This article outlines my thoughts and predictions for crypto markets heading in to 2022. At the end of the article I share my allocations and plans for this year.

Crypto Market Thesis Video

Bitcoin Market Outlook

Crypto markets have cooled off significantly since summer 2021 but expectations are high throughout the industry that Q1 and the rest of 2022 will be strong for Bitcoin and correlated digital assets.

There are a number of theories that are worth considering here:-

- Benjamin Cowens – Lengthening Cycles – Bitcoin will continue to go through market cycles but these will lengthen and no longer be correlated to the halvening events.

- Su Zhu & Dan Held’s – Super Cycle – Bitcoin appreciates in an Amazon-esque up only pattern and price forms a upward channel.

- Crypto Twitter – Double Top – Perhaps we don’t have a blow off top and the market sells off and capitulates into the next halvening cycle in 2024.

All of these are possibilities and I (along with most market participants) have a bullish bias to consider.

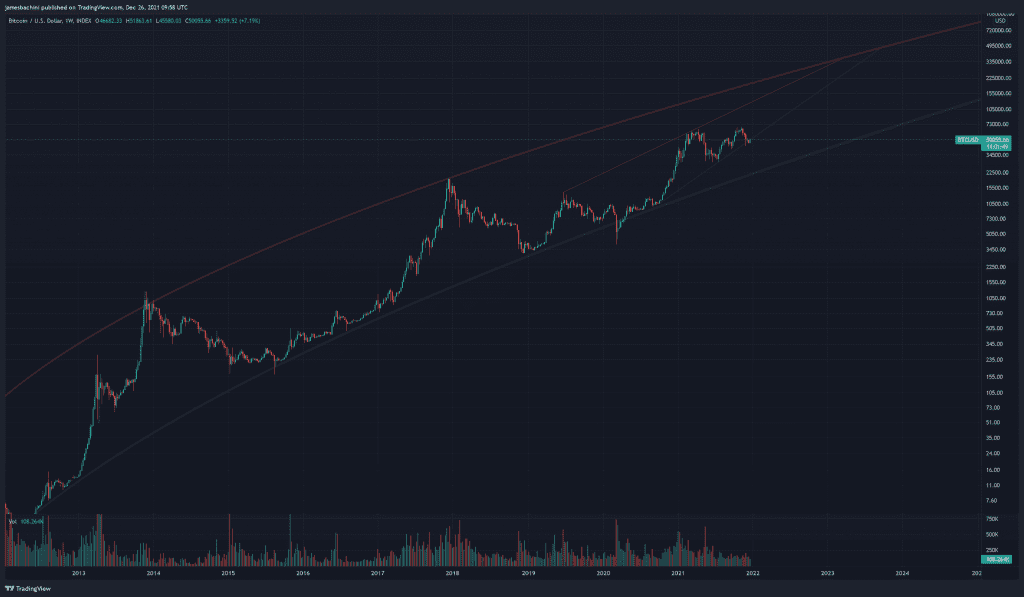

If we take a look at the high time frame log chart for BTC/USD I feel this adds weight to an argument for us being at a mid-bull-cycle position and getting ready for another leg up.

Could there be enough long-term holders looking to scale out during a blow off top that it decreases the likelihood of one forming?

Then there’s the 100k factor to consider if we get there. Bitcoin crossing $100,000 USD will be a newsworthy event and it’s going to attract a lot of press attention and extended predictions. FOMO is real and this may be the period where the market could accelerate, timing becomes harder and mistakes become more costly.

If the markets go the other way then I think that there’s enough support at $20k that it’s unlikely to trade below this for any significant amount of time. If Bitcoin ever gets into the $20-23k range again then it might be time to sell a kidney and risk-on as that’ll likely be a huge opportunity although it will feel terrifying at the time.

Ethereum

The general consensus is that Ethereum will outperform Bitcoin if markets go up and Bitcoin will recapture some ground if crypto markets go down.

This year there have been a couple of times where Ethereum has lead the market and I think this will become more prominent and hopefully we see greater decorrelation between digital assets.

ETH/BTC traded below 0.03 at the start of 2021, it’s now at 0.08. If gains continue then around 0.15 is the level to watch as that will be the flippening where Ethereum’s market cap will exceed Bitcoin. This will likely be another major mainstream news event and Ethereum will become a household name.

Ethereum is transitioning from a proof-of-work network to a proof-of-stake network in 2022. The pros and cons of this are too long of a discussion for this article but there’s some market effects that need to be considered.

