Starknet is a layer 2 zero knowledge rollup which uses a STARK cryptographic proof and Cairo based smart contracts.

A few days ago they released the STRK token and in this article I’ll dive in to the tokenomics.

Currently at time of writing the token trades at $1.91 and has a $1.39 billion dollar circulating supply. Fully diluted valuation is $19 billion with less than 10% of the total supply currently circulating.

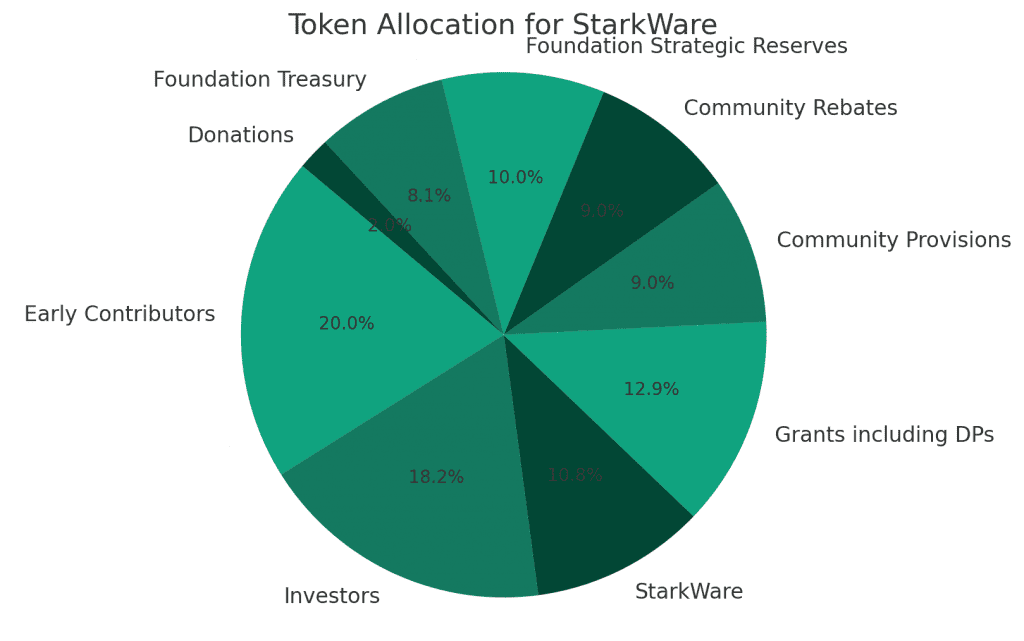

The distribution is as follows:

- Early Contributors (20.04%) Allocation for StarkWare’s team and early contributors, subject to a lock-up schedule.

- Investors (18.17%) Allocation for StarkWare’s investors, also under a lock-up schedule.

- StarkWare (10.76%) Funds for StarkWare’s operational services, including fees, service provision on Starknet, and engaging service providers.

- Grants and Development Partners (12.93%) Funding for research and development activities related to the Starknet protocol, with details on applications and allocations to be announced later.

- Community Provisions (9.00%) Distribution to contributors who supported and developed Starknet’s technology.

- Community Rebates (9.00%) Allocation for rebates to facilitate transitioning to Starknet from Ethereum, details to be announced in 2024.

- Foundation Strategic Reserves (10.00%) Allocation for the Starknet Foundation to support ecosystem activities aligned with its mission.

- Foundation Treasury (8.10%) Funds reserved for the Starknet Foundation’s treasury for operations and future initiatives.

- Donations (2.00%) Reserved for donations to institutions and organizations as decided by the Starknet Foundation.

To ensure the alignment of interests between Investors, Early Contributors, and the Starknet community, a lock-up schedule for their allocated tokens has been established, in line with decentralized ecosystem norms. Initially, up to 0.64% (64 million tokens) will be released monthly from April 15, 2024, to March 15, 2025, totaling 7.68% (768 million tokens) by March 2025. Subsequently, up to 1.27% (127 million tokens) will be unlocked each month from April 15, 2025, to March 15, 2027, cumulating to 30.48% (3.048 billion tokens) by March 2027.

During the lock-up, these tokens cannot be transferred, sold, or pledged, although voting delegation is allowed, and staking may be permitted when available.

The unlocks mean that this tokens circulating supply will increase in an accelerating manner which could affect supply on exchange if these tokens are liquidated.

Although the initial 0.64% monthly emissions do not sound a lot, it is 64m STRK tokens a month going into a 728m current circulating supply which is significant, more than doubling the supply of tokens in the first year.

The question is will these tokens find their way to exchange and impact price relative to other competing L2’s?