The crypto market has experienced significant recovery this year, with Bitcoin’s value surging from $16,500 to over $40,000. Growth was shadowed by increased regulatory scrutiny, particularly impacting centralized exchanges.

The Bitcoin halving in April 2024 is poised to be a pivotal event, historically triggering market rallies. The potential January approval of Bitcoin spot ETFs could usher in substantial institutional capital. Furthermore, the expected Fed interest rate reversal and Ethereum’s EIP4844 upgrade in April are key factors contributing to the market’s dynamics.

In this thesis I explore the emerging opportunities in the crypto market and discuss how I’m thinking about and positioning for the next stage of the market cycle.

Download PDF:

🔗 Crypto Market Thesis 2024

Published in HTML Format below as well.

Executive Summary

2023 marked a recovery phase for the crypto market, with significant price appreciation across digital assets. Bitcoin started the year at $16,500 and is ending it above $40,000 USD.

Regulatory threats intensified, impacting the industry, particularly the centralized exchange landscape with US exchanges such as Coinbase likely to benefit.

The upcoming Bitcoin halving in April 2024 is expected to influence market dynamics significantly, as it has historically been a catalyst for market rallies.

The potential approval of a Bitcoin spot ETF in Q1 could open the market to institutional investors, with expectations of a significant inflow of capital as ETFs fill up.

It’s an election year and the expected FED reversal of interest rate hikes is anticipated to positively impact risk assets, including cryptocurrencies.

Ethereum is expected to maintain its market leading position in the smart contract space. The EIP4844 upgrade, expected in April, is significant for Ethereum’s long-term scaling efforts and directly benefits transaction costs on L2’s.

DeFi remains a key sector with potential for growth, particularly in areas like real world asset tokenization and liquid staking derivatives where sustainable business models are being established.

2023 Year In Review

Following a rough previous year, 2023 has been all about recovery and a slow grind up for crypto markets. Most assets have doubled or tripled in price while market sentiment has been negative to neutral for most of the year.

Technical developments have been few and far between with notable exceptions of account abstraction and progressive web apps starting to appear and gain traction.

The thesis laid out last year was largely accurate with regulatory threats being rolled out into a full scale offensive against the industry. Out of the four narratives I highlighted, 3/4 have gained the expected attention from the community (Liquid Staking Derivatives, Zero Knowledge Technology, Real World Assets, Decentralized Data). The biggest failure was to foresee how important the spot ETF approval was to the market and Bitcoin’s outperformance in terms of risk adjusted returns.

AI exploded on the scene this year with ChatGPT finding product market fit. This has taken some attention and developer focus away from blockchain technology, rightfully so.

The US SEC & DOJ have been “cleaning up the industry” prior to the expected approval of a Bitcoin Spot ETF. Sam Bankman-Fried of FTX was convicted on fraud charges and CZ of Binance was forced to step down.

In the final months of the year we have just started to see the return of retail interest and demand for leverage on futures exchanges. Sentiment and markets feel in neutral territory between the extremes of the 2022 meltdown and the previous bull cycles.

Altcoins have had a tough year relative to the majors with many underperforming. Solana has been the notable exception outperforming with a 600%+ return YTD. Traders have been waiting patiently for the elusive alt season which is a period of peak opportunity in crypto markets.

The perception of cryptocurrency in mainstream media and traditional finance is shifting. There is far less negative talk from institutions and politicians, with the spot ETF likely to move it further towards a respected asset class.

In summary the blockchain sector has been through a period of recovery and consolidation. The industry lies at a critical juncture over the next few years and many participants, including myself, are excited about 2024 and beyond.

Four Year Cycle Dynamics

The Bitcoin halving event will take place in April 2024. This pivotal moment is when the supply going to miners is cut in half, reducing the distribution and inflation of the network. Halvings happen once every four years and over a small data set they have previously been catalysts for market rallies.

