The blockchain community has its own language and abbreviations which can seem quite daunting at first glance. Here is a glossary of defi definitions and terms that you’ll want to know and understand to interact in the space.

- AML (Anti-Money Laundering)

- AMM (Automated Market Maker)

- API (Application Programming Interface)

- APR / APY (Annual Percentage Rate / Yield)

- ASIC (Application Specific Integrated Circuit)

- ATH (All Time High)

- Address (Wallet Address)

- Airdrop

- Altcoin

- Arbitrage

- Audit

- Bag Holder

- Block Confirmation

- Block Height

- Block Reward

- Blockchain

- Bonding Curve

- Bug Bounty

- Bull/Bear Market

- CEX (Centralized Exchange)

- Cold Wallet / Cold Storage

- Collateral

- Composability

- Compound Interest

- Consensus

- Contract Address

- DAI

- dApp (Decentralized Application)

- DAO (Decentralized Autonomous Organization)

- DEX (Decentralized Exchange)

- Decentralization

- Deflationary Token

- Degen

- Delegated Proof of Stake

- Deposit

- Derivative

- Digital Signature

- Distributed Ledger

- Double Spend

- EIP (Ethereum Improvement Proposals)

- ERC20 Token

- ERC721 Token

- EVM (Ethereum Virtual Machine)

- Etherscan

- FOMO

- Fair Launch

- Fiat Currency

- Financial Primitive

- Flash Loan

- Fork (Hard Fork / Soft Fork)

- Gas (Ethereum Gas Fees)

- Genesis Block

- Gwei

- HODL

- Halving

- Hardware Wallet

- Hash / Hashing

- ICO (Initial Coin Offering)

- Immutability

- Impermanent Loss

- KYC (Know Your Customer)

- Layer 2

- Leverage

- Liquidation

- Liquidity Mining

- Liquidity Pool

- Liquidity Provider

- LP Tokens (Liquidity Provider Tokens)

- Mainnet

- Margin

- Market Cap

- Market Maker

- Maximalist

- Merkle Tree

- Metamask

- Mining

- Multi Signature Walet (MultiSig)

- Node

- NFT (Non-Fungible Token)

- Oracle

- P2P (Peer-To-Peer)

- Private Key

- Proof of Stake (PoS)

- Proof of Work (PoW)

- Protocol

- Public Key

- Pump and Dump

- ROI (Return On Investment)

- Rebalance

- Rollups

- Shard, Sharding

- Slippage

- Smart Contract

- Solidity

- Stablecoin

- Staking

- Sub-Chain / Side-Chain

- Synthetic Assets (Synths)

- Testnet

- Token

- Token Burns

- Tokenomics

- TradFi

- TVL (Total Value Locked)

- Validator

- Volatility

- Web 3.0

- Whale

- Yield

- Yield Aggregator

- Yield Farming

- Zero Knowledge Proofs (ZKP’s)

AML (Anti-Money Laundering)

Regulations applicable in most international markets aimed at preventing criminal activity. Anti-Money Laundering regulations require organisations providing financial services to monitor and report on suspicious activity relating to money laundering. Regulated crypto operators such as exchanges often enforce users to carry out KYC procedures and provide personal data to meet these requirements.

AMM (Automated Market Maker)

An automated market maker uses a pair of assets in a pool which are deposited by a liquidity provider. A trader can then trade one asset within the pool for the other paying a fee. The price will fluctuate with demand along a liquidity curve. Popular examples of automated market makers are Uniswap, Sushiswap and Pancakeswap.

API (Application Programming Interface)

An API provides an end point for developers to connect to so they can gain access to data and execute functions programmatically. Exchanges will provide API access and API keys for their users so they can trade programmatically using trading bots and scripts.

APR / APY (Annual Percentage Rate / Yield)

APR represents the annual percentage rate charged or earned for borrowing or lending money. However this doesn’t take into account the effect of compounding. If interest is paid out monthly the lender will earn interest on their interest. This compounding effect is taking into account using the APY calculation but not with APR.

ASIC (Application Specific Integrated Circuit)

An ASIC device is a noisy little box about a foot long that carries out a high powered hashing calculation around 10 trillion times every second. The devices are manufactured specifically for mining cryptocurrency. ASIC mining devices are estimated to consume around 0.5% of the world’s energy usage, primarily for mining Bitcoin.

ATH (All Time High)

When a cryptocurrencies price makes a new ATH it means it is more expensive and valuable now than it ever has been in the past.

Address (Wallet Address)

A Bitcoin or Ethereum address is a synonym for a public key. It’s the address that you share with someone so they can send funds to your wallet.

