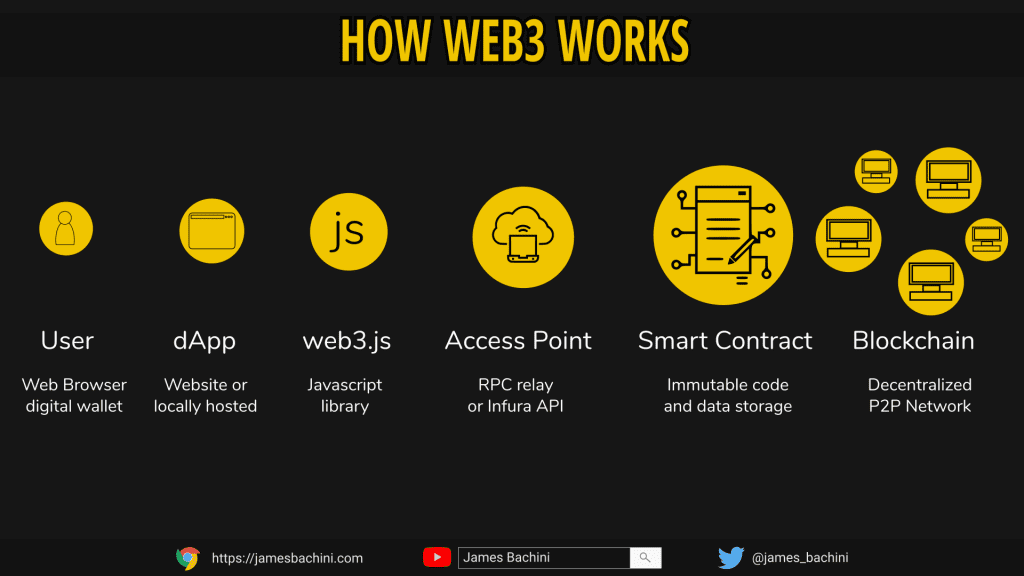

This Web3 investment thesis covers the potential disruption from decentralized permissionless computing. As blockchains scale it’s going to be possible to use smart contracts to enable users to store their own data creating the opportunity for a new era of decentralized applications.

Web3 Disrupting Data

Web3 disrupts the way we store data online by using decentralized technologies such as blockchains to store data in a distributed and secure manner. Unlike the traditional web, where data is stored on centralized servers owned by companies, web3 allows users to store data on a peer-to-peer network, making it more resistant to censorship, monetization, and data breaches.

Since data is stored on a decentralized network, users can access and share their data without the need for intermediaries. Users can take ownership over their own data in the same way NFT’s can be owned by a single wallet address. The user then has control over how that data is modified, created and deleted.

For developers web3 offers new opportunities for building decentralized applications with smart contracts. The ability to deploy immutable, permissionless code which scales to infinite users with relative ease is compelling.

Web3 counters the trend towards internet conglomerate consolidation, providing open source code, public data and user owned protocols. Imagine if your favourite social network had no central server, it wasn’t owned by any single entity, the community that used it owned the data they posted and the network itself.

Global Computer

Ethereum is leading the way as the smart contract platform of choice. While Bitcoin is the number one cryptocurrency it doesn’t have an application layer so Ethereum (and alternate L1’s & L2’s based on the same tech) is the blockchain of choice for the vast majority of web3 developers.

Ethereum is scaling through a number of avenues which is going to make web3 applications much more efficient over the next few years.

- Data sharding increases network storage capacity on mainnet

- zkRollups move computational requiements to a secondary network

- Account abstraction bundles transactions for improved efficiency & UX

These developments will open up new use cases where blockchains can compete with existing cloud computing architecture.