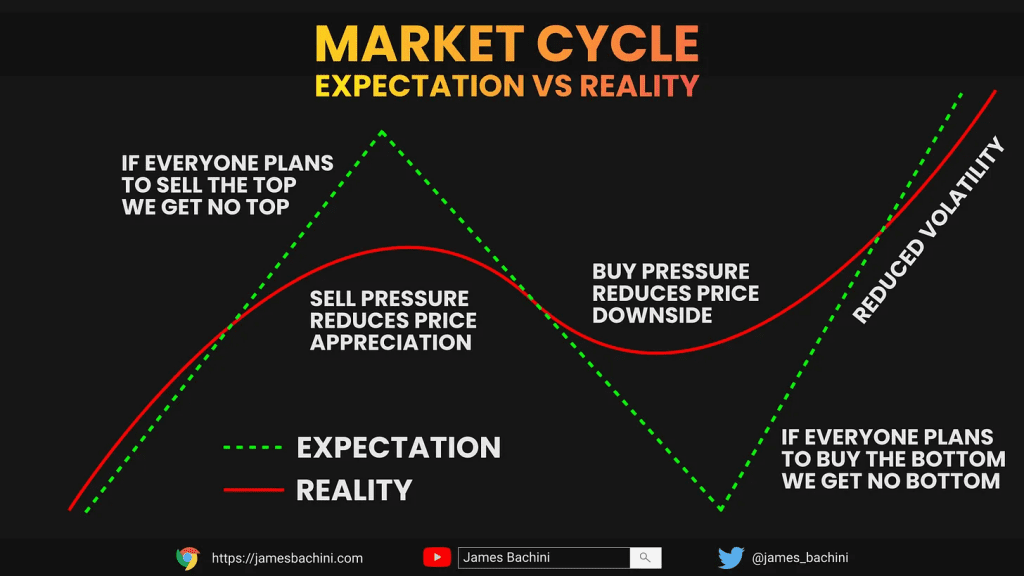

The four year cycle will not last forever but until it breaks it is expected to significantly influence market dynamics over the next two years. The industry is pricing this in with many long-term holders buying low to and hoping to sell into the next crypto bull market.

One major concern is that this has become a crowded trade and there could be significant resistance on the approach to the $100k level if Bitcoin reaches these heights. Considering where we were a year ago, this seems like a good problem to have.

ETF Approval & Implications

The potential approval of a Bitcoin spot ETF (exchange traded fund) would mean that Bitcoin can trade on the New York Stock Exchange. This opens up crypto exposure to a new audience of deep pocketed institutional investors, family offices and hedge funds.

Some expect this to go through as early as January 2024. The short-term trading could go either way with either a big move up or a classic “sell the news” scenario. Long-term I expect the ETF’s will fill up creating excessive demand on exchange at a time where new supply is getting cut due to the halving.

If money does pour into Bitcoin it’s hard to see the profits not being distributed up the risk curve to altcoins at some point. Blackrock has also registered an Ethereum spot ETF application which is expected to go through later in the year and there could be a rotation into ETH and other digital assets.

Macro Economic Factors

2024 is an election year for the US with debates starting in September and the Presidential election taking place in November. The FED is expected to reverse it’s rate hikes and the S&P500 looks set to make new all time highs. This is all positive for risk assets including cryptocurrencies which have become heavily influenced by macro factors.

Return of Leverage Trading

We are starting to see a resurgence of leverage trading in crypto markets. This will undoubtedly increase the further price moves towards previous all time highs. The knock on effects of leverage in the system are:

- Funding rates making cash and carry trades more appealing

- Potential for liquidation cascades and more volatility

We still aren’t seeing any projects gain major traction with decentralized perpetual futures trading although this seems to be a killer use case if someone can get the UX to compete with centralized exchanges.

The World Computer

I expect Ethereum to maintain its status as market leader in the smart contract space, despite being somewhat out of fashion. For developers Solidity and EVM blockchains have become the de-facto choice, it would be nice to see a viable competitor emerge in 2024.

ETH the asset has established a deflationary model due to burning fees more than offsetting staking rewards:

Ethereum’s EIP4844 upgrade, set for April, will significantly reduce Layer 2 transaction fees, with Arbitrum leading currently and ZK rollups emerging.

Solana’s resurgence is noteworthy, as its price appreciation brings more attention and potentially more development activity.

I believe the end game will be enshrined roll ups acting as the Ethereum mainnet with native interoperability between them and the original layer 1. This is perhaps still 5-10 years away so there is room for a competitor to emerge.

SocialFi & GameFi Developments

The fleeting success of Friend.Tech underscores the potential for a decentralized social network and emerging sub-sector in GameFi. The friend.tech execution was somewhat questionable but the app showcased several UI breakthroughs.

