The 60/40 crypto portfolio is a modern version of the stocks and bonds retirement portfolio that has been around for over 70 years.

The idea behind a 60/40 portfolio is to allocate 60% of an investment portfolio to high risk assets (stocks or cryptocurrency) and 40% to a yield producing low risk asset (bonds or stablecoins).

In this article I’ll be going through some ideas on allocations and how to structure and track a modern 60/40 crypto portfolio.

- Benefits of 60/40 Crypto Portfolio

- 60/40 Crypto Portfolio [Video]

- Cryptocurrency Allocations

- Stablecoin Allocations

- Where To Buy & Store Cryptocurrency

- Tracking & Rebalancing

- Market Cycles & Risk

- Alternative Crypto Portfolios

- Conclusion

Benefits of 60/40 Crypto Portfolio

The original idea behind the 60/40 portfolio was to balance the high expected returns from stocks with the low volatility of bonds in the most optimal way possible. By rebalancing the portfolio during market cycles a investor would essentially buy low and sell on the more volatile asset.

Today we can use this same theory to create an effective, easy to manage cryptocurrency portfolio using Bitcoin & altcoins in place of stocks and stablecoins & delta neutral strategies in place of bonds.

By always keeping 40% of the portfolio allocated to stablecoins the drawdown is reduced which is important in a market where Bitcoin can quite easily lose 80% of it’s value and altcoins more. The reduced returns from not being fully allocated to cryptocurrency can be made up from yield farming the stablecoins and the effectiveness of rebalancing the portfolio.

The 60/40 portfolio was known as the retirement portfolio and it works best when used as a long term investment across multiple market cycles. It’s an ideal strategy to dollar cost average in to using regular investments. By constantly topping up your portfolio you can rebalance it at regular intervals.

There’s so much opportunity in yield farming and futures premia currently that it’s possible to get 30%+ APY’s on a stablecoin pegged to the USD. As long as the US dollar doesn’t devalue too quickly this provides both great returns and low risk investment.

60/40 Crypto Portfolio [Video]

Cryptocurrency Allocations

Bitcoin is the number one cryptocurrency with more market share than all the rest of the altcoins combined. It has a first mover advantage, network effects from being a household name and most recently has become an acceptable asset allocation for corporate treasury funds.

There’s an argument to be made that Ethereum should outperform Bitcoin in the mid-term as it is positioned well to become the future of finance with an entire ecosystem of DeFi platforms being built on top of it. That being said Ethereum has competitors and has lost market share recently to projects like Binance Smart Chain due to high fees and slow development.

If you have time to stay up to date with the current cryptocurrency ecosystem and take an active interest then further allocation to altcoins will increase both risk and reward.

I personally aim to have a 33/33/33 split between Bitcoin/Ethereum/Altcoins with allocations in

| Crypto | % |

|---|---|

| $BTC Bitcoin | 33 |

| $ETH Ethereum | 33 |

| $BNB Binance | 6 |

| $FTT FTX | 6 |

| $UNI Uniswap | 5 |

| $AAVE Aave | 3 |

| $REN RenVM | 3 |

| $SNX Synthetix | 3 |

| $AVAX Avalanche | 3 |

| $AUTO Autofarm | 1 |

| $CAKE Pancakeswap | 1 |

| $YFI Yearn Finance | 1 |

| $SUSHI Sushiswap | 1 |

This will change on a weekly basis as I rotate altcoins looking for the best risk to rewards. For example I plan to rotate some of the Binance Smart Chain stuff out in the next few months as I believe funds will flow back to DeFi blue chips on Ethereum after the layer 2 roll outs. Yearn and Sushi are short term holdings on the expectations of Andre Cronje releasing his new products.

The point is that the more crypto assets you allocate funds to the more of a full time job it becomes in researching and keeping up to date with developments. If you want a passive portfolio then either 100% Bitcoin or up to 50/50 BTC/ETH will be a good bet to set and forget for 10 years+.

My long term hypothesis is that Bitcoin will become a store of value and will be used to transfer large sums in much the same way wire transfers are today. If someone is buying a house or needs to pay a manufacturer in China they might need to move some Bitcoin about. It’s unlikely in my opinion that Bitcoin will become a payment system used to buy your daily coffee and that includes the lightning network.

