Update November 2022. Binance is the best exchange.

In this article I’ll explore the differences between Binance vs FTX to find out what each offers and which you should be using. I’ll be assessing a number of factors such as markets, liquidity, security, fees, user interface and API’s.

- Binance vs FTX [Video]

- Introduction to spot and derivative markets

- Binance volumes and network effects

- Zero fees & taker vs maker explained

- Working with the API’s for algorithmic trading

- Usability and active trading in the UI

- Security considerations when holding funds on exchange

- Conclusion Binance vs FTX | Which is the best crypto exchange?

Binance vs FTX [Video]

Introduction to spot and derivative markets

Cryptocurrency markets are where people go to trade cryptocurrencies. If you want to exchange USD for an altcoin such as Ethereum you would generally use a broker or on-ramp to exchange USD for Bitcoin or USDT (a stable coin pegged to the USD) then use an exchange to swap the BTC or USDT for ETH.

This is further complicated by the emergence of derivative platforms which offer contracts based on the price of underlying cryptocurrency assets. So if you buy a BTC-PERP Bitcoin perpetual futures contract it’s value will follow the price of Bitcoin. Derivatives such as futures and options are complex financial instruments and should only be used by experienced traders.

Binance is regarded primarily as the number one spot exchange although they do have a large derivative markets as well. The platform is built and primarily focused around buying and selling cryptocurrencies to hold in the Binance wallets.

FTX is a derivatives exchange that has the majority of volume on their futures markets. The platform is “built for traders, by traders”. It was born out of Alameda Research, an organisation run by Sam Bankman-Fried, who were the biggest market makers and arbitrage traders in the world between 2018-2021.

Binance volumes and network effects

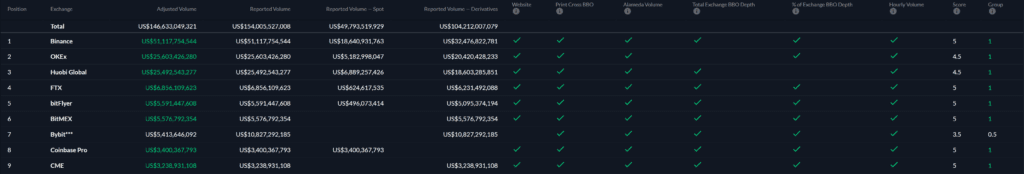

From the table below you can see that Binance has by far the most volume of any exchange.

This means that more assets are being traded on Binance than anywhere else. The fact Binance has the most volume creates a network effect that means people use the exchange more because they know it has the most liquidity.

Higher volumes mean greater liquidity and makes it easier to trade assets without slippage. If you’ve ever tried trading a low liquidity token you’ll know that just getting orders through can be difficult. This problem grows with the size of your positions as large orders affect the orderbook and market more.

Zero fees & taker vs maker explained

FTX currently offers zero fees for market makers. Let’s take a look at the difference between a market maker and a market taker before diving further into the fee structures.

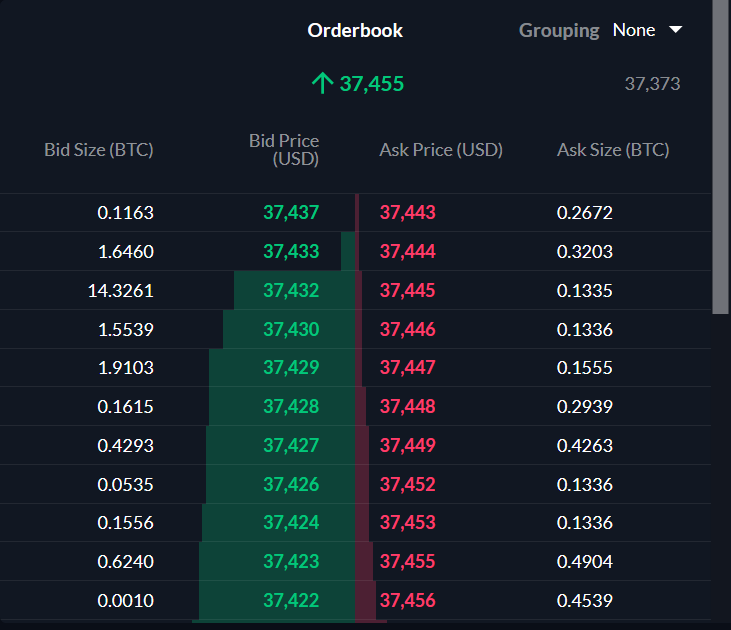

This is an orderbook for Bitcoin on FTX. To purchase Bitcoin traders have the option to place a limit order into this book below the current price. This will go into the orderbook and wont execute until someone is willing to pay that price. Alternatively they can place a market order which will execute instantly at the lowest price someone is willing to sell for.

