I’ve seen Anyswap popping up more and more in on-chain analytics reports as it’s grown to be a six billion dollar protocol by TVL. The platform just rebranded to Multichain and its fast becoming the market leader in cross chain bridges. If you want to transfer USDC from Ethereum to Polygon or Fantom or another EVM compatible blockchain you can probably do it with Multichain.

- Cross Chain Dex

- Analysing Cross-Chain Flows

- How To Use Multichain

- $60m Funding Round

- MULTI Tokenomics

- A Multichain Future

Cross Chain Dex

We have seen an explosion of alternate layer 1’s and layer 2’s over the last 12 months. Today we have more chains all with their own ecosystems and opportunities. But moving funds between the chains has proved problematic in that there hasn’t been a clear market leader in the space. Each chain will have it’s own native bridge and other on-ramps which vary in user experience.

Multichain is growing fast with $35 billion in trading volume to date and looking to fulfil this niche to develop a first mover advantage. High gas fees on Ethereum’s mainnet are pushing retail users towards alternative EVM (Ethereum Virtual Machine) blockchains and there is a need for interoperability between chains.

Anyswap started out as a cross-chain AMM but in early 2021 they removed the DEX functionality to focus on bridging services. In December they launched their new Cross-Chain Routing Protocol which aims to allow the interoperability of assets across blockchains.

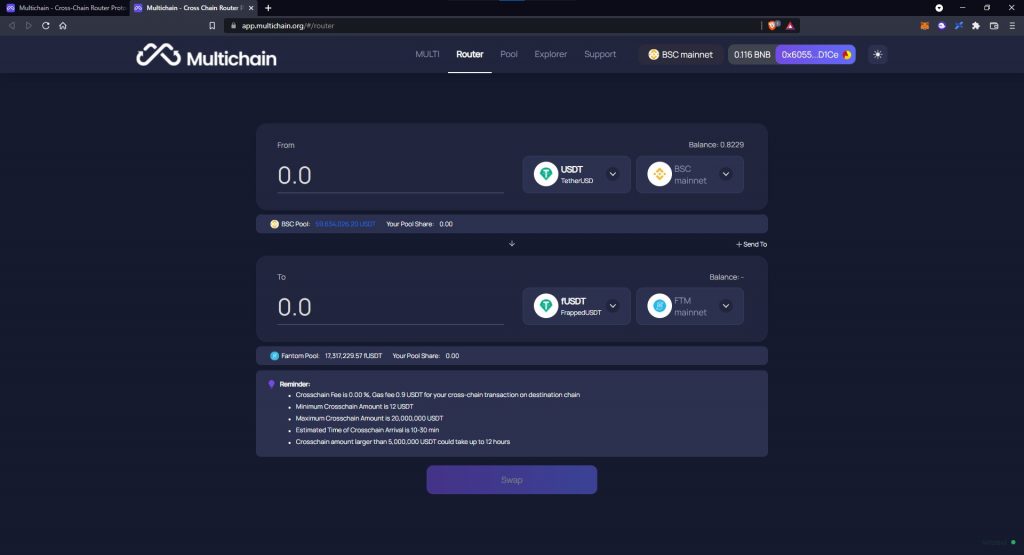

The user interface is intuitive for anyone that has used an automated market maker before. It is very similar to Uniswap with the addition of a network drop down tab alongside the asset being traded.

Cross chain transfers usually take around 5 minutes but can take up to half an hour depending on network conditions.

Fees are $0.90 USD for most alternate L1’s and $30 for Ethereum mainnet. There are minimum and maximum transaction amounts as well so check before sending.

