In this article I’ll go through my crypto portfolio and explain why I’m holding each of the digital assets. I’ll also be discussing the principles behind the portfolio and how I manage it.

- The Crypto Portfolio 2021

- Crypto Portfolio Video

- Yield Bearing Stablecoins

- Delta Neutral Strategies

- Layer 1’s BTC vs ETH vs ?

- Exchange Tokens

- DeFi Governance Tokens

- Micro Allocations

- Crypto Portfolio Principles

- How I Manage The Portfolio

- Conclusion

The Crypto Portfolio 2021

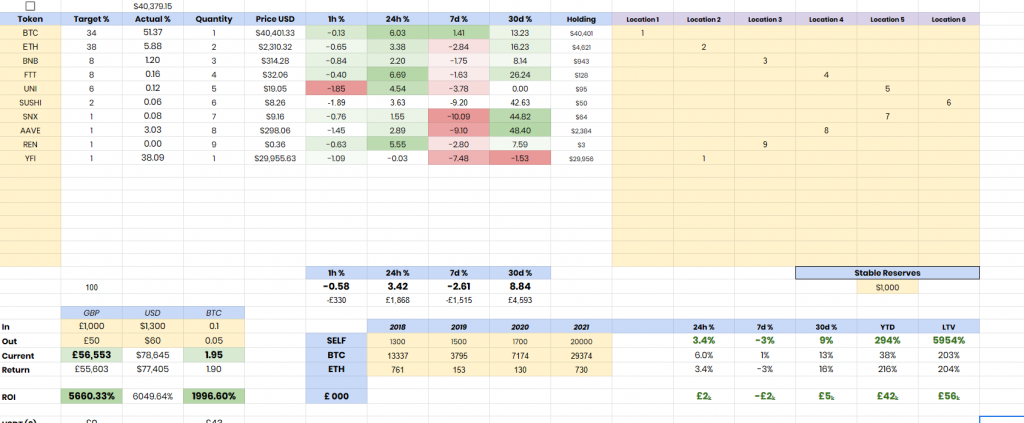

This is what my crypto portfolio looks like as of July 2021. I’m not a financial advisor, not financial advice, do your own research.

| Allocation | Digital Asset |

|---|---|

| 40% | USD pegged stable coins and delta neutral strategies |

| 22% | Ethereum ETH |

| 18% | Bitcoin BTC |

| 4% | Binance BNB |

| 4% | FTX FTT |

| 4% | Uniswap UNI |

| 2% | Sushiswap SUSHI |

| 1% | Synthetix SNX |

| 1% | Aave AAVE |

| 1% | RenVM REN |

| 1% | Yearn Finance YFI |

| <1% | Avalanche AVAX |

| <1% | PancakeSwap CAKE |

This doesn’t include funds I use for active trading, high risk strategies and trading bots. Pretty much anything degen I treat more like a business and use strategies as a revenue generator rather than a investment portfolio.

I started tracking the portfolio in 2017 and since then it’s up 443%. I measure the portfolio performance in USD, GBP and BTC terms. Bitcoin is up 135% over the same period so it has significantly outperformed a hodl strategy. It hasn’t been all roses and during the 2018 bear market I managed to lose around 60% of my capital. None of this is publicly verifiable so take it with a pinch of salt.

Crypto Portfolio Video | Why I Hodl These Digital Assets

In this video I talk briefly about each digital asset and my justification for holding. There are more details in the article below.

Yield Bearing Stablecoins

Stablecoins are my biggest allocation despite being pretty negative on the USD and fiat currencies in general. It’s something I’ve talked about before on this blog: 60/40 Crypto Portfolio

This helped me get lucky during the sell off after the Coinbase IPO and I feel having an allocation to stablecoins provides stability and automates market timing to help outperform over the long run.

Equally importantly it provides yield and my stabelcoin funds get moved around quite a lot. Just this morning I was researching stablecoin lending rates on Anchor protocol.

