Deribit is the leading options trading platform for cryptocurrencies. In this article I’ll be doing a comprehensive Deribit review and providing insights and strategies for options trading on deribit.com

- Deribit Demo [Video]

- Bitcoin Futures & Options

- How Options Are Priced

- Trading Options On Deribit

- Security & Liquidations

- Options Trading Strategies

- Deribit vs FTX

- Deribit User Interfaces

- Account Setup What You Need To Know

- Conclusion

Deribit Demo [Video]

Bitcoin Futures & Options

The Deribit brand combines Derivatives with Bitcoin and these derivatives come in two forms futures and options. Before we get into the platform specifics it’s important to understand these two financial instruments.

Futures

Futures contracts provide exposure to an underlying asset. They can either be settled on a specific date or in the case of perpetual futures they just track the asset price.

So a Bitcoin future that expires on the 25th June will be settled at the value of Bitcoin on that date. Prior to the date traders will place a premium on the futures contract in line with their price expectations.

Currently in February the June futures contract is trading at nearly $4000 USD more than the Bitcoin perpetual futures contract.

Options

Options contracts provide the option but not commitment to buy or sell an underlying asset at a predetermined strike price on a set date.

A call option gives the owner the option (but not obligation) to buy an asset and a put option gives the owner the option to sell an asset.

Traders can use options to execute complex strategies and effectively profit from price volatility which is so common in cryptocurrency markets.

Deribit is the market leading platform for Bitcoin and Ethereum options trading. It’s user base and volume has exploded since Bitcoin broke above $20,000 in December 2020.

Perpetual futures contracts have become expensive to buy and hold because of funding payments. This is the situation where longs pay shorts to balance the ecosystem when there are more people betting an asset will go up.

On FTX.com for example funding on the BTC-PERP has actually come down recently but is still at over 50% APR. This does not bode well to any kind of long term strategy.

This narrative alongside the “Gamestop Advertisement” for options trading has created a lot of demand for Deribit.

The availability of 10-100x isolated and cross margin leverage has multiplied the volumes currently being traded creating a increasingly liquid market.

On the 26th March 2021 we saw a record volume in options expiries with over $6,000,000,000 USD in options expiring in a single day.

How Options Are Priced

Deribit uses a European style options contract where on expiry the writer will make a settlement for any profits due. The black scholes model is used to price options which is mainly affected by:-

- Time Until Expiry – Longer = more expensive

- Implied Volatility – Higher volatility = more expensive

- Strike Price / Asset Price – Closer to the money = more expensive

Implied volatility can therefore be used as a gauge of an options cost relative to realised volatility. When Bitcoin markets are going up more people buy call options, sellers increase spreads causing the market to skew and making call options relatively expensive.

As a rough guide an implied volatility of 20% suggests the option is priced to expect a 1% move per day. So if an option has an IV of 100% it means the markets are expecting highly volatile markets where price is moving about an average of 5% per day.

So implied volatility is derived from the actual market price an option is selling for and realised volatility is the actual movement of the underlying market. Market makers and volatility funds will generally buy options when IV is cheap compared to RV and sell when it is expensive hedging where appropriate to get somewhere close to delta neutral.

To dive a little deeper here are four factors that come in to the pricing of an option on Deribit, these are affectionately known as the Greeks.

| Delta | Option Price Sensitivity This is the expected price movement of an options based on a $1 change in the assets underlying price. CALL options have a delta between 0 and 1, while PUT options are always between 0 and -1. If asset price increases the CALL option gets more expensive and the PUT option gets cheaper, delta measures by how much. |

| Gamma | Delta Sensitivity This is the expected change in delta based on a $1 price move. In practice this measurement is highest when the asset price is at the strike price and decreases as price moves away in either direction. |

| Theta | Time Decay How much the options price is likely to change day to day. Options with longer expiry dates are more valuable. I’d pay more for a CALL option to buy Bitcoin in 2030 than I would to buy it tomorrow. An option with a Theta of -5 will be expected to lose value of $5/day. |

| Vega | Volatility Sensitivity Vega is a measure of how much the option price will change based on a 1% change in IV (implied volatility). Much like Gamma it is highest when it is at the strike price and reduces the further it gets from the at the money price. |

We can see these figures by hovering over the delta column in the options trading platform on Deribit.