The prior is a market makers provide liquidity to the exchange, the later is a market taker removing liquidity to get orders executed in the fastest possible time.

Traders will often use both techniques depending on the urgency of order execution.

Fees differ between market makers and market takers.

| Binance Market Maker | 0.1% |

| Binance Market Taker | 0.1% |

| FTX Market Maker | 0% |

| FTX Market Taker | 0.07% |

Note that both exchanges have promotions which provide discounts for holders of their native tokens $BNB and $FTT respectively. There are also VIP levels which provide discounts and rebates for large trading volumes.

Working with the API’s for algorithmic trading

Both Binance and FTX have extensive API’s for collecting market data and executing trades.

I have worked with both extensively during the course of being at CMG and while they are similar there are some quirks. Generally I find the FTX API more agreeable to work with. Binance has some random ways of laying out data in the JSON responses and it’s not as intuitive as it could be.

For small scripts that are not time sensitive the REST API’s will suffice. For more frequent trading systems the websocket API’s provide event based real-time data.

There is documentation available on both here:

https://github.com/binance/binance-spot-api-docs/blob/master/rest-api.md

https://docs.ftx.com/#overview

Usability and active trading in the UI

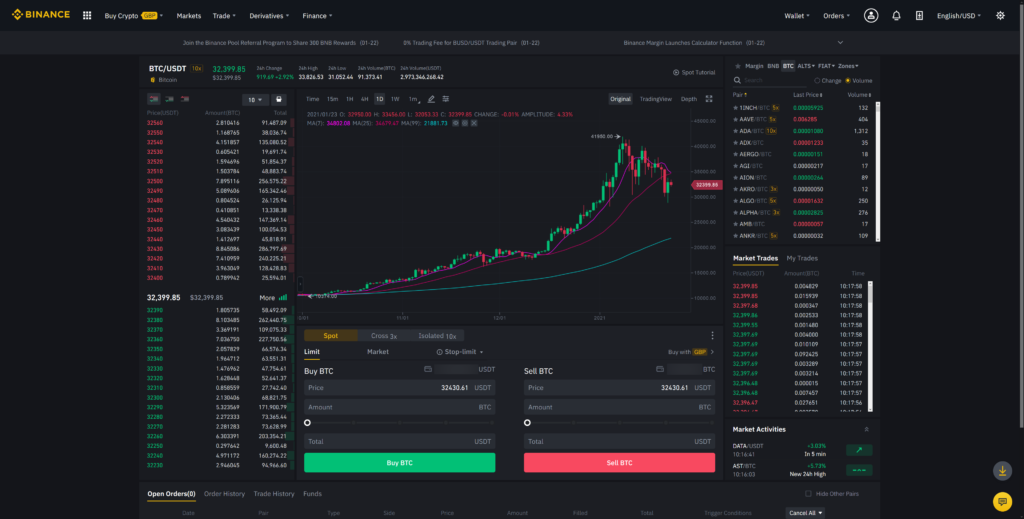

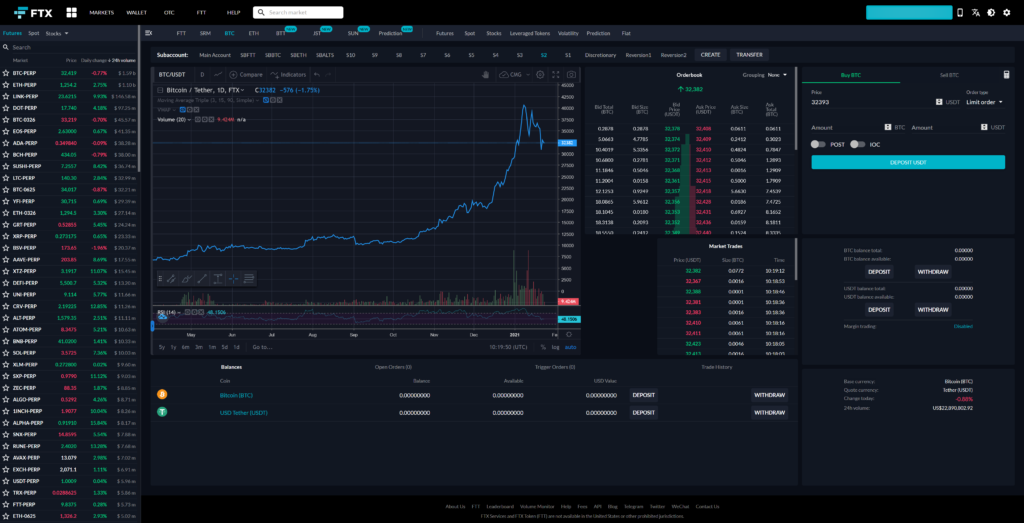

Here are some screenshots of the two web interfaces for the platforms.

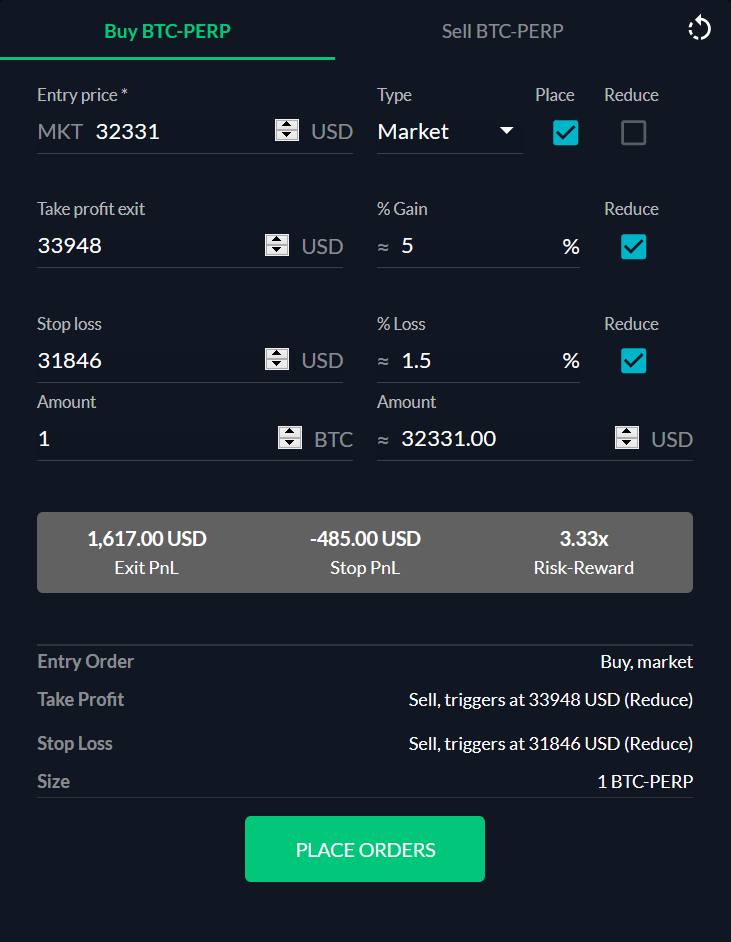

As you can see at first glance the user interfaces are quite similar. FTX has a few features that are quite useful for active traders such as the position calculator.

This allows users to set take profit and stop loss levels and then work out risk/reward factors really easily. It’s a useful tool for advanced users but probably not something someone who just wants to HODL would use.

