This definitive introduction to DeFi will take you from the very first days of Bitcoin all the way through to explaining the latest technologies emerging in sector.

If you are looking for a quick overview start here: DeFi Explained | An Executive Summary

This content is also available as a compiled eBook which is available to download for free.

Direct Download Links

PDF Format (Any Reader)

https://jamesbachini.com/resources/DeFiDemystified.pdf

ePub Format (E-Readers)

https://jamesbachini.com/resources/DeFiDemystified.epub

MOBI Format (Kindle)

https://jamesbachini.com/resources/DeFiDemystified.mobi

Chapter 1 acts as a primer on the underlying blockchain technology that DeFi is built upon. Without Bitcoin there would be no Ethereum, without Ethereum there would be no DeFi. The world was always going to move towards digital assets but these two breakthroughs provided the foundations for the explosion in decentralised finance.

In the coming years I believe we will see a migration of users towards consumer focused mobile banking applications that use DeFi on the backend to offer financial services. Over time there fare going to be more traditional finance companies such as banks and hedge funds start to explore the opportunities in DeFi.

The markets are currently immature, the technology is in it’s infancy. This increases both the risk and potential reward for early investors in the sector.

Understanding the technology is essential to understanding which projects will gain traction in the long term and will be part of this financial revolution.

DeFi Explained | An Executive Summary

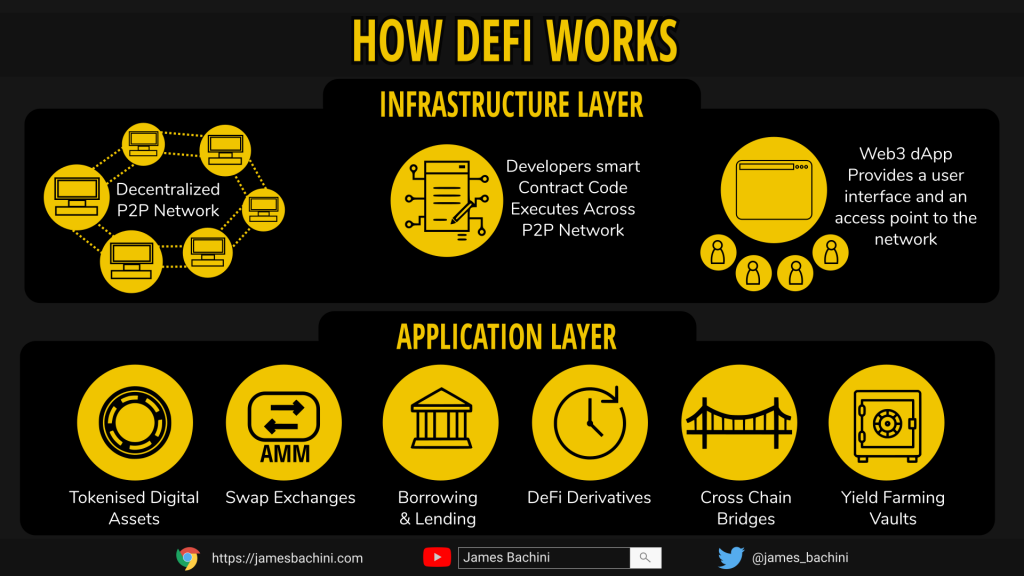

For a quick understanding of the DeFi sector we can break down the tech in to two areas, infrastructure and application layers.

DeFi Infrastructure Layer

The infrastructure for DeFi runs on a peer to peer network much like torrent or napster (for want of a better example) networks where each computer connects to another computer on the network to share information.

On Bitcoin they share transactional information about who is sending who funds. On Ethereum each node runs a virtual machine which is a isolated computer program that executes 3rd party code. Developers can deploy their smart contract code to the network and all the computers on the peer to peer network will execute it. Small amounts of data can be stored on the network as well.

For non-developers a web based user interface is provided. They can simply connect a web browser to the platforms website. Then funds can be deployed from a digital wallet which is often a browser plugin. The wallet is connected to the website, the website connects to the smart contracts and transactions and functions can be executed at the click of a button.

DeFi Application Layer

The application layer is built on smart contract backends and web3 dapp fontends much like traditional web development is built on databases and user interfaces.

At this point everyone has heard of tokens and there are two main types to be aware of.

- Fungible tokens = All the same My Bitcoin = Your Bitcoin

- Non Fungible Tokens (NFT’s) = Unique ownership rights, no one has the same NFT as me

Fungible tokens are swapped on automated market makers the most famous of which is Uniswap. These enable investors to deploy liquidity pools containing two digital assets and then traders can swap one for the other.

Borrowing and lending platforms enable users to take out over-collateralised loans and investors to gain a yield on their holdings.

DeFi derivatives are similar to traditional finance futures and options products except they use digital assets.

Ethereum isn’t the only network to create a booming DeFi ecosystem and as we see new emerging blockchains compete the ability to transfer funds between blockchains has become big business.

On top of all these building blocks developers can deploy yield farming strategies and vaults to programmatically move funds around to gain the best yield possible on their digital assets.

The expansion of DeFi is the biggest opportunity I’ve ever seen and I’m focusing on exploring, learning, investing and trading in these markets. I’ll also try and share as much as possible along the way so subscribe to my YouTube channel and connect with me on Twitter.

https://www.YouTube.com/c/JamesBachini | https://Twitter.com/james_bachini

If you’ve enjoyed these resources could you help share this content on social media and send it to anyone who you think might benefit from it.

Thank you.

Disclaimer: Not a financial advisor, not financial advice. The content I create is to document my journey and for educational and entertainment purposes only. It is not under any circumstances investment advice. I am not an investment or trading professional and am learning myself while still making plenty of mistakes along the way. Any code published is experimental and not production ready to be used for financial transactions. Do your own research and do not play with funds you do not want to lose.