Trading Options On Deribit

The Deribit video demo shows an example of live options trading.

The first thing I’d recommend doing is setting up sub accounts. This lets you isolate funds and leveraged positions so that if one thing goes wrong it doesn’t blow up your whole account.

You can keep the majority of funds in the main account and then transfer them across to sub-accounts to take out positions. This is a good way to split test strategies and manage risk.

The minimum order size on Deribit is 0.1 BTC which sounds a lot but bear in mind this is for options so a 0.1 BTC out of the money option might only require $200 of collateral.

You can buy and sell contracts on the open market place via a standard order book and do not have to wait for maturity. At any time you can close out a position by simply selling the contract at the current market rate.

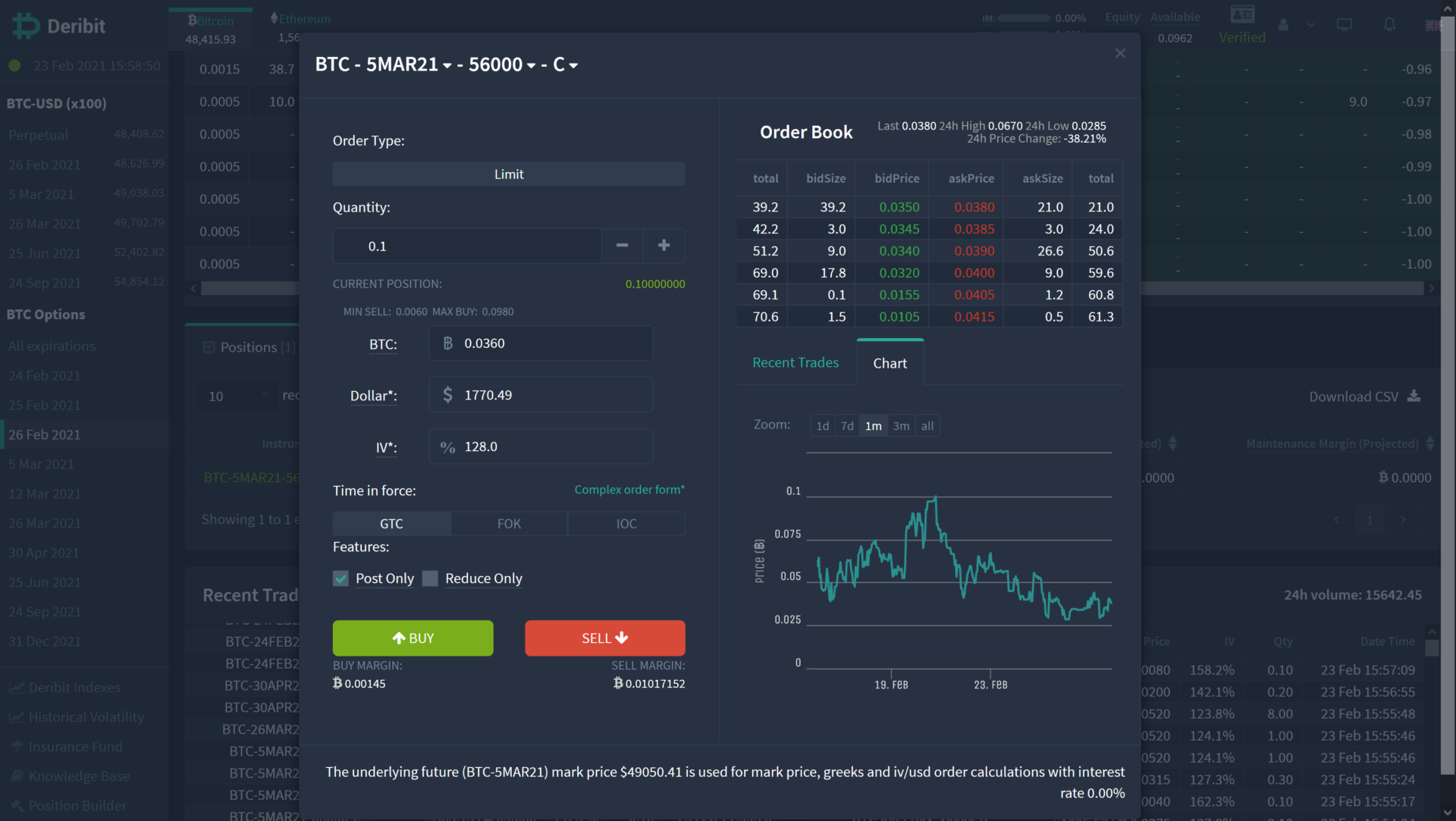

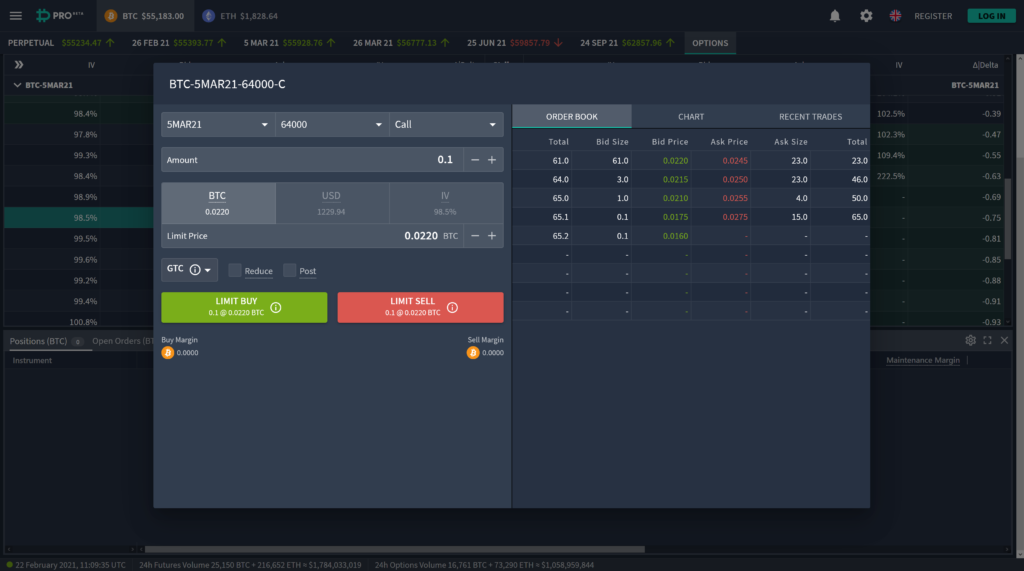

The above screenshot shows the order book for the 5th March Bitcoin Call Options with a strike price of $56,000. The bids are on the left of the table in green and list the amounts traders are willing to pay for the contract. The asks are on the right and show the asking price that traders are willing to sell at.

Below that we can switch between recent trades (network wide) and the price chart.

In the left column we have the order form. Quantity is the contract size in BTC/ETH. The BTC field is your bid price. Dollar amount is self expanatory and IV shows the implied volatility.

Below that there are options for:

- GTC – Order type: Good till cancelled. Leaves the order in the book

- FOK – Order type: Fill or kill. Completely fill the order upon submission or cancel it.

- IOC – Order type: Immediate or cancelled. Partial fill then cancel.

- Post Only: Cancels the order if the market moves so that you would be taking liquidity rather than being market maker

- Reduce Only: Cancel if order would be increasing rather than decreasing a position size.

Once you hit the buy/sell button the order will be delivered to the matching engine and once filled it will show up in your positions table.

Security & Liquidations

Deribit has been going since 2014 and has a long record of securely storing users funds. Their FAQ states that 99% of user funds are stored in cold storage which means they can’t be accessed via an internet connection.

It is an unregulated exchange based in Panama but operated in Europe I believe. DRB Panama Inc, a corporation incorporated under the laws of the Republic of Panama, registered at the (Mercantile) Record No 155684990. With current European legislation lagging and the UK’s FCA outright banning cryptocurrency derivatives this seems unlikely to change in the near term which may put some institutional investors off.

Liquidations incur a 0.5% fee for BTC and a 0.9% fee for ETH. After transaction costs have been removed remaining liquidation fees are added to the insurance fund. This currently stands at just over 600 BTC or around $35 million USD.