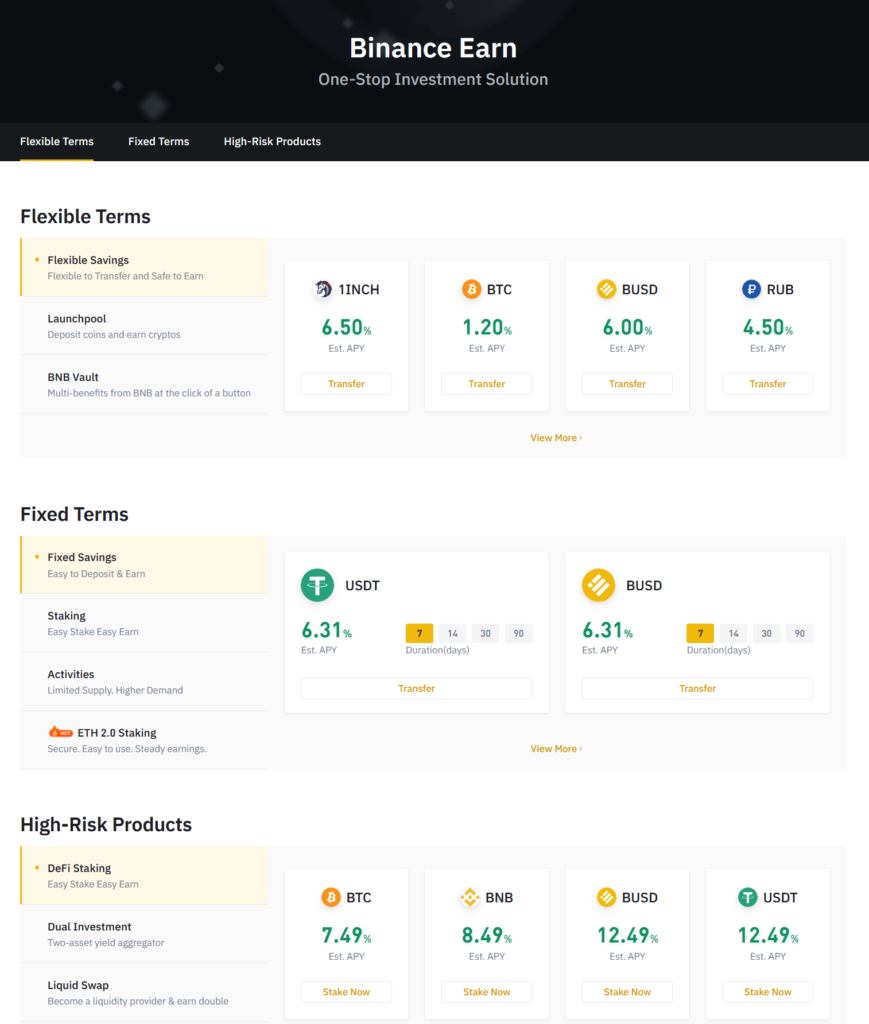

Binance has some advantages too, especially in the earn tab which lets users access savings programmes including Ethereum staking, DeFi and the launchpool for new tokens.

Security considerations when holding funds on exchange

Binance has been the largest cryptocurrency exchange since 2017. Since then they will have had some of the most sophisticated hackers in the world target their funds. Their hot wallets contain tens of millions of dollars of crypto assets and their cold wallets contain billions.

There was one successful attack where $40m in funds was lost. The founder CZ covered these losses from his own funds and users weren’t affected. This should offer peace of mind to users of the platform. Centralised exchanges are always going to be targets and security breaches are going to happen sooner or later. Binance in my opinion handled this one exceptionally well and they are probably stronger because of it.

FTX being a new exchange has a perfect track record as far as I’m aware. They are very proactive in developing new things and my concern would be that there’s not as many security protocols in place. This is largely speculative opinion however and time will tell. How they would handle a security breach is yet to be seen.

I hold funds on both exchanges and trust them to be safe. If you have the option to move funds to a secure offline wallet then this is always a good idea in the long-term.

Conclusion Binance vs FTX | Which is the best crypto exchange?

I think there is no clear winner and it comes down to what you are trying to achieve.

If you just want to buy some Bitcoin and maybe some altcoins to HODL and earn interest on then Binance would be the best option.

If you are looking to trade in crypto markets or want to setup algo trading bots then FTX is the more well suited exchange.

Setup an account for Binance here:

https://www.binance.com/en/register

Setup an account for FTX here:

https://ftx.com/#a=StartHere

Do you want to stay up to date with the latest developments in the crypto community? Get The Blockchain Sector Newsletter, binge the YouTube channel and connect with me on Twitter

The Blockchain Sector newsletter goes out a few times a month when there is breaking news or interesting developments to discuss. All the content I produce is free, if you’d like to help please share this content on social media.

Thank you.

Disclaimer: Not a financial advisor, not financial advice. The content I create is to document my journey and for educational and entertainment purposes only. It is not under any circumstances investment advice. I am not an investment or trading professional and am learning myself while still making plenty of mistakes along the way. Any code published is experimental and not production ready to be used for financial transactions. Do your own research and do not play with funds you do not want to lose.