This article is derived from a chapter in the free eBook explaining DeFi technologies:

DeFi Demystified | An Introduction To Decentralized Finance

The token economy is the accelerating migration of assets into the digital world. One of the first breakthroughs for Ethereum was a smart contract that facilitated the creation and transfer of tokens. Anyone who has ever run a startup will know the quest to reach product market fit. For Ethereum the token economy gave them their zero to one moment.

Understanding The Token Economy

Token contracts could be broken down into two categories:

- Fungible tokens where any one token was equal to another held by someone else on the same smart contract ledger.

- Non-Fungible Tokens (NFT’s) where the token was unique, a one of a kind digital asset.

From then on the majority of new projects in the blockchain space launched with their own token. In the future we might see everything tokenised in to a digital asset, stocks, bonds, real estate. Any contractual stake in a real world entity may eventually end up on-chain.

5th April 2017

I had followed Bitcoin’s development for some time however in 2017 something changed. It wasn’t just a single use electronic cash system any more. New projects were launching on a day to day basis. Blockchain technology seemed to be on the verge of disrupting every industry on the planet.

There was a boom in initial coin offerings or ICO’s to sell tokens to the public. Some of these tokens would double, quadruple or more overnight. Speculation ran rithe and I was drawn into expanding my portfolio of digital assets into more and more risky investments.

The ICO boom ended in disaster around the start of 2018 as the booming crypto markets came crashing back down to reality. Bitcoin went from $20k in December 2017 to $6k in February 2018. More risky altcoins and ICO tokens lost the vast majority of their value, some being wiped out completely.

An altcoin is any cryptocurrency other than Bitcoin. It stands for alternative coin and stems from when Bitcoin completely dominated the markets.

There are currently over 10,000 individual tokens and coins listed on the industry tracking platform CoinMarketCap. Of these over half use a variation on an Ethereum smart contract known as an ERC20 token. All of these tokens are controlled and powered by Ethereum’s global network of mining nodes. The ERC20 token template contains functions to create, transfer, approve spend and check balances.

Developers can take an ERC20 template code, change the name, ticker and total supply of tokens and deploy it to the blockchain in under an hour. It gave digital businesses a new way to raise funds and gain early traction building communities.

NFT’s – Non-Fungible Tokens

NFT’s are unique tokens deployed via a smart contract. Whereas a normal token is exchangeable for another just like it, a non-fungible token is a one off. NFTs are used to represent and transfer ownership of metadata often linked to digital art and collectibles.

Many market places and NFT portals provide web based applications for creators to easily mint NFT artworks without ever interacting with the underlying code. A creator may take a jpg image, upload it to Opensea or Rarible and mint an NFT.

A creator must pay the transaction fee to mint an NFT because it deploys a smart contract requiring a gas fee to be paid. Lower cost alternative chains and layer 2 solutions do exist but the majority of valuable NFT works are currently stored on Ethereum.