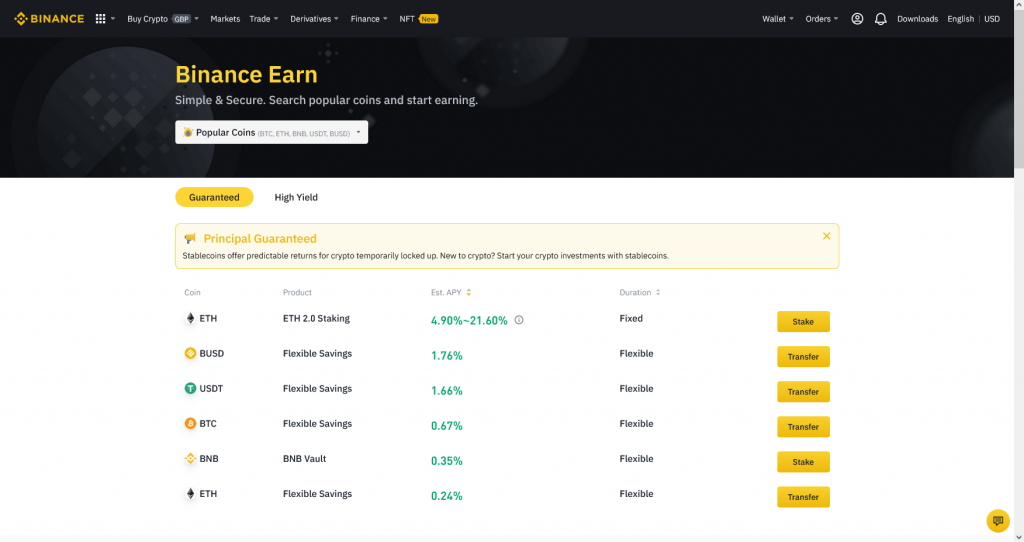

Currently the majority of my funds are in FTX lending and Binance Earn with relatively small allocations to DeFi lending and liquidity pools (none of which I’m particularly happy with).

Delta Neutral Strategies

Funding rates have collapsed since I first talked about it on the blog: Futures Funding Rate Strategy

If/when they pick up again I plan to allocate large amounts of capital to delta neutral cash and carry trades.

I’ll be short selling quarterly futures contracts to collect the funding premium and then hedging the exposure using assets from spot markets.

I’ve been doing a lot of work recently on order execution tests and optimising this process recently.

These strategies are fairly complex which provides some barrier to entry and the yields are extremely high for a strategy which is pegged to the USD.

My main concern with stablecoins and delta neutral strategies is inflation caused by quantitative easing. I need to maintain a yield higher than inflation to not lose purchasing power.

Layer 1’s BTC vs ETH vs ?

Right now I have a higher allocation of Ethereum to Bitcoin. This hasn’t been the case historically as most of the time I keep a larger chunk in Bitcoin. I use the BTC/ETH chart and BTC.D (Bitcoin Dominance) charts to plan this alongside fundamental analysis which I’ll talk about here.

Around the start of the year I came to the conclusion that it was going to be a big year for Ethereum. We had Eth2.0 being rolled out, layer 2 scaling solutions and DeFi was still growing fast. At the time Bitcoin was threatening to breakout of the $20k level and everyone was expecting a new bull run which ended up happening in a big way.

During bull cycles Bitcoin dominance tends to drop significantly as more capital is moved across the risk spectrum to lower market cap tokens and coins. This tends to happen in waves as Bitcoin goes on a run and then cools off and Ethereum catches up. Eventually Ethereum took off in a big and has outperformed by a significant margin. During bear markets money flows back to the safety of BTC and USDT and everything else gets crushed which causes Bitcoin dominance to rise again. I have found Benjamin Cowen’s videos and Technical Roundup educational and entertaining in understanding BTC/ETH market conditions.

I’m also a long term believer in the flippening which is a controversial opinion that Ethereum’s market cap will one day grow larger than Bitcoins. If I was going to set funds aside for 20+ years I would still choose Bitcoin because it is irreplaceable whereas Ethereum could be conceivably replaced by another smart contract network. I feel this is unlikely in the next decade or two as it has such a large advantage in terms of adoption, development and community support. The biggest challenger currently is perhaps Solana which I don’t hold because of technical reasons. Cardano apparently are launching smart contracts this year which will be interesting as they have a lot of broad support.

In the future I expect Bitcoin will be used like bank wire transfers only for moving large amounts of money around whereas Ethereum will be everything else. Almost all tokens are ERC20 and are built on top of Ethereum, DeFi is built on top of Ethereum and NFT’s are just Ethereum tokens. Who knows how far it will go but whatever the next big thing in crypto is, it’ll likely be built on the Ethereum network and that makes me very bullish.