Airdrop

When a new project launches a token it is quite common that they create an initial distribution via an airdrop. This provides a set amount of free tokens to anyone that meets certain requirements. These may be promotional in nature or simply to users who have previously interacted with their services. In September 2020 Uniswap distributed 400 UNI tokens via an airdrop to anyone that had previously used the platform.

A curated list of airdrops: https://etherscan.io/airdrops

Altcoin

An altcoin is any cryptocurrency other than Bitcoin. It stands for alternative coin and stems from when Bitcoin completely dominated the markets.

Arbitrage

In crypto markets arbitrage is big business. Networks of bots will scour centralized and decentralized exchanges looking for mispricing between assets. Arbitrage can be as simple as buying an asset on one exchange and hedging the position by selling on another or it can be more complex such as when triangular arbitrage exposes three way price discrepancies.

Audit

A security audit is performed by an external organisation on a project’s smart contract code. It provides some reassurance but by no means guarantees of the safety of funds within a smart contract. Not all auditors are created equally and an audit by a leading firm such as Certik carries more weight.

Bag Holder

A bag holder is someone that is holding an asset which they purchased either at an inflated price or at a time when it was more desirable. In pump and dump type schemes the traders who are left with tokens after the price crashes are called bag holders.

Block Confirmation

Exchanges and payment protocols often implement a minimum number of block confirmations to deposit funds. Each time a miner finds a hash and the block is finalised it counts as a block confirmation. So if a transaction requires 3 block confirmations this will be the block that contains your transaction plus two more on top to be completed.

Block Height

Block height is the number of blocks within a blockchain. This is often used as a de facto timing mechanism within smart contracts as developers can estimate the block height at a particular time in the future based on the average block times.

Block Reward

Block reward includes the mining fees and any transaction fees paid to miners when they find a hash which meets the difficulty rating. Each block will carry a reward for helping secure the blockchain which is how many cryptocurrencies distribute the supply of the token.

Blockchain

A blockchain is a chronologically stacked collection of blocks of data interlinked with cryptography. Each block contains a reference to the underlying block so that no middle block can be edited without changing every block on top of it.

Bonding Curve

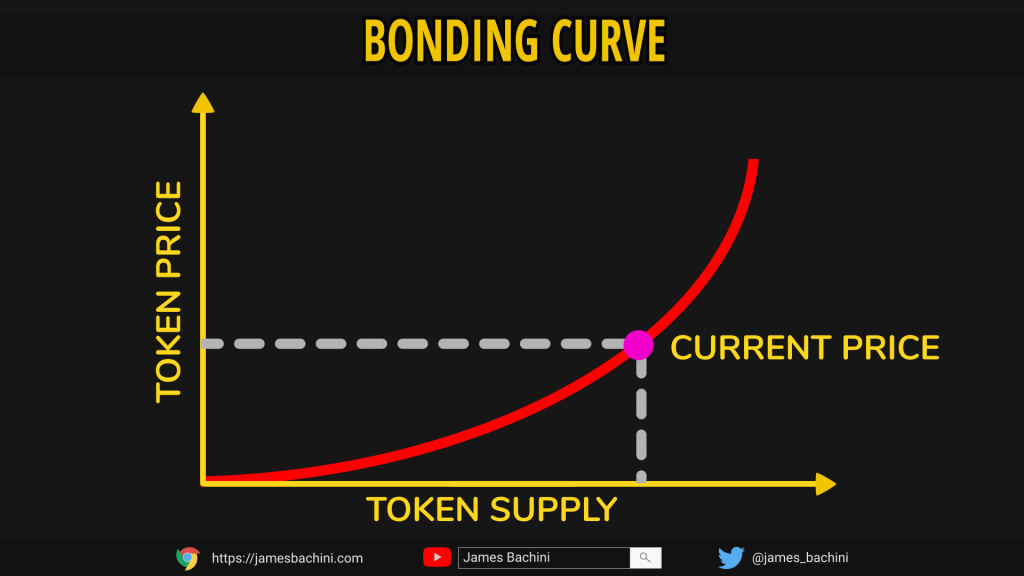

A mathematical formula or curve used to define a relationship between price and supply of an asset. Bonding curve contracts are used by some projects to increase the price of a token being sold as the supply increases.

Bug Bounty

A bug bounty is an offer of payment or reward for finding a security vulnerability in a code base. Bug bounties are often used to incentivise white hat hackers to ethically notify the core development team so they can patch the fault before anyone else becomes aware of the issue. Companies like Hacker One are used as intermediaries between hackers and development teams with top hackers earning in excess of one million USD a year.

