cryptocurrency

-

Frontrunning Crypto Catalysts For Fun & Profit

There is opportunity in crypto markets if you can get ahead of the next narrative and allocate capital prior to mass of market participants. Staying ahead of the curve often means keeping an eye on emerging trends and strategic moves that can significantly impact a project’s market perception and value. In this article I’m going…

-

Calculating The Intrinsic Value Of Bitcoin & Ethereum

Calculating the intrinsic value of Bitcoin, Ethereum and other digital assets is challenging due to its intangible nature. In this analysis I’m going to discuss common methods of calculating intrinsic value and then create a model using a combination of the methods. tl;dr based on the models described below: Methods Of Calculating Intrinsic Value Store…

-

Biggest Misconceptions About Crypto User Demographics

Due to my blog and YouTube channel I get detailed analytics on crypto user demographics. In this article I’ve compared my own data with other accounts, studies and published demographic information. My Demographic Data Here are some screenshots from Google Analytics and YouTube. My content is almost solely focused on blockchain, web3, crypto. This data…

-

Monolithic vs Polylithic Blockchains

Bitcoin is a monolithic blockchain, consensus is achieved on a single chain where all state data is stored. The Cosmos ecosystem is an example of a polylithic chain where there are multiple sub-chains running under a single consensus client. Monolithic Blockchains Monolithic blockchains are single-chain protocols where all functionalities including programmability through smart contracts, consensus…

-

Blood in the streets for crypto markets

A year ago I outlined my 60/40 digital asset portfolio which was 60% crypto and 40% USD stablecoins. One of the biggest benefits to this portfolio is that during market downturns it leaves you with capital to deploy. Today has been one of the most chaotic days in crypto markets ever and I’m going to…

-

History of Cryptocurrency | How Bitcoin & Ethereum Created A Trillion Dollar Asset Class

This article is derived from a chapter in the free eBook explaining DeFi technologies:DeFi Demystified | An Introduction To Decentralized Finance The history of cryptocurrency starts long before Bitcoin. Blockchain’s have been around since the 1980’s and Bitcoin was built not as a totally novel concept but on top of other works like Nick Szabo’s…

-

The Truth About Where Yield Comes From In DeFi

Interest rates in traditional banks are 0.1%, have you ever wondered how DeFi yield farmers are getting 20-100% yields on their digital assets? Is it sustainable wealth creation or a giant ponzi that risks collapsing in on itself. That’s the question we are going to explore in this article looking at where yield comes from…

-

Crypto Market Thesis 2022 & Current Portfolio Holdings

This article outlines my thoughts and predictions for crypto markets heading in to 2022. At the end of the article I share my allocations and plans for this year. Crypto Market Thesis Video James On YouTube Watch On YouTube: https://youtu.be/ogBcbwuasWw Bitcoin Market Outlook Crypto markets have cooled off significantly since summer 2021 but expectations are…

-

How To Short Sell Crypto

Short selling the best asset class of the the last 10 years is a risky venture at the best of times. However there are situations where it can be profitable to get the shorts in while markets or individual token valuations are crashing. In this article I’ll be explaining how to short sell crypto such…

-

Crypto Research | Due Diligence & How To Find The Next 10x Token 🧐

When market conditions are right there are abundant opportunities in seeking out high quality and early stage crypto projects. In this post I’ll walk-through my crypto research process from screening and researching crypto projects to due diligence and tokenomics. An Introduction To Crypto Research James On YouTube Where To Find New Crypto Projects Being early…

-

Impermanent Loss Calculator | How To Calculate And Mitigate DeFi’s Biggest Risk

Impermanent Loss Calculator Enter the quantities for the two assets in a full-range liquidity pool and a future price ratio to find out what the impermanent loss would be: Base Asset Qty: Token Asset Qty: Future Price Ratio: Calculate How Impermanent Loss Is Calculated In this article we will look at what impermanent loss is,…

-

Bitcoin ETF | Why A Bitcoin ETF Changes Everything

On Tuesday 3rd August the head of the SEC gave the clearest signal yet that they are readying for the approval of the growing list of Bitcoin ETF products awaiting regulatory approval. “I look forward to the staff’s review of such filings, particularly if those are limited to these CME-traded Bitcoin futures” Gary Gensler @…