The other time that Bitcoin outperforms is when it goes on a parabolic move and altcoins lag for a week before playing catch up. That potentially could be the situation we see if/when Bitcoin breaks $42k resistance and it’ll be something I’m watching closely.

I enjoy the Ethereum ultrasound money narrative even if the volatility makes it laughable. When inflation picks up having a deflationary digital asset which can be staked to earn yield on ETH2.0 & DeFi protocols is going to be very appealing. Right now institutions for the most part have been focused on Bitcoin but it’s day 1 and over time I believe they will expand their allocations to ETH and other digital assets.

There are a number of supply changes happening on Ethereum which are going to impact the supply and demand. We have EIP1559 redirecting transaction/gas fees from miners to a burn address. This is due to be rolled out on August 4th 2021. Then during the later stages of ETH2.0 migration from proof of work to proof of stake the tripple halvening event will drop the annual supply from 4.3% to 0.43% (4% > 2% > 1% > 0.5%). I believe stakers are also more likely to hodl the newly minted ETH than miners who have overheads in fiat.

The only other layer 1 asset I hold is a tiny allocation of Avalanche which I’ll talk about in the micro allocations section.

Exchange Tokens

I’ve been really bullish on exchange tokens for some time. BNB and FTT have been some of my best performing assets. A lot of the fee generation and revenues in crypto ecosystems come from trading fees and exchange tokens provide exposure to that business.

Binance BNB

Binance is the market leader in cryptocurrency exchanges and for good reason. The exchange is reliable, trustworthy and innovative. There are people that would argue about reliable and trustworthy but noone can make a case for Binance not being one of the fastest innovators in the space. They’ve set themselves apart from the competition and have won around 60% market share of the entire crypto trading volume.

BNB is Binance’s native token. It’s a great example of a token that keeps growing in utility. Originally the tokenomics were built around reduced trading fees and buy back burns. However in early 2021 the Binance Smart Chain started to gain traction really quickly and it used BNB as it’s token for fees and a lot of liquidity pools and staking protocols on the network used BNB as a base asset. Demand soared and BNB went from around $35 at the start of the year to $300 today.

Most of my BNB tokens are on Binance Earn where they earn staking fees and launchpad token rewards while some are allocated to liquidity pools on Binance Smart Chain. My biggest allocation is to the BNB-CAKE pool which is then staked on PancakeSwaps farms with an APR of 65% currently.

There are two major bearish considerations for BNB:

- Ethereum layer 2 scaling solutions will suck liquidity from Binance smart chain.

- Regulators like the recent FCA debacle will damage the exchange and cause negative sentament.

However I’m happy to hold the token because there’s always the chance that CZ and his team will come up with something new like the recent Binance NFT launch.

FTX FTT

I discovered FTX at just the right time and the way the platform is setup helped me develop analytical trading bot strategies which ultimately led me to take more of an active interest in crypto markets towards the end of last year.

Sam Bankman-Fried is CEO and one of the most respected members of the crypto community. His journey started with arbitrage trading through Alameda Research before he founded FTX. The exchange’s motto “built by traders, for traders” rings true and I have more trading volume on FTX than anywhere else.