Bull/Bear Market

A bull market is used to describe a market that is trending upwards with the price of an asset inflating. A bear market is the opposite when a market is in decline. A trader can be bullish or bearish depending on their current market bias or sentiment.

CEX (Centralized Exchange)

A CEX or centralized exchange is a trading platform like Binance or FTX where a central company runs it. These exchanges are usually order book based with a matching engine to connect buyers and sellers.

Cold Wallet / Cold Storage

A cold wallet is a way of storing funds by keeping the private key offline. An example would be when the Winklevoss twins who were early adopters for Bitcoin purchased a laptop, set up a private key/public key pair, divided the private key in to 3 parts, each part was duplicated and then put each of the six parts in a different bank security box across the country. This is an extreme example of keeping keys secure. The main idea is to make it (almost) impossible for hackers to gain access to your keys if they aren’t connected in any way to the internet.

Collateral

When taking out a futures position or borrowing funds on a lending platform collateral is used to secure the loan. So a futures platform may give you 20x leverage. This means you need to post $100 in collateral, which may be USD stablecoins, Bitcoin or some altcoins, and then you can trade with $2000 positions. Note leveraged trading leads to liquidations which loses the collateral on account.

Composability

In DeFi terms composability is the potential for smart contracts that form the DeFi protocols to interact with each other. A contract might connect to a lending platform to take out a flash loan and then use those funds to interact with an automated market maker to swap tokens for example.

Compound Interest

When a user invests a sum of money an annual rate of interest will often be quoted. However interest is usually paid out more regularly, sometimes as often as every block. This means that the interest we get paid today will start earning interest itself tomorrow. This interest on our interest is known as compound interest and it is very powerful. Albert Einstein described compound interest as “the eighth wonder of the world”. Note that APR rates don’t include compound interest and APY rates do. If we invest $100 in a yield farming protocol with an APR of 100% that pays interest daily we end up with $271.46.

Consensus

A decentralized network of machines acting together as one need to decide on the current state of the network. In blockchain this might be the ability to finalise a block and move forwards with the chain. To do this the network with have code which forms it’s consensus algorithm. Normally more than 50% of the nodes will need to agree for consensus to be reached.

Contract Address

A smart contract address is like the post code of a smart contract on a decentralized network. It maps to the memory address of the executable code on the virtual machine. When we want to interact with a contract we often need the contract address. A common example of this is a token address which describes where to find that token contract.

DAI

DAI is a stablecoin token pegged to the USD. It was launched in late 2017 by MakerDAO and immediately underwent a stress test as the crypto markets crashed. The token is stabilized through the use of overcollateralized loans, often in the form of Ethereum. It was perhaps the first decentralized finance protocol to gain attention and adoption.

dApp (Decentralized Application)

When we interact with apps we will generally download a binary to our phones or visit a central website. A dApp in contrast to this can be compiled and built from source code on our local machines. They will often use a blockchain to share and manipulate data in a decentralized way. While it’s possible to compile a dApp from source more often a user will visit a website which hosts the dApp and interacts with it from there.

DAO (Decentralized Autonomous Organization)

DAO’s provide the governance mechanism for many DeFi protocols. It is based on a voting mechanism where proposals are submitted and then voted on by holders of governance token. Votes that get passed change the course or parameters of the protocol.

DEX (Decentralized Exchange)

Decentralized exchanges include order book based exchanges like IDEX and automated market makers like Uniswap. An orderbook exchange will list bid and ask prices and users will be able to place orders into the book which are filled by a matching engine. A automated market maker uses a liquidity pool of two assets which can then be traded against the pool along a price curve.

Decentralization

The entire blockchain sector is built around the concept of decentralization. This means that a network has no central point of failure and is instead built around equal peers. Decentralization is not a binary concept and networks can become more or less decentralized over time.

Deflationary Token

A deflationary token is an asset where the circulating supply reduces over time. It becomes more rare often through a burning process where tokens are sent to an address which no one has access to.

Degen

Short for degenerate which in DeFi terms can be used both as an insult and a compliment at the same time. It is usually assigned to a trader, yield farmer or NFT collector who takes on high risk strategies. Someone who trades meme coins with their life savings on leverage would be considered a degen.

Delegated Proof of Stake

DPoS is a consensus algorithm where stakers can allocate their voting capacity to 3rd party nodes on the network. It removes the need for stakers to run nodes themselves as they can simply vote through a node operator providing trust in that party act in their interest to secure the blockchain.

Deposit

When we send funds to a new platform we are depositing funds. Centralized exchanges will often provide deposit addresses where you can “load up” your account.