1st May 2007

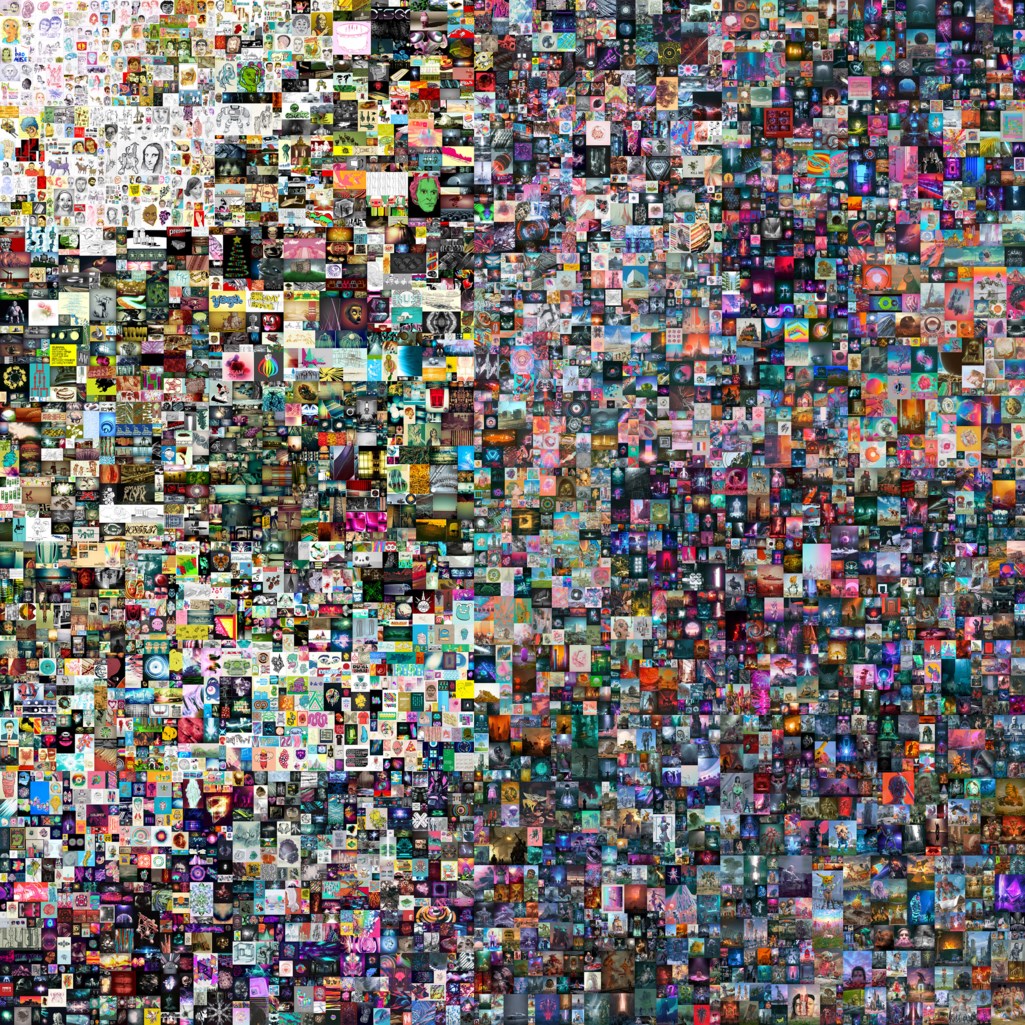

It was a warm May morning in Wisconsin when the artist Mike Winkelmann started work on what would become the most valuable NFT ever created. Every day for over 13 years he created a new piece of art and posted it online using the nickname Beeple.

The works were collaged together and minted in an NFT smart contract which became known as “The First 5000 Days”. It was auctioned at Christies in New York on the 11th March 2021 for $69,346,250 US dollars.

This wasn’t the first indication that something was happening in the NFT space. Months earlier some early Ethereum developers and supporters had started buying up a series of crypto punk NFT’s to use as avatars on social media. These were already rising rapidly in value when the Beeple auction took place.

The ERC721 token is the industry standard token used for NFT’s. It contains many of the standard ERC20 token functions alongside additional functions to declare and modify ownership and store metadata. Metadata contains the data which the NFT represents; it is often a hash of the data rather than the data itself.

“An NFT has more utility than cryptocurrency because you’re getting an asset that you want as a collectible, which is a status symbol.” Gary Vaynerchuk

There is more information on NFT’s here: NFT’s | Non Fungible Tokens

Governance Tokens

A decentralised autonomous organisation or DAO is a smart contract built to manage voting and governance for a new type of organisation. There are no CEO’s, no managers, no hierarchy of control. Instead token holders propose updates which then go to a demographic vote.

Governance tokens are used to control the development and direction of an organisation. A DAO is an extreme example of a fully decentralised organisation however governance tokens can also be used to implement a voting system in more traditional equity formed companies.

Token holders and conglomerates can get together to post a proposal which is then voted on by the governance community.

Protocols often require funds to operate. For example a lending and borrowing platform needs a float and lenders before they can start lending. DeFi protocols will often bootstrap initial funding through liquidity mining. This is the incentivisation to get users to deposit funds to the platform. This may take the form of distributing governance tokens to early adopters or providing high APY returns for staking LP tokens for the ETH/GovToken pair providing a liquid market for the governance token.

For a token to go up in value the demand must outweigh the supply on exchange. The economics of the token ecosystem are known as tokenomics. There are various methods to try and increase demand and reduce supply such as staking, fee burning and holder benefits.

30th April 2016

The original DAO project raised $150m via an initial coin offering or ICO. The tokens were distributed to 11,000 contributors in late May. Then disaster struck.

On the 12th June 2016 Stephan Tual posts to the DAO blog “No DAO funds at risk following the Ethereum smart contract ‘recursive call’ bug discovery”

Four days later, while DAO developers are working on a fix, a hacker drains 3.6m ETH from the DAO’s treasury. At the time this was 15% of the entire circulating supply of Ether and would be worth billions today.

A solution was proposed by Vitalik to fork and update the code being run by miners blacklisting the hackers funds. This went through but raised a number of questions whether the Ethereum network was truly decentralized.

A fork is when code is split or duplicated to a new repository. A hard fork creates a new duplicated blockchain and nodes must update their software to participate. A soft fork is seen as a more minor alteration to existing code and continues on the existing chain. When major changes are pushed out a subset of the nodes may not accept them continuing with alternate or pre-existing code. This division of nodes is known as a hard fork. An example of this took place on Bitcoin where Bitcoin Cash split off due to a debate over block sizes.

The blockchain sector prides itself in being transparent which includes the vast majority of code being open source. This means that it can be forked by anyone and developers can create replicas of their favourite DeFi protocols quite easily.

“With DeFi, we are building the finance system of tomorrow that is more efficient, faster, more rewarding, and levels the playing field for everyone.” – Olawale Daniel

This article is derived from a chapter in the free eBook explaining DeFi technologies:

DeFi Demystified | An Introduction To Decentralized Finance