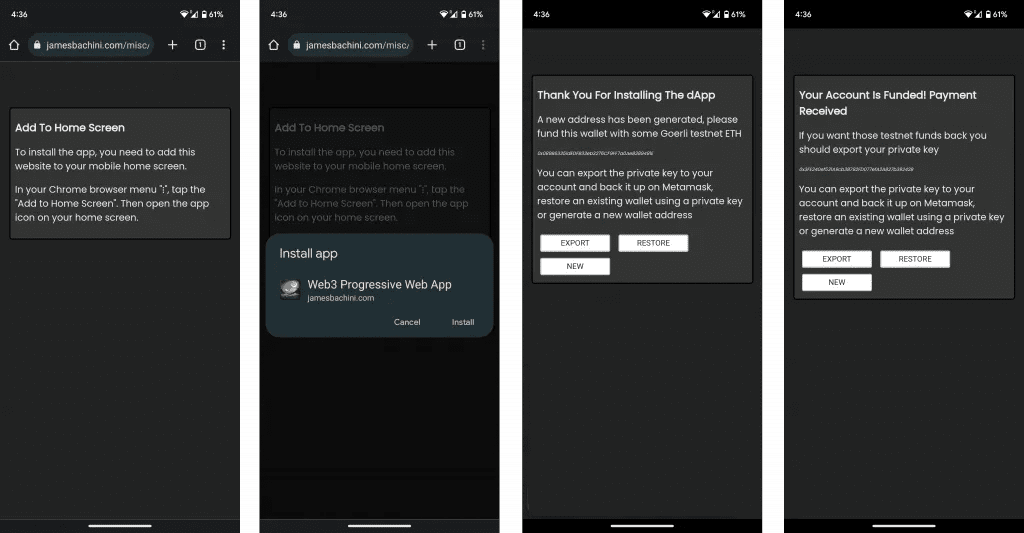

Progressive web apps – bypass the restrictions and fees imposed by Google Play and Apple’s App store. To date web3 hasn’t really broken into the mobile app world and most transactions are still executed on desktop browsers connected to Metamask. Mob3™ is coming and it could happen very quickly if something finds product market fit and a viral coefficient.

Account Abstraction – while not a full integration friend.tech abstracted away the requirement of a 3rd party digital wallet. 2024 will see various dApps utilize more impressive account abstraction features such as bundlers & sponsored transactions to execute smart contract functions at the click of a button.

The transformation of Twitter into X, an “everything app” is significant. When cars go fully driverless Elon has a market advantage of being able to deploy a fleet of vehicles for your taxi and food delivery requirements. Further to this I expect mobile banking apps and X to establish methods of storing value in crypto assets and only converting them to fiat when paying for local goods.

Crypto Exchanges

US regulatory aggression disrupted the exchange landscape. Binance’s legal challenges & hefty $4 billion fine signify a period of intense regulatory scrutiny and offers the chance to champion home grown, compliant exchanges.

Coinbase as a US public company is more aligned with regulators and positioned to benefit from the anticipated retail influx in the next bull market and potential business from Bitcoin ETF’s. $COIN stock was the best performing asset in my ISA (tax free wrapper) last year and I continue to hold.

Uniswap’s shift towards a more centralized model, including RFQ systems, frontend fees and censorship, may open opportunities for new decentralized exchanges to capture pockets of market share, despite Uniswap’s significant first mover advantage.

Tier 2 exchanges like MEXC, Gate, and Kucoin could gain prominence by being the first to list microcap cryptocurrencies, which larger exchanges can’t touch through fear of regulatory response.

DeFi Sector Prospects

Despite currently being out of fashion, DeFi is too important to remain subdued.

Real world assets are gaining traction as treasury bond yields have been making their way into tokenized products. This opens the door for more niche asset classes to be tokenized and sustainable business models to be created.

Liquid staking derivatives offer an easy way to get staking rewards on top of layer 1 holdings such as ETH, SOL, MATIC. The dominance of Lido finance in this field has attracted criticism as they approach the 33% market share threshold. I still hold both stETH and the LIDO governance token but am looking to diversify my holdings further in 2024.

In regards to Stablecoins, USDT is still the market leader and has strong positioning as a base asset for many top centralized exchanges. I believe they are a strong candidate for regulatory scrutiny which could be beneficial to the market share of USDC, DAI and potential new entrants.

What Is Next In DeFi?

I don’t have a good answer to what DeFi summer 2.0 will look like or how it will start but I believe an opportunity will present itself in the next couple of years. If Bitcoin can go on to make a new all time high in 2024 or 2025, attention will come flooding back and emerging technology in DeFi and across the blockchain sector will benefit.

