Below I have outlined the reasons why I invested my kids college fund into pictures of cats and why CryptoKitties are my highest conviction bet in the NFT space.

Historical Significance

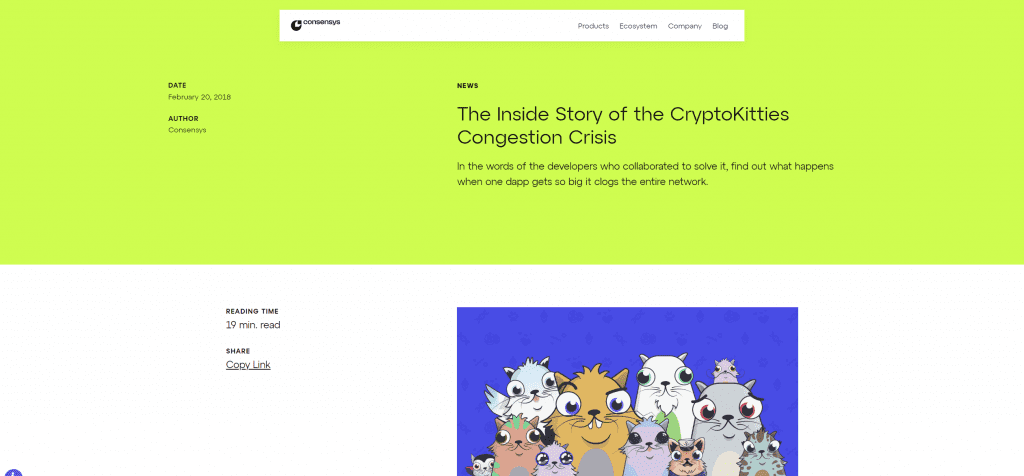

CryptoKitties hold a unique place in the history of blockchain adoption and NFTs. It was the first time I remember the Ethereum network becoming congested, and that was around Christmas 2017. The hype around CryptoKitties was so intense that it made getting transactions through impossible, marking a pivotal and frustrating moment when Ethereum found product market fit.

While other projects like CryptoPunks were launched earlier in 2017, they remained relatively niche and unknown at the time. CryptoKitties on the other hand became a mainstream sensation and brought a new wave of users to Ethereum who were setting up wallets for the first time.

This was the first web3 game that really took off and made waves, making it clear that the blockchain wasn’t just about finance and ICO’s which were popular at the time, it could be about fun, collectibles and breeding kittens too.

On the technical side, the CryptoKitties contract is based on the ERC721 standard, which was one of the first of its kind. This contrasts with the Punks contract, which wasn’t fully ERC721 compatible, leading to the reliance on wrapped Punks. There’s also a lot of custom functionality within the CryptoKitties contract that I haven’t fully explored yet.

The 2021 NFT Boom

Fast forward to 2021, and the NFT landscape had shifted, with much of the focus on projects like Bored Ape Yacht Club and, to a lesser extent CryptoPunks and CryptoKitties.

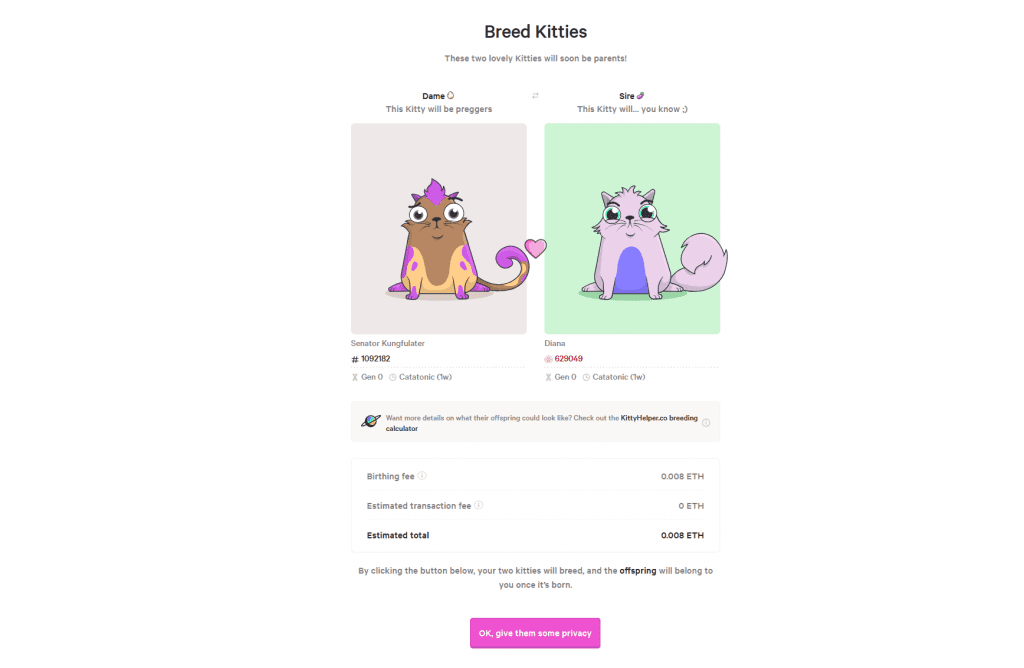

Unlike BAYC and Punks, CryptoKitties allows for breeding, which means there’s an unlimited number of them. This breeding mechanic, while innovative, decreases the digital scarcity that often drives the perceived value of NFTs.

