Last month Vitalik caused a stir when he suggested that DeFi “can’t be the thing that brings crypto to another 10-100x adoption burst”

In this article I’m going to share my thoughts on why DeFi is still the no.1 most important use case for Ethereum.

- Lack of Financial Inclusion

- Lack of Transparency

- High Costs, Fees & Slippage

- Snail Mail Pace

- Restrictive Bank Hours

- Centralized Counterparty Risk

- Lack of Innovation

Lack of Financial Inclusion

In a world where millions remain unbanked, DeFi offers a beacon of hope. Traditional finance has long excluded large populations due to lack of access to banks, credit systems, or regulatory barriers. Lucrative financial markets such as stocks, bonds, and derivatives have often been restricted to accredited investors, limiting opportunities for the general public.

DeFi breaks down these barriers by leveraging the power of the internet. It throws open the doors to a vast array of financial services, from basic banking to complex investment instruments, all without the need for intermediaries or gatekeepers.

Anyone with an internet connection can access lending, borrowing, trading, and yield farming opportunities. This democratisation of finance is not just about access; it’s about empowering individuals to take control of their financial future, regardless of their geographical location or economic status.

Lack of Transparency

The opaque nature of financial institutions, with their hidden fees, obscure decision making processes, and obfuscated financial products, has eroded trust over the years.

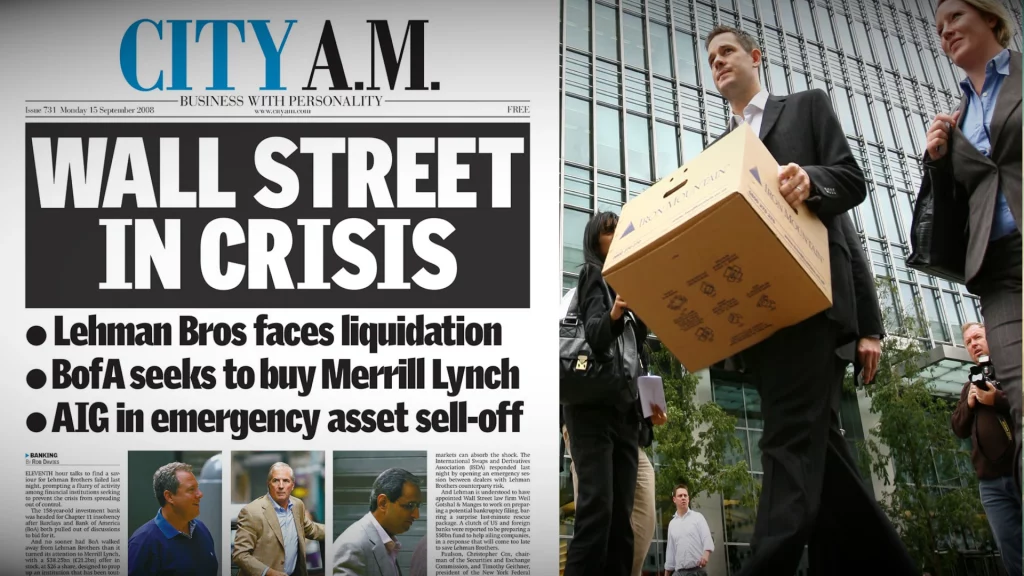

Since the 2008 meltdown many people feel like they’re navigating a maze blindfolded when dealing with traditional financial systems.

DeFi is built on open, fully transparent, public blockchain networks. Every transaction, rule, and system change is laid bare for all to see, creating a new era of financial transparency. Smart contracts, which form the backbone of DeFi platforms, are open source and auditable.

This means that users can verify exactly how a financial product works, what fees are involved, and how their money is being used. This level of transparency not only builds trust but also allows for community driven improvements and innovations.

High Costs, Fees & Slippage

The cost of financial services has been a significant burden for many, with high fees eating into savings and investments. Traditional banks and financial services often charge exorbitant fees for transactions, remittances, loans, and currency exchanges. These costs can be particularly punitive for small transactions or for individuals in foreign countries sending money back home.

Do you know what percentage you pay on getting your own money out of a cash machine abroad?

DeFi cuts out all the middlemen. Whether you’re sending money from anywhere in the world, taking out a loan, or making an investment, there will be a protocol which offers a cost effective alternative to traditional banks.

While it’s worth noting that blockchain transaction fees can sometimes be high during periods of network congestion, ongoing developments in scaling solutions are continually addressing this issue.

Snail Mail Pace

In an age of instant communication, why should financial transactions crawl at a snail’s pace? Traditional banking transactions can take days due to layers of intermediaries, especially when it comes to international transfers. The antiquated SWIFT system, still widely used for global transactions, can leave funds in limbo for days on end.

We continue to find uses for snail mail even though email has sped up communications over the last few decades. The same will eventually be true of tradfi institutions, we will still need a bank account but much of our funds in 20 years time will be stored on-chain.

DeFi transactions, especially on fast blockchains, are completed in seconds. The ability to move large sums of money quickly and cheaply is not just convenient; it will transform how businesses operate on a global scale.

Restrictive Bank Hours

The constraints of bank operating hours have long been a source of frustration. Traditional banks operate during limited working hours and may not be easily accessible, especially in remote areas. This can be particularly problematic in emergencies or for individuals working non standard hours.

Code never sleeps.

DeFi platforms, operate 24/7 and never close. Whether it’s the middle of the night or a bank holiday, your financial services are always at your fingertips. This round the clock access is convenient and allows for more efficient use of capital, as funds can be moved and invested at any time, potentially leading to better returns and more dynamic markets.

Centralized Counterparty Risk

Centralized control in traditional finance has led to numerous issues, from economic crises to the manipulation of financial policies. The 2008 financial crisis starkly illustrated the dangers of having too much power concentrated in a few large institutions. In traditional finance, economic crises or bank failures can lead to catastrophic losses and economic turmoil, while political tensions can result in account freezes or sanctions.

DeFi’s decentralised nature means there is no single party in control, significantly reducing the risks associated with centralised authority. This shift not only makes the system more resilient but also puts power back into the hands of the users.

In DeFi, you truly own your assets, with no central authority able to freeze or confiscate them. This decentralisation also makes the system more resistant to censorship and political interference, providing a level of financial freedom that was previously unattainable for many.

Lack of Innovation

Traditional financial systems are often closed source and slow to innovate due to regulatory burdens, legacy systems, and risk aversion. The process of introducing new financial products or services in the traditional finance world can be painfully slow, often taking years from conception to implementation.

DeFi, on the other hand, is a hotbed of innovation. Its open protocols and composability allow for the creation of novel financial products, pushing the boundaries of what’s possible in finance. The concept of “money legos” in DeFi means that different protocols can be combined in innovative ways to create entirely new financial products. This rapid pace of innovation is not just exciting; it’s driving the evolution of finance itself, creating more efficient markets and opening up new possibilities for wealth creation and management.