This article is derived from a chapter in the free eBook explaining DeFi technologies:

DeFi Demystified | An Introduction To Decentralized Finance

If smart contracts form the back end brains of a DeFi platform then dApps or decentralized applications form the front-end that we interact with as users.

In theory dApps can be compiled from source code and run locally without needing a central point of access. In practice the compiled code is uploaded to a website which serves as the access point for the DeFi application for the vast majority of users.

The Evolution Of Web3

The web was built as a publishing portal based on print media which was considered Web version 1.0. After the dot com boom and bust the web evolved to web 2.0 where social media networks revolutionized the space. Users create, share and consume their own content.

Social media giants emerged providing services in exchange for our personal data to improve their advertising targeting. Web 3.0 according to Ethereum “refers to decentralized apps that run on the blockchain”. The concept promises social networks with no central entity in charge, there is no one to profit or monetize our personal data.

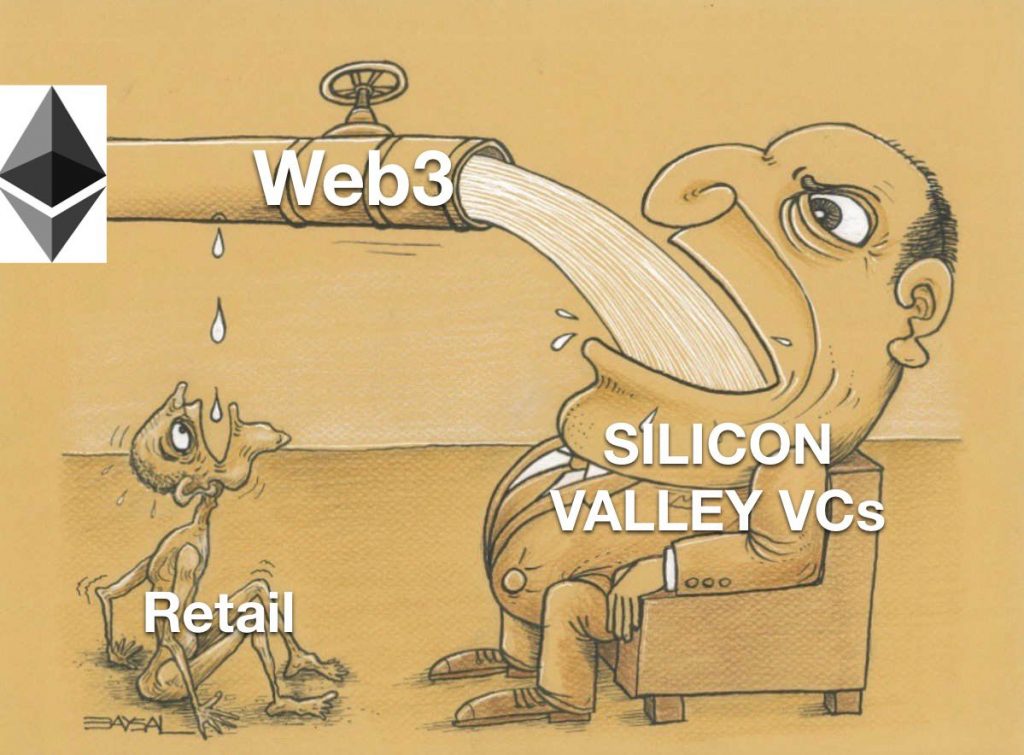

Web3 has come under some criticism recently, most notably from Twitter founder and Bitcoin maximalsist

Jack Dorsey. He highlighted the impact of VC funding rounds on early stage blockchain projects and the negating effect it had on decentralisation.

How dApps Are Built

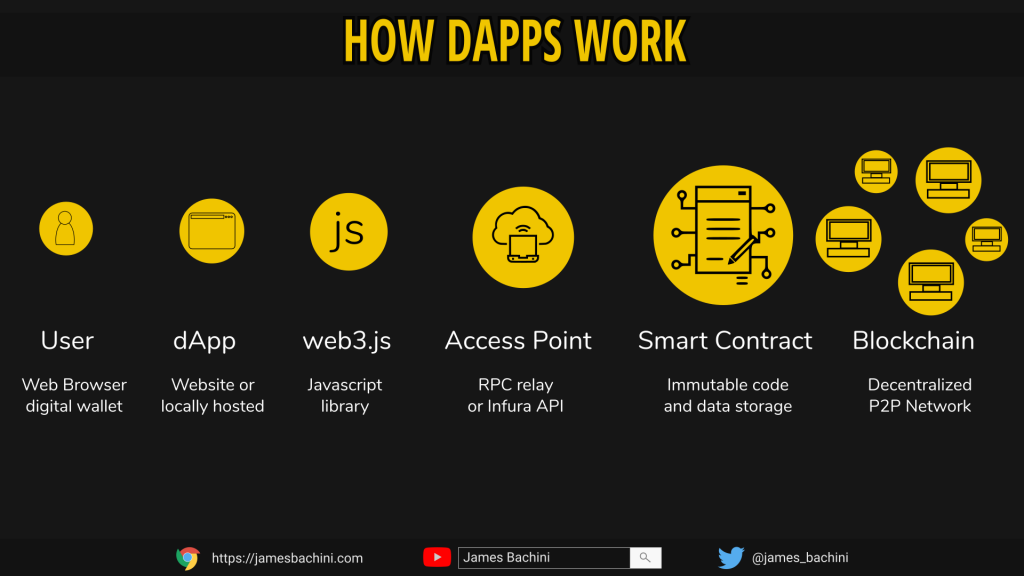

Decentralized applications are built using the same frameworks as existing websites. A web or app developer will import a Javascript module such as web3.js or ethers.js which will provide a library of tools to build on. The module will connect to a node on the Ethereum network, often via a service provider called Infura.

The developer will provide a mechanism to connect a wallet to the application which the end user will need to confirm. They can then execute complex smart contract functions at the click of a button.

The entire blockchain sector is built around the concept of decentralization. This means that a network has no central point of failure and is instead built around equal peers. Decentralization is not a binary concept and networks can become more or less decentralized over time.

Often blockchain technologies start very centralised with a developer as the central point of failure. Over time the network builds and momentum dissipates control.

“It’s clear to me now that Ethereum is the new currency of the Internet. It’s way ahead of where Paypal was in its day, and it’s much more exciting to its customers than Paypal ever was.” Gil Penchina

An Existential Threat To DeFi

I am as guilty as anyone of using centralised web interfaces instead of compiling front ends from source.

It’s so much easier to go to Uniswap’s website and interact with smart contracts via a nice web interface running on AWS.

However there are multiple concerns over centralisation here. The vast majority of users keep their funds in Metamask which is a ConsenSys owned product. The wallet connects to the Ethereum network via an API provider called Infura which is also owned by ConsenSys. Infura is a single point of failure where if there was a denial of service attack on their infrastructure it would make DeFi almost unusable for the vast majority of market participants.

Probably more of a threat than denial of service attacks is regulation. ConsenSys is a large corporation that has to oblige with any regulations law makers can come up with. The SEC is being particularly aggressive with a regulation through enforcement policy and large companies in the industry are easy targets.

This is in no way a criticism of ConsenSys themselves who have done more than anyone to bring DeFi to the masses. At some point though it may be worth thinking about why we are all here in the first place and how we can build better decentralised infrastructure either on top of existing web technologies or as a separate entity.

This article is derived from a chapter in the free eBook explaining DeFi technologies:

DeFi Demystified | An Introduction To Decentralized Finance