After reading Chip War by Chris Miller I was intrigued to see what developments have taken place since the book was written and if Moore’s Law is still alive and well.

TSMC & Taiwan Strait

Taiwan Semiconductor Manufacturing Company has maintained its position as the world’s leading chip manufacturer. The company announced ambitious plans for a 2nm process, with pilot production expected to begin in 2025.

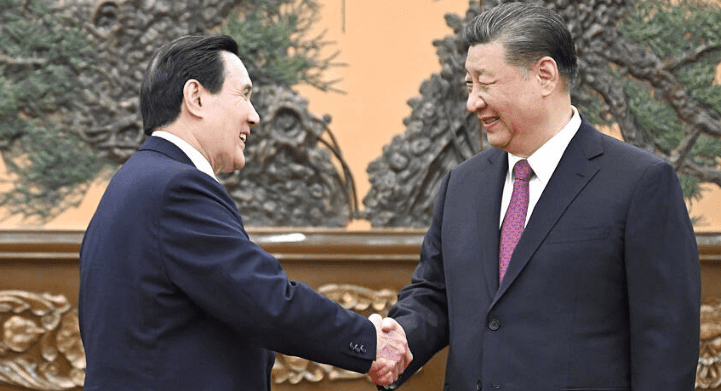

The ongoing friction between China and Taiwan has died down somewhat with imminent invasion looking less likely. Chinese President Xi Jinping has met former Taiwanese President Ma Ying-jeou. The headline quote from the meeting by Xi “External interference cannot stop the historical trend of reunion of the country and family” did not overshadow the assumed direction of political rather than military ambitions.

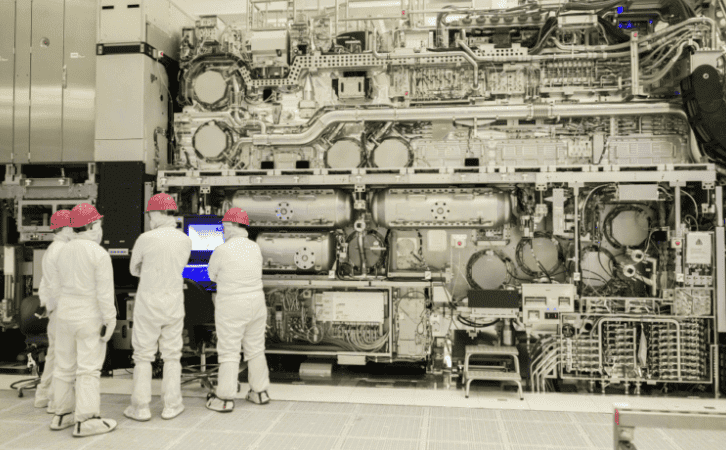

ASML & High-NA EUV

The leading Dutch company that produces EUV lithography machines for chip manufacturing ASML has made significant strides in developing next generation technology, particularly in the realm of High NA EUV lithography machines. These advanced systems promise to enable the production of chips with even smaller and more densely packed features.

ASML shipped its first High NA EUV machine to Intel in 2023 for research purposes.

The company has faced increased export restrictions to China, impacting its ability to sell advanced lithography machines to Chinese customers due to US fears about China’s military capabilities.

“The Dutch company flagged the growing list of restrictions imposed by the United States, mostly with the assent of the Dutch government. Those include Dutch licensing requirements for most of ASML’s advanced product lines, as well as a unilateral move by the U.S. in October 2023 to restrict exports of older equipment to unspecified Chinese plants”

Reuters

What seems peculiar is we haven’t seen much of a push back from China on this. The Lowry Institute has suggested this is driving innovation for Chinese chip manufacturers who have already build 5nm machines *

Despite these challenges, ASML has maintained its near monopoly on the most advanced EUV lithography technology, which remains crucial for producing the most advanced chips.

x86 vs ARM vs RISC V

The rivalry between x86 and ARM architectures has intensified in recent years, with ARM making significant inroads into markets traditionally dominated by x86. Apple’s resounding success with its M series chips, based on ARM architecture, has sent shockwaves through the industry, demonstrating the potential for ARM based systems in high performance computing applications.

ARM based servers are gaining traction in data centres as well, challenging the long standing dominance of Intel and AMD. Nvidia’s announcement of plans to develop ARM based CPUs for data centres and AI applications further underscores the growing appeal of the ARM architecture in high performance scenarios.

In response to this shifting landscape, Intel and AMD have not remained idle. Both companies have focused on improving their x86 designs, with a particular emphasis on enhancing efficiency and integrating specialized accelerators to maintain their competitive edge.