The insurance fund provides protection to traders who lose more than what they deposited to their accounts. There was an issue in the March 2020 crash which led to a large drawdown in the insurance fund which has now been rectified. The insurance fund is transparently reported here:

https://www.deribit.com/main#/insurance

Options Trading Strategies

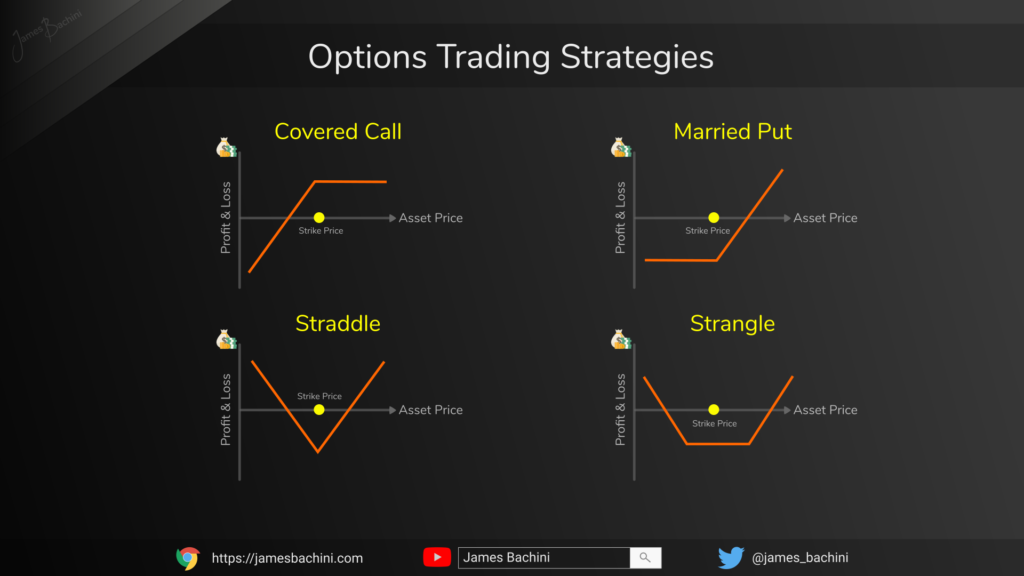

Here are four options strategies which can be used to either increase profitability, lock in yields, hedge risk or take out complex positions in volatile markets.

Covered Call

This strategy is used extensively by institutional investors in traditional markets but is less common in crypto markets where participants feel entitled to 10-100x returns year on year. It essentially sells off some of the upside to lock in a premium gained by selling a call option. It is executed by writing a call option at the same time as purchasing an asset. This generates revenue from the sale and premium of the option while limiting the upside of their trade or asset exposure. A trader might purchase Bitcoin for $50k and write a call option for $60k limiting the upside to 20% before the close of the period but receiving a premium on the sale of the options contract.

This kind of strategy can be used to yield an extra 10-15% a year but this will be offset by opportunity cost if Bitcoin moves more than expected to the upside in a short period of time. I believe this strategy will become more popular as markets mature and market cap increases naturally cause a decrease in volatility.

Married Put

This is a hedging strategy that limits the downside exposure on a trade. If a trader purchases 1 BTC for $50k and then purchases a put option at $45k they have limited their potential loss to $5k during the time period of the option.

This then works like a stop loss without the chance of getting wicked out of a position by Arthur Hayes.

Option Replacement

This strategy involves selling a futures or spot position when technical analysis suggests there could be a chance of a breakout in either direction. A trader will sell 1 BTC and purchase 1 short term call option. This limits downside to the price of the option but still provides exposure to a big up move.

This can be used when Bitcoin is trading in towards the point of a triangle or wedge. The longer that it has been range bound the more volatile the breakout is likely to be and the more value this strategy provides.

Straddle

A straddle is used to maximise returns on volatile assets when price direction is unknown. If for example Bitcoin is expected to be lively over the next week a trader might buy PUT and CALL options at the same strike price. If the price stays stable and between the two strike prices then the trader loses money. If the price moves outside of the strike prices significantly in either direction then the trades stand to profit. This creates the classic V shaped P&L graph.

