Imagine opening your favourite social app knowing that every photo, comment, and connection you create is yours, stored in a wallet only you can access, portable to any future platform, and even capable of earning you revenue instead of Meta’s shareholders.

That future is no longer science fiction; it is the central promise of Web3 social media, and the race to build it has already started.

Instagram, Facebook, TikTok, and X monetized an estimated $118 billion in advertising revenue in 2023, and more than 97% of Meta’s income came from selling targeted ads.

The average user spends 151 minutes a day inside these feeds, yet receives no share of the economic value created.

Attention becomes the commodity; data, the raw material; algorithms, the extraction machinery; and centralized corporations, the sole beneficiaries. Compounding the imbalance, opaque recommendation systems curate content in ways that maximise screen time rather than well being, while platform policies altered with the stroke of a pen can de rank, demonetize, or delete an account overnight.

The Decentralized Social Network

Blockchain technology offers a sharp break from that bargain.

By storing social graphs, content, and even reputation scores on open, programmable ledgers, Web3 platforms let users hold private keys that unlock their personal data whenever and wherever they choose.

Smart contracts automate monetization so that tipping, revenue sharing, and platform governance flow directly to contributors without intermediaries. Transaction costs once made this vision impractical, yet advances such as optimistic rollups, zero knowledge proofs, and account abstraction wallets have reduced average fees on leading Layer-2 networks to fractions of a cent and cut confirmation times to under two seconds.

As a result, the user experience is beginning to feel indistinguishable from Web2-minus the lock in.

Let’s look at some examples…

Lens Protocol

A Modular Social Graph Launched by the team behind Aave in mid 2022. Lens stores every post, comment, follow, and collect action as an NFT on Polygon POS.

The architecture separates the underlying social graph from any front end interface, allowing developers to spin up new clients LensFrens, Orb, Buttrfly, and more against the same dataset.

About 235,000 profiles have been minted to date, yet monthly active wallets hover near 11,000, reflecting friction points such as wallet onboarding and high minting fees when Polygon congestion spikes.

Still, Lens demonstrates how composability can generate novel experiences: users can set “follow modules” that require small micro payments, token holds, or allow lists before someone can subscribe, embedding economic logic directly into social actions.

Farcaster

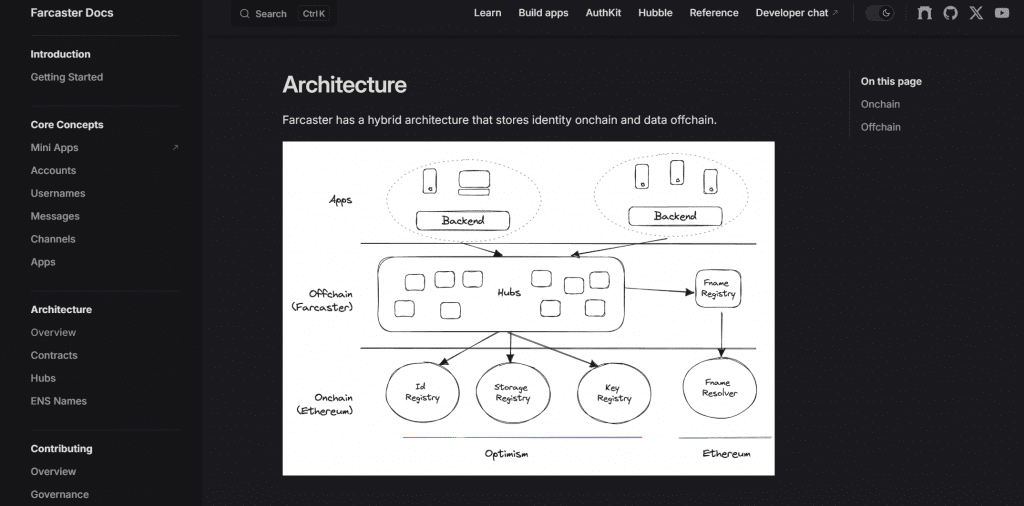

Farcaster takes a different tack, building atop Optimism and deliberately capping early sign ups to preserve API reliability.