The CryptoKitites game is built around this breeding program. Two original cryptokitties, known as Gen Zero or Gen0, can breed a new one with a combination of their traits which will be Gen One. Two Gen One NFTs can breed a Gen Two second generation etc.

There was a hard limit of 50,000 Gen Zero CryptoKitties but only 38,015 were ever minted (more than the 10,000 limits on BAYC and Punks), this higher supply reduces digital scarcity and perceived value.

This is part of the reason that Bored Apes stole the lime light in 2021, the scarcity and valuations captured the attention of a mainstream audience, I remember Paris Hilton buying an Ape and going on to release her own NFT series.

My general thesis is that NFT’s are cyclical and attention/demand will return. When that happens my bet is that Gen0 CryptoKitties will outperform Apes, Punks and other blue chip NFT’s for reasons outlined below.

Market Dynamics & Liquidity

The higher supply of 50k Gen0 CryptoKitties will take longer to be absorbed by long term holders. As time goes on people like myself will come in and take them off the market but this will play out slower than items that have greater digital scarcity.

There are 121,268 holders of all generations of cryptokitties, this is more than any other major NFT project to my knowledge with the exception of the Ethereum name service which are the .eth ENS domains.

The greater supply does bring some benefits as well. The price per item will always be lower than a punk making them more affordable to a greater percentage of the population.

I allocated capital between 0.019 and 0.03 ETH for gen0 cryptokitties which is about $50-$80 at time of writing per NFT. In contrast, a floor punk is currently $80,000 and an Ape is around $15,000.

Even with the greater supply these valuations seem completely out of line and it’s clear that Apes and Kitties are unloved compared to Punks. This is a mechanic of the non-fungible market place where valuations aren’t based on fundamentals, they are built on desirability and trends.

Liquidity is my biggest concern with investing in NFTs, if I buy one Bitcoin I can always sell one Bitcoin. If I buy an obscure NFT I can only sell it if I can find a buyer for that particular NFT or collection.

Gen Zero CryptoKitties offer some distinct advantages. They are a well known blue chip NFT which is sought after by a significant community of collectors. More importantly for me is the diversity in venues to buy and sell them:

- OpenSea

https://opensea.io/collection/cryptokitties

And other 3rd party NFT marketplaces. Not the best way to buy/sell in bulk but good UI for browsing and figuring out what you are looking for. - CryptoKitty Official Auctions

https://www.cryptokitties.co/search?include=sale&search=gen:0

Dutch auction system where the price decreases linearly over a user defined time period and band. - NFTX Kitty Vault

https://v2.nftx.io/vault/0x9b9fb226e98c4e90db2830c9aefa9cfcbe3b000a/buy/

At time of writing there are around 600 CryptoKitties in the vault, UI is awful but you can paste in the vault contract address as an owner and browser that way. - WG0 Token Vault

https://etherscan.io/address/0xa10740ff9ff6852eac84cdcff9184e1d6d27c057

Over 2400 Gen Zero Cryptokitties are locked in this vault with liquidity on Sushiswap and Uniswap. You can browse using the vault as owner again and keep a record of the UID’s you want. Then go to Etherscan and call the function:

burnTokensAndWithdrawKitties([123123],0xYourAddress)