Currently the supported chains are:-

- Bitcoin

- Ethereum

- Terra

- Avalanche C-Chain

- Binance smart chain

- Celo

- Cronos

- Fantom

- Polygon

- Fuse

- Fusion

- IOTEX

- Harmony Shard 0

- Huobi Heco chain

- Kucoin

- Moonriver

- OKExChain

- Shiden

- Telos

- XDai

- Arbitrum

- Boba

- Blocknet

- ColossusXT

- Litecoin

Multichain operates it own network of nodes based on Secure Multi Party Computation (SMPC). Individual nodes sign transactions across multiple rounds of communication to validate data. The bulk of the development has been completed by Jowenshaw and is open source on Github: https://github.com/anyswap

Analysing Cross-Chain Flows

Multichain has an interesting block explorer tool which we can use to gain insights and spot trends in how funds are moving between chains.

If we open up a browser console and check the network connections we can see the explorer is querying the following API:

https://bridgeapi.anyswap.exchange/v2/all/history/all/all/all/all?offset=0&limit=50&status=10From there I was able to build a quick script that queries the last 1000 transactions and counts the assets being transferred and the networks they are being transferred to.

The code for this I have open sourced at: https://github.com/jamesbachini/Multichain-Analytics

I started hitting rate limit issues after a while but it could be improved to track and store data over time to see how trends are emerging. The idea would to provide an early warning indicator as to which chains are gaining traction.

How To Use Multichain

To use Multichain we need to have Metamask or an alternative digital wallet installed.

Connect the wallet to the app at: https://app.multichain.org/#/router

Once connected, select an asset and a network to transfer from and to. You should have the wallet connected to network you are transferring from and the wallet should contain the funds selected.

Enter an amount and check the reminders section to see fees, minimum amounts etc. On a USDT transaction from BSC to AVAX the minimum was $12 USD with a $0.90 USD transaction fee.

If the minimum amounts and fees are OK click “Approve” to approve the spend of tokens. Then once the approval has gone through click “Swap” and confirm the transaction.

If you don’t have the network you are transferring to in your Metamask network list you can add it at: https://chainlist.org

Developers

For developers looking to bridge their own ERC20 tokens across mulitple chains there are a couple of options. You can either let Multichain deploy the token contracts across alternate chains or you can deploy them and provide the contract addresses.

$60m Funding Round

In December 2021 Multicoin announced a $60m raise at a $1.1B valuation led by Binance Labs. Other VC in the round included Three Arrows Capital, Tron Foundation and Sequoia Capital China.

This funding provides a long run way to expand the team, product and volumes as the platform evolves. There is some information on a vesting schedule in the docs but it’s unclear if this relates to the recent funding round, the number of tokens sold and if equity was included as well.

“Multichain financing is carried out in the form of tokens. The tokens are from the Multichain foundation allocation, and they are all locked in a certain period of time listed as below:

- 60% of the token locked for 8 years

- 30% of the token locked for 3 years

- 10% of the token locked for 1 year”

From https://docs.multichain.org/faq

MULTI Tokenomics

The MULTI token can be upgraded from the previously used ANY token using the 1:1 conversion app on Multichain’s website. The total supply is capped at 100 million with current circulating supply at 18.6m. The remaining tokens are to be used at the discretion of the DAO with tokenomics being upgraded to a veMULTI model emulating The Curve Wars.

While details are currently sparse it seems likely that users will be able to lock up their tokens to gain voting rights on the relative weightings of future MULTI distribution.

A Multichain Future

We are already living in a multichain digital economy and have been since Binance Smart Chain launched in late 2020. This is only going to get bigger as more money moves from Ethereum which may end up becoming a chain of proofs rather than something that is used by individuals. With ZKsync launching this year and a number of alt L1’s continuing to provide liquidity incentives it seems likely that we will see a growing amount of cross chain transactions.

Multichain has positioned itself well to benefit from this evolution and has the platform, VC backing and potential to establish itself as the market leader in the space.

The MULTI token risks being diluted by the high total supply relative to the circulating supply. It seems possible that VC’s have purchased a significant stake all be it one which is vested until December 2022. The still to be disclosed tokenomic model relating to veMULTI could provide a catalyst for strong short term price action and the long term fundamentals of the project as a whole look solid.