Strangle

This strategy is similar to a straddle except out of the money options are purchased with a gap between the put and the call. The put strike price will be below the call strike price creating a wider P&L chart where the price has to move further from the strike price to profit.

Deribit vs FTX

No Deribit review would be complete without comparing it to the other major player in this field FTX. Binance has also recently added “Vanilla Options” but their business is more focused around sport markets.

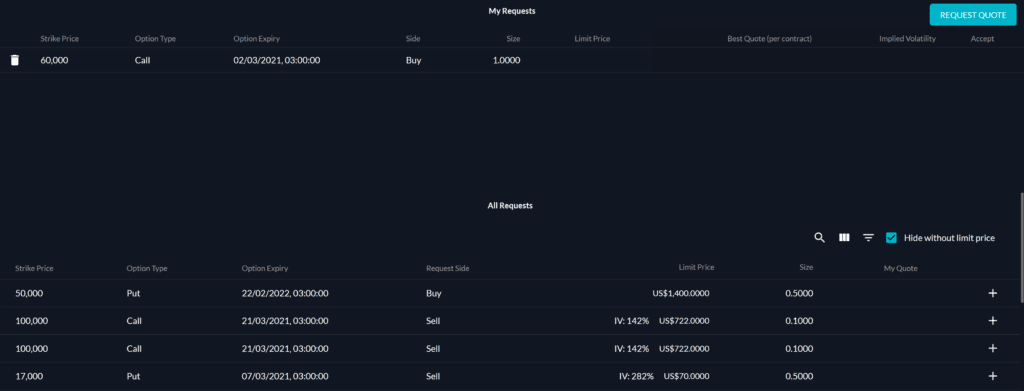

For perpetual futures contracts I prefer trading on FTX. The platform is sleek, the API perfect, there’s huge volume and I really like the work they do for effective altruism. For options trading however on FTX you need to request a quote and it’s not as open and transparent as Deribit.

Deribit User Interfaces

There are a number of different ways to trade options on Deribit.

- The Standard Web Platform

- Mobile Apps for iOS and Android

- Deribit API

- UI Pro Web Platform (BETA)

- Position Builder (Planning)

The Standard Web Platform

The standard web platform is likely to be what you’ll be using the first time you set up an account and log in to Deribit.

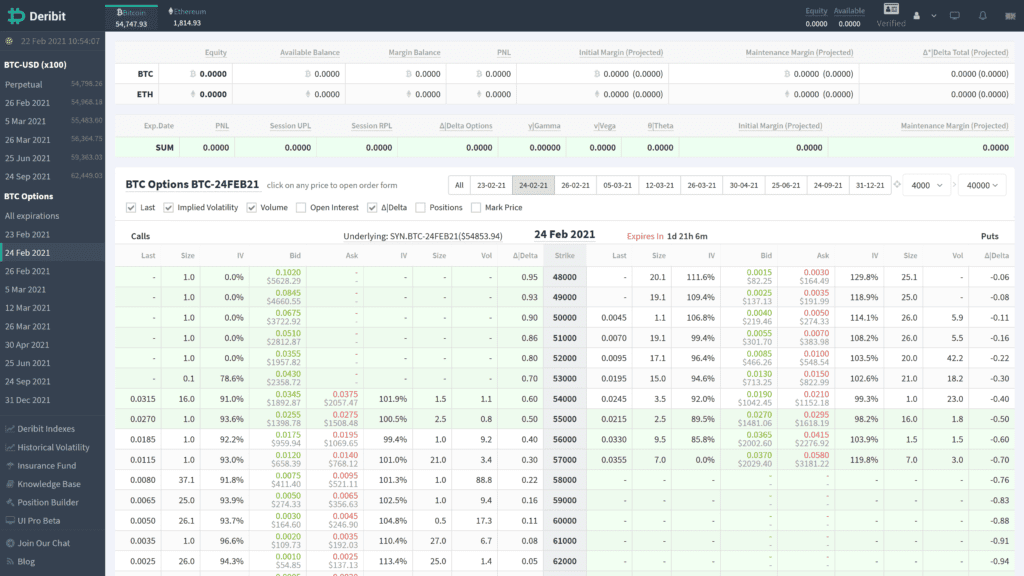

It’s relatively intuitive assuming you understand how options and futures contracts work. Select an options date from the left hand side. The strike price is outlined in grey down the middle with calls on the left and puts on the right side of that. The bid/ask prices are labelled in green and red representing the BTC value (USD value below) the market is willing to buy and sell those contracts for.