Ethereum I think will continue to grow through the DeFi space until it reaches a point where it challenges traditional finance. Eventually I can see consumer focused alternative banking apps becoming popular which use layer 2 solutions on Ethereum for cheap fast transfers and DeFi systems on the backend to provide financial services. Assets will be stored in a choice of decentralised tokens and central bank digital currencies and will be instantly interchangeable upon spend.

Stablecoin Allocations

Stablecoins are mainly pegged to the USD so there is some foreign exchange risk if you live outside of the US and track your portfolio performance in a different fiat currency. There are three methods I’d recommend looking at for allocating stablecoin assets.

- Yield farming stablecoins

- Delta neutral futures funding arbitrage

- Stablecoin lending on DeFi platforms

Yield Farming Stablecoins

The current best opportunity I could find for yield farming would be on Beefy.finance via Belt.fi operating on the Binance Smart Chain and offering 69.44% APY on a basket of four stablecoins USDT-USDC-BUSD-DAI.

There’s multiple layers of risk here and something like Curve on Ethereum which offers 39% APY on a similar basket of stablecoins might be a safer, more comfortable investment.

The best opportunities for yield farming are always changing and this type of strategy favours an active investor who can gauge risk and allocate funds accordingly. There are some incredible short term unsustainable opportunities available for projects that are bootstrapping liquidity.

Futures Funding Arbitrage

This is a delta neutral strategy meaning we take a position in two assets that balances itself out. I wrote a full article about this here: Futures Funding Rate Strategy

Essentially you would buy spot Bitcoin and short sell a perpetual future or a quarterly or annual futures contract to collect the premium. If Bitcoin price moves up or down the short balances the spot position and it stays pegged to the base currency which is USD.

Stablecoin Lending

Lending rates vary based on demand for leverage which is generally driven by bull cycles. Currently Aave is offering 16% APY on GeminiUSD stablecoins. Gemini is a custodian run by the Winklevoss twins of Facebook fame who were also very early adopters in Bitcoin. If you’ve read Bitcoin Billionaires then you’ll know you aren’t likely going to get rug pulled here.

Lending rates aren’t as competitive as Yield farming or futures arbitrage but they are a most passive strategy where you can allocate funds and forget about them for the most part. You’ll still be earning more than having money in a traditional finance bank and there’s very little risk because loans are over-collateralised.