Each user mints an on chain identity called an “FID,” then stores the bulk of their content in decentralized storage such as Arweave or personal servers called Farcaster Hubs. The dual model keeps fees microscopic minting an FID costs ~$4 once and lets posts propagate in near real time.

Daily active addresses crossed 35,000 in March 2024 after the launch of client app Warpcast’s “Frames,” which embed interactive mini apps directly into posts. By March’s end, Frames recorded more than 2 million interactions ranging from NFT mints to cross chain swaps, hinting at a future where every social post becomes a gateway to commerce or on chain action.

When comparing Lens vs. Farcaster, pure usage data still tilts toward Farcaster. Its average daily active wallets outnumber Lens’s by a factor of three despite Lens launching earlier.

Developer momentum also favours Farcaster, with more than 300 open source repositories tagged within six months of its mainnet deployment versus 120 for Lens.

The competition illustrates how modular architecture, low fees, and wallet less onboarding are no longer nice extras but table stakes for user growth.

Other Contenders

Nostr, a lightweight protocol signed with Bitcoin keys, exploded onto the scene when Jack Dorsey donated 14 BTC in 2022. The network reached 16 million public keys, yet active relays remain under provisioned and spam is rampant because relays collect no fees and bear the cost of storage.

DeSo, with a $200 million war chest from Andreessen Horowitz and Coinbase Ventures, opted for its own Layer-1 chain, but locking users into a bespoke ecosystem alienates developers already proficient in Ethereum tooling.

Bluesky, often mentioned in the same breath, does not reside on chain at all and therefore cannot offer true data self custody.

Across these projects, adoption hurdles repeat: wallet complexity, seed phrase anxiety, clunky onboarding, and scarce mainstream incentives. The cold start problem is brutal; without familiar faces, users open an app once and churn.

Network effects remain the moat incumbents rely on, and simply decentralizing the back end does not override the psychological gravity of where friends already congregate.

The Search For A Schelling Point

History shows that platforms can still pierce entrenched networks when a novel format meets viral distribution.

TikTok’s fifteen second, music layered clips reached 653m users in it’s break out year (2018) by exploiting algorithmic discovery rather than social graphs.

A Web3 analogue could ignite if a single irresistible feature draws creators who then bring their audiences. Built in monetization is the obvious candidate: imagine earning $0.02 every time someone reposts your meme or receiving DAO governance tokens proportional to the engagement you drive.

Because these payouts are programmatic, they scale globally without renegotiation. Once a critical mass of influencers and micro creators taste direct revenue, the gravitational pull could flip, turning existing walled gardens into distribution channels that funnel traffic outward.

Economics will not serve as the sole spark.

Regulatory shifts, such as Europe’s Digital Markets Act mandating data portability, could accelerate migrations. Likewise, Apple’s rumored tightening of IDFA tracking threatens the ad models of incumbents, potentially leaving creators searching for supplemental income. A sudden event a widespread de platforming, a data leak, a viral disinformation incident could also become the moment when “self custody for content” transforms from geeky talking point to mainstream necessity.

SocialFi projects already experiment with sustainable revenue loops.