Mobile Apps for iOS and Android

I haven’t used the mobile apps so couldn’t comment on my experience with them. They get reasonable reviews on the app store which for a complex product I think is expected.

Deribit API

The Deribit API is well developed and there are a bucked load of wrappers for various coding languages including:

Android

ASP.NET Core

C

Clojure

C++ Qt5

C++ REST SDK

C#

Erlang

Go

Java

JavaScript

Kotlin

Objective-C

PHP

Python

R

Ruby

Scala (Akka)

Swift 4

TypeScript

This is the main repository for the latest clients:

https://github.com/deribit/deribit-api-clients

API limits are currently 5 requests per second for exchange trading. You can set up an API key from the web platform in SETTINGS > API > ADD NEW API KEY.

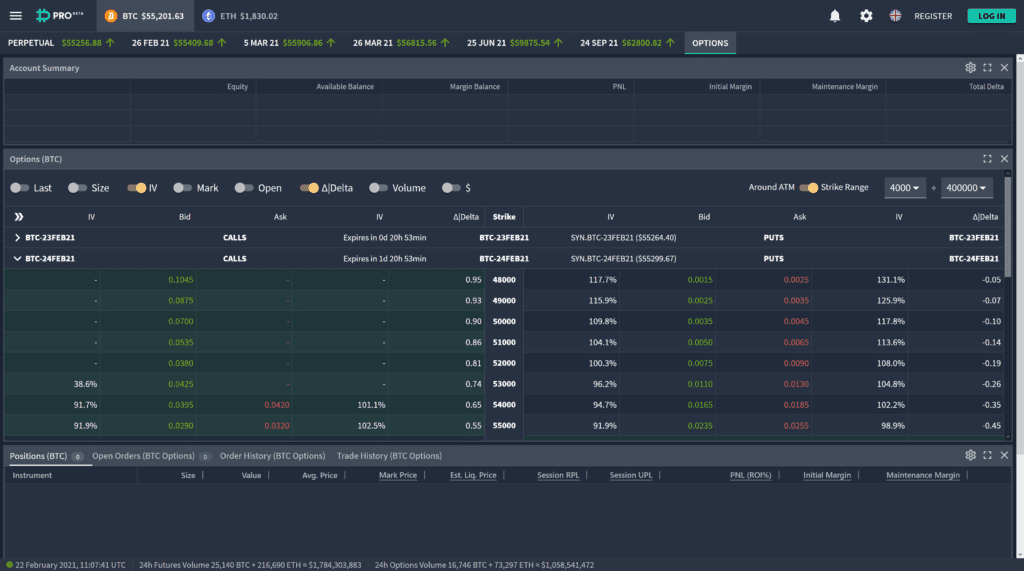

UI Pro Web Platform (BETA)

This pro version I actually find simpler to use than the standard web interface. I think that this will likely be rolled out site wide over the next few months as it is currently in a beta development stage.

The functionality is the same but the options dates are filled in collapsible containers. Double clicking on an option will bring up the order book.

The UI Pro interface is a bit more like Binance/FTX which if you are coming from those platforms will make it easier to get to grips with. Both the standard web interface and the UI Pro interface have dark modes, sold! 🌛