Where To Buy & Store Cryptocurrency

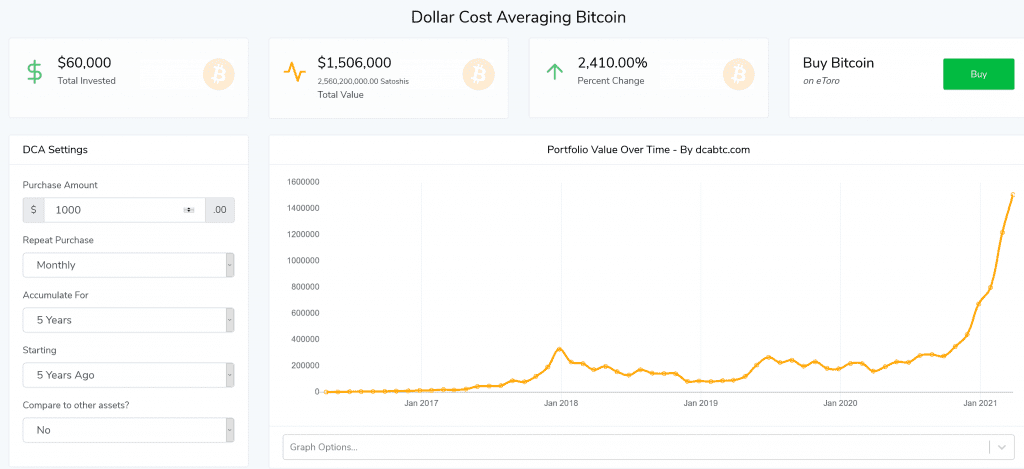

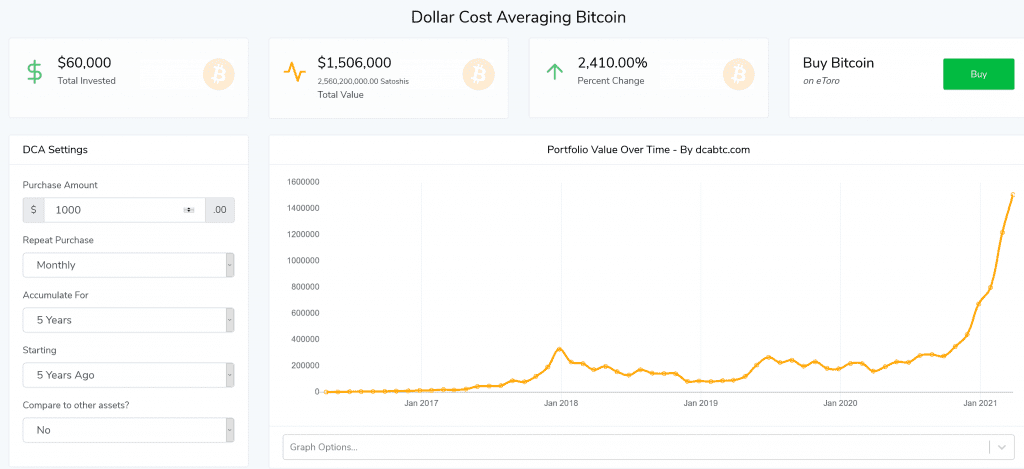

Dollar cost averaging into a portfolio reduces the risk of short term volatility spikes. Pretty much the only way it’s been possible to lose money in cryptocurrency markets over the last few years is to buy the top and sell after a crash. Dollar cost averaging solves this by allocating a fixed amount of funds over an extended period of time.

You can purchase Bitcoin on apps like Coinbase or Trust Wallet. For more advanced users you might want to consider using an exchange such as Binance or FTX.

There’s more information about the two leading exchanges here: Binance vs FTX

Coinbase has a recurring buy feature that enables users to set up an automated system for dollar cost averaging. It also has higher fees of up to 4% on orders, you are essentially paying for a excellent UX and simple to use platform.