-

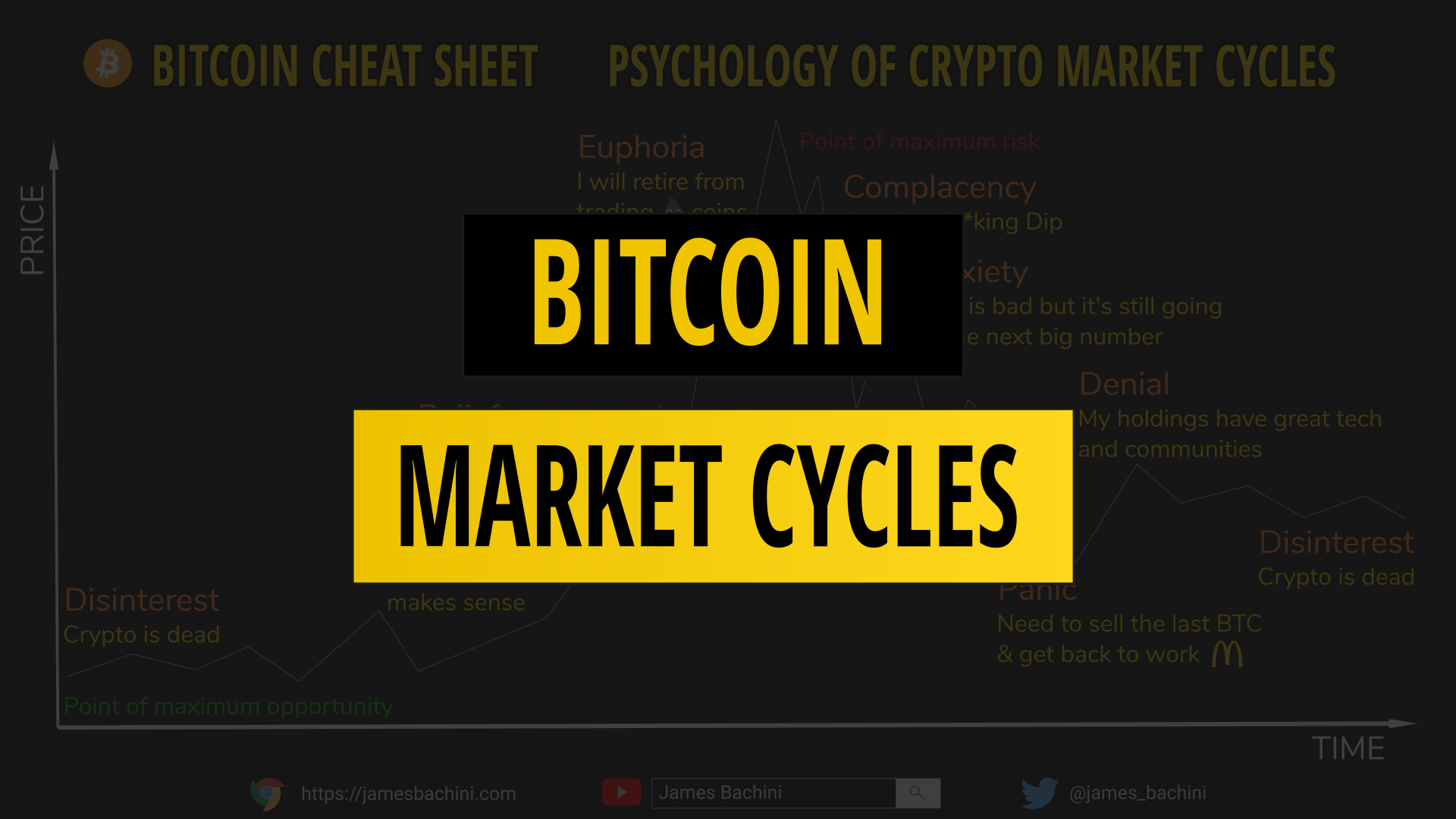

Bitcoin Market Cycle | How To Navigate Crypto Market Cycles 📈

The Bitcoin market cycle is volatile and emotionally challenging for investors but both Bitcoin and the wider crypto sector follow familiar cycle dynamics to other markets. Prophecy Was Given To Fools While I’ve never found a way to predict what the market will do next it’s both useful and fairly easy to understand where you…

