GammaSwap is a decentralized exchange that allows perpetual leverage trading on any token without liquidation risk from price movement, while also offering additional yield to liquidity providers through borrow fees. In this article I will write up my internal research notes, this is not a sponsored post and I currently have no stake in GammaSwap.

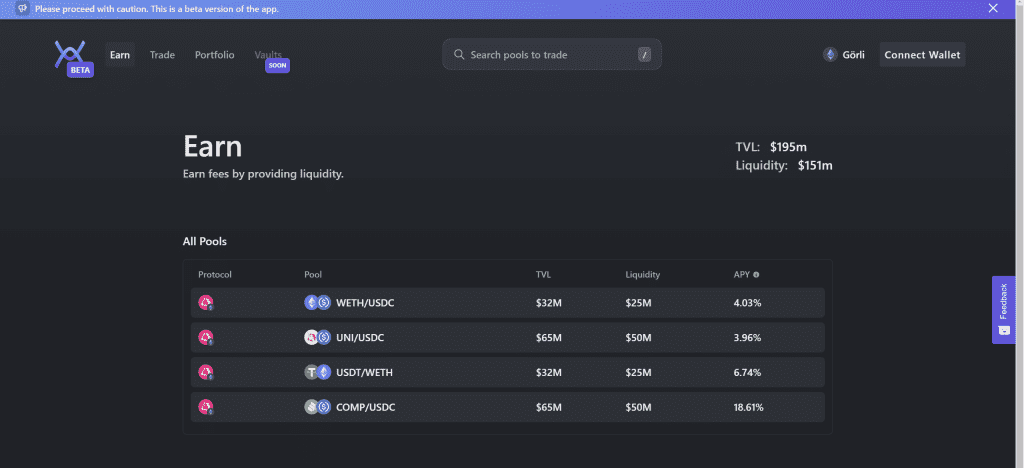

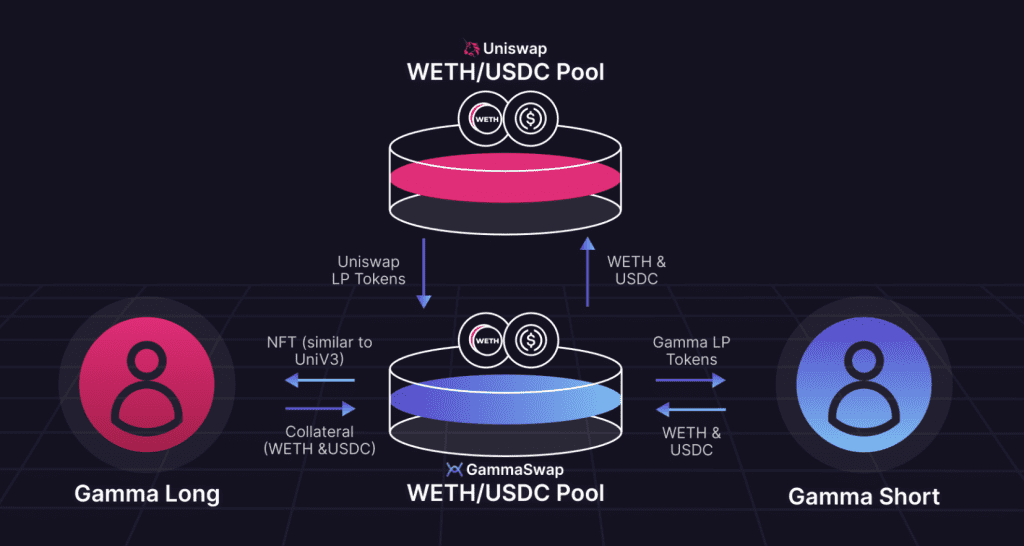

Liquidity Providers (LPs) can provide liquidity in any pool to earn a higher yield than with a standard AMM LP position. In return the LP receives a GammaSwap ERC-20 token that collects all of the fees from the underlying Automated Market Maker (AMM) plus additional borrow fees from traders in GammaSwap. Borrowers can use GammaSwap to hedge LP exposure or speculate on token price movements, essentially turning the LP’s Impermanent Loss into their Impermanent Gain.

GammaSwap is built as a middle layer for various AMMs, including Uniswap, SushiSwap and Balancer. To open a leveraged position, one must provide collateral in the underlying tokens, and the Loan-to-Value (LTV) ratio can be as high as 95%. The PNL of a borrower is calculated as the Impermanent Gain minus the interest rate.

The main difference between GammaSwap Perpetuals and traditional finance perpetual futures is how the products are composed. The perpetual options available on GammaSwap have a dynamic delta and can technically go to infinity, making the leverage always changing throughout the curve. There is no funding rate, but rather a utilization rate that is dynamic based on open interest.

The protocol is not reliant on oracles and instead calculates the profit and loss of borrowed positions based on the liquidity invariant and the interest rate.

GammaSwap’s perpetual leverage trading model make it a compelling project to keep an eye on in the DeFi space. There currently isn’t a token available but it is likely coming as the docs contain a TBA section on Tokenomics.

GammaSwap is entering a competitive space which is expected to see growth in coming years as traders move over from centralized exchanges to decentralized markets.