Is loss aversion causing long-term underperformance in our portfolios?

In bear markets I find it harder to rebalance my portfolio and allocate capital to riskier investments. This creates an unintentional de-risking in bear markets where there is a better long-term risk to reward.

- Risk In Market Cycles

- Rebalancing Less

- Venture Capital Deployment

- Shiny New Things

- Risk Aversion Research

- Contrarian Investing

- Conclusion

Not a financial advisor, this is an introspective article that should not be taken as financial advice.

Risk In Market Cycles

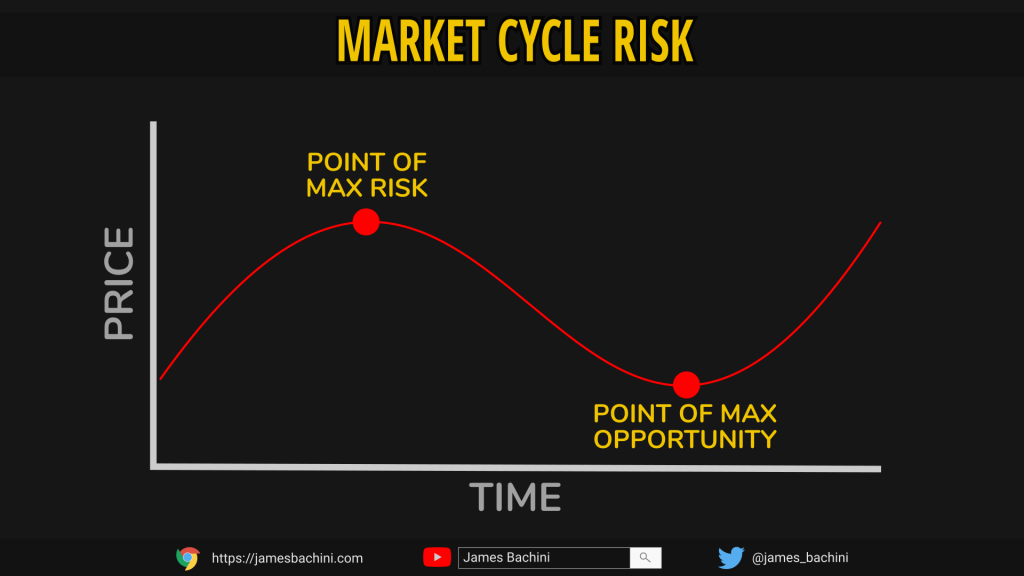

Consider the following simplified market cycle chart

Our risk levels are at their highest when the market is euphoric after a big run up. This is the time when Uber drivers are telling you about the latest and greatest meme coin. Our psychology during these times has been primed in recent memory that risk equals reward so many fall in to the trap of allocating capital at the worse possible time.

The opposite is also true in bear markets where the bottom of the capitulation stage marks the point of maximum financial opportunity and arguably least risk. Is Bitcoin a much safer investment after a 50% pull back than it is after a 3x bull run?

The problem is that during these periods of doom and gloom when the news is negative, the price is constantly in a downward trend and altcoins are going to zero it’s extremely difficult to go risk-on. Our recent bias has been trained to expect further risk to equal further ruin.

