Tokenized US treasuries offer a yield on stablecoin holdings and with rising interest rates they are quickly gaining traction in DeFi markets.

In this article I want to look at two projects to see how they compare and how the real world asset ecosystem is shaping up.

Real World Assets

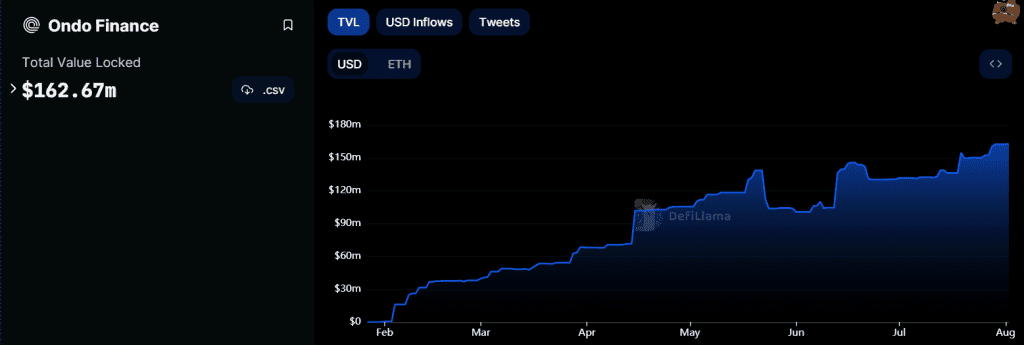

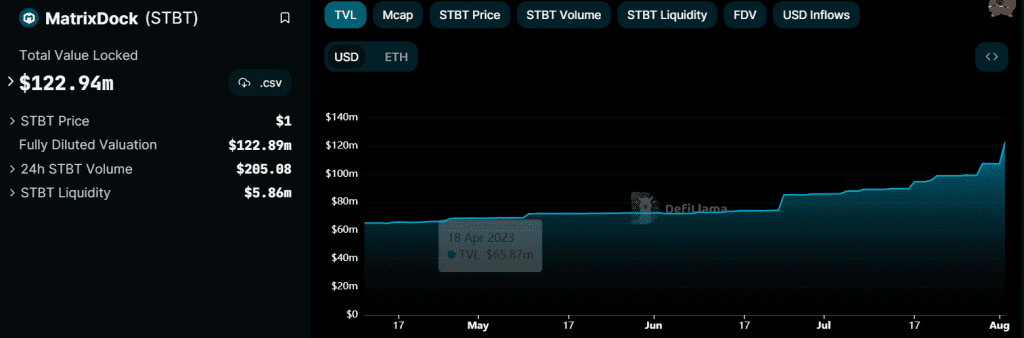

In the last six months we’ve seen two DeFi protocols grow to 9 figure TVLs by bridging traditional finance and decentralized finance. Both Ondo Finance and Matrixdock are tokenizing real world assets to create sustainable yield bearing stablecoin positions in DeFi.

Over the last year the Fed has raised interest rates to fight inflation. This has created an opportunity for institutional investors to get around 5% yield on short term treasuries. Treasuries are government issued bonds which are regarded as one of the safest investments.

This is great for accredited institutional investors but what if these same products were made available to the masses globally via decentralized finance?

That’s exactly what is happening as new protocols have emerged to create tokenized US treasuries. Anyone with a metamask wallet can now purchase and hold tiny amounts of tokens which represent a US treasury position.

Ondo Finance

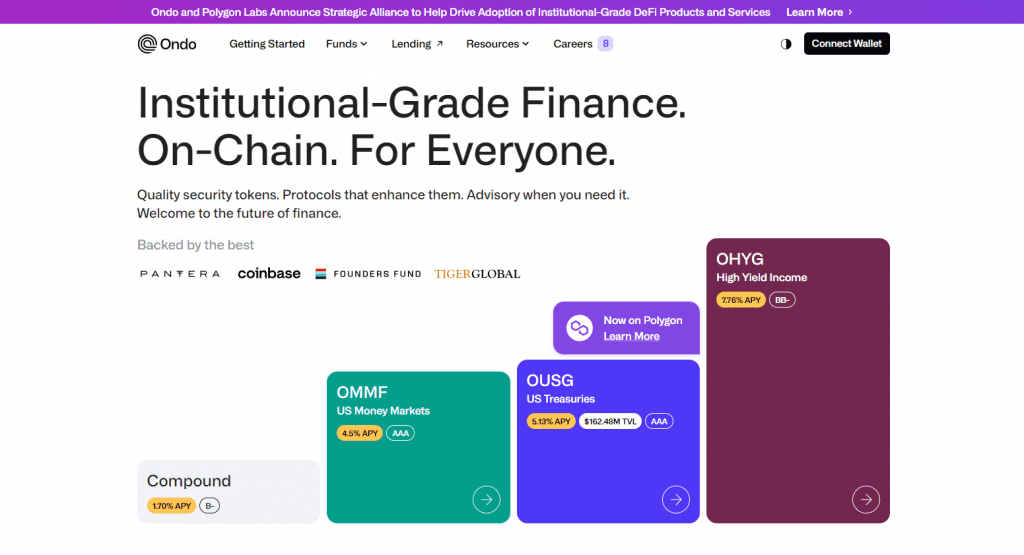

Ondo Finance is a platform that aims to democratize access to institutional-grade financial products and services. It does this through managed funds which are available to “qualified purchasers“. This means that users need to meet accredited investor requirements, whitelist and go through KYC/AML before purchasing Ondo products.

