In this Bit.com review I’ll take a first look at a new exchange from the co-founder of Matrixport and Bitmain.

- Bit.com Review & Demo [Video]

- Who Are Bit.com?

- What Differentiates Bit.com

- Spot, Futures & Options

- Bit.com Fees & Limits

- Conclusion

Bit.com Review & Demo [Video]

Who Are Bit.com?

Bit.com is a new exchange registered in the Seychelles offering spot, futures and options markets for digital assets. The chairman is Jihan Wu who co-founded Matrixport and Bitmain.

Matrixport is the largest crypto bank in Asia with $5B in monthly trading volume and $10B in assets under management. Matrixport was established in February 2019 as a spin-off from Bitmain Technologies. Bitmain is the world’s largest manufacturer of ASIC mining devices. They build the hardware that powers and secures the Bitcoin network and have a lot of influence over the international mining community.

The exchange is clearly well funded which you can tell from the premium domain, 200BTC insurance fund and professional roll out.

What Differentiates Bit.com

Bit.com has only just launched and already has the second largest options market in the world after Deribit. The platform is built with traders in mind, perhaps due to the influence of COO Daniel who joined the company from a position as VP of Merrill Lynch.

Performance wise the docs quote a 10k transactions per second matching engine with less than 50 ms round trip latency. The insurance fund has been seeded with 200 BTC, roughly $6,000,000 USD at today’s prices.

On the leveraged trading side liquidations are carried out via an incremental liquidation mechanism which will benefit active traders.

@Bitcom_exchange “For bit.com we are providing a better and professional service then others. We can guarantee our asset is safe as our asset is put in custody. Besides, we operate the exchange in a regulated way, we have different licenses for AML, requirement for KYC, no internal market maker to interfere any trading, and providing good customer support and follow up.

We provide portfolio margin and cross-margin( coming soon) in order to meet different client’s trading strategy. We also support RFQ function ( options) to provide the best price within 2 minutes. We understand client well, as we are trader as well. Including COO Daniel, he was the VP from Merrin Merrill Lynch. He was in charge of options and FX trading there. He designed the business, and underlying of Bit.com

Currently our options trading volume is the second largest in the world, owning BTC/ETH/BCH options, and of course we also have futures and spot trading”

from @Bitcom_exchange via Twitter

Spot, Futures & Options

The Bit.com exchange is separated into three sections.

– Spot markets enables users to buy/sell digital assets themselves

– Futures markets enable leveraged trading of futures contracts

– Options markets enable trading of options contracts

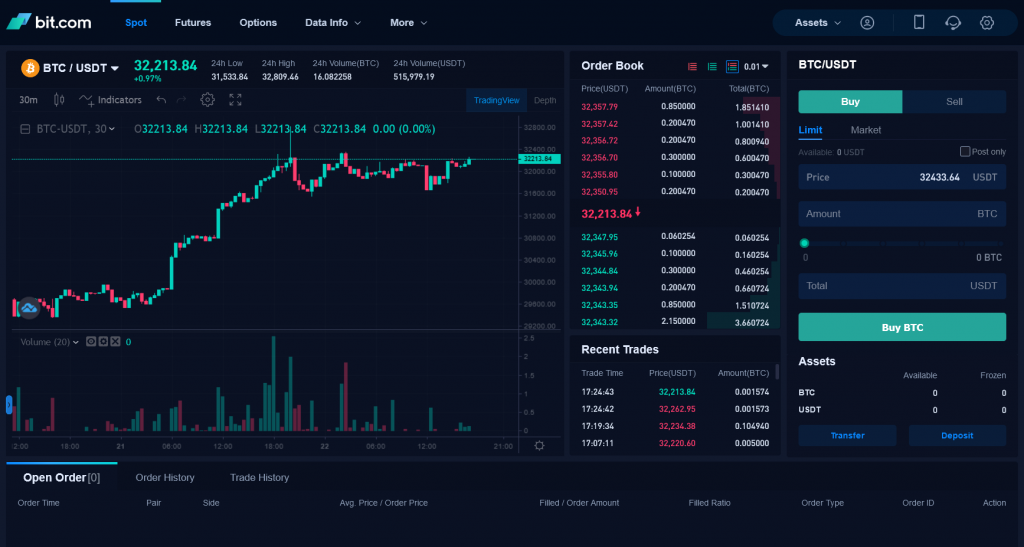

Spot Markets

There are currently only four markets available on the spot exchange making it quite specialised:-