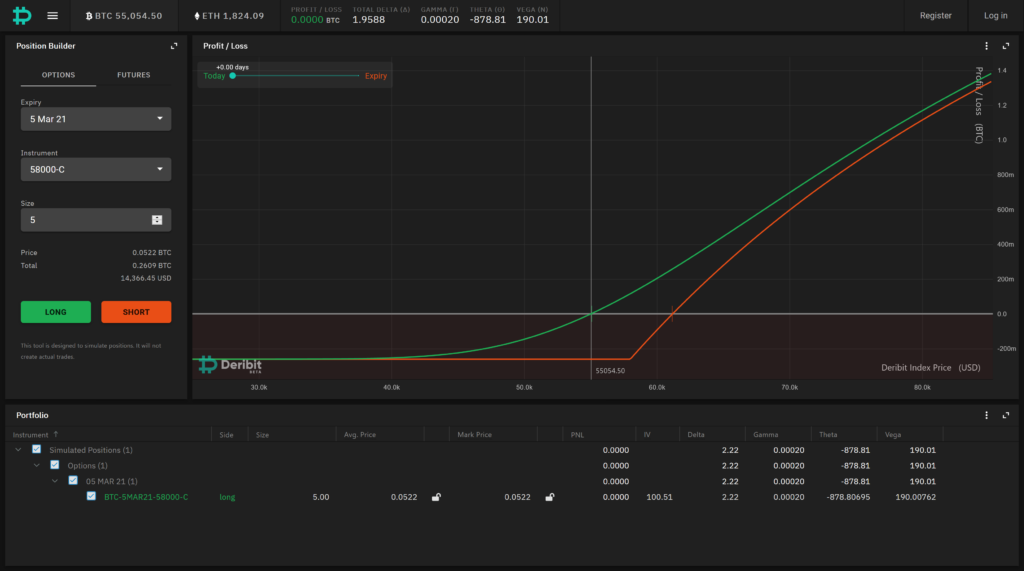

Position Builder

The position builder isn’t a tool for execution of trades but does come in useful for planning and looking at potential positions.

You can set the date and strike price that you are interested in and pull up a graph of the expected profit and loss. The days to expiry can then be adjusted using the slider to see the effect of time decay.

Account Setup What You Need To Know

tl;dr KYC is a pain, min orders and fees are relatively high.

Start by setting up an account here:

https://www.deribit.com/reg

Use a strong, unique password and be sure to setup 2fa. Then we start the fun of KYC (know your customer).

Despite Deribit being an unregulated exchange they still require KYC verification in a two stage process. The first step is to provide all your personal information including inside leg measurement. The second step is to upload ID and proof of address documents to their servers. It’s a pain, there’s some level of personal data risk. I expect they need to do it to protect themselves from international money laundering legislation.

If you have any issues with setting up an account there is always support available at [email protected]

Once you have a verified account it’s time to add some collateral. This can only be in the form of BTC or ETH. There are currently no options to use stablecoins for collateral. This surprises me as it’s kind of the industry standard to zip Tether around exchanges.

Trading with leverage relies on the valuation of the asset used as collateral. In the case of cryptocurrency this can add some unwanted risk and exposure to the price of that asset.

Another consideration is the minimum order size which is considerably higher than most other exchanges. For Bitcoin this is 0.1 BTC ($5500 USD) and for Ethereum it’s 1 ETH ($2000 USD). This may prevent traders working with limited working capital from using the platform.

Note that if you are placing an order for a 0.1 BTC out of the money contract then this will tie up collateral to a fraction of that amount in line with the cost of the contract. There is leverage available as well which can multiply both gains and losses.

As an example if a trader wants to buy an option for 0.1 BTC with Bitcoin currently sitting at $50k then they are going to be paying roughly 0.002 BTC or $100 USD for a weekly call option with a strike price of $60k. This will vary depending on the factors listed here: How Bitcoin Options Are Priced.