-

Bitcoin vs Ethereum | Everything You Need To Know About BTC & ETH

The Bitcoin vs Ethereum debate is passionately argued by maximalists for both sides. This article and video explains the fundamental differences in how they work, what makes them unique and why Ethereum carries more risk and potential reward. Bitcoin vs Ethereum [Video] James On YouTube Fundamental Differences In 2008 an anonymous developer using the pseudonym…

-

Bit.com Review | A New Crypto Exchange

In this Bit.com review I’ll take a first look at a new exchange from the co-founder of Matrixport and Bitmain. Bit.com Review & Demo [Video] James On YouTube Who Are Bit.com? Bit.com is a new exchange registered in the Seychelles offering spot, futures and options markets for digital assets. The chairman is Jihan Wu who…

-

Crypto Portfolio | What I’m Hodling & Why In 2021

In this article I’ll go through my crypto portfolio and explain why I’m holding each of the digital assets. I’ll also be discussing the principles behind the portfolio and how I manage it. The Crypto Portfolio 2021 This is what my crypto portfolio looks like as of July 2021. I’m not a financial advisor, not…

-

Arbitrum Tutorial | How To Use The Ethereum Layer 2 Solution

This Arbitrum Tutorial explores what Arbitrum is and how it works, the opportunities layer 2’s present for investors and developers, before testing the deployment of smart contracts on the Arbitrum network and calculating gas fee reductions. What Is Arbitrum? Arbitrum is a layer 2 scaling solution for the Ethereum network. The L2 has opened it’s…

-

Certification Of Bitcoin Mining Sustainability ♻️

This article explores Bitcoin mining sustainability and the idea of classifying Bitcoin by how it was mined to incentivise renewable energy. The Video: How To Incentivise Sustainable Bitcoin Mining James On YouTube The Idea: Tracking Bitcoin From Source The idea is to identify the public key addresses of miners who use renewable energy and then…

-

Deflationary Effect Of Wealth Concentration

With inflation rising there is going to be more attention on government statistics like the consumer price index CPI. However these metrics don’t fully represent inflation in respect to the devaluation of fiat currency. This article explores the effects of wealth concentration and how it might affect all of our futures. Introduction In recent years…

-

Order Execution Strategy Tests 📋

In this article I’m going to test different methods to find the best order execution strategy for buying and selling cryptocurrency. I’m going to define a test to enter and exit a delta neutral position, write trading bot code for each strategy in NodeJS and execute each on an isolated exchange sub-account to see which…

-

Twitter Trading Bot | Elon + DOGE = Profit

In this article I’ll share how I built a Twitter trading bot to trade a cryptocurrency called DOGE every time Elon Musk tweeted something mentioning it. I’ll be using NodeJS to query the Twitter API and then executing trades on FTX. Building A Twitter Trading Bot Video James On YouTube The “Elon Effect” Opportunity Anything…

-

DeFi Passive Income | How To Generate Yield On Crypto Assets

This ultimate how to guide will show you how to earn a passive income on your crypto holdings. We will start by looking at different types of DeFi passive income and how it works. Then I’ll explain how liquidity providers earn transaction fees and explore market leaders including Uniswap, Pancake Swap, Pangolin and Raydium. Finally…

-

Decentralised Finance | A Comprehensive Guide To DeFi

Decentralised finance is revolutionising the blockchain sector. It provides a playground of opportunities for investors, traders and developers. This article provides a comprehensive in depth guide to everything DeFi. What Is Decentralised Finance? Decentralised finance is an extension of cryptocurrency and blockchain applications enabling borrowing, lending, trading and investing. DeFi provides financial services through the…

-

Binance vs FTX | Which Is The Best Crypto Exchange?

Update November 2022. Binance is the best exchange. In this article I’ll explore the differences between Binance vs FTX to find out what each offers and which you should be using. I’ll be assessing a number of factors such as markets, liquidity, security, fees, user interface and API’s. Binance vs FTX [Video] James On YouTube…

-

Cryptocurrency During The Next Recession

I learnt the hard (and expensive way) not to try and predict stock market timings so I wont guess when the next recession will occur. Like a knock on the door from someone wanting to talk about Jehovah, you know it’s going to happen but it’s normally at the most inopportune time when you don’t…