Projects with good tokenomics and low fully diluted valuations will outperform. New will outperform old. TVL and traction will provide signal through the noise.

I plan to continue researching new protocols and use my experience as a developer to identify +EV opportunities as they emerge.

There’s a full list of research and analysis posts here:

https://jamesbachini.com/category/blockchain/analysis/

Opportunity & Positioning

As we go into 2024 my portfolio is weighted towards Ethereum and its ecosystem. I expect a staked Ethereum position to outperform over the next 10 years as the world computer has fundamentally more utility than any single cryptocurrency.

I will continue to research new digital assets and take opportunistic swing trades to take advantage of market narratives and emerging technology.

| Staked Ethereum | 57% |

| Bitcoin | 30% |

| RocketPool RPL | 2% |

| Lido Finance LDO | 2% |

| Conic Finance CNC | 2% |

| Lybra Finance LBR | 2% |

| Polygon MATIC | 1% |

| Early Stage Micros/Locked/Vested | 4% |

I’m not holding any significant amount of stablecoins and have been fully allocated since late 2022 although there is room to distribute more BTC/ETH to higher beta altcoins.

My long term plan is to rebalance back to a 60/40 crypto/stablecoin position during any future potential bull market with Bitcoin price targets between $90-240k. This is no doubt a crowded trade and the plan is susceptible to change.

When rebalancing I’ll be looking for sustainable yield bearing stablecoins and delta neutral positions, notably cash and carry trade using stETH as collateral.

Potential Narratives

zkEVM Layer 2’s

Zero knowledge technology will play an important part in the future of blockchain technologies. EIP4844 will make transactions on these chains cheap and emerging zero knowledge rollups could gain significant traction as they incentivise adoption of their ecosystems at the application layer. This would be my best guess right now as to where a new DeFi narrative might emerge.

Bitcoin Ordinals BRC20 Tokens

The tech side of this is awful but that doesn’t mean it’s not +EV. One Bitcoin core developer suggested ordinal spam could be removed via a hard fork which would likely create a significant chain split which we haven’t seen since 2017. With all this drama and attention from the halving and spot ETF’s, BRC20 tokens could see significant upside if retail catches on.

Decentralized Stablecoins

Stablecoins found product market fit and Tether is making in the region of $5B USD annually by taking dollar wire transfers and investing them in treasuries in exchange for minting an ERC20 token. This is big business and I expect the SEC will take a closer look and perhaps start litigation next year. This opens the door for USDC and decentralized stablecoins with MakerDAO’s DAI, Curves crvUSD and Aave’s GHO all potentially benefiting. My hope is we see a new project establish market share with a truly decentralized model that scales.

Mob3

The combination of account abstraction and progressive web apps opens the door for mobile applications to integrate web3 technology. I don’t know if this will be in the form of a social network like Friend.Tech or a viral game like Pokemon Go (with an in-game economy) but I expect there to be significant developments and opportunities in this area. If something takes off it will likely establish an exponentially growing user base very quickly so anyone looking to allocate capital will need to be able to do so at short notice.

| The Blockchain Sector Newsletter If you enjoyed this and want to stay up-to-date with my market commentary and developer insights consider subscribing to The Blockchain Sector Newsletter at: https://bachini.substack.com 🍾 100% free forever 🥂 No subscription required “The blockchain sector covers the entire market of digital assets from layer ones to the latest and greatest DeFi protocols and emerging technologies” |

| Disclaimer The information provided is for general informational purposes only and is not intended to address your specific financial needs or provide personalized investment advice. I am not a financial advisor, this is not financial advice. I do not endorse any third-party projects or make any guarantees or recommendations about their performance. It is your responsibility to do your own research and seek independent financial advice before making any investment decisions. Please note that investing in cryptocurrencies and other digital assets carries inherent risks, including but not limited to price volatility, liquidity issues, and the potential for loss of your entire investment. Past performance is not indicative of future results. Any pricing and performance data contained in my publications is obtained from various sources believed to be reliable, but I cannot guarantee its accuracy or completeness. Any opinions expressed may change at any time and you should independently verify all facts. Do not make investment decisions based on the information provided. To the full extent of the law I can not be held liable for any losses or damages resulting from your reliance on the information provided. Any arrangements you make with third parties named on the site are at your own risk and responsibility. Your investments are your sole responsibility and you acknowledge that you use the information provided at your own risk. |