Adding another dimension to this architectural battle is the rise of RISC V, an open source instruction set architecture that has begun to make waves in the industry. RISC V offers a license free alternative to both x86 and ARM, potentially reshaping the future of chip design and manufacturing. An open source architecture should be appealing to China which sees it as credibly neutral level playing ground.

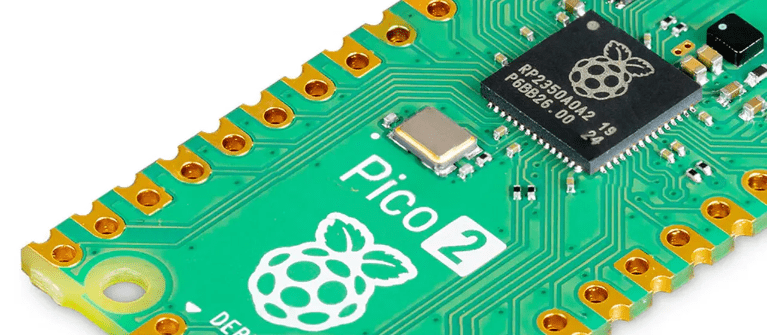

In August 2024 the Raspberry Pi Pico 2 Launched with both Arm & Risc V Cores. While it’s still not a mainstream competitor it’s becoming more likely it will challenge in the future.

Moore’s Law

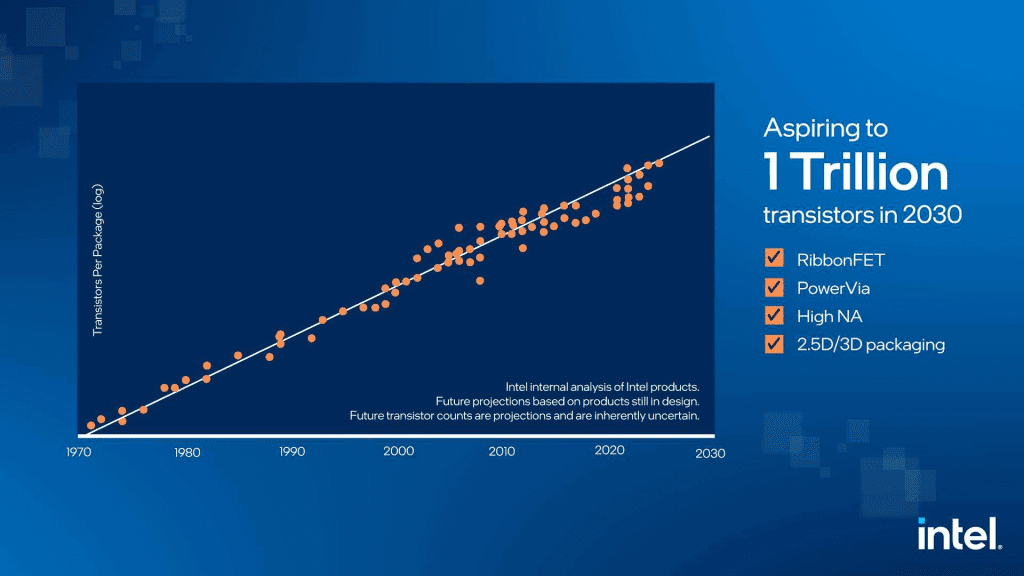

The debate over the continuation of Moore’s Law remains as lively as ever, with opinions divided on its current state and future prospects. While the traditional approach of shrinking transistors has indeed slowed, chipmakers have explored alternative avenues to improve performance and efficiency.

Advanced packaging techniques, such as chiplets and 3D stacking, have emerged as powerful tools in the semiconductor industry’s arsenal. These approaches allow for continued performance gains even as traditional scaling faces increasing challenges.

The introduction of new materials and transistor designs, like gate all around RibonFETs, which have helped push the boundaries of performance and efficiency. Intel intend to start integrating RibonFET based nanosheet transistors at 3nm and 2nm process nodes.

The development of ASIC chips for AI and other applications has demonstrated that exponential performance improvements are still possible, even as general purpose CPU scaling has slowed. These domain specific architectures have opened new avenues for innovation and performance gains.

Moore’s Law has been slowing since inception, the original prediction was to double every year until Moore revised it to every two years in 1975, a decade after the original prediction. Today it is more like every 4 years for general logic processors. The prediction remains an incredible foresight into the exponential growth of computing power.

The original author of Chip War, Chris Miller, wrote an article in 2024 suggesting the future race to tech supremacy could be in AI data centres. Read it here: https://www.ft.com/content/202c3240-fa20-4081-a2a7-8470b7f12110