Derivative

A derivative is a financial instrument that is used to gain exposure to an underlying asset. In crypto the most popular example is that of perpetual futures contracts. Quarterly futures and options contracts are other forms of derivatives. In crypto markets derivatives are traded at greater volumes than the underlying spot markets. This means there is more buying and selling of Bitcoin futures than there is of actual Bitcoin.

Digital Signature

Transactions need to be signed before they are sent to the nodes that form the blockchain network. This is achieved via a private key, public key pair and is usually done in the background via a digital wallet such as metamask. The transaction data will be hashed and then signed using the private key and elliptic curve cryptography. This will then be sent to nodes along with the public key to prove the sender approves the transaction. The nodes have a cryptographic function to check if the signature matches the public key for the account.

Distributed Ledger

A decentralized network can hold a list of funds pertaining to who owns what. This distributed ledger provides a way to store and transfer assets without 3rd party approval.

Double Spend

Bitcoin’s initial breakthrough was to solve the double spend problem which ensures a user on a decentralized network can’t send their coins to different addresses on different peers. The consensus mechanism ensures that only one block will move forwards and that can only include a single spend of the tokens.

EIP (Ethereum Improvement Proposals)

When Ethereum goes through an upgrade it’s initially put forward as an EIP. These are then quoted when the changes are put into place. EIP-1559 for example gained attention in 2021 because it redirected transaction fees from miners to a burn address reducing the distribution of new tokens.

ERC20 Token

The majority of crypto tokens use an ERC20 token contract. Anything that is traded on Uniswap or Sushiswap is ERC20 or a variation built on top of it. The ERC20 token contains functions to create, transfer, approve spend and check balances.

Open Zeppelin ERC20 Token Template: https://github.com/OpenZeppelin/openzeppelin-contracts/tree/master/contracts/token/ERC20

ERC721 Token

The ERC721 token is the industry standard token used for NFT’s. It contains many of the standard ERC20 token functions alongside additional functions to declare and modify ownership and store metadata. Metadata contains the data which the NFT represents it is often a hash of the data rather than the data itself.

Open Zeppelin ERC721 Token Template: https://github.com/OpenZeppelin/openzeppelin-contracts/tree/master/contracts/token/ERC721

EVM (Ethereum Virtual Machine)

A virtual machine is like a version of windows running in a window on your laptop. Think of it as a operating system running as an application on top of the main operating system. Ethereum’s virtual machine is designed to run across a network of nodes that agree on the persistent state of data on the network. It’s not just Ethereum that uses EVM, it’s also used by alternate chains like Binance smart chain, Polygon and HECO.

Etherscan

A block explorer provides a user interface for anyone to search for transactions, user accounts and blocks on a blockchain network. Etherscan is Ethereum’s block explorer and is a pillar of the industry. When a user sends a transaction they’ll often be quoted a confirmation tx address which can be copy and pasted into etherscan to see the details of that transaction.

FOMO

FOMO stands for fear of missing out. It’s the feeling you get when you work the industry only to find out your Uber driver has outperformed your portfolio because he invested in a meme token that went viral on TikTok. Fomo can lead us to invest at the worst possible time when markets are toppy and due for a correction.

Fair Launch

The concept of a fair launch token was popularized by Yearn Finance when they released their governance token without any team allocation or VC interest. They simply gave it away to the people that were using the protocol. This created a strong community which benefits the project to this day.

Fiat Currency

Government backed currencies such as the US dollar and Euro are known as fiat currencies. The issuance of new supply is often obfuscated through borrowing mechanisms, fractional reserve banking and quantitative easing. Inflation inevitably eats away at the real value of fiat currencies over time.

Financial Primitive

Simple financial products such as loans and insurance can be classed as financial primitives. They are the fundamental financial services that a protocol may provide. In a DeFi sense financial primitives is often used to describe the complete ecosystem around which a tokens economics is built.

Flash Loan

The concept of a flash loan is quite abstract in that it lets a user borrow millions of dollars with no collateral but only for a few seconds. A flash loan must be paid back in the same block that it is borrowed or the transaction will fail. It’s best explained through an example. A user will take out a flash loan for a stablecoin and then use these funds to swap for token A, in the same block they will swap token A for token B and then token B back to stablecoins. If the triangular arbitrage trade resulted in more stablecoins being received they will pay back the loan in the same block and profit the remaining funds. Flash loans have also been used to carry out flash loan attacks which give hackers access to huge amounts of capital to manipulate prices on liquidity pools.

