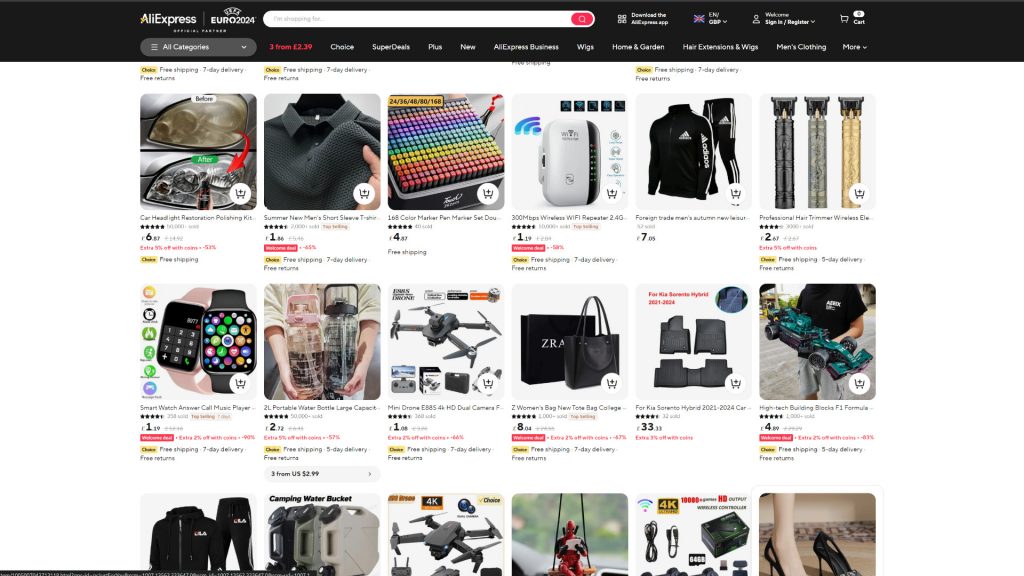

I first became addicted to eBay a couple of decades ago, over time I started ordering more and more on Amazon, I’ve now found myself ordering more on AliExpress and having items shipped directly from China.

During the Euros (soccer tournament) AliExpress was one of the main sponsors which got me thinking that this trend might start to play out across western economies.

Founded in 1999 by Jack Ma, Alibaba is often referred to as the Amazon of China. An ecommerce giant which specializes in retail and technology.

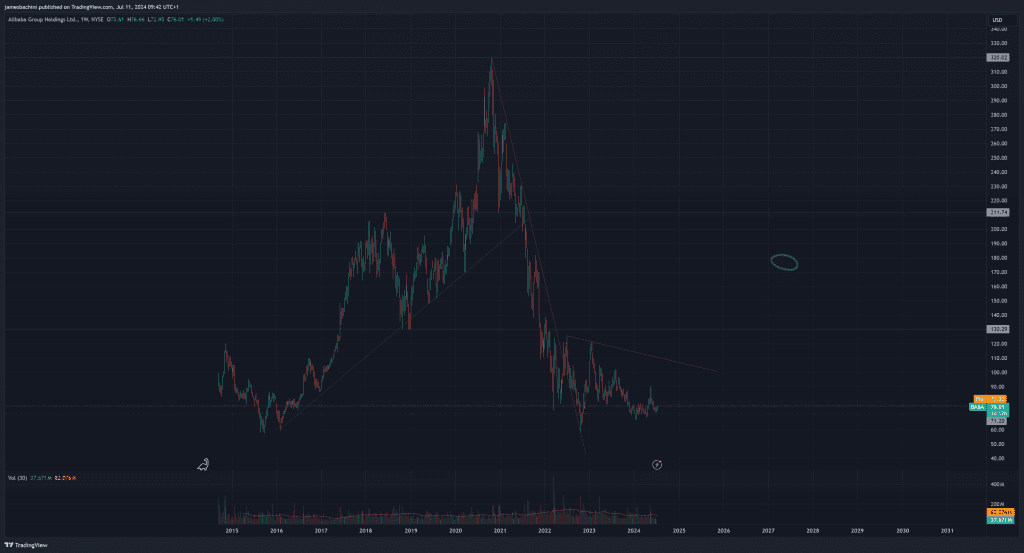

Since covid Chinese share prices have collapsed relative to the SP500 which is making new all time highs.

This contradicts my own thesis that China will become the worlds largest economy and BRICS will establish significant political power.

Alibaba is the largest e-commerce company in China, with significant market share through its platforms Taobao and Tmall. The company benefits from the growing middle class and increasing internet penetration in China.

Alibaba Cloud is the equivalent of AWS and is the leading cloud service provider in China and is expanding rapidly. Alibaba’s revenue is diversified across these e-commerce, cloud computing, digital media and entertainment and innovation initiatives.

As we’ve seen with the AliExpress adverts, Alibaba is expanding internationally. It is very competitive on price relative to eBay & Amazon. The catch is that you have to wait a week for delivery which I find for most things isn’t a problem.

Particularly for small consumables that are easy to ship it is unbeatable. I’ve also purchased a coffee roasting machine and a koi carp food dispenser which are both larger items that have shipped with no problems.

There is a huge marketplace in western economies for it to grow into here with Amazon having nearly a 10x market cap:

| Alibaba market cap | $0.29 Trillion USD |

| Amazon market cap | $2.07 Trillion USD |

This highlights a significant difference in scale between the two companies, with Amazon being considerably larger in terms of market value.

Alibaba has consistently reported strong revenue growth. For instance, the company reported revenue of $205.7 billion for the fiscal year ending March 2023. Alibaba has a strong track record of profitability, with a robust balance sheet and significant cash reserves, allowing for strategic investments and acquisitions.

Artificial intelligence and particularly automated delivery transportation could revolutionize the industry and Alibaba could be at the forefront of this evolving economy.

The growing population of middle classes in China and the wider BRICS economic bloc provides significant headroom for internal growth.

While regulatory scrutiny is a concern, the Chinese government (previously fined for antitrust and privacy issues) has also shown support for leading tech companies to establish global competitiveness.

The biggest concern is tensions between the US and China. This could impact Alibaba, particularly concerning tariffs, trade restrictions, and potential delisting from US stock exchanges. It was only a few years ago that political analysts were discussing the imminent invasion of Taiwan. If China does start to flex it’s political muscles this could damage it’s international businesses and this investment.

From a technical analysis stand point I like the chart too. Price seems to have bottomed out and the 180 area is over 2x return from the current price offering asymmetric investment opportunity in my opinion. If price loses the level I don’t mind firing another bullet around $40 and am not interested in taking any profits until/if it makes a new all time high above $320.

Overall it’s a strong buy for me which I’ve allocated to using a UK ISA (tax-free government investment scheme) and the NYSE listed BABA @ $77 on 2024-07-11. Investment timeframe is 10 yrs+ as it will take some time for the consumer apps like AliExpress to gain traction in western markets.

Please note that I am not an investment professional and can not offer financial advice. DYOR.