A few summers back I watched an Ethereum based microlending protocol bleed 78% of its liquidity in 48 hours, not because its code failed but because it could not tell real borrowers from bots.

If an economy cannot distinguish one human from another, the promise of web3 and decentralized finance stays hypothetical.

Today I want to show you why proof-of-personhood remains the single biggest unlock for the next $1.5 trillion of digital assets, why the battle against KYC fraud now feels like chess against a swarm of AI-powered pigeons, and how a new generation of decentralized identity systems is finally arming builders with durable, privacy-preserving answers.

The Mirage of On-Chain Pseudonymity

Bitcoin taught us that wallets can move billions without revealing names.

That superpower birthed a creed; privacy by default, openness by consensus, verification only when absolutely necessary.

Yet money does not move in a vacuum. To lend, insure, hire, or even date someone you first need to know that the other party is human, unique, and capable of honoring commitments.

Pseudonymity gives each wallet an equal voice, but economic reality rarely treats every entity as equal risk. The result is a persistent trust gap.

Credit bureaus place average default rates near 2% for prime borrowers. Uncollateralized lending protocols on Ethereum face delinquency rates north of 15% because they lack reliable identity granularity. Their only safe harbour has been over-collateralization, a solution that prices out the very users DeFi promised to serve.

A Stanford study from late 2023 estimated that inadequate identity tooling suppresses lending volume by roughly $380 billion across DeFi and adjacent sectors.

Why KYC Feels Broken

Traditional “know your customer” practices mimic airport security lines, show a credential issued by a trusted authority, match a face, then step through.

In web3 that linear model buckles. A wallet can belong to a DAO, a multisig, or a script composed of twelve smart contracts. Worse, an attacker can spin tens of thousands of wallets in minutes.

This is the Sybil problem, named after the 1973 case study of a woman with multiple personalities, now automated by cloud GPUs.

Companies fight back with document verification and selfie checks. Yet forged passports have an 8 % pass rate on leading SaaS KYC platforms according to a 2022 Interpol audit. Generative AI jeopardizes even liveness tests; diffusion models can produce pitch-perfect deepfakes that fool 4-point nod-and-blink sequences. Every month the attackers get cheaper, faster, and harder to detect. The compliance officer’s inbox becomes a crime scene.

Sam Altman’s Ocular Bet

Enter proof of uniqueness through biometrics.

Tools for Humanity, the company behind Worldcoin, claims to have verified more than 4 million people in 34 countries by scanning their irises with gleaming orbs.

The cryptographic hash of a retina pattern is nearly impossible to forge, yet the system still stumbled.

Recruiters in Nairobi and Bangalore paid individuals as little as $25 to stare into the device and immediately transfer the private keys attached to those identities.

By January 2024 the resale market for verified Worldcoin wallets on Telegram had crossed 135,000 units, according to Chainalysis estimates. The lesson is sobering, perfect biometrics alone do not deliver perfect identity if economic incentives make identity a commodity.

The Path To Decentralized Identity

A decentralized identity system tries to square three circles.

- First, only the rightful owner should be able to present the credential.

- Second, verifiers (banks, marketplaces, games) should be able to confirm attributes without learning everything about the holder.

- Third, no single gatekeeper should wield the power to delete or counterfeit credentials.

The W3C DID standard proposes anchoring a public key on a blockchain while leaving personal data off-chain under user control. When Alice wants to prove she is over eighteen or owns a university degree, she presents a zero-knowledge proof derived from the original credential; the verifier checks the signature against the public key registry on-chain. Nobody else learns her birthdate or GPA.

Real-world numbers are encouraging.

PolygonID, which uses zk-SNARKs for age and residency proofs, reduced KYC verification times for a Spanish crypto-exchange from seventy-two hours to under three minutes while lowering error rates by 63%.

Gitcoin Passport, a composite score that weights multiple identity signals, cut Sybil-related grant fraud by an estimated 88%.