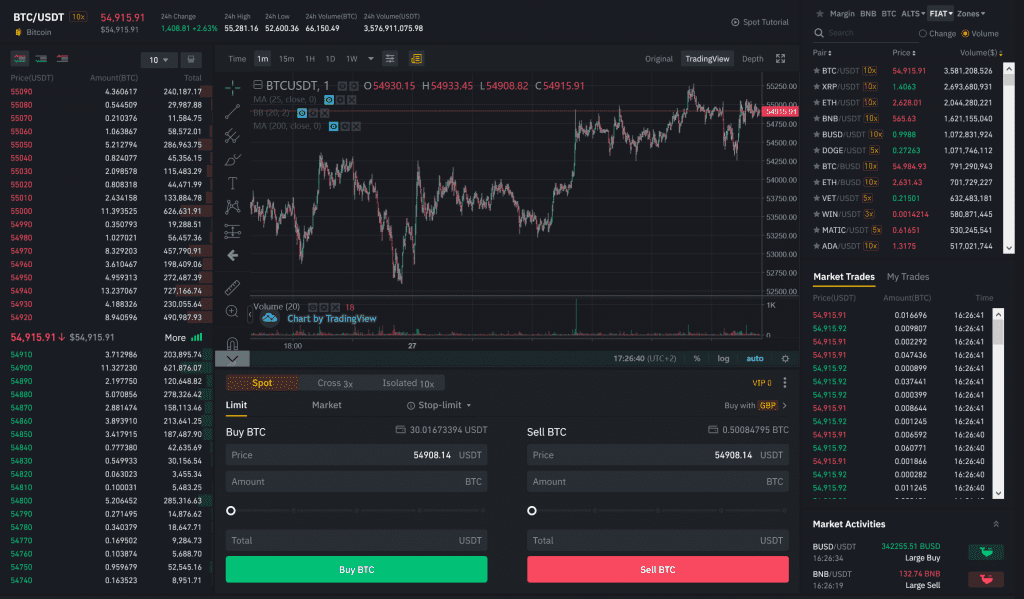

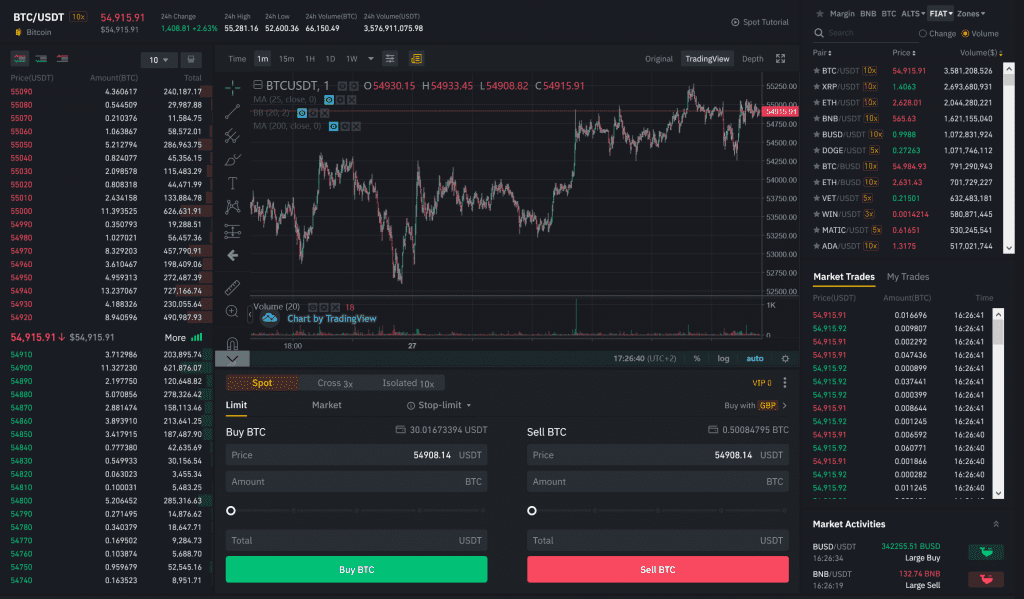

Exchanges are more complex for example with Binance you can wire money across using a bank transfer. You then need to exchange GBP for USDT using a orderbook system before purchasing BTC or whatever cryptocurrency you wish to buy using the USDT. It’s more complex but it’s more powerful too. Things like the future funding arbitrage can only be done using an exchange.

Exchanges use an orderbook of bid and ask prices where you can place either limit orders away from the current price or market orders at the current price.

The second challenge is safely storing cryptocurrency. There’s an argument to be made that storing it on exchange is a viable option for many users. Binance, FTX and Coinbase all offer custodian services and you can leave your funds in your online wallet.

For larger amounts it is worth assessing the risk and where possible moving funds either into a digital wallet or cold storage. You can use a device like a ledger nano to safely store cryptocurrency and you have full ownership with no 3rd party custodian.

Some things to consider when storing cryptocurrency are:

- How will you back up your mnemonic phrase (back up key)? A top of the range hardware wallet doesn’t provide much safety if it’s stored in a box with your keys written on a piece of paper.

- What happens if you die?

- How can you lower the risk of theft and loss?

- Is your personal security, 2fa, password security etc. good enough?

If you are storing funds on exchange always use two factor authentication and change your email password and any backup email provider passwords prior to setting up the account. Don’t store sensitive data unencrypted on your device.