- BTC / USDT

- ETH / USDT

- BCH / USDT

- BTC / USDC

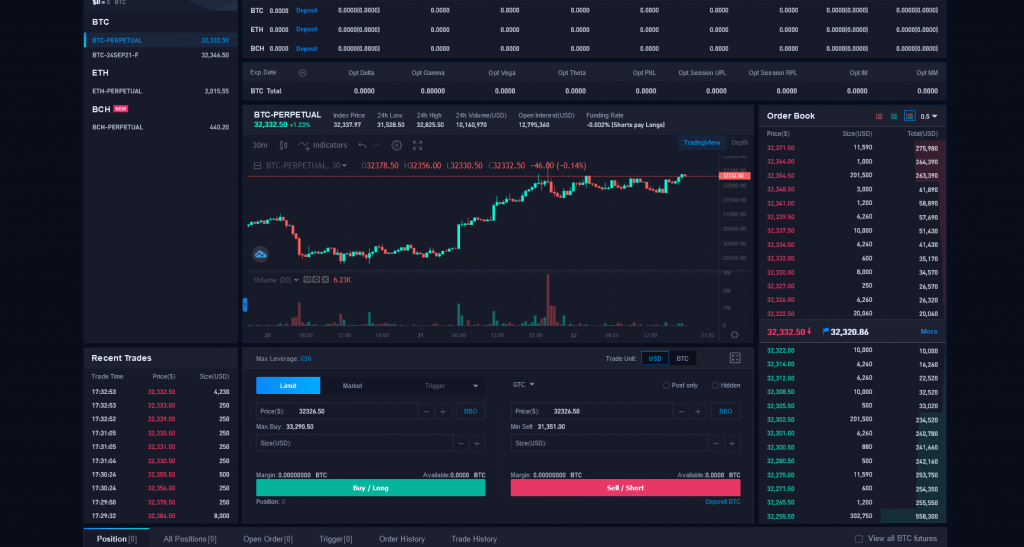

Future Markets

There is currently one quarterly futures contract available for September and the perpetual future contracts.

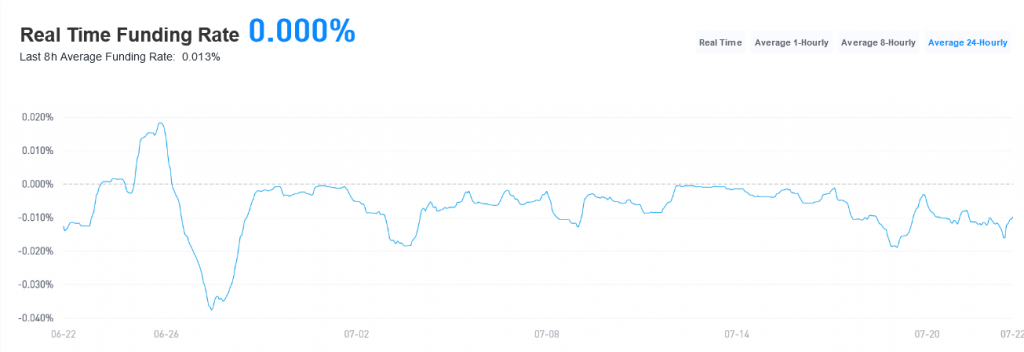

Funding rates are a bit erratic but this might be worth keeping an eye on for potential cash and carry trades if the sentiment shifts positively in the future.

