a couple of months later. Some art work has multiple editions of the same piece diluting the value.

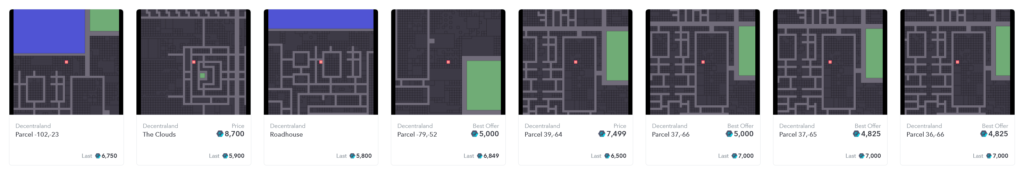

Decentraland

Available from in game market place originally and now available on opensea.

Price range from $5000 to $2m

There are currently 43689 private land parcels, 33886 district land parcels, 9438 roads and 3588 plazas. Private land parcels have a virtual size of 16x16m. There are two tokens in the ecosystem an ERC20 MANA token which is burnt when purchasing LAND NFT’s.

NFT Funds & Fragmatisation

Want exposure to the best and most valuable non-fungible tokens but don’t have the best part of $40k to shell out for a punk? Perhaps an NFT fund can help. There are a few different players in this field with NFTX gaining the most traction with it’s PUNK index token.

The concept of collecting expensive digital art in a fund and then selling off divisible shares in that collection is making expensive NFT art accessible again to retail investors. This continues to drive the price up, attracting more investment which then drives the price up further.

This could be compounded if an exchange such as FTX releases a PUNK-PERP perpetual futures contract which would enable investors to take leveraged positions in the NFT space. It would also allow traders to manage and quantify risk better by setting stop losses.

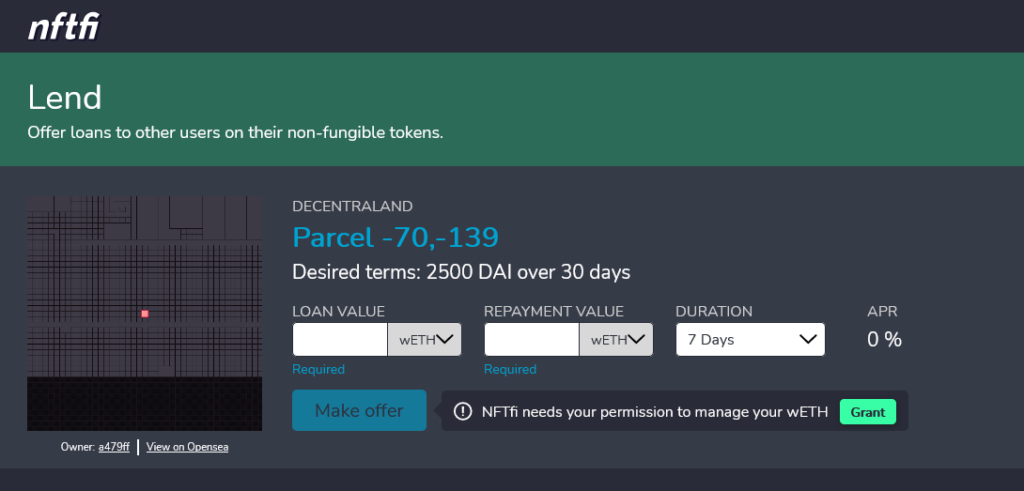

NFT’s As Collateral

This is where I start to get a bit concerned about the future of the space. There are currently marketplaces popping up for providing loans using non fungible tokens as collateral.

The loan is based on the resale value of the NFT. If the value or liquidity of the NFT goes to zero then the borrower simply wont pay back the loan.

Resale Value & Liquidity

This is my biggest concern about the current NFT space. There’s a lot of hype and retail money being thrown at it for speculation purposes. I’m not sure what percentage of market participants buy NFT’s because they genuinely appreciate the art or historical significance but it’s not high. Prices are increasing month on month and a portfolio of NFT art purchased a year ago would have likely seen 10x-100x returns.