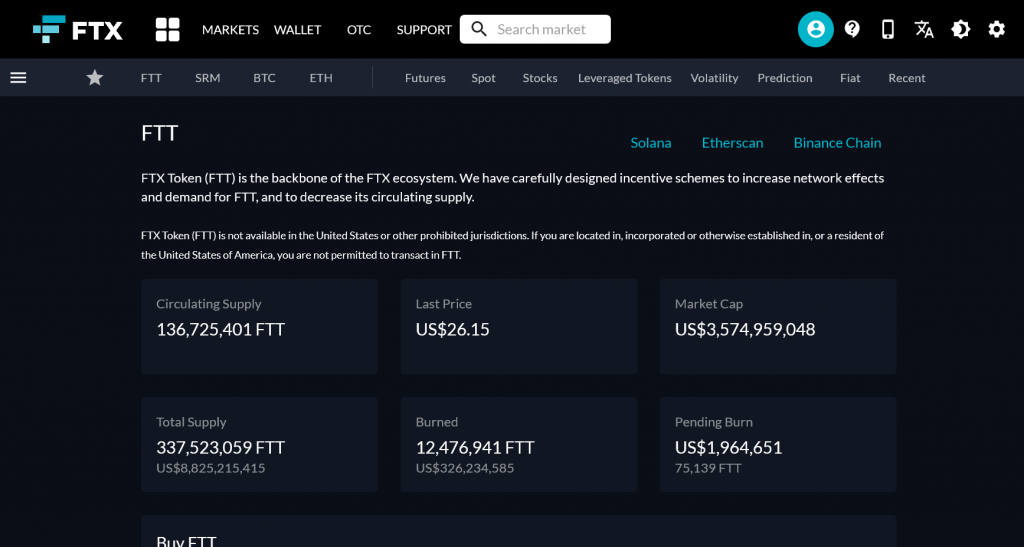

The FTT token is interesting because it has historically outperformed Bitcoin in both up and down markets. It provides discounts and even rebates on trading fees so market maker strategies only need to break even to make money. There is also a buy back mechanism where 33% of trading fees are used to buy back and burn the token. FTX has grown incredibly quickly and the buy back amounts have increased to around $5m/week.

The bearish case for FTX is regulatory threats which are considerable as the trading volumes are mainly derivatives. Also I feel that new major developments from Sam and his team will likely have their own token rather than increase utility for FTT. There is a whole basket of digital assets known as “Sam’s Coins” already.

The bullish case relies on future growth which could come from tokenised stocks and commodities, prediction markets or an increase in speculation on options where FTX is in a good position to capitalise and compete with Deribit.

DeFi Governance Tokens

I believe DeFi is the future of finance and I think one day we will have central bank digital currencies alongside crypto in mobile wallets which provide DeFi products and services to the masses on the backend.

I hold the two leading automated market makers Uniswap and Sushiswap for many of the reasons I hold the exchange tokens as well as the exposure it gives me to the potential of layer 2 solutions creating a new DeFi boom.

I also hold what I consider to be the market leaders in lending (AAVE), synthetic assets (SNX) Bitcoin on-ramp (REN) and yield farming automation (YFI).

DeFi is a new and rapidly evolving space and these allocations change often. I try to look for assets with good tokenomics that will likely still be around and useful in 10 years time and provide asymmetric risk.

Uniswap UNI

Uniswap changed the DeFi landscape and Hayden Adams, the creator, will go down in history as one of the greatest financial innovators of the era. Before Uniswap there was IDEX which was great but it could never compete with centralised exchanges whereas Uniswap simplified things with a easy swap transaction via a two asset liquidity pool.

I received an airdrop of 400 UNI tokens on release just for being an early adopter of the protocol which would now be worth around $6000 USD. Since then it’s become my largest DeFi holding and the platform that I’m most confident will still be in use well into the future.

Uniswap’s ease of use and the possibility to launch tokens instantly have established it as a household name in crypto communities. It is a recognised brand and dominates trading volumes on any network that it launches on. It’s been copied and forked by dozens of projects which lead to them protecting the source code with a questionable business license on the latest v3 release.

Sushiswap SUSHI

Sushiswap had a disruptive start with it’s founder essentially trying a rug pull before returning the funds. Somehow it survived and thrived and now has an established supportive community behind it.

Sushiswap in my opinion is the largest competitor for Uniswap and their partnerships and allegiances with Yearn Finance and others could be positive in the future.