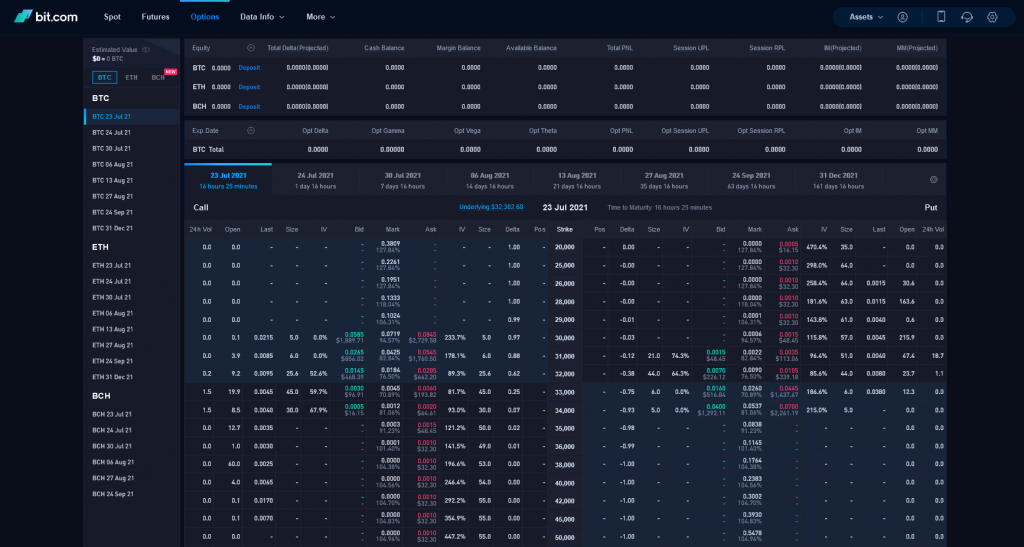

Options Markets

The options markets will probably be the biggest draw as they offer BTC, ETH and BCH options up until December. I believe they were the first to offer BCH options. This could be a huge draw for options traders if they add more altcoins in future.

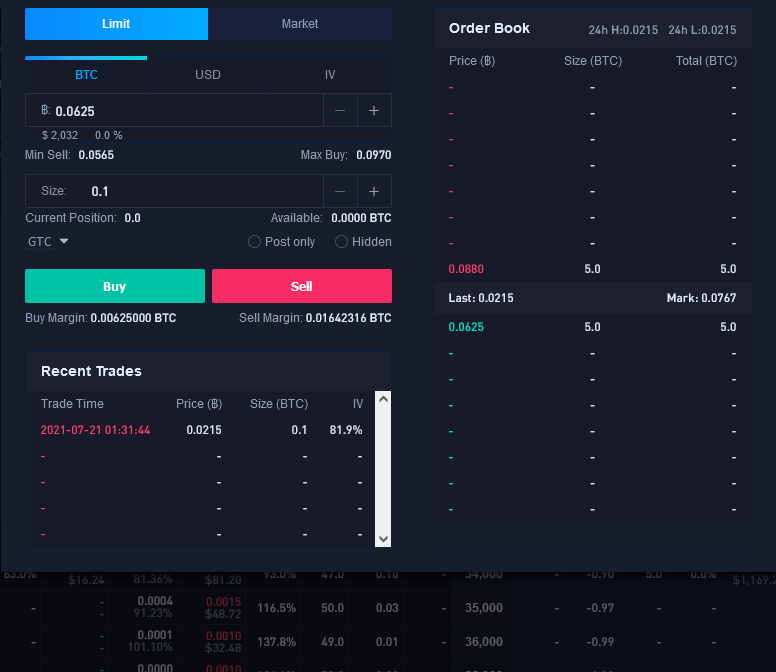

Here is the options order form:

Trading volumes are low as it’s just launched but I’d expect these to grow to a point where perhaps they could take on the market leader Deribit. Generally I can foresee crypto options becoming more popular like they have in traditional finance with the Robinhood effect. Bit.com is well positioned to grow with this increasing demand for altcoin options products.

Bit.com Fees & Limits

Here are the current trading fees:

| Market | Taker Fee | Maker Fee |

|---|---|---|

| Spot Markets | 0.07% | 0.02% |

| Perpetual Futures | 0.05% | 0.01% |

| Quarterly Futures | 0.05% | 0.01% |

| Options Contracts | 0.03% | 0.02% |

Fees are tiered and market makers doing more than $30m / month pay 0% maker fees and there are rebates beyond that for higher volumes. They also offer a market maker protection program on request, more info here: https://support.bit.com/hc/en-us/articles/360057591213-Bit-com-Market-Maker-Protection

API Limits:

- Public API (per IP)10 times/second

- Private trade (per user)5 times/second

- Private wallet (per user) 1 time/second

- Private others (per user)5 times/second

- Maximum web socket connections 30

Maximum leverage on perpetual futures is 50x

Withdrawals require mobile phone confirmation. There are three levels of KYC (name & ID, facial recognition and then video verification).

Minimum withdrawal limits are:

- 10 USDT

- 0.05 ETH

- 0.0005 BTC

Conclusion

It’s still early days for the new exchange but with Bitmain behind the application there’s a strong chance this establishes itself as a major player in crypto markets. There’s a long way to go if it will eventually compete with FTX or Binance for retail investors but I wouldn’t bet against one of the most innovative teams in China.

Trading volumes are low currently ($20m/24hrs) but will grow over time but for now there’s an opportunity for market makers to run their algorithms in a less competitive market. For traders looking to buy/sell options it’s a compelling package with plenty to offer.

Hopefully this Bit.com review and demo has proved of interest.