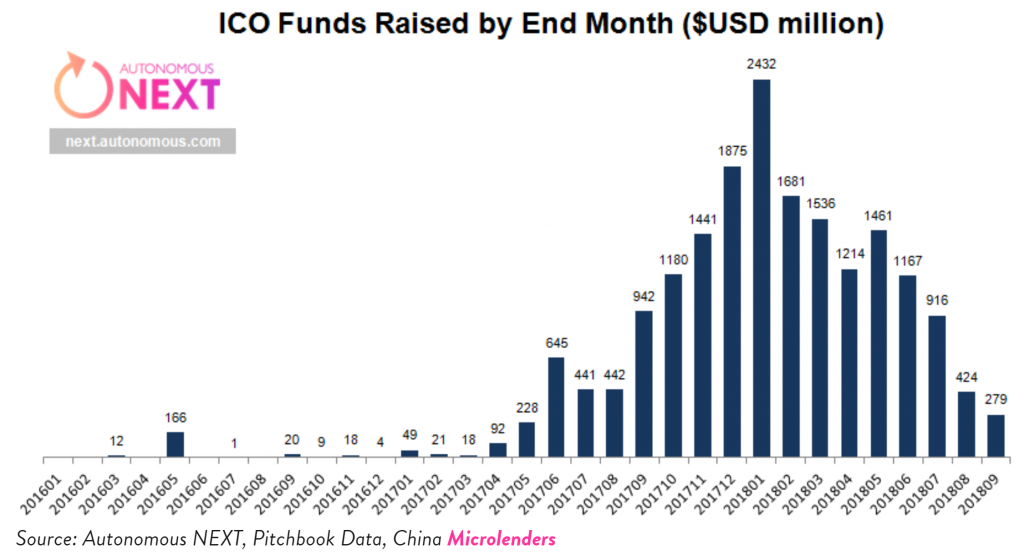

It unfortunately reminds me of the ICO bubble in 2017-2018 where there were profits to be made for getting in early and flipping new projects but a lot of investors became “community members” as the bear market set in. Investment in ICO’s went from hundreds of millions to near zero in the space of six months and many projects lost 90%+ of their valuation as investors rushed for the exit.

During the next bear cycle a lot of investors could potentially become “in it for the art” as prices could fall off a cliff if liquidity dries up. While prices are going up there is always going to be a buyer and new market entrants push the price higher and higher.

What starts as a cooling off period of price action could lead to increased supply and literally zero demand further plummeting prices. What percentage of market participants are going to disappear if prices drop 30% in a month and the outlook is bearish?

Any collateralised investment vehicles will likely tumble like a house of cards and I don’t know how the mechanisms for liquidation will work in that scenario.

In my opinion there will always be a value on the top 1%. There is probably a price where I would bite the bullet and buy a Crypto Punk or a Beeple just because I buy in to the narrative that they potentially have some historical significance. I’m not sure the remaining 99%, the long tail of NFT art work and collectibles will fair so well. A lot of non fungible tokens will become worthless no matter what happens in the broader cryptocurrency markets.

Conclusion | Would I Buy An NFT?

Let’s look at CryptoPunks specifically and use that to build an investment case. Supply is 2100 times lower than Bitcoin. However I’d argue that demand will never exceed a fraction of Bitcoin. Institutional investment is just getting started for cryptocurrency but I can’t see this translating to billion dollar investments in the NFT space. This somewhat limits the upside potential compared to holding Bitcoin or Ethereum.

The upside relies on two factors the continued adoption of index funds like NFTX’s PUNK token which can be used as a store of value and the realisation of the narrative that NFT’s become the future of art and collectibles.

So how can we assess a fair value around an asset like non fungible tokens?

A valuation relative to the total cryptocurrency market is one way to estimate broad valuations in the NFT space. The total market cap of all cryptocurrencies is currently $1.78 trillion USD. The following figures are pure guesstimates based on very little reliable evidence, you should come up with your own figures based on your own assumptions.

I feel that the NFT space could perhaps reach a maximum of 5% of the entire market. Cryptopunks specifically could be 5% of NFT space. Meaning the cryptopunk ecosystem could perhaps be worth 0.25% of the entire crypto market or roughly $4.46b giving the maximum average price for a punk to be worth $445k. This is roughly a 10x multiple of current market prices. If the crypto market expands the price of punks is correlated to ETH so I’d expect that to expand with it.

So perhaps relative to an investment in BTC/ETH there is a case for investing in non fungible tokens. There’s 10x more upside but also significantly more risk. If I could invest in a perpetual futures contract for the PUNK token using a tight stop I’d do that tomorrow. My concern with actually owning a PUNK or a Beeple or DecentraLAND would be that I get left with an illiquid asset that no one wants if the market takes a downturn.

It will be interesting to see how pricing relative to USD and BTC/ETH is affected by future market cycles and if there is a market downturn. If prices remain relatively stable over the next few years I think this will be very bullish for the NFT space. If prices drop dramatically and we do see a drying up of liquidity there could be a buying opportunity when everyone else has lost interest.

Would I buy a NFT today in the middle of bull cycle? No. Will I in the future? Probably indirectly via a perpetual futures contract tracking the underlying asset of an index fund of NFT collectibles.

I hope you’ve found this content as interesting to read. The NFT and crypto space is developing at an incredible rate. Check out my YouTube channel and connect with me on Twitter for updates and more content.

https://www.youtube.com/c/JamesBachini

https://twitter.com/james_bachini

Two other people that I’d recommend checking out in the space are:

Jamie Burke – I saw Jamie talk at one of the Blockchain conferences in London around 2019. He was the first person I saw actively investing and talking about NFT’s and the metaverse. His VC firm Outlier Ventures are active in DeFi, NFT’s and dCommerce.

DCL Blogger – Matty’s YouTube channel is a great resource for anyone looking to learn more. He is one of the largest independent Decentraland investors and produces some great content on investing in NFT’s.