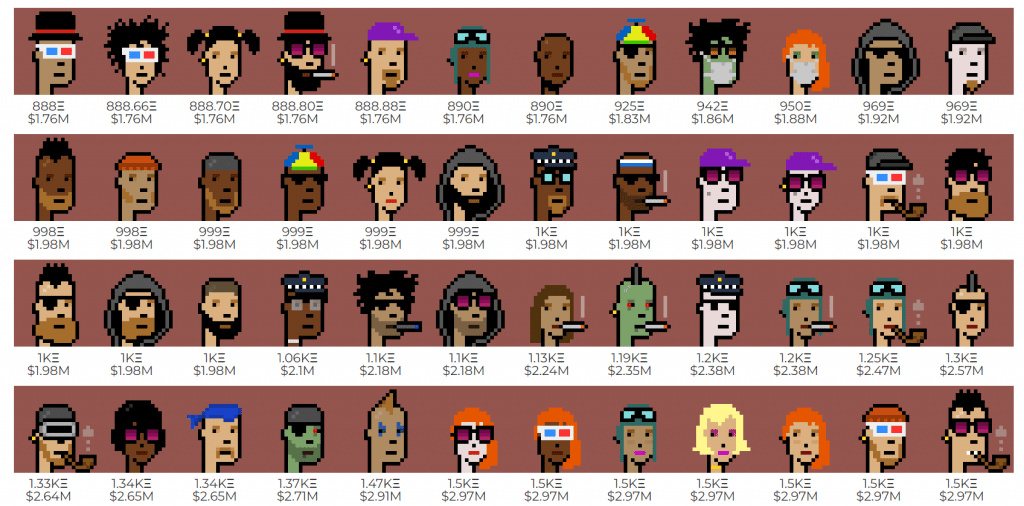

NFTs

NFTs are unique digital assets that are stored on a blockchain and are verifiable proof of ownership of a specific piece of content or digital asset. These assets can be anything from digital art to music to virtual real estate, and they have the potential to transform the way we think about ownership and value in the digital world.ds

One of the key benefits of NFTs is that they enable creators to monetize their digital creations in a way that was previously not possible. This has the potential to unlock new revenue streams for creators and corporations. They are typically unique digital tokens, which creates a sense of exclusivity and scarcity that is highly valued by collectors. This value proposition is similar to that of traditional collectibles such as art, where value is derived from quality, scarcity and exclusivity.

NFTs can help to incentivize participation in the web3 ecosystem. By providing verifiable proof of ownership, NFTs can enable users to participate in decentralized applications and earn rewards for their contributions. For example, a decentralized social network might reward users with NFT profile pictures.

Royalties provide income streams for creators long after the drop is sold out. NFT creators have earned over $1.9 billion in royalty revenues to date by setting a transfer fee percentage when an item is purchased in secondary markets.

The NFT market experienced a boom and bust in recent years, with total sales volume increasing from less than $100 million in 2020 to over $25 billion in 2022. This growth is being driven by mainstream adoption, rising awareness of digital assets and the emergence of new NFT use cases.

If we look back in art history then the renaissance period stands out as a leap forwards in technique and artistic quality. There is a good chance that the migration to digital formats will be seen as a modern day renaissance.

NFTs are expected to play a key role in the development of virtual economies within games and the metaverse. NFTs can represent virtual assets and establish ownership and authenticity of digital products.

From an investment perspective NFT’s do have some liquidity concerns. Much like selling fine art, each unique piece requires a willing unique buyer. During market declines all but the most popular blue chip NFT assets become illiquid.

DeFi

DeFi is an emerging sector that has the potential to disrupt traditional financial systems by providing an open, decentralized, and permissionless alternative for financial services.

The traditional financial system is centralized and inefficient, with high fees, slow transaction times and limited access. DeFi provides an alternative that is faster, cheaper, and more accessible to anyone with a digital wallet.

The market opportunity for DeFi is significant, I estimate the total value locked (TVL) in DeFi protocols will exceed $1 trillion by 2025.

Decentralized finance can be broken down into subsectors where we are seeing early signs of product market fit

- Swaps & Trading – Uniswap is the dominant market player in this field currently although no one has created a truly successful trading platform on DeFi yet.

- Borrowing & Lending – Usually conducted with over-collateralized loans

- Staking – Liquid staking tokens make it easy for users to earn staking rewards

- Stablecoins – Tokens pegged to fiat currencies like USD

Currently the main use case for digital assets is speculation and investment but eventually that will evolve the encompass everything we use financial services for in traditional finance.

DeFi preceded the web3 movement but it is set to merge with consumer facing products that compel every day users to self-custody their own digital assets.

DAOs

DAOs are decentralized autonomous organizations that operate on blockchain technology, allowing for community decision-making, governance and transparent operations.

To date, DAOs have funded more than $60 million in grants and hold ~$10 billion in liquid treasury assets. It is likely that the use cases of DAOs will continue to evolve as more projects adopt the governance structure.

As new web3 projects emerge, it is likely that DAOs will play an increasingly important role in shaping and governing these protocols.

DAOs have faced some challenges related to governance and decision-making, such as voter apathy and the potential for manipulation by large token holders. We will likely see new governance models and mechanisms emerge to address these issues.

One key benefit of a DAO structure and governance token is it gives users and the community a stake in the projects success. By offering tokens to users they can have skin in the game and become super-users and promoters of the products.

Regulation

Regulators are currently targeting the blockchain sector, including DAOs. While in their purest form, DAO’s may not have a central entity that regulators can target, in practice, there are often individuals or entities that register domain names, operate social media accounts and provide other support services that regulators can litigate.

Regulators need to establish clear guidelines and regulations around blockchain technology and decentralized autonomous organizations to ensure compliance with existing laws and regulations.

The US is losing its lead in Web3 and then next 10 years of policy will have a significant impact on the positioning of the crypto industry.