Users can invest in different funds offered by Ondo using stablecoins. After an investment is made, tokens representing a share of the fund are deposited into the user’s wallet. Ondo’s funds are overseen and managed by Ondo Capital Management who then invest in bond ETFs from tradfi giants like Blackrock.

At time of writing the US Treasuries product OUSG is most popular offering 5.13% APR.

The token prices and fund net asset value is calculated daily by the fund administrator. An oracle then updates a price feed for redemptions.

How Ondo Finance Works

- Begin by completing the Know Your Customer (KYC) and Anti-Money Laundering (AML) process with Ondo. Review and sign the necessary fund documents.

- Provide an Ethereum wallet address to be whitelisted for the fund. This wallet will be your point of transaction. You can then subscribe by transferring USD coins to the fund’s smart contract.

- After the daily Net Asset Value (NAV) is calculated and your subscription request is accepted, O-USG tokens representing your shares in the fund will be issued to you.

- Any dividends from the ETF will be reinvested to purchase more of the same ETF, thus increasing the fund’s value. Investors can schedule auto-selling for regular liquidity.

- To redeem, a user submits a redemption request by sending O-USG tokens to the fund’s smart contract.

- Once the daily NAV is computed, the redemption request is accepted, enough ETF shares will be sold to cover the redemption.

- The resulting USD will be wired to Coinbase, converted into USDC, and then distributed to your wallet.

Ondo Finance represents a new breed of DeFi protocol which is far from decentralized. It’s a business, fully permissioned and fully KYC’d with an integration into DeFi networks.

The accredited investor requirements remove some of the value in making the products available to the masses. Somewhere along the line of legal requirements the tagline “Institutional-Grade Finance. On-Chain. For Everyone.” got lost and what we have is a growing tradfi fund with tokenized sales.

Matrixdock

Matrixdock is a platform that creates tokenized U.S. Treasury securities available on the Ethereum blockchain. The first such product they have released is the Short-Term Treasury Bill token (STBT). The STBT represents U.S Treasury securities with maturities of six months and reverse repurchase agreements that are collateralized by U.S. Treasury securities.

Matrixdock brings risk-free interest rate of treasury bills to DeFi ecosystems.

Matrixdock like Ondo requires accounts to be approved via a KYC/AML white-listing process and to satisfy specific income or net worth requirements.

The funds used to mint the STBT tokens are invested in reverse repurchase agreements collateralized by U.S. Treasury securities and U.S. Treasury securities maturing within six months. These assets are held as collateral with a third party custodian.

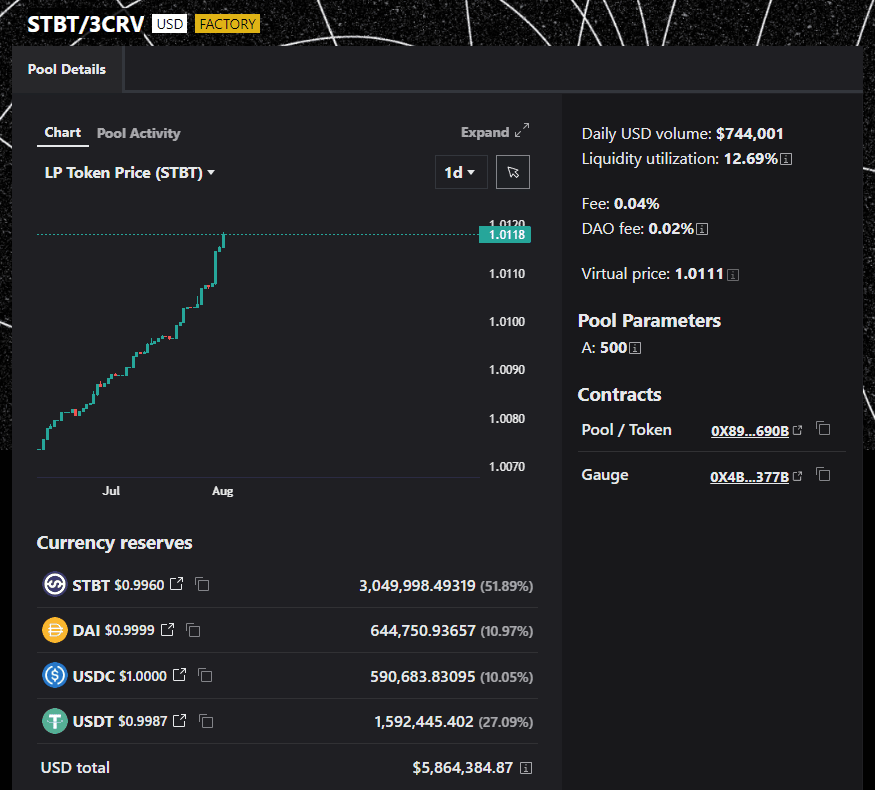

The STBT tokens are transferable among whitelisted addresses and can be traded directly via the STBT/3CRV pool on Curve Finance which currently has $6m in liquidity and $750k daily trading volume.

Conclusion

My first impression of these protocols was one of disappointment with the inherent lack of decentralization in the products. The legal risk for developers to sell US treasuries to non-accredited KYC’d investors must be significant which is why we haven’t seen permissionless tokens at this stage.

The inherent requirement of a centralized party to manage real world assets provides a target for regulators and law enforcers which is the root cause of the legal requirements.

The hope of bringing institutional grade finance to the masses and democratizing these products in permissionless autonomous systems still seems a long way off.

With all that being said the growth in RWA and both these protocols TVL is impressive and perhaps there is a middle ground where digital assets held on-chain by institutions and funds can benefit from these emerging products.