Fork (Hard Fork / Soft Fork)

The blockchain sector prides itself in being transparent which includes the vast majority of code being open source. This means that it can be forked, copying existing code to our own project and then modifying it from there. When major changes are pushed out a subset of the nodes may not accept them continuing with alternate or pre-existing code. This division of nodes is known as a hard fork. An example of this took place on Bitcoin where Bitcoin Cash split off due to a debate over block sizes.

Gas (Ethereum Gas Fees)

When we place a transaction on the Ethereum network we have to pay a transaction fee known as a gas fee. The fee varies widely depending on network congestion and usage. At times of peak demand it can cost in excess of $100 to make a simple token swap.

You can check the latest gas fees at: https://ethgasstation.info

Genesis Block

The first block on a blockchain is known as the genesis block. Bitcoin’s genesis block famously included an encoded message saying “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

Gwei

Ethereum’s native token Ether (ETH) can be broken down into one billionth denominations known as Gwei. These are used more in development than on user interfaces. Think of it like cents to dollars. 1 ether = 1,000,000,000 gwei.

HODL

In December 2013 BitcoinTalk forum user GameKyuubi posted a somewhat intoxicated message declaring “I AM HODLING”. Having misspelt holding the post led to the term sticking and is now widely used within the community. It simply means to hold on to an asset through the ups and downs. Often quoted as hold on for dear life.

Original post: https://bitcointalk.org/index.php?topic=375643.0

Halving

Halving or halvening events occur when a tokens distribution of new supply to miners is cut in half. This occurs approximately once every four years on the Bitcoin network with the next halving due in 2024.

List of cryptocurrency halving events: https://halvingdates.com

Hardware Wallet

A hardware wallet is a small USB type device that stores private keys and the funds associated with them in a secure manner. It can often be disconnected completely from the internet making it more difficult for hackers to gain access.

Hash / Hashing

A hash is a code which represents some data. If we imagine all data can be broken down into binary ones and zeros. A hashing algorithm can be used to calculate a value of that data. The algorithm is one way meaning you can calculate the hash from the data multiple times but can not calculate the data from the hash. If just one byte of the data changes the hash will change completely. The most common hashing algorithm is known as SHA256, a 256-bit (32 bytes) hash usually printed out as a hexadecimal number of 64 digits.

ICO (Initial Coin Offering)

New projects launching a token will often offer that token in exchange for funds to bootstrap their project. There was an ICO boom towards the end of 2017 which slowly evolved to IDO’s (Initial dex offerings) and IEO’s (initial exchange offerings).

Immutability

Blockchains are immutable because no one is able to change the existing data. Blocks are interlinked and stacked on top of each other with each new block containing a hash of the underlying block. Changing a block from 3 days ago would mean every block since would need to be recalculated and rewritten.

Impermanent Loss

When a liquidity provider deposits funds to an automated market maker they receive fees in exchange for accepting the risk of impermanent loss. If one asset goes up in price and the other goes down the pool will fill up with the lower value asset. The liquidity provider is always on the bad end of price action. If the price returns back to the base level such as often is the case with stablecoins, no impermanent loss will be suffered however if the price move is permanent so is the loss.

KYC (Know Your Customer)

KYC regulations require financial organisations to collect personal and organisational data on their customers and report any suspicious activity. It is used to prevent money laundering and is a requirement of any regulated financial institution. Users will often have to complete KYC steps when signing up to a new exchange to lift withdrawal limits and features.

Layer 2

L2’s are sub-chains that form consensus based on smart contracts which live on the layer 1 main chain. Optimistic rollups are an example of layer 2 scaling solutions which promise faster, cheaper transactions with the benefit of layer 1 security.

Leverage

When a trader makes a trade with leverage they are effectively borrowing money to place that trade. If the trade goes against them they risk being liquidated if the loss comes close to exceeding their collateral position. For example a user can deposit $10 to an exchange, purchase a Bitcoin futures position worth $200 with 20x leverage but if the price of Bitcoin drops close to 5% they risk getting liquidated and losing their deposit.

Liquidation

When using leverage it’s important for the protocol or exchange to prevent losses exceeding the collateral posted. For this reason a liquidation engine will sell positions to recap funds automatically if a margin requirement is not met. Liquidation engines work differently across the industry but many market sell assets which can cause liquidation cascades and highly volatile price action.

Liquidity Mining

Protocols often require funds to operate. For example a lending and borrowing platform needs a float and lenders before they can start lending. DeFi protocols will often bootstrap initial funding through liquidity mining. This is the incentivisation to get users to deposit funds to the platform. This may take the form of distributing governance tokens to early adopters or providing high APY returns for staking LP tokens for the ETH/Native pair providing a liquid market for the governance token.