Gaming

Web3 games (aka GameFi) present a huge opportunity to welcome new users to crypto.

Gaming is one of the most popular industries globally. The integration of digital assets into gaming can appeal to millions of gamers worldwide, especially younger generations who are already familiar with virtual currencies and in-game economies. By providing gamers with more opportunities to earn and spend digital assets, GameFi can help to increase the adoption of web3.

Most gamers already have the necessary hardware to run blockchain-powered games and many are already familiar with the concept of virtual currencies. This means that the adoption process for GameFi is likely to be easier than for other applications.

As more gamers start using GameFi economies, the value of the network increases and more users are attracted to the platform. This can create a virtuous cycle of adoption for web3.

Social Media

Decentralized social media has the potential to disrupt a trillion dollar industry. Decentralized social media offers users the opportunity to own and control their data, have access to a censorship resistant platform and potentially earn revenue directly from their contributions.

A decentralized social network could look like something from Ready Player One with a virtual reality metaverse for us to explore. Or it might be something more simple like a replica of a text & image based social network feed that we use so frequently today.

One of the biggest obstacles to mass adoption is the lack of a user friendly interface for accessing decentralized social media platforms. This can be addressed through the development of hybrid systems that offer users a temporary account sign-in, through a familiar username and password system, while also providing more experienced users with the option to upgrade to a truly decentralized platform through their digital wallets.

The monetization of decentralized social media platforms can be achieved through a DAO or governance token that incentivizes growth and drives any monetization on the platform. The challenge will be to ensure that monetization does not turn off users, and that the platform remains accessible to all users regardless of their ability or willingness to pay.

There is more information in this newsletter where I cover the potential for a decentralized social network to gain adoption: https://bachini.substack.com/p/true-freedom-a-decentralized-social

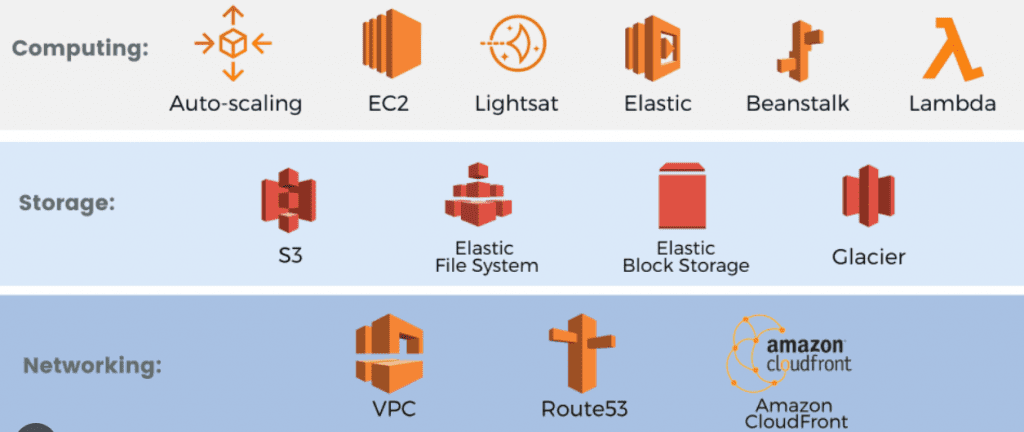

Decentralized AWS

We use Amazon Web Services and other cloud computing providers for much of what we do online whether we realise it or not. Approximately 1 in 3 of all the servers that run the internet are owned by Amazon and leased through AWS.

When we watch a series on Netflix or browse a Linkedin feed that data is being streamed through AWS servers.

While decentralized computing wont change this overnight it does offer some fundamental advantages over centralized cloud services.

Right now blockchains can’t compete because data is slow and expensive but as Ethereum scales this is all about to change. This could unleash a new wave of web3 products built and run on decentralized networks where no single entity controls the data.

Stakeholder Networks

The catalyst for this new wave of products will be self-ownership. Let’s take Twitter as the common example.

If you have two social networks which have the following features which would you use:

- Twitter – funded and owned by private US company, data owned and monetized by corporation, creators earn nothing, pay for exposure.

- Decentralized Twitter – funded and owned by early adopters, data owned by users themselves, not monetized or creators earn from micro payments, permissionless exposure.

By giving ownership of the product to the users they are empowered to promote the product. In the same way that TikTok exploded out of nowhere in a matter of weeks because it had a better algorithm, I believe we may see a web3 social network explode because it has users as stakeholders. The network effect of incentivising users to become promoters can create a viral coefficient which will grow a new decentralized social network faster than anything we have seen in the very short history of social media.

Web3 represents a significant investment opportunity, driven by the potential for improved infrastructure, innovation and mass adoption. The Web3 ecosystem is evolving, creating opportunities for a new generation of products where users are empowered and benefit economically as owners.