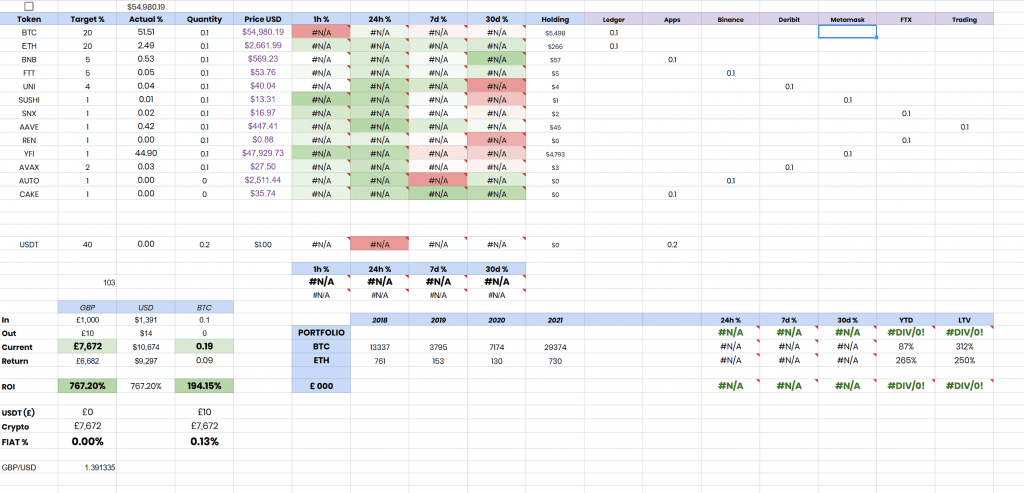

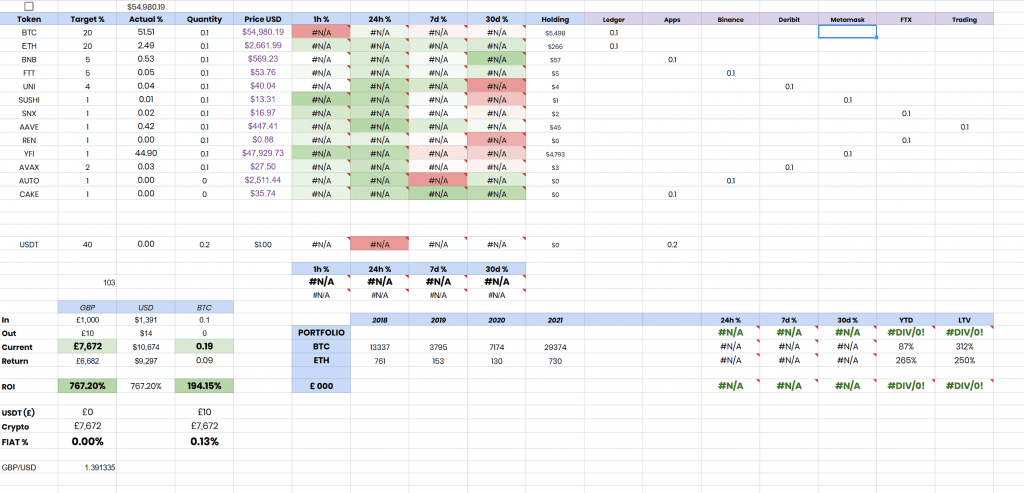

Tracking & Rebalancing

To track your 60/40 crypto portfolio you can either use a dedicated app or a spreadsheet. I like to use a Google docs spreadsheet similar to this one:

https://docs.google.com/spreadsheets/d/1HrdM4ATmr-BxPoXrIOemrEU4sAW0HeylQSmkWyfEGmg/edit?usp=sharing

You’ll need a data provider to get the hourly and daily percentages working. The benefit of a spreadsheet is that you can customise it to your hearts content to see the data that is most important to you.

Alternatively you can use something like Blockfolio which is owned by FTX to track your assets across exchanges.

A dedicated app can connect to the exchange API’s to check account balances and report in real time on your cryptocurrency holdings.

Why Rebalance The Portfolio?

Rebalancing is critical to a 60/40 portfolio because it enables the semi-passive allocation of funds in a fairly optimal way according to market cycles.

Imagine a portfolio that has 60% Bitcoin and 40% USDT. If Bitcoin crashes 50% we end up with 42% Bitcoin and 58% USDT. We then rebalance back to a 60/40 ratio essentially buying the dip. Likewise if Bitcoin price increases 50% we end up with a 69% allocation to Bitcoin and we need to sell some off after a run up increasing the USDT balance.

It’s very hard to time markets but rebalancing a portfolio like this works because it’s so simple. It’s a proven strategy that takes away the need to time a market bottom or market top which is almost impossible to do consistently.

