A year ago I outlined my 60/40 digital asset portfolio which was 60% crypto and 40% USD stablecoins. One of the biggest benefits to this portfolio is that during market downturns it leaves you with capital to deploy.

Today has been one of the most chaotic days in crypto markets ever and I’m going to outline why I decided to fire a bullet and deploy half my stablecoin allocation to BTC @ $30k and ETH at $2200.

UST and Luna

The market has been in a downtrend since it peaked in November 2021. Luna the native token of the Terra ecosystem set an all time high of $115 at around this time. Their core product was UST a stablecoin pegged to the US dollar and Anchor a protocol offering ~20% annual returns.

A few days ago UST started to lose it’s peg after an aggressive market participant depleted the Curve liquidity pools. This caused a rush to the exits and at time of writing UST is trading at $0.30 and Luna has crashed all the way down to $0.50.

This forced the Luna Foundation to sell its reserves of Bitcoin valued at around $1.4 billion to unsuccessfully defend the UST peg at $1 US dollar.

Bitcoin getting sold alongside the negative sentiment caused the markets to fall further. This caused Luna token price to crash which is used as collateral for UST and the extraction of remaining capital created a viscous circle of doom in the Terra ecosystem.

Many of the large VC funds in the space such as 3AC, Jump and Genesis were involved in the Luna ecosystem and the knock on effects could be damaging.

This has also provided an invitation for regulators to step in and start looking at DeFi and stablecoins with more scrutiny which could harm innovation.

Inflation & SP500 Beta

As if that wasn’t bad enough CPI inflation statistics were released today and they came in slightly hot at 8.3%, up from 8.1% the previous month.

This was actually considerably better than I was expecting and I hope that this is the start of a levelling off for inflation although it’s still too early to draw any conclusions.

During the March 2020 covid crash where Bitcoin nuked to below $4k it became clear that the American stock market was becoming more correlated with Bitcoin. Prior to that a lot of people, myself included, expected Bitcoin to perform well in the event of a market crash. The narrative of a “vent to release pressure on fiat” was passed around a lot and it was generally expected that if markets crashed Bitcoin could be seen as protection against a recession and/or inflation.

The opposite became true and more and more Bitcoin has been performing like a risk asset or leveraged SP500 position. I heard a theory that this happened because “Chicago Quants” entered the markets and their HFT expertise and data was better than crypto native firms, market makers and exchanges so they started to dominate the order books.

I still fundamentally don’t believe that Bitcoin should perform like a risk asset and at some point I believe it will decorrelate with the SP500. It’s something to watch out for in the future as a divergence could signify a change in market structure.

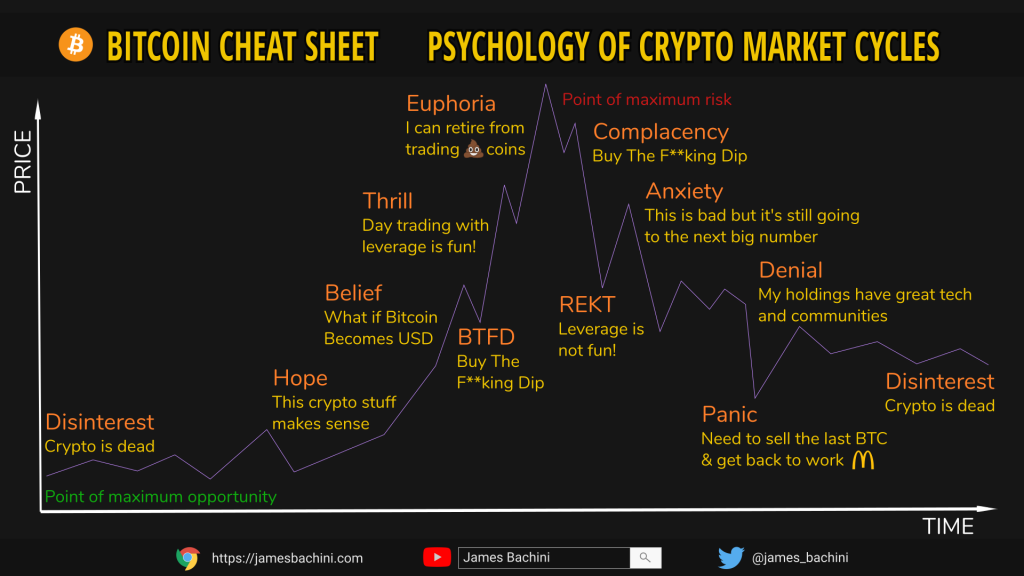

Market Cycles

An old slide but something I come back to a lot.

For me I think we are somewhere between the denial and panic stage of the market. Sure there’s a chance we go down further from here and if we are in a normal 4 year cycle then we have a long way to go before the next bull run. However these events don’t happen very often in markets so for me it’s a great time to allocate capital and start buying.

General interest in crypto and NFT’s has tailed off which is also a signal that we are beyond the point of maximum risk.

Allocations

I plan to hold 80% in crypto and 20% in stables and if Bitcoin falls below $20k I’ll go all in crypto.

My current target allocations on the crypto side are as follows.

| BTC – Bitcoin | 33% |

| ETH – Ethereum | 40% |

| FTT – FTX Exchange Token | 6% |

| BNB – Binance Exchange Token | 6% |

| UNI – Uniswap DeX | 2% |

| SUSHI – Sushiswap DeX | 2% |

| AAVE – Aave Borrowing & Lending | 2% |

| REN – Ren Protocol | 1% |

| LDO – Lido Liquid Staking | 2% |

| TRI – Trisolaris (Near Ecosystem) | 2% |

| CRV – Curve Finance | 2% |

| MULTI – Multichain Cross-chain DeX | 2% |

On the stablecoin side I have my funds on exchange ready to deploy further if we get an extended liquidation cascade or wick down to $20k.

Update 20/6/22 – Markets dived further over the weekend and I got fills on BTC as low as $18k and ETH @ $900. Managed to allocate most of the stablecoins leaving the remaining on limit orders as stink bids all the way down in case of a big wick to zero.

DeFi tokens such as UNI, SUSHI, AAVE and REN have underperformed greatly the last year and I haven’t been rebalancing so they are closer to 1% allocations with ETH currently at 43% continuing to outperform in the run up to the merge. I will be rebalancing these over the coming days/weeks.

I think it’s going to be very hard to outperform a stETH (staked ETH) portfolio over the next few years so that is where I want to deploy the majority of my capital. The counter-argument is that it has become a crowded trade and in bear markets BTC tends to perform better.

It’s a terrifying time to be buying crypto. The markets look as bad as I’ve seen them in a couple of years. I honestly believe that these are the best times to trade.

Bear in mind my risk tolerance is high and my time frame is decades, this isn’t something you should copy trade. My ability to time the markets is either lucky or bad with not much in between. Not a financial advisor, not financial advice.