DeFi

-

The Truth About Where Yield Comes From In DeFi

Interest rates in traditional banks are 0.1%, have you ever wondered how DeFi yield farmers are getting 20-100% yields on their digital assets? Is it sustainable wealth creation or a giant ponzi that risks collapsing in on itself. That’s the question we are going to explore in this article looking at where yield comes from…

-

How To Make Cross Chain Transfers With Multichain

I’ve seen Anyswap popping up more and more in on-chain analytics reports as it’s grown to be a six billion dollar protocol by TVL. The platform just rebranded to Multichain and its fast becoming the market leader in cross chain bridges. If you want to transfer USDC from Ethereum to Polygon or Fantom or another…

-

Curve Wars | The Best Way To Gain Exposure To The Curve Wars

A battle rages for control of DeFi’s biggest protocol as stablecoins fight for liquidity. Million dollar bribes being paid for votes, enemies becoming alliances and an ultimate prize at stake. This article explores why CRV is so valuable and why it likely isn’t the best way to gain exposure to the Curve wars. The CRV…

-

Crypto Market Thesis 2022 & Current Portfolio Holdings

This article outlines my thoughts and predictions for crypto markets heading in to 2022. At the end of the article I share my allocations and plans for this year. Crypto Market Thesis Video James On YouTube Watch On YouTube: https://youtu.be/ogBcbwuasWw Bitcoin Market Outlook Crypto markets have cooled off significantly since summer 2021 but expectations are…

-

DeFi Risk | A Framework For Assessing & Managing Risk in DeFi

The high yields available in decentralised finance come with a downside. DeFi risk is real and if you are participating in the markets then you should know how to assess and manage that risk. By building a risk assessment framework for yield farms and DeFi opportunities we can better assess fair value and allocate capital…

-

How To Clone Safemoon

In this tutorial I’ll show you how to clone Safemoon and create your own token on Binance Smart Chain. I’m going to do this without any development tools using only a web browser with the metamask plugin. Safemoon is a cryptocurrency token with a function that taxes 10% of all transactions and redistributes 5% to…

-

Crypto Index Funds | Set Protocol & Index Coop

This article looks at the future of crypto index funds running on DeFi and in particular the Set Protocol and Index Coop. Crypto index funds known as sets provide a single token which represents a managed or fixed fund of digital assets. Index Funds in TradFi and DeFi In traditional finance index funds are the…

-

Intermediate Solidity Tutorial | Building On DeFi Lego Bricks With Hardhat 👷

In this intermediate solidity tutorial I’ll be building, testing and deploying a smart contract to rebalance a digital asset portfolio. The idea is to look at how we can work with external smart contracts to start building our own products on the lego bricks of DeFi. The Challenge To create a solidity smart contract to…

-

How To Stake Ethereum, Luna or Solana| LIDO Staking Tutorial

As Ethereum moves to a proof of work network it opens up the possibility to stake our assets to gain a yield. We can do this by running our own validator node on the network… or we can use a liquid staking platform. In this lido staking tutorial I’m going to look at the LIDO…

-

112 DeFi Definitions | Blockchain Glossary

The blockchain community has its own language and abbreviations which can seem quite daunting at first glance. Here is a glossary of defi definitions and terms that you’ll want to know and understand to interact in the space. AML (Anti-Money Laundering) Regulations applicable in most international markets aimed at preventing criminal activity. Anti-Money Laundering regulations…

-

Crypto Research | Due Diligence & How To Find The Next 10x Token 🧐

When market conditions are right there are abundant opportunities in seeking out high quality and early stage crypto projects. In this post I’ll walk-through my crypto research process from screening and researching crypto projects to due diligence and tokenomics. An Introduction To Crypto Research James On YouTube Where To Find New Crypto Projects Being early…