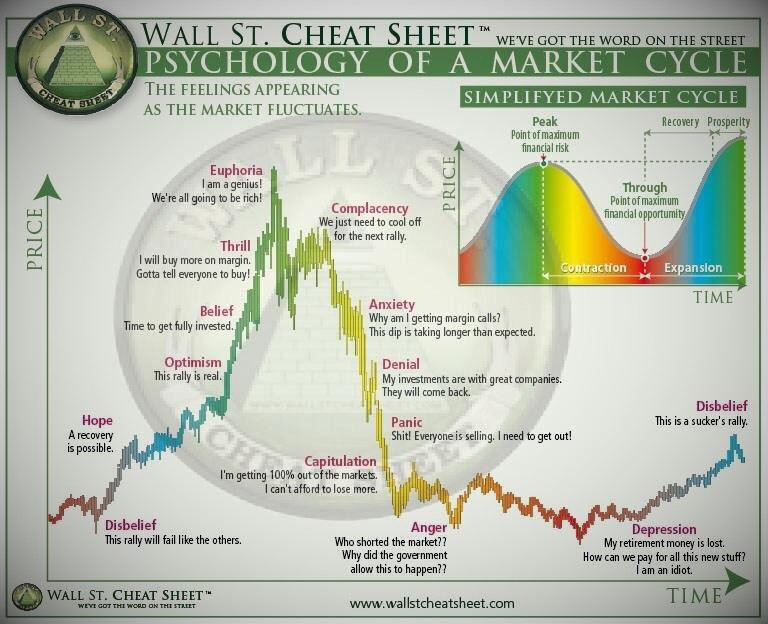

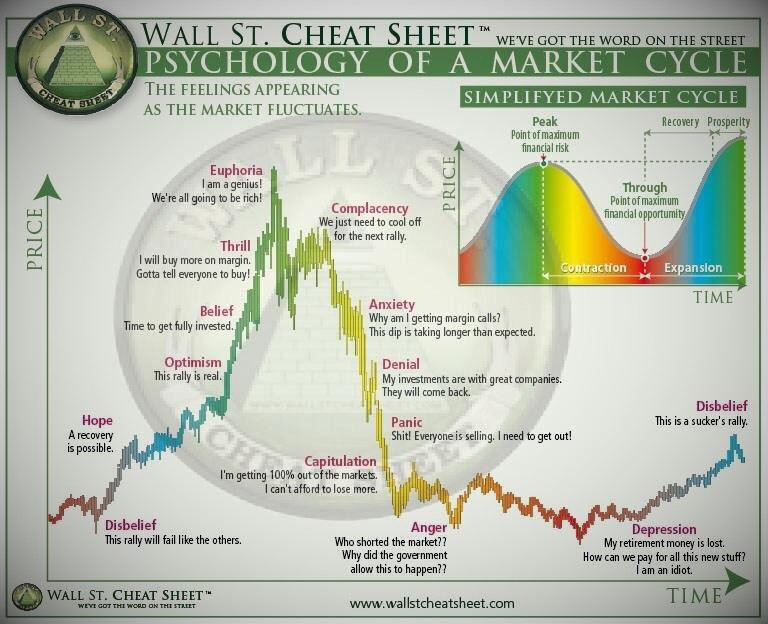

Market Cycles & Risk

While it may be impossible to predict market tops, bottoms and future price accuracy it is very easy to tell where you are in the market cycle for cryptocurrency.

This is a high time frame chart, probably daily. If we put a Bitcoin daily chart up next to it how does it fit in? Sentiment can also give you an indication of where we are in the cycle. A quick look at https://twitter.com/search?q=%23cryptocurrency and it doesn’t take a genius to see where we are in the cycle just from the memes.

So right now I believe we are in the mid to late stages of a bull cycle. Perhaps this isn’t the best time to buy into a position in Bitcoin in a single sum, at least not compared to March last year when it was trading below $4,000 USD.

There’s also a risk of waiting for a correction that never comes. There are people much smarter than myself who are predicting a supercycle where Bitcoin will just keep steadily going up and and the wild 80% down swings will be a thing of the past. The case for this goes something along the lines of we are seeing a digitally scarce asset hold it’s value while governments across the world erode value through quantitative easing causing the value of fiat currencies to slowly decline towards zero.

The answer to this problem of market timing is dollar cost averaging over an extended period of time. If price goes up your portfolio does well in the short term if price goes down you get to buy in at a lower price improving performance in the mid to long term.

The longer the period you can dollar cost average into a position the lower the effect of short term price movements and unexpected volatility.