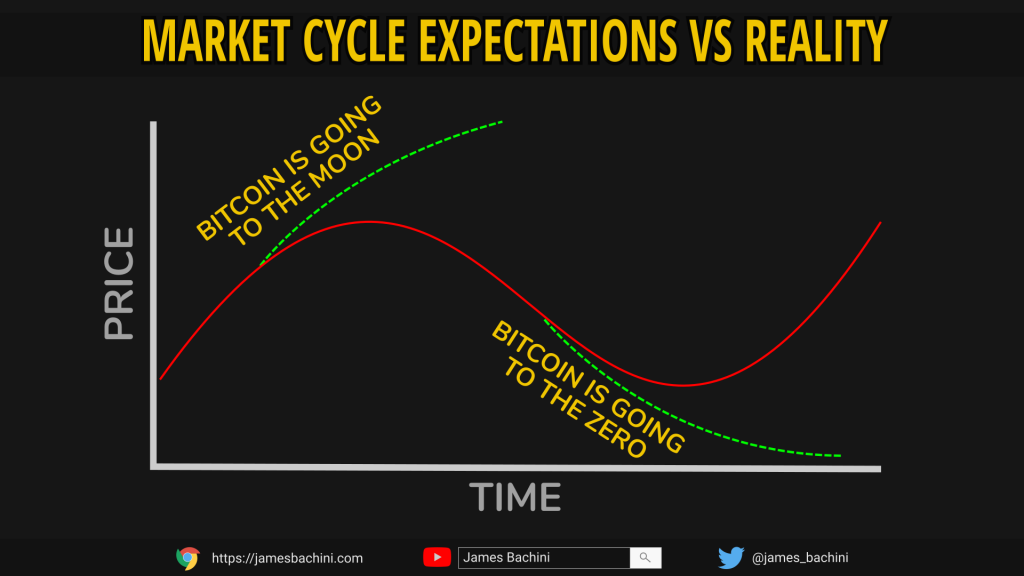

Timing these market cycles is a challenge because no-one can predict the future and where the bottom will be. At any point in a bull cycle there will be someone making headlines because they predict the price of Bitcoin is about to do a 5x and in bear cycles the same people will be calling for further declines and retraces to previous levels.

Rebalancing Less

The main reason I decided to investigate this is because I noticed a leak in my own investing. In bullish markets I’ll rebalance my portfolio at least once a week selling off pumping altcoins for BTC, ETH & USD. I’ll also be actively looking for new projects with potential to gain traction and allocating a small percentage to something on average once a month.

Since the start of the year we have been in a downwards market and I haven’t rebalanced my portfolio or taken any new positions. The altcoins that are at the far end of the risk curve have fallen to about half of their target allocations as BTC and ETH have grown because they’ve fallen less relatively in the bear market.

This has created a situation where my portfolio has passively become more risk-off because the overall weighting has shifted to less volatile assets. This wasn’t something I analysed before the event, it was simply a case of not being able to bring myself to sell BTC/ETH to buy an altcoin that just lost 20% of it’s value in the last 24 hours.

I think this is common in crypto markets and in future if I’m unwilling to rebalance I shouldn’t be in the position in the first place because other traders/investors will be doing the same. During bear cycles there is a flight to safety and higher quality projects with long-term horizons tend to outperform the shiny new things from the recent bull run which sell off hard.

This is only part of the problem however the main concern is that my portfolio becomes risk-on during bull markets where we are at maximum risk and risk-off during bear markets where there is maximum financial opportunity.

Venture Capital Deployment

The same is true of venture capital with negative market sentiment causing seed capital to dry up across the industry. CoinTelegraph recently reported that VC investment doubled in 2021 but fell 38% in the last month.

VC’s and angel investors get token allocations at discounted rates but often don’t have the liquidity to sell their positions in a short time frame.

One of the best trades over the last couple of years is to short any perpetual futures contract that FTX lists, especially if Alameda (same group) holds a large vested allocation. It’s the worse kept secret that many VC’s are taking positions with a vesting schedule preventing them from selling the asset but then shorting the futures contract to sell off/hedge their position before the vesting period ends.

The liquidity available only gets worse in bear markets and short term winners become impossible to find which naturally causes VC’s to become more risk averse.

In the last few months we’ve seen Andreessen Horowitz commit $4.5B and Binance commit $500m to seed funds for new crypto projects. These allocations don’t seem to be making their way down the funnel to developers currently. Funding has become much more difficult to come by and I’ve heard from many people in the industry there is less capital being deployed.

Shiny New Things

Regularly rebalancing a portfolio during a bear cycle might not be optimal either. In the next bull run the projects that appreciate the most will not be the projects that launched in the 2017 or 2020. There will be a emerging wave of shiny new things that will outperform the market on the way up.

