In this analysis we will be looking at Premia Finance and the potential of DeFi options protocols.

This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to Premia at time of writing. Do your own research, not investment advice.

What Are DeFi Options?

Decentralized options are financial instruments allow individuals to trade contracts in a permissionless environment.

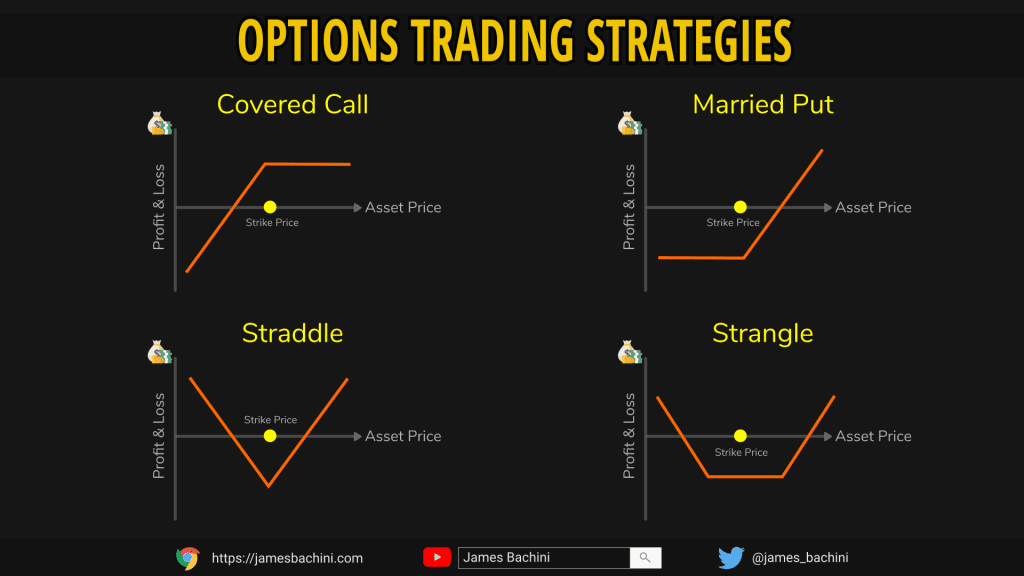

Options contracts give the buyer the right, but not obligation, to buy or sell an asset at a set price at a set time and date. A option to buy an asset for bullish investors is called a “Call Option”, a contract to sell an asset for bearish investors is called a “Put Option”. Options are either in the money or out of the money depending on the assets current price relative to the strike price.

In crypto Deribit has seen some success in creating widely traded markets for Bitcoin and Ethereum options. However this is a centralized exchange and we haven’t seen a leading protocol emerge for trading DeFi options at this time.

Traders can use options to express their thesis and market expectations in complex ways, hedge their exposure, return a yield on their holdings and better manage risk.

About Premia Finance

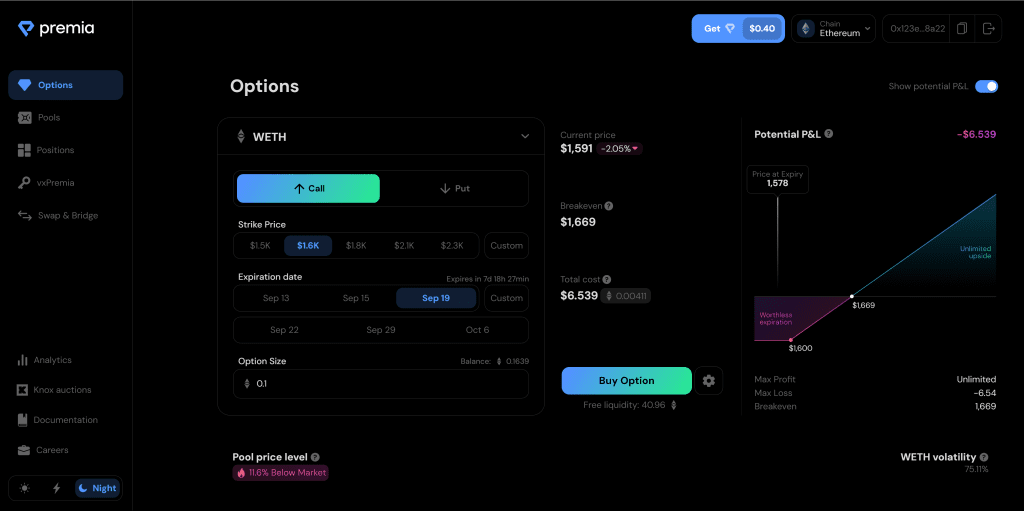

Premia Finance introduces a novel system for trading decentralized options through its unique peer-to-pool model. This provides users the ability to customize options in terms of strike prices and expiration dates, offering flexibility and the chance to exercise their options at any point before they mature.

Liquidity providers can earn yield from the premiums collected from underwriting options and see a consistent return via liquidity mining rewards. Moreover, Premia’s unique architecture enables liquidity providers to optimize their capital utilization, aiming to offer the most efficient returns.

Premia Finance does not impose any mandatory lock up periods. This empowers LPs to manage their assets efficiently, making them free to withdraw their capital at their discretion.

Premia gets price data via a synthetic IVOL (implied volatility) oracle which allows any smart contract to query on-chain data. This provides an accurate and reliable pricing mechanism which changes with each option trade.

Premia Tokenomics

The Premia token has a 100m total supply with currently only around 10% circulating. This is the distribution table:

| Description | Allocation |

|---|---|

| Cross-Chain Liquidity Mining Fund | 30% |

| Development Fund | 20% |

| Safety / Insurance Module | 10% |

| Initial Community Distribution | 10% |

| Founder Allocation | 10% |

| Future Incentives Program | 10% |

| Marketing and Education Fund | 5% |

| Ecosystem Grants Fund | 5% |

Premia tokens can be locked by users to receive vxPremia in return through a Curve value escrowed model.

Three main purposes of this model include governance, utility, and incentives.

- vxPremia holders can vote on platform proposals and submit their own

- Holding a substantial amount of vxPremia can result in trading fee discounts

- Premia tokens are given as rewards to liquidity providers on Premia for underwriting options, with each pool’s reward amount managed by the “Manifold Control” which is determined by vxPremia holders

The token hasn’t been performing well in a bear market, many altcoins have struggled. It’s mainly traded on Sushiswap against a WETH pair.

DeFillama is reporting the TVL at just below $3m whereas on Premia’s website it is reported at $880k.

Conclusion

There’s a lack of traders and demand for this type of product currently but options trades became very popular in tradfi markets with the Gamestop WallStBets saga.

While perpetual futures contracts will always hold the most potential, I believe we will see growth in DeFi options markets as well. These products are ideally suited to degen traders that want to make highly leveraged time sensitive bets on the majors.

Premia Finance has competition from Opyn, Hegic, Lyra and others. This is currently a crowded market with a severe lack of demand in a bear market. If/when crypto markets recover and speculation returns, demand will pick up and I’d expect at least one of these players to emerge successful.