All eyes will be on Ethereum around May/June when the merge is due to take place. Proof-of-stake opens up staking which should appeal to institutional investors familiar with revenue generating assets. If entities like Michael Saylor’s Microstrategy start buying up ETH then it’s going to increase demand significantly.

The merge will also trigger a triple halvening event making ETH a deflationary asset. Over the long term this will reduce supply, in the short term it will provide a very bullish narrative.

At time of writing the ETH2.0 staking contract has 8,793,618 ETH locked (valued at over $35 billion USD). Some of this was staked at a time when ETH was trading at below $100. It is locked until the merge is complete at which point the stakers funds are returned with interest in ETH. There’s a high possibility that post-merge some ETH stakers are going to want to realise some of those gains for real world purchases. This could potentially cause a sell the news type event around the time of the merge.

It’s impossible to talk about Ethereum without complaining about gas fees which have limited development and usage. Ethereum TVL at the start of 2021 was 98% of the total DeFi market, it’s dropped since to 67% as users are priced out of using the network.

There’s the potential for Ethereum to become a chain of proofs and it’s primary use will be for securing 3rd party layer 2’s which scale the Ethereum virtual machine to a mass audience. One bearish question is what happens if layer 2’s decide they don’t need layer 1 validation. Starkware a ZK rollup has already stated that it doesn’t intend to pay transaction fees for proofs on Ethereum forever.

Ethereum also faces strong competition from alternate layer 1’s such as Avalanche, Solana, Polygon and Binance Smart Chain. Emerging layer two’s such as ZKsync could potentially recapture much of the lost TVL if they release a token and incentivise yield farmers and developers.

Ethereum continues to evolve and find new use cases and I believe it will continue into 2022 and beyond. ETH is currently my largest holding.

Regulation

The main focus for regulatory news is going to be on the US. It’s not so much that no where else matters as much as the markets don’t care about other jurisdictions. (I say that as a small island Brit). The US markets for many consumer products and tradfi will make up about ~50% of the total market which is why it is so critical for global crypto companies.

The stereotypical bad guy here is Gary Gensler chair of the Securities and Exchange Commission (SEC). His academic background includes lecturing on blockchain topics so he knows the technology. However the SEC likely look to make examples of crypto companies and defi project teams in 2022.

There are a number of ongoing legal disputes including Luna’s Mirror (MIR) protocol, the Ripple (XRP) case and Coinbase’s lend product.

How these pan out will likely affect wider markets and it remains to be seen how far the SEC will go to attempt to gain regulatory control of crypto markets.

This will likely play out in favour of more decentralised protocols. If a platform is genuinely governed by a DAO and has anonymous developers then it’s going to be extremely difficult for the SEC to prosecute. It’s more likely that they’ll go after the low hanging fruit of centralised exchanges and DeFi blue-chip projects with professional teams and corporate entities governing them.

I am still hopeful that we will see a Bitcoin spot ETF in 2022. The futures ETF has gone ahead without any drama so a spot ETF is what the market wants and a logical next step. This will likely see Grayscale’s Bitcoin fund converted to an ETF as well.

The Coinbase IPO in May 2021 was a dramatic event for the markets as it acted as a catalyst for a wider sell off in digital assets. Despite this I think we will likely see more companies in the space listing to go public with the biggest likely candidates being OpenSea and Binance.

There’s speculation that Changpeng Zhao or CZ as he’s affectionately known is already the richest man in the world. If Binance goes public then this will cement the fact and be another positive narrative for cryptocurrency in general.

NFTs

At the start of 2021 I thought that institutional interest would reach Ethereum through the DeFi space however…

I have a friend that works in enterprise development and I’m hearing that demand isn’t for DeFi, all interest at a corporate level is currently focused on NFT’s. Notably from consumer facing brands such as sporting and premium goods that want to use it as a promotional tool.

While NFT’s demand and attention is growing it’s not without risk. The markets for non-fungible tokens are inherently illiquid. If no-one wants to buy your jpeg then it’s value is zero. At some point I believe we will see a deep bear market in the NFT space and a lot of it will go to zero much like ICO’s in 2017.

During these periods which may or not be in the next year I believe we will see a rush to quality. Punks, BAYC, Beeples are always going to hold some value. There will always be a bidder for the truly seminal works.

In Q4 2021 Facebook changed their name to Meta and presented their vision of a digital future. The company has positioned itself exceptionally well to be the market leader in this space controlling the leading hardware and investing Billions in perhaps the worlds toughest software challenge.