-

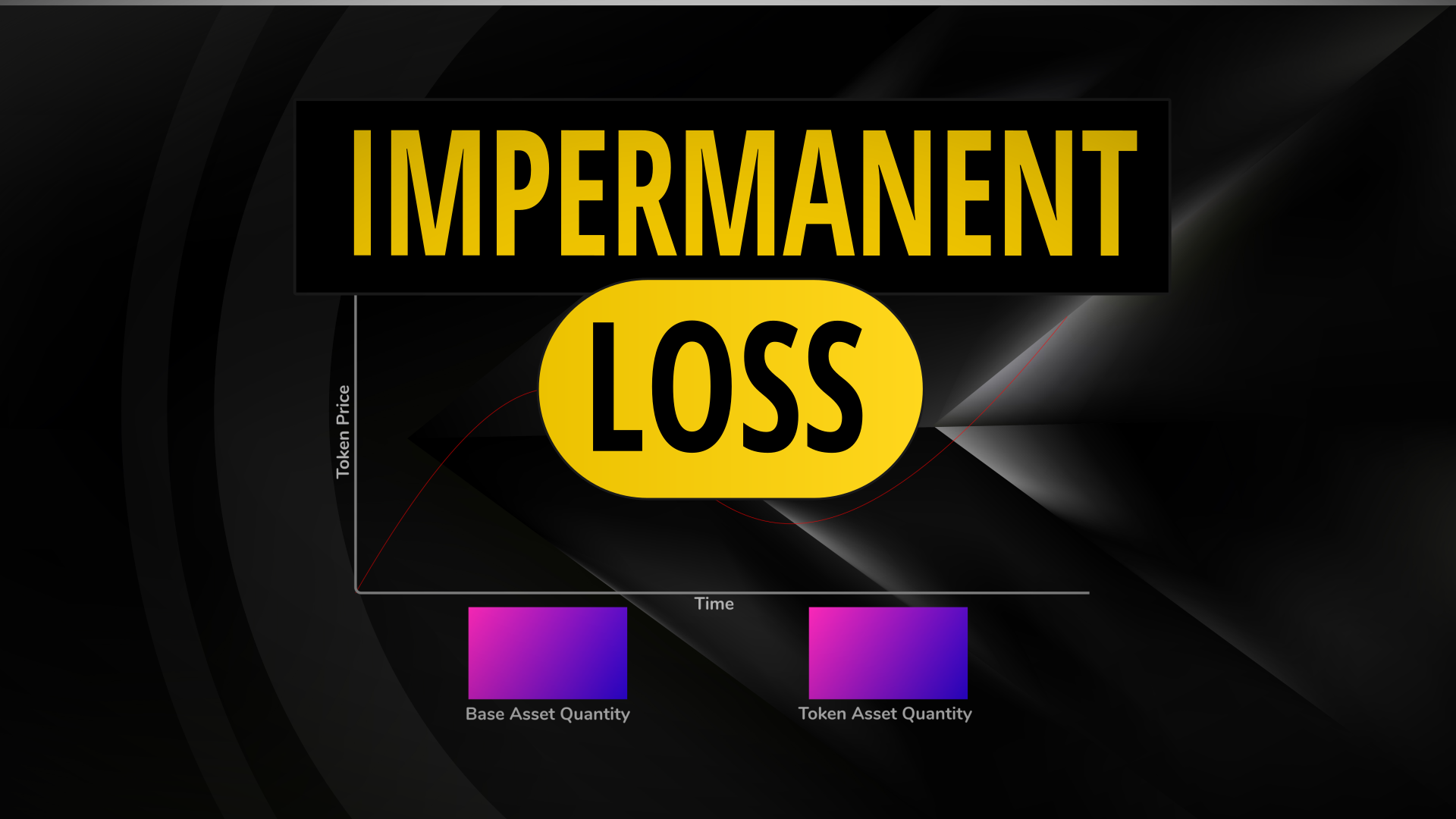

Impermanent Loss Calculator | How To Calculate And Mitigate DeFi’s Biggest Risk

Impermanent Loss Calculator Enter the quantities for the two assets in a full-range liquidity pool and a future price ratio to find out what the impermanent loss would be: Base Asset Qty: Token Asset Qty: Future Price Ratio: Calculate How Impermanent Loss Is Calculated In this article we will look at what impermanent loss is,…

-

Bitcoin vs Ethereum | Everything You Need To Know About BTC & ETH

The Bitcoin vs Ethereum debate is passionately argued by maximalists for both sides. This article and video explains the fundamental differences in how they work, what makes them unique and why Ethereum carries more risk and potential reward. Bitcoin vs Ethereum [Video] James On YouTube Fundamental Differences In 2008 an anonymous developer using the pseudonym…

-

Crypto Portfolio | What I’m Hodling & Why In 2021

In this article I’ll go through my crypto portfolio and explain why I’m holding each of the digital assets. I’ll also be discussing the principles behind the portfolio and how I manage it. The Crypto Portfolio 2021 This is what my crypto portfolio looks like as of July 2021. I’m not a financial advisor, not…

-

Optimism Tutorial | How To Use Optimism On Ethereum

In this Optimism tutorial we will be looking at what Optimism layer 2 is, how to use it and how to develop smart contracts on the Ethereum layer 2. What is Optimism & Layer 2? Optimism is a layer 2 scaling solution for Ethereum which offers lower transaction fees. For consumers who are used to…

-

Arbitrum Tutorial | How To Use The Ethereum Layer 2 Solution

This Arbitrum Tutorial explores what Arbitrum is and how it works, the opportunities layer 2’s present for investors and developers, before testing the deployment of smart contracts on the Arbitrum network and calculating gas fee reductions. What Is Arbitrum? Arbitrum is a layer 2 scaling solution for the Ethereum network. The L2 has opened it’s…

-

How To Create A New Token And Uniswap Liquidity Pool

In this article I will create a new token and make it available to swap on a decentralised exchange. I’ll be deploying a solidity smart contract to mint an ERC20 token on Ethereum and setting up a liquidity pool on Uniswap v3. Create A New Token & Liquidity Pool [Video] This video provides an overview…

-

Huobi Exchange Review

Huobi is the second largest crypto exchange in the world by trading volume. In this article I am going to undertake a comprehensive Huobi exchange review looking at trading, fees, HECO and the HT Token. Who is Huobi? Huobi Group was founded in 2013 by Leon Li. Huobi was originally based in Beijing and now…

-

DeFi Passive Income | How To Generate Yield On Crypto Assets

This ultimate how to guide will show you how to earn a passive income on your crypto holdings. We will start by looking at different types of DeFi passive income and how it works. Then I’ll explain how liquidity providers earn transaction fees and explore market leaders including Uniswap, Pancake Swap, Pangolin and Raydium. Finally…

-

Decentralised Finance | A Comprehensive Guide To DeFi

Decentralised finance is revolutionising the blockchain sector. It provides a playground of opportunities for investors, traders and developers. This article provides a comprehensive in depth guide to everything DeFi. What Is Decentralised Finance? Decentralised finance is an extension of cryptocurrency and blockchain applications enabling borrowing, lending, trading and investing. DeFi provides financial services through the…