Liquidity Pool

A liquidity pool usually contains a pair of assets which can be swapped. For example a Uniswap liquidity pool might have ETH as the base asset and an ERC20 Token as the traded asset. Price is calculated along a curve dependent on the quantity of assets in the pool. If someone starts buying the ERC20 token with ETH it pushes the price up as more ETH is added and the ERC20 tokens are removed from the pool.

Liquidity Provider

A liquidity provider will usually provide a pair of assets such as ETH and ERC20 tokens in equal weighting to a liquidity pool. They will earn fees whenever someone trades in that liquidity pool. When providing liquidity they will receive LP tokens in return (see below).

LP Tokens (Liquidity Provider Tokens)

LP tokens act like a receipt for the funds deposited and they will automatically be sent to the same address that deposited the funds. LP tokens can be transferred and can often be staked on DeFi platforms in return for staking rewards.

Mainnet

A trade made on margin is executed using borrowed money. A percentage of the total trade value is kept on account as collateral to cover potential losses. If losses exceed collateral a liquidation event will occur and the trader will lose the collateral posted.

Margin

A trade made on margin is executed using borrowed money. A percentage of the total trade value is kept on account as collateral to cover potential losses. If losses exceed collateral a liquidation event will occur and the trader will lose the collateral posted.

Market Cap

The market cap or capitalization of a cryptocurrency is the calculated by multiplying the circulating supply by the token price. This is usually a debatable issue with leading websites not including vested tokens and treasury wallets in the circulating supply.

Market Maker

A market maker will provide liquidity to an order book on a traditional exchange. They will often place both bid and ask to buy and sell the same asset at a varying spread away from the current market price.

Maximalist

Maximalism is a mindset in which someone feels that a single coin or token holds value above everything else. Bitcoin maximalism arose towards the end of 2017 with maxi’s declaring everything else in the sector worthless. More recently we’ve seen more Ethereum maximalism where proponents believe that alternate chains are meaningless.

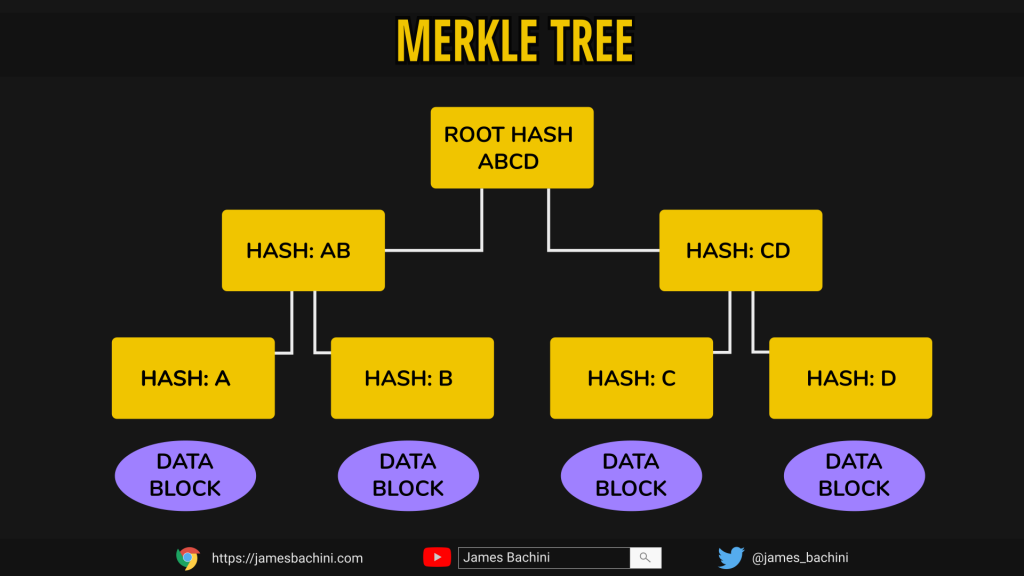

Merkle Tree

Merkle trees are a data structure where hashes are used for verification. A root hash can be used to verify underlying blocks of data provided across an untrusted peer to peer network. It’s possible to verify each block of data contains the commitment from the root hash.

Metamask

The most popular digital wallet for Ethereum and EVM compatible chains is Metamask. It can be installed as a browser plugin or via a mobile app. Metamask can be used to setup and manage accounts, transfer funds between accounts and interact with web3 applications.

Mining

In the sense of proof of work consensus mining involves hashing a block of data over and over again each time changing a random variable to get a different hash. If a hash meets a set difficulty level the miner will finalise the block and the chain moves forward. Mining is generally carried out on high powered ASIC devices. The industry has been criticised for excessive electrical usage.