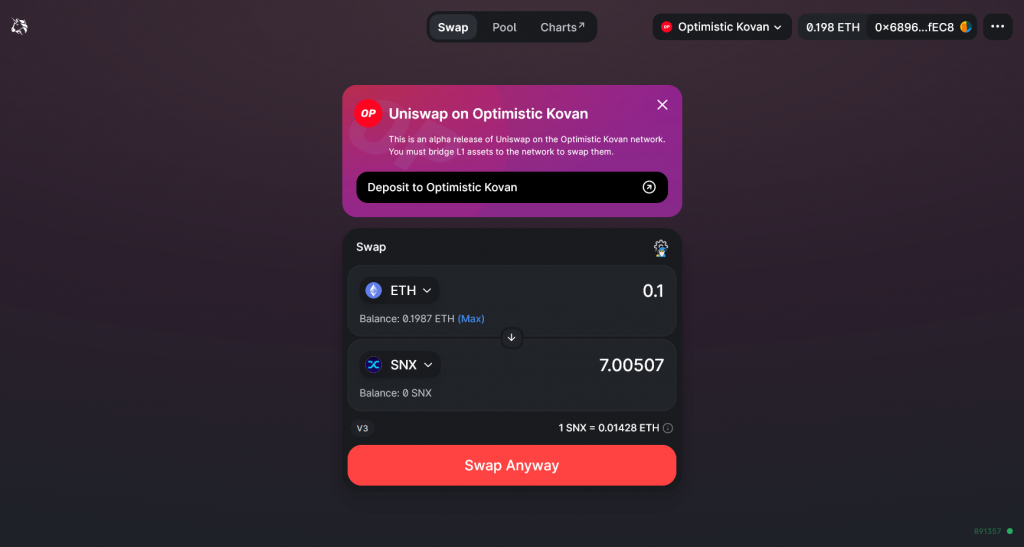

I don’t have as much conviction on the SUSHI token as I do with UNI and it was only recently added to the portfolio a couple of months ago to try and increase exposure to Ethereum DeFi ecosystems in wake of layer 2 roll outs such as Optimism and Arbitrum.

Synthetix SNX

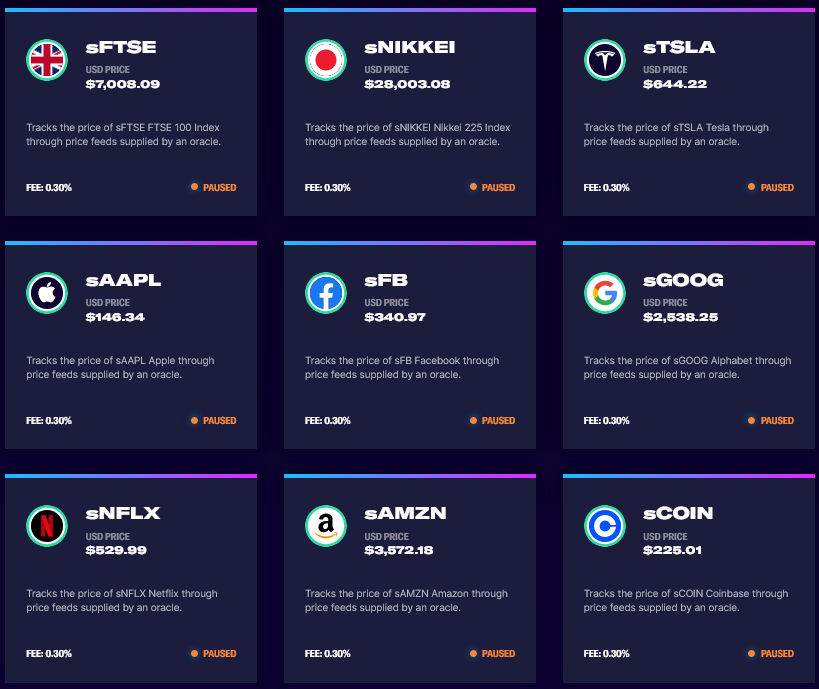

Synths or synthetic assets track the price of any underlying asset. So a price feed from an oracle service provides a price feed which traders can use to gain exposure to the underlying asset on a decentralised network.

Synthetix has great branding and the tokenomics and staking benefits holders. However they have struggled to gain traction due to soaring Ethereum gas fees. I have been meaning to make a video on Synthetix for some time but initial tests were requiring $200+ transaction fees which for most people is unfeasible. Layer 2 scaling solutions and Eth2.0 scaling will solve this.

Synthetix will be launching on Optimism imminently and it could be a really big deal. Want exposure to Gold, Oil or Tesla and thousands of other potentially tradeable assets? Synths could be the answer and having a allocation to the sector of tokenised assets is something I’m very keen to have in my portfolio.

Aave AAVE

Aave is currently the largest DeFi platform by TVL with over $10,000,000,000 in locked assets*.

It’s a lending and borrowing platform which provides over collateralised loans. This is very popular for a number of uses:

- Low risk leverage positions at favourable rates

- Tax planning by borrowing fiat on assets to avoid capital gains

- Gaining a yield from securely lending assets on low risk audited smart contracts

Aave CEO Stani Kulechov is another inspirational and impressive character who is widely respected in the crypto community.

Aave launched on Polygon which is an EVM compatible sub-chain but hasn’t announced L2 integrations yet. I believe it’s only a matter of time and they are well positioned for another boom in DeFi.