The counter argument to the supercycle “this time is different” theory is that human nature is what it is and while financial markets don’t repeat themselves they often rhyme. This cycle there is a lot more leveraged speculation on futures markets causing liquidation cascades and very quick 10-20% market drops. We still haven’t seen a big correction this cycle but it’s perfectly possible. So many investors who went through the bull/bear cycle of 2017-2018 will have PTSD and a exit plan in place if there’s a significant down turn that it could cause a rush to the exit on a big move.

There’s an argument that institutional investors could prop up markets as the demand for Bitcoin on corporate treasuries, sovereign wealth funds and hedge funds grows. I’d expect volatility to decrease naturally as the market matures and the market cap increases. So realistically how low could Bitcoin go and how can we measure risk?

For this hypothesis I’d suggest that it’s beyond probable reasoning that Bitcoin would go below $10k again. Unless US legislation or a black swan event seriously disrupted the blockchain sector there would be enough people willing to bet the farm at that level to bid prices back up.

In this calculation I’ve also not discounted inflation of the USD stablecoin assets although this could be a concern if consumer inflation and asset inflation levels continue increasing.

$1000 Portfolio

$600 Bitcoin @ $55k/BTC

$400 USDT

Worse Case Scenario

$110 Bitcoin @ $10k/BTC

$400 USDT (lower if rebalancing frequently)

This shows that if you were regularly rebalancing your 60/40 portfolio you’d be buying BTC all the way down and you could lose more than half your investment.

In that scenario would you have enough confidence in the technology to continue dollar cost averaging in? If not start here: https://bitcoin.org/bitcoin.pdf

To stop dollar cost averaging in when prices crash is the second worse thing an investor can do. The absolute worse would be buying the top to capitulate and sell the bottom. Understanding the risk and pre-defining it can help with making better decisions should these scenarios play out… which hopefully they wont.

The beauty of a delta neutral strategy like the futures funding arbitrage on the 40% stablecoin allocation is that if the Bitcoin market crashes that trade will actually do exceptionally well because the futures market can decline to below the mark price of the spot asset. This will somewhat offset the loss of value in the 60% cryptocurrency allocation although not anywhere near enough to not lose money in USD terms in a big drawdown.