Multi Signature Walet (MultiSig)

A multisignature wallet or multisig is a digital wallet that requires multiple signatures to transfer funds. For example a Gnosis multisig wallet might be setup by a team who want to secure their treasury funds. There might be 5 team members who are signatories on the account and it may be set to require at least 3 signatures for a transaction. Each user will be given a private key/public key pair via a digital wallet like metamask. They can then propose and sign any transactions to transfer funds which wont go through until 3 team members have signed off on the transaction. Multisig wallets are used to mitigate the risk of theft, lost keys and hacked funds.

Node

A node is a computer operating on a distributed peer to peer network. Each node will connect to multiple other peers to share information and data across the network. Not to be confused with Node.js which is a Javascript runtime and development tool.

NFT (Non-Fungible Token)

Non fungible tokens are one offs. Where as one bitcoin is worth the same amount as any other one bitcoin, a NFT is unique and is only worth what someone is willing to pay for it. NFT’s are used to digitally represent art, digital assets and liquidity receipts.

Oracle

Smart contracts can not connect to external data sources such as API’s. For this reason to get information into a contract it must be provided by a service such as an oracle. Oracles can provide any type of data but in DeFi it is usually price data from centralized exchanges. This is useful for developers to prevent the risk of price manipulation on-chain.

P2P (Peer-To-Peer)

A peer-to-peer network is a collection of computers all talking to each other in a group. There is no central server or data provider and data is communicated by whispers between the peers.

Private Key

A private key is a set of one’s and zero’s often represented in hexadecimal alphanumeric format. It acts as the primary data input for account creation in cryptocurrency because the public key is derived from the private key. Private keys, as the name suggests, should be kept private as anyone who has access can sign transactions and take any funds in the account.

Proof of Stake (PoS)

In a proof of stake network token holders vote on the finalisation of blocks. It is assumed that token holders will be most financially incentivised to secure the blockchain. The network will find consensus by the block which has the most votes in terms of staked tokens. In practice slashing mechanisms and limits are put in place to further prevent malpractice between stakers.

Proof of Work (PoW)

In a proof of work consensus mechanism a block is hashed repeatedly until a hash is found to match a set difficulty. Hashing is carried out on specialised hardware known as ASIC devices. Proof of work is often criticised for its excessive electrical consumption but complemented for its extreme decentralization.

Protocol

A protocol is used to describe a smart contract or collection of smart contracts which provide a service in decentralized finance. The frontend of the service is referred to as the platform while the backend is described as the protocol although these terms are often used interchangeably.

Public Key

A public key is the same as your address. On Ethereum it will start with 0x… to show it’s a hexadecimal address. The public key is derived from an accounts private key however it is not possible to find the private key from a public key. When we want a user to send us funds we will share our public key and they will send funds to that address.

Pump and Dump

A pump and dump scheme is an ethically questionable trading method where a token is bought up and then announced to a trading group. As traders pile in it pushes the price up to a point where it’s unsustainable. The token price then dumps as there’s a rush to the exits and as everyone tries to cash out. Anyone left with tokens at the end is considered a bag holder.

ROI (Return On Investment)

When an investor commits funds to a financial instrument they expect a return on that investment in the form of capital appreciation. ROI is a measure of that return, it can be calculated via the formula: (final value of investment – initial investment) / total cost of investment including fees x 100%

Rebalance

When allocating assets to a diversified portfolio the individual assets will move away from their target allocations as prices fluctuate. Rebalancing is the process of selling a partial amount of any assets that have gone up in price and buying any that have gone down in price. This rebalances the portfolio back to the target allocations. It can be used to somewhat automate the process of buying low and selling high.

Rollups

Roll ups are a form of layer two scaling solution. Transactions are rolled up in an amalgamation process and stored in a inbox within a layer 1 smart contract. The transactions are processed via external nodes on layer 2 taking a lot of the execution and computational work away, then state is updated and sent back to layer 1. A dispute mechanism is used to prevent misuse between validator nodes on layer 2.

Shard, Sharding

A shard is a subset of data and sharding is used by data management software to break down large data sets into more manageable packages. By the end of 2021 the ethereum blockchain will be over 1TB in size and transferring this data across a decentralised network potentially could become more difficult. Sharding will enable nodes to work with a subset of the entire blockchain which will ease the computational burden of past transactions.

Slippage

The price movement caused by an order is called slippage. When an asset is traded on exchange the quoted price is often the midpoint between the leading bid and leading ask price. However when a market order is placed it can take out more than just the leading price eating into the order book and removing liquidity.