RenVM REN

RenVM provides a BTC onramp to Ethereum. Essentially you can’t gain a yield or participate in the DeFi economy with Bitcoin without some sort of bridge.

RenVM provides that bridge that lets users exchange BTC for an ERC20 RenBTC token on Ethereum. It is a network of darknodes that provide permissionless and private transfer of value between blockchains. The network is designed to store secrets in a decentralised manner and I’ve previously discussed the potential for private scripts with the team which should be released in the next year.

The tokenomics are based on a 0.1%+ fee for transactions which is distributed to the darknodes which require 100,000 bonded REN. The value of the token is derived from the financial benefits of collecting fees from operating a darknode.

The bullish case is built on the Ethereum eats Bitcoin narrative which I partially subscribe to as I expect more Bitcoin will move to DeFi over the mid-term. The bearish case is the lack of growth and dominance of a more established centralised competitor in WBTC (wrapped BTC).

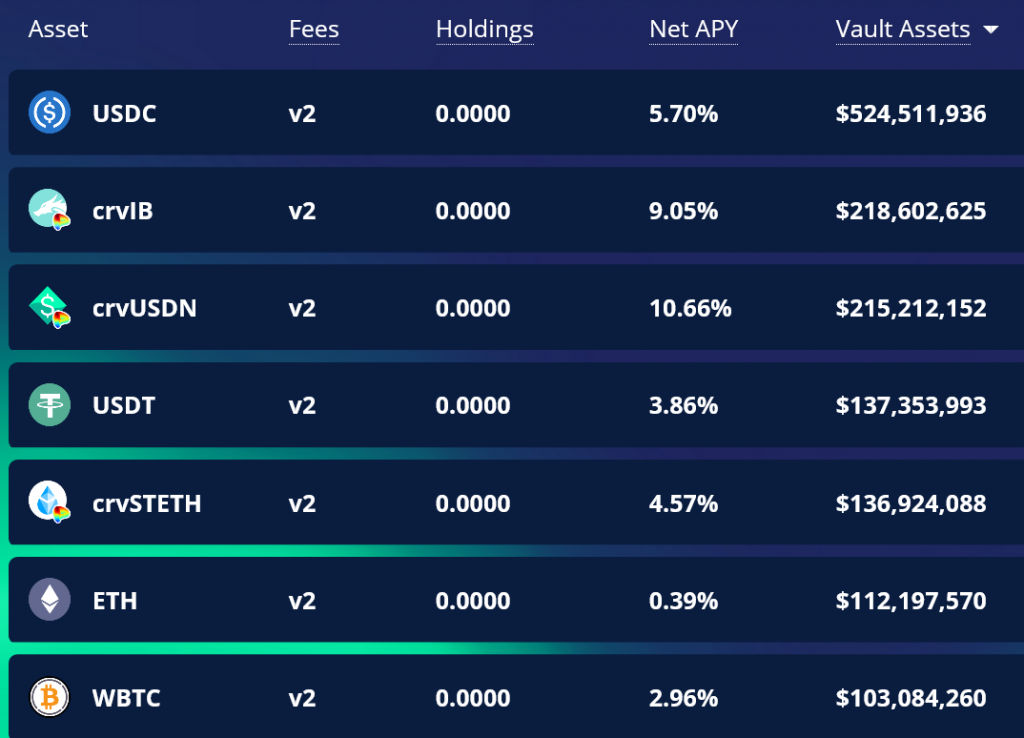

Yearn Finance YFI

YFI was a fair launch token which gained huge popularity in the summer of DeFi. I missed the biggest opportunity for early adopters but later became bullish on the long term prospects of the Yearn brand.

Yearn Finance provide automated strategies for yield farming. You can connect metamask to https://yearn.finance and easily invest in vaults which run automated DeFi strategies to earn yield.

Yield farming automation is a hard thing to get right and there are all sorts of 3rd party and smart contract risks involved. The Yearn team headed by Andre Cronje are arguably the best and most trusted in the sector.

I believe DeFi strategies are only going to get more complex as more DeFi lego bricks and opportunities enter the market. Yearn could provide the backend monetisation strategies for a new generation of asset management platforms.

