Asymmetry Finance has emerged as a significant player in the liquid staking wars, offering an aggregated liquid staking token. This article explores the core functionalities of Asymmetry Finance and its core product safETH.

This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to Asymmetry products at time of writing. Do your own research, not investment advice.

Asymmetry Finance offers a managed portfolio of liquid staking tokens, leveraging algorithmic strategies that aim to optimize returns across a variety of different DeFi products.

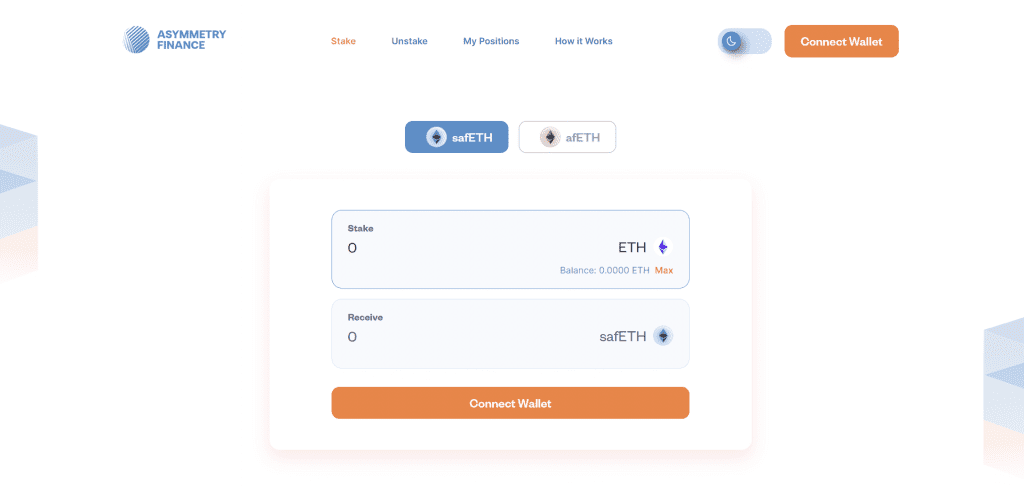

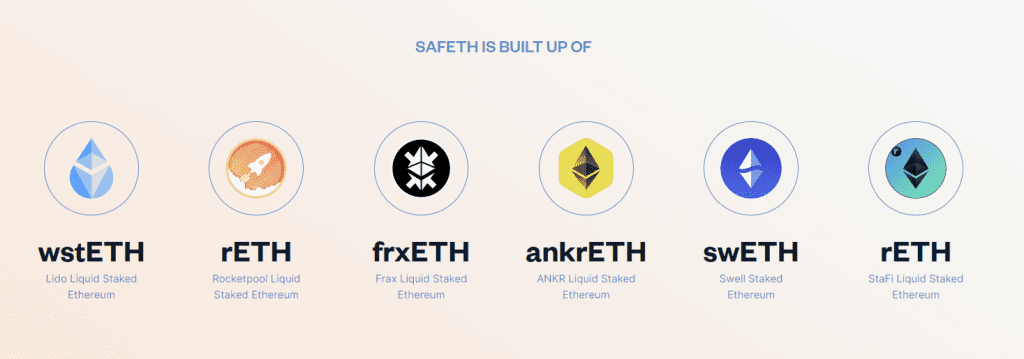

The primary offering of Asymmetry Finance is safETH. This provides users with exposure to a diversified basket of liquid staking products.

Users of safETH benefit from reduced risk of relying on a single staking product while contributing to the diversification of the overall Ethereum staking pool.

| Derivative | Symbol | Weight |

|---|---|---|

| Lido Finance Staked Ethereum | wstETH | 26% |

| Rocketpool Staked Ethereum | rETH | 27% |

| Frax Finance Staked Ethereum | sfrxETH | 27% |

| Swell Network Staked Ethereum | swETH | 15% |

| StaFi Staked Ethereum | rETH | 3% |

| Ankr Staked Ethereum | ankrETH | 1% |

Asymmetry Finance and its safETH product offer a compelling value proposition in the DeFi space. There are plans to launch additional products which use more complex strategies to combine volatile digital assets with stablecoins and rebalance based on market conditions. I assume this will work like a 60/40 stock/bond portfolio which is a product I’ve considered building myself for internal use.

I would like to see more of these types of vaults used throughout DeFi as their code is law style of investing can benefit retail investors taking away the potential for human misjudgments.

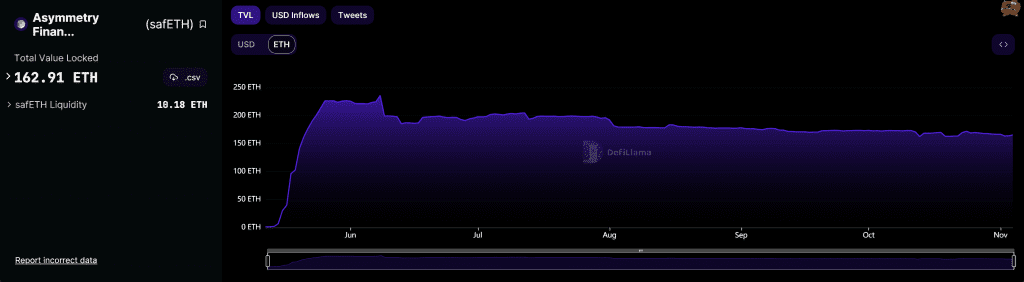

Traction is a concern as TVL in ETH terms has been dropping off since shortly after launch.

Another concern is the empty Github repository linked to from the website. The contract itself is available on Etherscan and verified, all be it behind a proxy contract.

There’s some interesting code in the contract such as this function which directs deposit collateral to the portfolio assets.

function doMultiStake(

uint256 _minOut,

uint256 price

) private returns (uint256 mintedAmount) {

if (enabledDerivativeCount == 0) revert NoEnabledDerivatives();

uint256 totalStakeValueEth = 0;

uint256 amountStaked = 0;

for (uint256 i = 0; i < enabledDerivativeCount; i++) {

uint256 index = enabledDerivatives[i];

uint256 weight = derivatives[index].weight;

if (weight == 0) continue;

IDerivative derivative = derivatives[index].derivative;

uint256 ethAmount = i == enabledDerivativeCount - 1

? msg.value - amountStaked

: (msg.value * weight) / totalWeight;

amountStaked += ethAmount;

uint256 depositAmount = derivative.deposit{value: ethAmount}();

uint256 derivativeReceivedEthValue = (derivative.ethPerDerivative(

true

) * depositAmount);

totalStakeValueEth += derivativeReceivedEthValue;

}

mintedAmount = (totalStakeValueEth) / price;

if (mintedAmount < _minOut) revert MintedAmountTooLow();

_mint(msg.sender, mintedAmount);

emit Staked(

msg.sender,

msg.value,

totalStakeValueEth / 1e18,

price,

false

);

}They have had a security audit by Zellic and there is a bug bounty on Code4rena.

There is mention of an ASF token with hints on their blog of an airdrop to safETH holders.

My gut feeling is this is an early stage project that has support from a whale or crypto fund which makes up the majority of the TVL. It will be worth monitoring to see if the new products being released can capture product market fit and propel ASF in to the big leagues.