Smart Contract

Code compiled to run on a blockchain network such as Ethereum are know as smart contracts. They are essentially just programs written in a text editor, much like any other coding language. Smart contract code is deployed to the network via a process known as migration.

Solidity

The main coding language used to create smart contracts on the Ethereum network is called Solidity. It’s a statically typed language designed around the Javascript syntax making it familiar for web developers.

Stablecoin

A token that is pegged to an underlying asset such as the US Dollar is known as a stablecoin. Stablecoins are very important in DeFi because they can be used to provide collateral in a less volatile asset. Different stablecoins have various mechanisms in place to follow their base asset however there is no guarantee and it’s possible for stablecoin tokens to decouple from their peg.

Staking

DeFi protocols will often incentivise funding and liquidity providers by distributing a governance token to staked funds. A user can either use the protocol or purchase the governance token on exchange and use this to stake and earn further funds.

Sub-Chain / Side-Chain

Ethereum is open source code which means it can be forked and changed by anyone who understands how it works. Sub-chains like Polygon are modified copies of the Ethereum code that run a separate chain in parallel. Some protocols will deploy smart contracts across multiple side-chains.

Synthetic Assets (Synths)

Synthetic assets are a derivative product which aims to track an underlying asset. A user can trade stocks, index funds, commodities and cryptocurrencies using synthetic assets. They are backed by a liquidity pool which acts as a balancing and funding mechanism for the protocol. If all the synthetic assets go up at the same time then the liquidity pool diminishes in value. In practice the diversified nature of the assets works well to keep things in balance.

Testnet

A testnet is a playground for developers and end users to try out things with valueless funds. A developer can get free testnet ETH from a faucet and use this to deploy their smart contracts. A user can use their free ETH to try out new DeFi platforms and experiment with the latest innovations without risking any funds.

Token

A token is built on a smart contract that stores ledger of who owns what. The majority of cryptocurrencies are built on the ERC20 token standard. Tokens often include functions for minting, transfer between accounts, approving spend by 3rd parties or contracts and checking balances of accounts.

Token Burns

Sometimes token contracts include a burn function otherwise it is sufficient to send funds to the 0x0000000000000000000000000000000000000000 address which no one has a private key for… unfortunately as it contains over $1.5B in tokens.

Tokenomics

For a token to go up in value the demand must outweigh the supply on exchange. The economics of the token ecosystem are known as tokenomics. There are various methods to try and increase demand and reduce supply such as staking, fee burning and holder benefits.

TradFi

TradFi refers to traditional finance. The institutions of Wall Street and the square mile in London would be considered TradFi.

TVL (Total Value Locked)

Smart contracts can contain funds locked within the contract itself. A good example of this is the liquidity pools on automated market makers like Uniswap. The smart contract address owns the funds until a user redeems them. The total value locked within a smart contract or protocol is often expressed in USD terms.

A list of DeFi projects ranked by TVL: https://defipulse.com

Validator

A user can stake their tokens on a proof of stake network and run a node to actively participate in the validation of the blockchain. Validator nodes connect to the peer-to-peer network to process transactions and blocks.

Volatility

Many cryptocurrency assets are described as being highly volatile. This means that the price can swing wildly in both directions. Bitcoin often has 50%+ drawdowns and altcoins are even more volatile. In 2018 many tokens lost 95%+ of their USD value causing disruption throughout the industry.

Web 3.0

The first version of the web was a publishing platform built on the idea of print media. Website publishers would produce content for consumers to read. Web 2.0 was the revolutionary rise of social networks where users themselves create the content. Web 3.0 is the decentralization of content and social networks. The concept promises social networks with no single point of control where no entity can sell your personal data.

Whale

A crypto whale is an affectionate term used to describe someone that has a very large holding in cryptocurrency. These are generally early adopters, crypto funds and high net worth individuals.

Yield

The return on investment we can get from staking or lending can be described as yield. This is usually provided by a platform as an APR figure or APY figure (includes compound interest).

Yield Aggregator

A yield aggregator will automate some of the yield farming process by claiming staking rewards and then restaking to compound the returns.

Yield Farming

Yield farmers operate a cat and mouse game of looking for new protocols to get in early on and start earning the best rewards. Often yield farmers will only participate in a single farm for a period of a few days or weeks before switching to the next project that wants to bootstrap liquidity and is offering incentives to do so.

Zero Knowledge Proofs (ZKP’s)

Zero knowledge proofs use cryptographic methods to verify data without sharing the actual data. In cryptocurrency ZKP’s can be used to validate a transaction without revealing whose wallet was used to send the funds. This adds ythe potential for a privacy aspect to an otherwise transparent blockchain system.

Hopefully some of these DeFi definitions have been helpful.