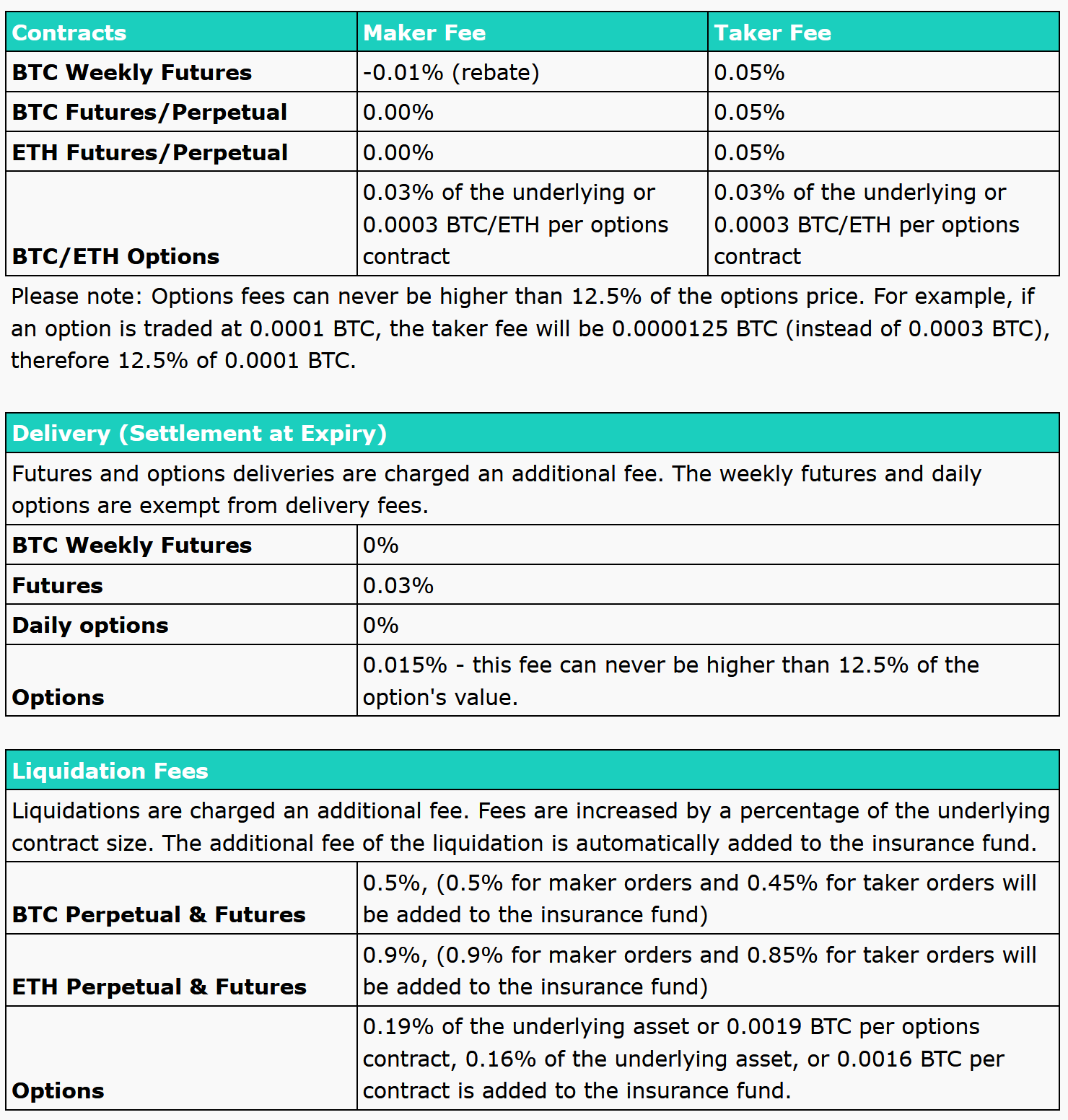

The final thing to be aware of is the fee structure. It’s not cheap. This is the current fee structure as of February 2021.

None of that put you off? I personally feel that it’s inline with expectations and while not being overly thrilled to pay 0.03% on every trade it’s competitive and transparent which is why it’s popular. The options trading fee has been reduced at some point in the last few months as it was 0.04% when I first started using it. Hopefully we will see this downward trend in fees continue in line with increased exchange volume and liquidity.

Conclusion

Deribit’s minimum order sizes and complex financial instruments means it’s best suited to professional traders and investors. If you have past experience with options or are willing to learn then it is a valuable addition to the toolbox.

The platform is mature and trustworthy to the extent that a centralized exchange can be. Security is as good as you would hope with 99% of user funds in cold storage. The downsides for me are the KYC requirements and fees. None of these are deal breakers however which is why the exchange is growing trading volumes exponentially.

Deribit is currently the leading provider of options for Bitcoin and Ethereum. If you want a put or call option and understand the risks then it’s undoubtedly the place to go for that.

Setup an account here:

https://www.deribit.com/reg