Imagine waking up to a dashboard that shows overnight sales from three continents, settled in Bitcoin, USDC, and Ether. Each payment final, fraud proof, and already in your private wallet. No chargebacks. No rolling reserves. No credit card processing fees.

That promise, more than any headline about blockchain, is why thousands of entrepreneurs are adding Coinbase Commerce to their stores this year. If you sell anything online and especially if you’re tired of watching payment processors and banks collect the fattest margin read on.

How Coinbase Commerce Works

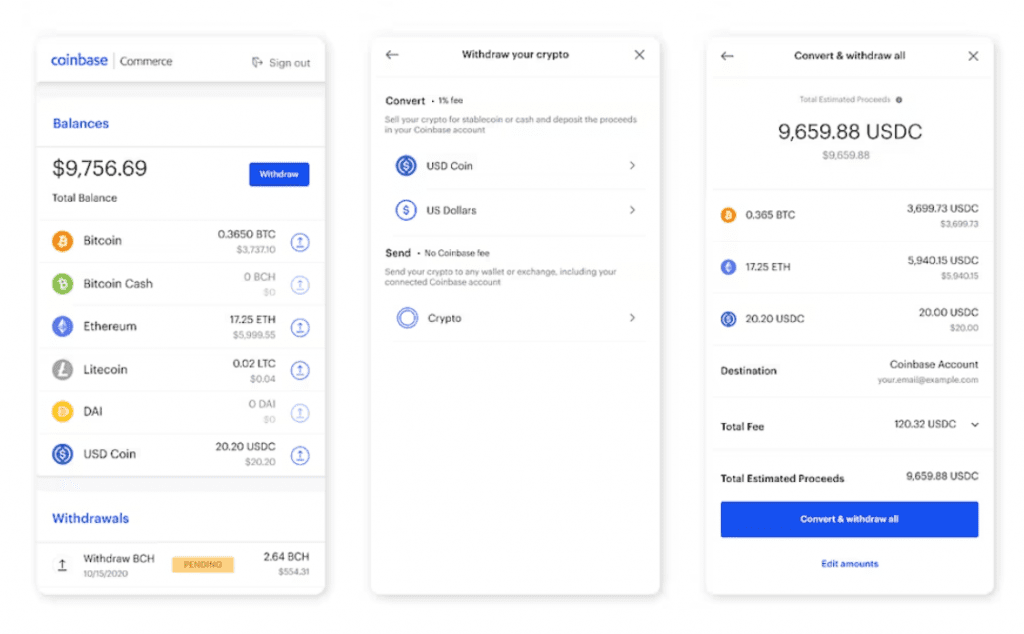

At its core, Coinbase Commerce is a non-custodial payment gateway, a software layer that lets customers pay you in crypto while letting you, the merchant, decide whether to hold, swap, or instantly convert those funds.

When a shopper clicks “Pay with Crypto” Coinbase Commerce generates a unique on chain address, listens for the required network confirmations, and fires a webhook back to your server once the payment is final. Because funds go straight from the customer’s wallet to the blockchain address you control, Coinbase never takes possession and therefore never exposes you to counterparty risk.

Creating A Checkout Button In Minutes

Coinbase Commerce is available in 100+ countries, covering every territory Stripe does plus several emerging markets that PayPal still blocks.

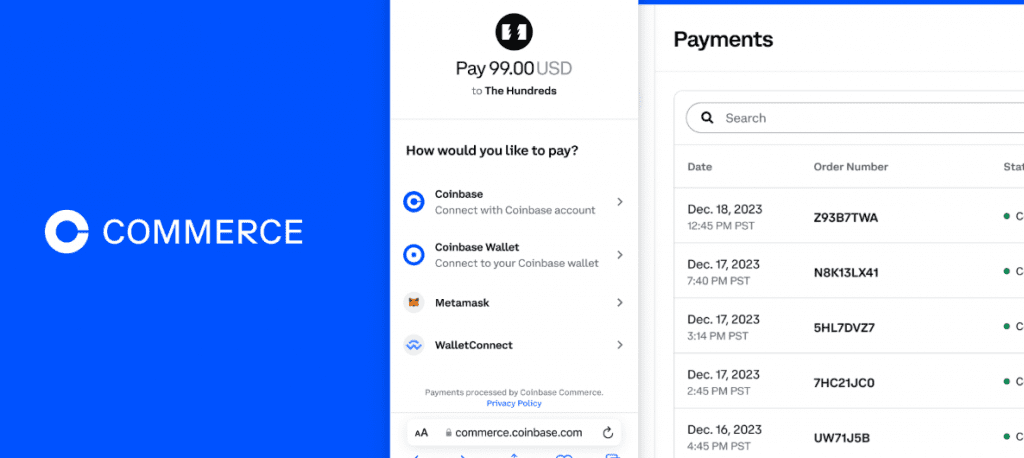

Non developers can accept their first crypto payment without writing a line of code. Inside the dashboard you click “Create Charge” enter the product name, price, and currency, and copy paste the generated HTML snippet anywhere on your site.

The button triggers a hosted checkout page that supports Bitcoin, Ethereum, Litecoin, Dogecoin, Bitcoin Cash, DAI, and all ERC-20 assets held on Coinbase, including USDC. Every transaction can settle in the asset the buyer chooses, or you can preselect a currency such as USDC to simplify bookkeeping.