Micro Allocations

Avalanche AVAX

I actually hold AVAX and PNG (Pangolin) on Beefy Finance’s vault earning 205% APY. I believe these assets will move in tandem reducing the risk of impermanent loss.

Avalanche takes a multichain approach to solving individual problems with individual chains. It’s the EVM compatible C-Chain that I’m most interested in as it potentially benefits from Ethereums toolkit and popularity.

TVL on Pangolin has steadily increased but it hasn’t performed as well as I hoped meaning that its stayed at micro allocation levels since I made the initial investment.

PancakeSwap CAKE

This was once a very large allocation to the BNB-CAKE liquidity pool and farm on Pancake swap which earns 66% APY. I’ve drawn it down over a period of time and closed the AUTO-BNB completely that I was holding because of concern that funds could migrate to Ethereum layer 2’s.

PancakeSwap is a well known brand because of projects like Safemoon launching on it and non-technical speculators using mobile apps like Trust Wallet to purchase tokens on the AMM.

I still have some conviction in the platform and Binance Smart Chain in general and this provides a small exposure to both as well as providing yield on a small part of my BNB allocation.

It’s the number one AMM on Binance Smart Chain but it’s not something that I truly believe will still be used 20 years from now.

Update: ThorChain RUNE

Literally just as I am posting this I started building up a small allocation to RUNE. ThorChain is interesting because it connects multiple chains and enables cross chain swaps.

I feel the market has over reacted to the recent hacks dropping the price from $21 to below $4 where I entered. Funds were lost in the hacks but were covered by the emergency fund so no users lost investments. It was on the chaosnet which as the name suggests is in beta. I took a look at the code responsible and I don’t believe there are any fundamental errors, just oversights that are being battle tested out.

The network is currently paused, which is about as bad as it gets for what I feel is a good project providing a good buying opportunity on the recovery play.

Bear argument is that original hype and sentiment has died. Shapeshift integration might not be as big as it originally seemed as Shapeshift might be struggling for traction according to usage stats. Main risk is another hack once the network comes online could crush the price further.

Crypto Portfolio Principles

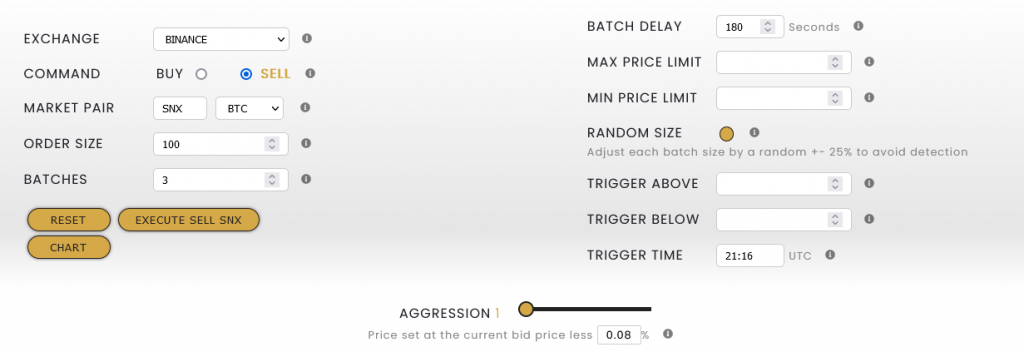

Rebalancing

I rebalance my portfolio daily and discretionally which in the past has worked quite well. I tend to either put limit orders in around key levels or more often I’ll use an automated script to execute batched limit orders over a longer period of time. This is very efficient and reduces trading fees and provides some automation to market timing.

By rebalancing the portfolio I sell an an asset when it goes up and buy more when it goes down. I find it’s important to have conviction in the holdings, when I’m sceptical about rebuying an asset that isn’t performing as well as the rest of the portfolio then it should have never been there in the first place as this is the best time to buy high conviction investments.

Diversified Asset Classes

My crypto portfolio grew from about 10% of my net worth to over 30% in the last year and that’s about the limit of what I’m comfortable with.

I also invest in real estate, stocks and commodities. Generally I try to keep it simple and passive. There’s a big difference in buying a house to rent out to buying a real estate investment trust and I don’t enjoy being a landlord. For stock market exposure I invest as much as possible in an ISA (tax efficient UK government scheme) and consistently dollar cost average into low fee ETF’s tracking major indices at home and abroad. For commodities I use ETF’s as well and I use gold, silver, copper and oil as a hedge against inflation.