Government On The Ledger

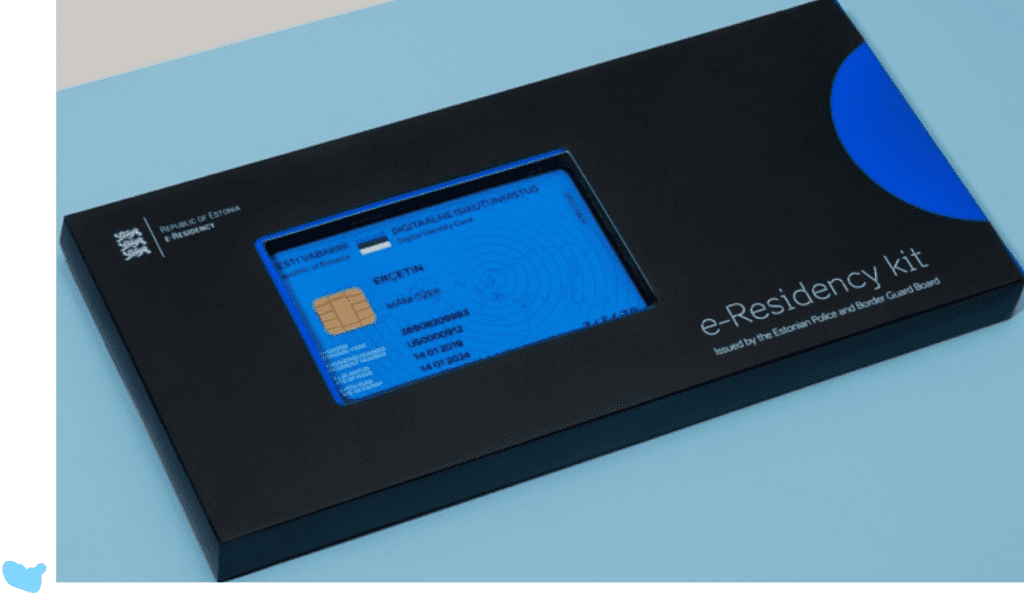

Could a state issue passports as decentralized credentials?

In 2024 the government began piloting DID compatible identity cards whose public keys register on the country’s KSI blockchain, an append-only ledger with cryptographic linking but no monetary token. Any verifier, from a German fintech to a Brazilian freight forwarder, can confirm the card’s validity without querying an Estonian API.

Contrast that with today’s centralized databases. When the U.S. Office of Personnel Management was breached in 2015, 22 million background files leaked. A DID passport would reveal exactly one bit (valid or revoked) and nothing about place of birth, security clearance, or fingerprints. Encryption and decentralization together deliver both resilience and discretion.

Yet there is a governance catch. If revocation keys sit with the state, political whim could still erase a dissident’s legal existence. Decentralization must not mean merely moving data off government servers; it must mean distributing control, perhaps via multiparty threshold signatures that include courts and civil-society overseers. The technology exists; the constitutional will remains the bigger hurdle.

Sybil Resistance In The AI Age

Large language models now author entire scam campaigns that mutate faster than blacklists can update.

Identity therefore needs more than a single root credential. The emerging best practice blends three layers.

First comes scarcity based uniqueness

- biometric hashes

- hardware-secured keys

- social-graph position

All items costly to replicate at scale.

Second is behavioral reputation system that track on-chain records of timely loan repayments, dispute resolutions, GitHub contributions etc.

Third is selective disclosure in the form of zero-knowledge proofs that allow someone to demonstrate that their composite score exceeds a threshold without revealing the raw inputs.

Opportunities For Web3 Builders

The surface area is vast.

Wallet providers can embed privacy-preserving verifiable credentials, turning account creation from a tedious selfie ritual into a single tap. Marketplaces can support pay-per-trust schemes, where a new seller posts zero collateral but uses an on-chain credit score derived from verified gig-economy earnings. DAO governance can abandon one-token-one-vote for one-human-one-vote without doxxing members, mitigating whale capture.

Consider health data. A clinic could issue a verifiable vaccination credential; a traveler proves compliance to an airline without exposing medical records.

In the European travel sector alone, frictionless vaccine verification could save an estimated €850 million in annual staffing and delay costs, according to an IATA white paper. Multiply that logic across diplomas, professional licenses, carbon credits, and age restricted content , each a new market for DID middleware.

Business models evolve accordingly.

Companies charge per proof generation, per credential issuance, or via SaaS dashboards that monitor revocation events. Because proofs reveal nothing but validity, the data cannot be sold to advertisers, aligning revenue with user privacy.

The Road Ahead

Within five years I expect three converging trends.

- Ubiquitous passkeys on phones will replace typed passwords, giving every consumer a hardware-backed public-private keypair. We are already seeing this start to emerge today.

- Mainstream wallets will treat verifiable credentials as first-class citizens, akin to tokens.

- Regulation will endorse zero-knowledge-based KYC. The EU’s eIDAS 2.0 framework already mandates mutual recognition of digital identities across member states and explicitly references self-sovereign implementations.

A decentralized identity stack does not guarantee utopia. It can be corrupted by coercion, monopolized by hardware vendors, or hamstrung by red tape. But it does rearrange incentives.

Instead of entrusting personal data to honeypots that eventually leak, citizens hold their own keys. Instead of giving attackers an easy target, systems force them to pay the real world cost of uniqueness. Instead of surrendering privacy for convenience, users gain both.

Decentralized Identity Systems Takeaways

• Decentralized identity bridges the trust gap that currently costs DeFi an estimated $380 billion in suppressed lending capacity.

• Pseudonymity alone cannot enable credit; verifiable uniqueness and reputation are essential for risk-based finance.

• Traditional KYC fights a losing 8 % false-acceptance battle against AI-assisted forgeries; DID with zero-knowledge proofs cuts fraud by up to 88 % in live deployments.

• Biometrics like Worldcoin’s iris hash add scarcity but can be commoditized when economic incentives misalign; combining biometrics with wallet-bound cryptography is crucial.

• Government-issued DIDs promise stronger privacy than current passport databases but require distributed revocation authority to avoid political overreach.

• A three-layer defense—scarcity, behavior, selective disclosure—offers the best Sybil resistance in an AI-driven threat landscape.

• Web3 builders can tap new markets in credit scoring, borderless hiring, DAO governance, gaming, and health records by integrating decentralized identity middleware.

• Over the next five years, passkey ubiquity, wallet integration, and supportive regulation like eIDAS 2.0 will push DIDs from niche to norm.