Integrating With Node.js A 38 Line Example

Developers looking for a native checkout flow will appreciate the Commerce API’s simplicity. Below is a minimal Node.js Express server that creates a charge and verifies the webhook:

import express from 'express';

import {Client, resources} from 'coinbase-commerce-node';

import bodyParser from 'body-parser';

import crypto from 'crypto';

Client.init(process.env.COINBASE_COMMERCE_API_KEY);

const {Charge} = resources;

const app = express();

app.use(bodyParser.json());

app.post('/create-charge', async (req, res) => {

const charge = await Charge.create({

name: 'Premium Hoodie',

description: 'Fire logo hoodie, ships worldwide',

local_price: {amount: '75.00', currency: 'USD'},

pricing_type: 'fixed_price',

metadata: {order_id: req.body.orderId},

redirect_url: 'https://store.example.com/thank-you',

cancel_url: 'https://store.example.com/cart'

});

res.json({hosted_url: charge.hosted_url});

});

app.post('/webhook', (req, res) => {

const signature = req.headers['x-cc-webhook-signature'];

const hmac = crypto

.createHmac('sha256', process.env.COINBASE_COMMERCE_WEBHOOK_SECRET)

.update(JSON.stringify(req.body))

.digest('hex');

if (signature === hmac && req.body.event.type === 'charge:confirmed') {

const orderId = req.body.event.data.metadata.order_id;

// mark order as paid in your database

}

res.sendStatus(200);

});

app.listen(5000, () => console.log('Server running'));That’s the entire flow:

- Create a charge

- Listen for the charge

- Fulfill the order once blockchain confirmations hit

Most teams plug this into an existing order model in under an hour.

Decoding The Fee Structure

Transaction fees are where Coinbase Commerce shines. The service charges a flat 1 % on all incoming payments period. There are no fixed per transaction cents, no cross border markup, no “high risk” surcharges, and no chargeback penalties because crypto payments are irreversible by design. The only additional cost you might incur is miner or gas fees, which the buyer pays at checkout.

Nothing illustrates value better than raw numbers. Below is a snapshot of the effective cost per $100 domestic transaction as of Q2-2025. Data come from public fee schedules and average network gas statistics:

| Provider | Base Fee | Surcharge | Cost On $100 | Chargeback Risk |

| Coinbase | 1 % | $0 | $1.00 | None |

| PayPal | 2.99 % | $0.49 | $3.48 | Up to 180 days |

| Stripe | 2.9 % | $0.30 | $3.20 | 120 days |

| MoonPay | 4.5 % | $0 | $4.50 | None |

Because Coinbase Commerce is non custodial, PCI DSS compliance is offloaded to the customer’s wallet. You never touch card data. However, you still must secure webhook endpoints, rotate keys, and implement robust order reconciliation. Most merchants set up a hot wallet for day to day operations and periodically sweep funds to cold storage.

From a tax perspective, each crypto payment creates a cost basis equal to the USD value at receipt, and future price movements produce capital gains or losses when you eventually convert to fiat. Popular accounting suites like QuickBooks and Xero accept CSV exports from Commerce, but specialist tools such as CoinTracker or TaxBit automate this workload, refusing to sync settled transactions with historical exchange rates.

If you want zero exposure to price volatility, you have two options:

- Link a Coinbase Exchange account and enable “Auto Convert” so all incoming crypto is sold to USD, EUR, or GBP at spot for the same 1 % fee.

- Accept stablecoins only. USDC issued by Circle and Coinbase holds a 1 : 1 peg to the dollar and settles on chain in under a minute, eliminating both volatility and banking delays.

Future Proofing Your Store With Digital Assets

Digital commerce is entering a phase where payment, ownership, and loyalty converge. Crypto rails are no longer speculative side bets; they are becoming part of a composable stack that includes NFTs as proof of purchase, verifiable on chain reviews, and token gated membership tiers. Coinbase Commerce already exposes a metadata object that merchants use to mint NFTs post payment or drop ERC-20 loyalty tokens into the buyer’s address.

The macro trends reinforce adoption: cross border e commerce is growing at 17 % CAGR, while traditional correspondent banking costs remain flat or rising. Meanwhile, Layer-2 networks slash transaction costs to fractions of a cent Base, Optimism, and Arbitrum already process thousands of transactions per second at < $0.01 gas. CBDCs are likely to speed settlement but will still rely on private gateways for retail. Positioning your store now means you will not scramble later when customers expect to pay in whatever asset sits in their wallet app.

Coinbase Commerce Takeaways

- Coinbase Commerce is a non custodial gateway that lets you accept Bitcoin, Ethereum, USDC, and other major assets with a flat 1 % fee and no chargebacks.

- Sign up and deployment can be done in under ten minutes for no code users and about an hour for developers integrating the REST API and webhooks.

- Compared with PayPal and Stripe, merchants save roughly $2-$3 per $100 sale and eliminate 100 % of chargeback liability.

- Code integration is lightweight: a 20-line Node.js snippet covers charge creation, signature verification, and order fulfillment.

- Auto convert options and stablecoin only checkout remove crypto volatility while preserving cost savings and global reach.

- Accounting is straightforward with CSV exports or direct sync to CoinTracker and TaxBit, and PCI compliance is simplified because you never handle card data.

- Early adoption positions your brand for emerging Web3 features like NFT receipts, tokenized loyalty, and near instant cross border settlement on Layer-2 networks.