This article is derived from a chapter in the free eBook explaining DeFi technologies:

DeFi Demystified | An Introduction To Decentralized Finance

USD stablecoins have become big business with over $100 billion of collateral locked in USDT and USDC alone. This article dives in to how stablecoins work, the different types and looks at some of the most popular and remarkable stablecoins on the market today.

How Stablecoins Work

Stablecoins are a form of ERC20 token which aims to match the price of an underlying asset. Usually they are pegged losely to the USD and provide a critical role in the DeFi ecosystem.

- Traders will hold stablecoins when they want to remain neutral in uncertain markets.

- Yield farmers will deposit stablecoins to gain a yield on a low risk asset.

- Automated market makers often use stablecoins as a base asset instead of ETH.

Collateralised Stablecoins

Collateralised stablecoins have a simple business model. Take payment and hold collateral then issue a token to represent the value of that collateral on chain.

Examples of collateralised stablecoins include USDT and USDC. A company will issue new tokens when receiving payments via bank wires. They will also accept tokens in return, burn them and issue a payment as part of a withdrawal process.

The issue with this business model is that it is centralised around a single corporation that is responsible for managing the collateral. Enter algorithmic stablecoins which aimed to decentralise the issuance of stablecoins.

Algorithmic Stablecoins

The issues with centralised custodial stablecoins led naturally to the concept of a decentralized alternative. Algorithmic stablecoins are smart contracts which aim to track the price of an underlying asset such as the USD.

These often work with two pools of capital a high volatility native token and the stablecoin token. The aim is to smooth out price swings in the stablecoin via incentive mechanisms using the high volatility asset.

Issues arise if confidence is lost in the protocol as there is no guarantee the asset will always be valued and traded at $1. Shortly after the launch of FEI the valuation dropped to below $0.8 due to unprecedented supply hitting exchanges and a rush to exit.

Stablecoins Compared

Obviously no stablecoin is perfect and most have derived from their peg to some degree at some point in their history. The following are all currently traded at $1 and this document outlines some of the key and unique features that have made these stablecoins so popular.

USDT

The most widely used stablecoin has always been USDT. US Dollar Tether isn’t decentralized at all, it’s a token backed and managed by centralized exchange Bitfinex. A company will send a bank wire to Tether Holdings Limited and they will mint and send USDT tokens in return. The tokens can be withdrawn by sending them back, where they’ll be destroyed in a process known as burning, and the funds will be sent back in real US dollars.

15 October 2018

The value of USDT dropped to $0.90 after growing concern over the ability of Bitfinex to pay back more than two billion USDT in circulation. In theory it should be a simple business model, hold the funds until they want redeeming. However federal prosecutors were investigating Bitfinex for using the funds to provide liquidity for their other business operations and manipulate the price of Bitcoin.

Today there is more than 70 billion US dollars of tether in circulation. It is still a controversial and concerning issue for the industry although tether have gone some way to providing audits on their reserves and holdings.

USDC

USDC is a direct competitor to USDT which has grown in popularity, partly due to the legal issues Bitfinex faced. USDC or USD Coin is managed by Circle and Coinbase.

UST

UST is the stablecoin of the Terra/Luna ecosystem. It has become a $10 billion dollar asset thanks to great lending rates available on Anchor Protocol.

The currently APY for lenders of UST is 19.46% which far outweighs anything available in traditional finance.

Note that the SEC is currently investigating the Terra protocol. It’s believed this is mainly focused on Mirror protocols synthetic assets but that investigation will possibly cover Anchor and UST as well.

MIM

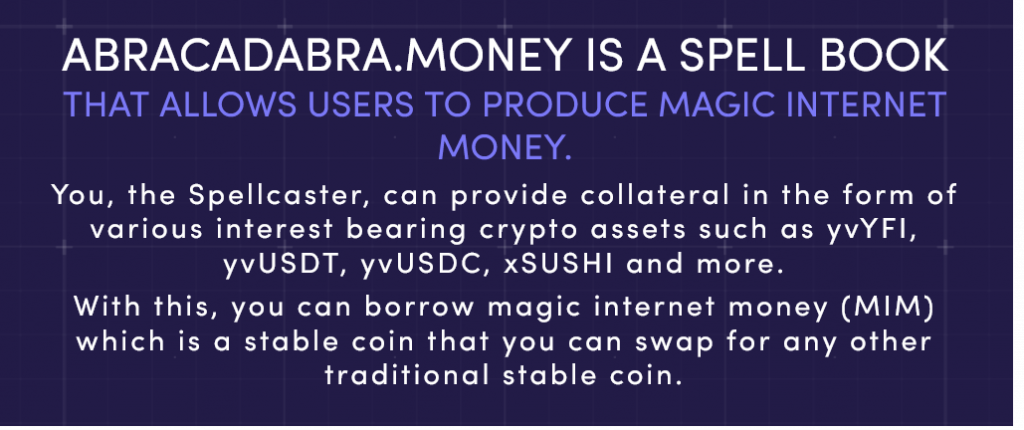

MIM stands for magic internet money and is the creation of blockchain developer Daniel Sestagalli. It’s another high yielding stablecoin on lending platforms like abracadabra.money

MIM is one of the big players in the Curve Wars where protocols are fighting for voting rights to create liquidity.

DAI

DAI was launched in late 2017 by MakerDAO and immediately underwent a stress test as the crypto markets crashed. It was perhaps the first decentralized finance protocol to gain attention and adoption.

Today DAI has lost much of it’s market share to new entrants in the markets but it was seminal for stablecoin and general DeFi technology.

FRAX

Frax pioneered a fractional reserve system which combines collateral and algorithmic stablecoin technology. It is community governed via a DAO and uses oracle price feeds to maintain it’s peg to the US dollar.

The project has two tokens the FRAX stablecoin and a FXS governance token which receives fees, seigniorage revenue and excess collateral value. FXS is a speculatively traded DeFi token and is highly volatile in terms of price. FRAX is the stablecoin pegged to the USD and should always trade at $1 in theory.

This article is derived from a chapter in the free eBook explaining DeFi technologies:

DeFi Demystified | An Introduction To Decentralized Finance