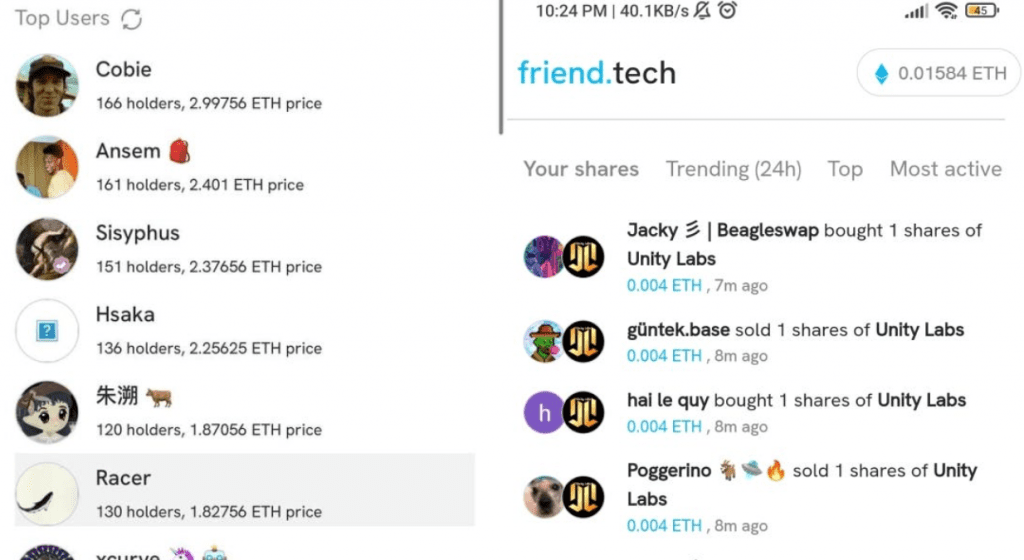

Friend.Tech converted Twitter follow lists into tokenized chatrooms, capturing $50 million in fees within three months by taxing trade volume of room shares.

Despite volatility and controversy, the model showcased how speculation on creator access can bootstrap liquidity fast enough to cover infrastructure costs.

On Lens, collect modules allow artists to mint posts as limited edition NFTs, yielding average primary sale revenues of $120 per post for top accounts.

Farcaster’s Frames have generated more than $3 million in on chain swap volume linked directly from social feeds within eight weeks of launch. These figures are minuscule compared to Meta’s cash flow, yet they demonstrate viable bottoms up economics that reward users first and platform second.

A Timeline For The Tech

Account abstraction, removes the need for seed phrases by turning smart contracts into wallets that recover with email or biometrics. Gas sponsorship lets dApps pay for user transactions, erasing the mental toll of budgeting fees. When UI friction falls below the pain of algorithmic manipulation in Web2, the mainstream crossover happens almost by default.

Predicting tipping points is fraught, yet several timelines converge.

Creators frustrated by ever shrinking ad revenue shares already test subscriber hosted funding models on Patreon and Substack. Putting these vectors together.

Gen Z, the demographic most distrustful of centralized platforms according to a 2023 Deloitte survey, will represent ~35 percent of the global workforce by 2030 and command decisive cultural sway.

This is a reasonable timeline given the current trajectory and I would be surprised if a decentralized social network of some form didn’t gain 100m+ users by the year 2030.

My view is that this will be something new and novel that blows up and goes viral rather than an existing network that reaches a tipping point.

Ownership has cascading effects beyond personal gain. For developers permissionless composability enables third party innovation without gatekeeping. Imagine a researcher building misinformation detection directly into the global social graph, or a remittance service attaching micro payments to chat threads in emerging markets.

There will be significant opportunities for web3 builders over the next decade.

Open data turns the single player sandbox of current networks into a multiplayer economy of apps, experiments, and, inevitably, better alignment between user incentives and platform health.

Web3 Social Network Takeaways

- Today’s social media extracts hundreds of billions of dollars yearly by monetizing your attention and data while paying users almost nothing

- Web3 social platforms store content and relationships on open blockchains so users keep custody and can monetize directly

- Lens and Farcaster lead the pack; the former focuses on NFT based social graphs, the latter on low fee, developer friendly architecture

- Technical hurdles wallet UX, gas fees, network effects are shrinking as L2 costs fall below one cent and account abstraction removes seed phrases

- A viral feature that pays creators instantly could serve as the schelling point that flips adoption, similar to TikTok’s rapid rise

- Regulatory pushes for data portability and potential ad model shocks add external pressure favouring decentralized alternatives

- Expect the first Web3 network to surpass 100 million users by 2030 if current development and creator migration trends persist