I would love to see an open metaverse with decentralised transparent standards that anyone can use and no central gate keeper. However I think there’s a strong possibility that Zuckerberg runs away with it and builds a product over time that organisations like Decentraland and The Sandbox just can’t compete with.

There is an opportunity for developers and artists here as well to build 3rd party product for Facebook’s Meta product. This could become like the mobile app gold rush of 15 years ago and provide the necessary competitive labour environment the software development requires.

A best case scenario would be a digital world where there’s a choice like between Apple and Android. Perhaps we will have Oculus/Meta and generic goggles running “OpenMeta”. Unless someone can figure out a way to incentivise and coordinate the open metaverse projects into a multiverse I fear we may just end up with Apple and no viable Android.

DeFi

DeFi is where I feel most comfortable analysing projects and making investments. 2021 hasn’t been the best year for the space relative to other digital assets but I remain bullish on the future of finance.

This year will see a lot of difficult work go into layer zero and interoperability between chains. I am keeping my eyes open for a market leader to emerge in the cross chain bridges space which could prove particularly lucrative if someone can get the user experience right and open it up to as many chains and assets as possible to get a first move advantage.

There’s been a lot of focus on building a DeFi version of FTX this year and I think this may be the wrong approach. A replica of a centralised exchange will never provide a 10x better experience to the exchange. Someone needs to come along and build a DeFi first trading platform that bridges multiple chains and liquidity pools. In the same way that Uniswap simplified the central order book on IDEX I hope someone will do the same for perpetual futures and leveraged trading on DeFi.

Options volumes are expanding across the industry on Deribit and decentralized options protocols of which there are apparently now nine. Options trading will grow in 2022 and beyond as more sophisticated investors enter the markets. Options strategies such as covered calls could also provide interesting strategies for revenue generating vaults and yield farms.

Olympus DAO took the industry by storm with it’s rebasing token. I think we will see more extreme ponzinomics next year with fractional reserve assets perhaps gaining traction. As developers we need to be careful we don’t build a house of cards that could come crashing down under volatile market conditions.

The Curve wars rage on and the protocol recently exceeded $20B in TVL. There doesn’t seem to be any end to how far this can go as it’s probably the destination alongside ETH2 staking that will appeal to institutions and wealth funds entering DeFi.

Alternate layer 1’s and layer 2 ecosystems look set to have another year of exceptional growth. Opportunities will present themselves if you can find a way to stay ahead of the money flow.

My Plan

My current holdings at the end of 2021 are as follows (not including stablecoins):-

| Digital Asset | Portfolio Allocation |

|---|---|

| BTC | 35% |

| ETH | 42% |

| FTT | 6% |

| BNB | 6% |

| UNI | 2% |

| SUSHI | 2% |

| AAVE | 2% |

| LUNA | 2% |

| LDO | 2% |

| REN | 1% |

I’ve had some exceptional returns from SOL and AVAX this year as well and while I remain bullish on these ecosystems I think that the market values the native tokens higher than I do currently.

ETH/BTC I actively rotate between and I think I will move back into BTC at some point this year as a flight to safety.

Exchange tokens have done well and I expect any revenue generating projects with tokens in the space to continue to outperform.

Decentralised exchanges UNI & SUSHI have underperformed but I hold believing in their long-term future. The SEC is a threat to both projects and the exchange tokens mentioned above. A high profile legal battle could create negative sentiment in the market and destroy token value.

AAVE and REN have done well but are probably my two least conviction holdings currently. AAVE can become a household brand in DeFi but needs to aggressively expand cross-chain. REN I think what they are building is compelling and will provide a technology that is unique and useful in a multi-chain world.

LUNA and LIDO are more recent allocations and both have outperformed my overall portfolio. Luna I allocated to the bLuna/Luna pool to receive the Astroport drop. I’ll monitor the market in fear of a sell off as these tokens unlock. LDO is Lido liquid staking and I’m bullish on the long term future of staking and Lido’s position as market leader in this space.

I also have a significant portion of my net worth in stablecoins diversified across various liquidity pools, lending platforms and yield farming strategies. A large proportion of this will go in to basis trades if funding rates heat up. Digital assets account for less than 50% of my net worth with property, shares and businesses making up the rest.

For active trading I’ll continue to buy into forced selling on any major liquidation cascades and develop new systems trading strategies to exploit inefficiencies in the markets.

If markets go down over the next year I’m well positioned to deploy capital in the event of a capitulation in Layer 1, DeFi and NFT markets.

Cryptocurrency is the biggest opportunity I’ve ever seen and I’m focusing 100% of my working life in 2022 on exploring, learning, investing and trading in these markets.