Modern 60/40 Portfolio

I try to take the decision making out of market timing as much as possible. When I start thinking about getting a yacht it’s usually time to sell and when I feel sick it’s time to buy. Using a 60/40 portfolio makes this easier as it forces me to buy low and sell high.

More info on this here: 60/40 Crypto Portfolio

Don’t Lose Money

Rule number one is to never lose money. Rule number two is to never forget rule number one.

Warren Buffett

I believe that just by staying in the game for the long haul you can be successful in crypto markets. I try to manage risk in a way to outperform Bitcoin while not ever losing a significant amount in USD value. That’s an unachievable goal over shorter time frames but over annual or longer periods it should be attainable.

I try not to do anything stupid or too clever or get too degen with my main personal portfolio. I have a separate pool of funds for high risk investments and any short term trading.

Dollar Cost Averaging

Dollar cost averaging into a position is a good way to manage the exceptionally high volatility of digital assets. I try to ask myself how much conviction do I have in this project. If the price dropped 80% and I lost a lot of funds would I want to buy more?

By dollar cost averaging either in to individual positions or an overall portfolio you can put yourself in a win win position where if the price goes up you make money if it goes down you get to buy cheaper.

Asymmetrical Risk

When looking at new projects or lower market cap tokens I try to find opportunities of asymmetrical risk. It’s possible to justify a small allocation to the most riskiest ponzi that TikTok is shilling if the upside is significant enough to make it +EV (positive expected value).

Generally I keep the really high risk stuff to a separate portfolio where I can use trend following bots to give me an edge for short term trades but the same principles apply for long term investments. Any asset where the upside is more than half a chance of doubling should be a buy or at least worth considering.

There’s so much opportunity in crypto that it becomes a case of allocating the portfolio to the highest risk/reward assets.

One thing to be aware of is that it’s tempting to move up the risk curve in a bull market when everything is going up and there is maximum risk for low cap tokens and be overly risk adverse in bear markets when there is maximum opportunity.

How I Manage The Portfolio

Tracking Performance

You’d think being a developer that I have some very technical tracking platform set up or at least use a 3rd party app but I don’t I use a Google Docs spreadsheet.

I use the following headings for each digital asset that I’m currently holding.

| Token | Target % | Actual % | Quantity | Price USD | 1h % | 24h % | 7d % | 30d % |

I then have some tables to track performance against USD, GBP & BTC.

I do use a custom price feed which I set up myself and import the data into Google docs via the following function:

=IMPORTDATA("https://example.com/apiURL/?rand="&$A$1)You could likely use a public API just as easily to import price data.

Then on the A1 cell I use a tick box to update the form manually as the cacheing and refresh rate is a bit weird in Google docs.

Rebalancing & Execution

When an asset deviates from it’s target allocation I need to either buy or sell some of it to rebalance the portfolio. Most of the time I use an automated script with a simple frontend to batch limit orders on exchange holding a fixed percentage off the market price and then update the spreadsheet the following day.

Occasionally I will rely on simple high time frame technical analysis to highlight key levels and areas where I’m interested in doing business. I’ll place limit orders manually around these levels ahead of time and wait for them to execute if and when price reaches the target.

Generally I use Binance for order execution and sometimes FTX if I have the funds there and am looking to trade a high liquidity spot market.

I don’t currently hedge the portfolio or short sell anything however I may start once I have more confidence and test data on short strategies from my active trading bots. Generally I think shorting the best performing asset of a generation is a bad idea but there are certainly times where it’s +EV. I have in the past short sold futures instead of selling spot to rebalance the USD aspect and this works very well as a delta neutral strategy.

Conclusion

This is how I currently manage my crypto portfolio. I don’t believe it’s optimal or anywhere near perfect and I’m still figuring this out as I go. I wouldn’t want anyone copy trading me and please don’t take any of this information as a recommendation of a particular project.

Summary

I track and self-manage a 60/40 portfolio of digital assets which includes stablecoins, Bitcoin, Ethereum, exchange and DeFi tokens. I’m currently very bullish on Ethereum and DeFi which I think will outperform the markets and enable me to improve upon a hodl BTC strategy while reducing risk by holding yield bearing USD.

Hopefully this crypto portfolio walk-through has been of interest and helps someone avoid some of the numerous and expensive mistakes I’ve made along the way.