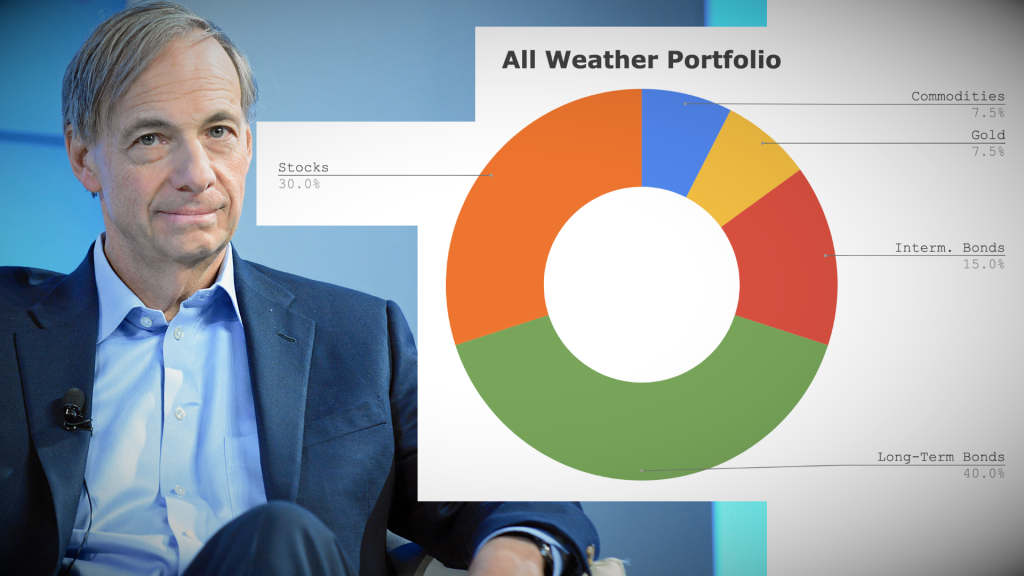

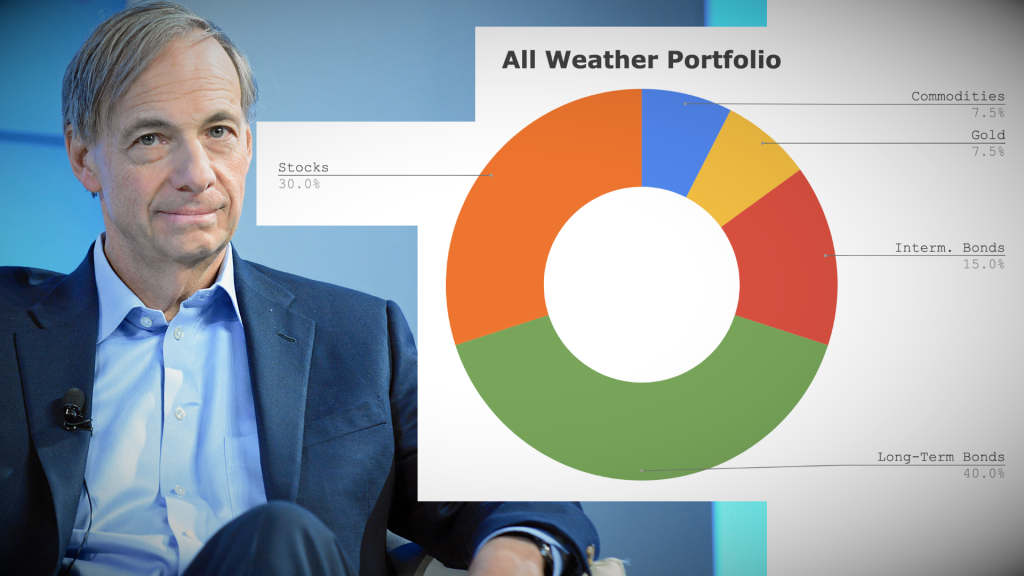

Alternative Crypto Portfolios

The 60/40 portfolio is fairly risk adverse by today’s standards. The actual allocations could and probably should be adjusted to meet your risk tolerance.

One suggestion that’s been used in traditional finance is to balance the portfolio by your age. You should allocate a percentage to low risk investments based on your age. So if you are 20 years old you hold 80% Crypto / 20% Stablecoins and if you are 60 years old you hold the majority of the fund in stablecoins.

The reason for this is that the less time you have available to wait out market cycles the less volatility and risk you should accept. The idea is to prevent withdrawal of the retirement fund during a bear market where assets are at a low point.

For active market participants with an extreme risk tolerance it may be worth allocating a proportion of funds to a leveraged trading account. Using leverage can increase both profits and losses.

There are opportunities all over the blockchain sector with new developments happening at a fast rate. DeFi yield farming for example has only been about for less than a year but having a flexible enough portfolio to capture these opportunities can be financially beneficial.

The reason we can get huge APY returns on yield farming platforms is because the market is immature over time these opportunities will decrease as large funds and institutions gain confidence in the space and start deploying capital.

So far I’ve only talked about cryptocurrency but a cryptocurrency portfolio should only form a part of a larger investment portfolio.

While I can’t bring myself to invest in bonds I think there’s a definite case for investing in ETF’s, stocks, REIT’s and commodities. Money is being printed at an alarming rate and it’s flowing into assets faster than ever before.

In many countries there are tax efficient methods of investing in these asset classes such as the ISA in the UK.

I believe that there unprecedented once in a lifetime opportunity right now in cryptocurrency markets but I still own ETF index trackers in a tax efficient ISA to diversify in case I’m wrong.

Conclusion

The 60/40 crypto portfolio might well be the most boringly effective cryptocurrency strategy in the world. It takes all the decision making fun out of actively managing holdings. It also takes away some danger of human error messing up what could well be the opportunity of a lifetime.

A 60% allocation to cryptocurrency assets such as Bitcoin and Ethereum provides exposure to the asset class. I’m guessing anyone that has read this far already has asset allocation to cryptocurrency but perhaps not stablecoins. The remaining 40% exposure to stablecoin and delta neutral strategies provides many benefits such as:-

- Low risk asset pegged to USD

- High returns relative to traditional finance

- Reduced volatility and drawdowns

- A war chest to deploy on any dips through rebalancing

Recently I saw someone bitterly posting about the crypto markets on Twitter that “Everyone is a genius in a bull market” but I’d argue that you don’t need to be a genius to win at poker if you are sat at the right table.