In 2017 we had EOS which was a faster, more efficient Ethereum killer. In 2020 we had Solana with much the same value proposition. In 2023 we will likely have a new Ethereum killer and it’ll outperform EOS & SOL. The same with DeFi, DeX’s, ponzi tokens, borrowing & lending platforms. There is better risk to reward on newly launched projects that enables them to gain traction and grow faster than the incumbents like Uniswap & Aave.

So why am I still holding Uniswap & Aave? Because I believe that they have formed a foundational layer in DeFi and will be used increasingly over the next decade.

- Is it optimal to hold these projects through a bear market? No.

- Is it optimal to sell these projects towards the bottom & de-risk? No.

- Is timing the market and de-risking at the top difficult? Yes but not impossible

The only thing you want to be holding through a bear market is a Guinness. However by the time you know you are in a bear market the damage has already been done.

Risk Aversion Research

Psychologist and Nobel prize winner Daniel Kahneman stated that “For most people, the fear of losing $100 is more intense than the hope of gaining $150”. This loss aversion concept is used widely in direct response marketing and behavioural finance where the fear of loss is a much more compelling reason to take action than the potential to gain.

Risk aversion is believed to be a favourable human trait from an evolutionary perspective*. Over the past ten thousand years, humans that have been more cautious have been more successful. This doesn’t set us up well for investing and trading in modern markets however.

This also suggests that there are varying levels of risk aversion. I consider myself to be a risk adverse investor, however a traditional financial advisor who isn’t familiar with digital assets might disagree. To some degree investors need to be comfortable taking on quantifiable risk and accepting the gains/losses that come with it.

Loss aversion is at the root of many other psychological quirks such as:

- Status quo bias – People prefer things to stay as they are rather than accept change

- Sunk cost fallacy – I’ve already put so much in, I need to keep going

- Endowment effect – greater need to retain an owned object than acquire that same object

Contrarian Investing

Contrarian investing is a methodology where trades are placed against the active market sentiment. When markets get frothy and euphoric a contrarian will be de-risking. When the markets are down only and there is blood in the streets a contrarian will be buying.

This sounds simple but it’s something I’ve found very difficult in the past. I got lucky and managed to sell a significant amount of my digital asset portfolio on the day of the Coinbase IPO when BTC traded at around $63k, which turned out to be a local top and it felt like I was making a huge mistake at the time. I allocated 50% of my stablecoin portfolio back in to BTC/ETH during the May 2022 sell off below $30k and it again felt like I was making a mistake.

If BTC drops below $20k I plan to allocate the rest of my stablecoins to BTC/ETH and again it will feel awful because there will be predictions at the time that Bitcoin is going below $10k or back to $3k.

The smart money (which I am not claiming to be) in this industry is able to bypass their natural psychology of loss aversion and time their entries and exits based on technical and fundamental analysis without bias. This is something where I still have leaks and room for improvement. Being aware of the psychology and reasons why these decisions feel so difficult can go a long way to overcoming them.

Conclusion

While I don’t expect I’ll be able to time the markets to the day, week or even month in the future I do need to be able to allocate capital efficiently during the later stages of a bear cycle and de-risk during the later stages of a bull cycle.

There is a lot of noise and predictions across social media about where the bottom might form for Bitcoin. No one really knows and the best we can do is play the percentages. Dollar cost average in during bear markets and out during bull markets would be a good starting point. Shifting this back to the later stages of each market cycle would be more optimal. Targeting key levels where price might find strong support may be more optimal still.

I need to take a long hard look at my portfolio allocations and decide what are long term holdings, which tokens are likely to outperform a staked Ethereum position and what shouldn’t be in there. I then need to rebalance regularly to assure I don’t de-risk passively at the worse possible time.

The bear market wont last forever and when the big green candles start printing there is going to be a massive opportunity with shiny new things. There will be another #AltSeason and the latest credible projects will become the darlings of the next bull run. I need to continue researching the latest developments in the space and aggressively allocating capital to the best new projects.