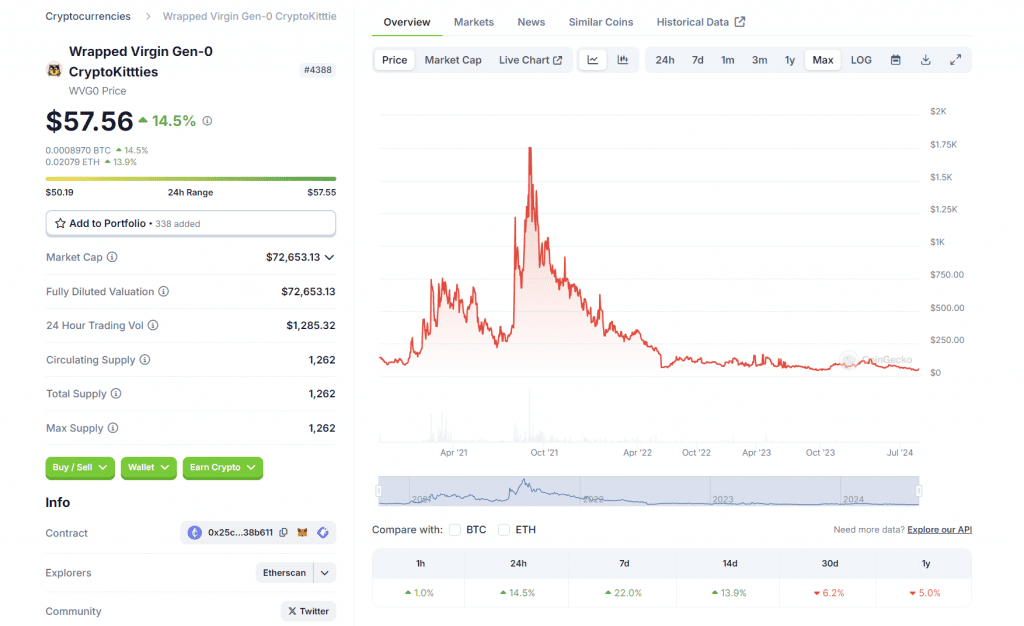

I had issues trying to put through more than one at a time which was painful. - WVG0 Token Vault

https://etherscan.io/address/0x25c7b64a93eb1261e130ec21a3e9918caa38b611

Over 1200 virgin Cryptokitties (that haven’t been bred yet) locked in the vault. Price is a little higher for the token. Works exactly the same as above. Must be a UI for these tokens somewhere but I couldn’t find much info. There’s a tracker on coingecko here: https://www.coingecko.com/en/coins/wrapped-virgin-gen-0-cryptokitties - WCK Token Vault

https://etherscan.io/address/0x09fE5f0236F0Ea5D930197DCE254d77B04128075

This is the bargain bucket of all and any cryptokitties. You’ll be lucky to find anything rare in here but there are some early ones. I purchased everything from this vault minted before the end of 2017 and it cost more in tx fees than token cost.

The token vaults can also be used to get a reasonable overview of price action over time… which is not a pretty chart.

I’ve made purchases across all the above venues, and if I were to sell, I’d have multiple options to spread the liquidity.

I put together some tools and scripts for interacting with the token vaults here: https://github.com/jamesbachini/CryptoKitty-Buyer

I’ll write about these in more detail in a later tutorial.

Cryptokitties are more liquid than many other NFT projects and this is important now and more so in the future, which we will discuss.

Brand & Virality

CryptoKitties are adorable digital cats on the internet, what’s not to love?

I don’t see them being used in the same way as BAYC or Punks, which have become status symbols and social media avatars. Instead, CryptoKitties have value as collectibles, more akin to digital Pokémon cards. Their appeal lies in their cuteness and the nostalgia of the early days of NFTs rather than in social signalling which is a big value add for Punks in particular.

They have already proven their ability to go viral once and the home run would be for them to regain attention and attract another wave of new collectors. However if that never happens it’s likely that they’ll continue to appreciate inline with the overall NFT industry due to their historical significance.

I spent more time than I care to admit looking at different cat jpegs trying to decide if someone could fall in love with this one or not. I think the aesthetics matter and if price appreciates like I expect it to then someone will need to really want this particular NFT to buy it in the future.

In a best case scenario if ETH appreciates to $20k and Gen Zero Kitties appreciate to 1 ETH then they will likely become attractive to larger investors as well. Crypto funds and high net worth individuals will value liquidity above all else.

In a worse case scenario there are more options and liquidity to exit the position. If I needed the funds in an emergency I could use the NFTX vault to cash out instantly at the floor price without listing and finding a buyer.

From a risk reward perspective in USD terms the $50 -> $20,000 best case scenario is a potential 400x return, anything over 100x is an obvious high risk low likelihood moonshot.

Timeframe & Outlook

I believe NFT demand will follow market cycles, with peaks in 2017, 2021, and possibly another one due in 2025 or 2029 or maybe it wont follow a strict four year schedule like Bitcoin but will come and go.

I’m prepared to hold these for a decade or more if needed, as I think NFT technology is crucial enough to eventually become the go to solution for a wide range of non-fungible digital assets. In the long run, early NFT projects like CryptoKitties could be looked back on as part of a renaissance period in the emergence of digital art and collectibles. 2017/2018 cryptokitties were right at the forefront of this and at the time they were the project that brought not only NFT’s but Ethereum to the masses.

CryptoKitties may not have the immediate scarcity driven value of BAYC or Punks, but they represent an essential chapter in the history of NFTs. Their liquidity, unique brand appeal, and historical significance make them one of the few things I expect may outperform a staked Ethereum position.

This is because the marketplaces are all priced in ETH so in dollar terms the price of a CryptoKitty NFT moves with ETH. I expect if markets start to pick up and we see another bull run, funds will move up the risk curve from Bitcoin to Ethereum to Altcoins & NFT’s. If attention comes back to cat jpegs the value will go up in ETH, which will likely coincide with ETH going up against the dollar in a bull run.

Gen Zero CryptoKitties are my highest conviction bet in the NFT space and I believe they are currently undervalued in the NFT sector which is also undervalued. Time will tell if this thesis plays out and the kids get to go to college (this is just a joke, don’t spend your kids inheritance, not investment advice).