This article is derived from a chapter in the free eBook explaining DeFi technologies:

DeFi Demystified | An Introduction To Decentralized Finance

The history of cryptocurrency starts long before Bitcoin. Blockchain’s have been around since the 1980’s and Bitcoin was built not as a totally novel concept but on top of other works like Nick Szabo’s BitGold which predated it. However the explosion of Bitcoin, Ethereum and other cryptocurrencies created a trillion dollar asset class built on an elegantly simple idea. The decentralisation of financial technology via a shared blockchain.

Bitcoin | Zero To One For Blockchain

31 October 2008

Hal Finney was at home in Temple City, California, reading a post about a peer-to-peer cash system. The whitepaper described blocks of data, stacked in numerical order and interlinked with cryptography known as a blockchain. The elegant beauty of a blockchain meant that to change any single block you would need to adjust all the blocks on top of it. This provided an immutable store of data that could be used to keep a record of transactions.

The paper described digital cash distributed to miners who interlink the blocks in a process known as proof of work. A miner on the peer-to-peer network takes all the waiting transactions, compiles them into a block of data and then repeats a hashing calculation over and over again. Roughly every ten minutes one miner on the network will find a hash which meets a set target criteria and the block is finalised. The miner gets a block reward and the network moves on to the next block starting the process over.

Hal was intrigued by the concept of digital money and contacted the developer. Satoshi Nakamoto was obviously an anonymous pseudonym, perhaps for an individual or a small group, perhaps it was Hal himself, to this day the creator of Bitcoin is still a mystery.

Satoshi mined over 1,000,000 Bitcoin in the early days, worth billions and has never moved or used any of those funds. If Bitcoin reaches somewhere around $200,000 Satoshi Nakamoto will become the wealthiest person in the world.

The first block on a blockchain is known as the genesis block. Bitcoin’s genesis block famously included an encoded message saying “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

22nd May 2010

In Bitcoin’s early days it was used experimentally by cypherpunks and libertarians. The concept of digital money was novel and there was no value associated with the actual Bitcoin’s themselves. If anyone could run a program on a home laptop to mine them how could they be digitally scarce?

This changed over time as demand grew and supply was constantly halved every four years due to the halvening schedule. Perhaps the most notable turning point was in May 20210, a time when the community gathered and discussed all things Bitcoin on the forum BitcoinTalk.

Laszlo Hanyecz posted a message to the forum on the 18th May stating “I’ll pay 10,000 bitcoins for a couple of pizzas.. like maybe 2 large ones so I have some left over for the next day. I like having left over pizza to nibble on later … If you’re interested please let me know and we can work out a deal.”

Four days later a user called Jercos got the pizza delivered and collected his Bitcoin payment. It was the first time that Bitcoin had been used to make a purchase and today the 22nd May is still celebrated as Bitcoin Pizza Day by the blockchain community.

Bitcoin went on to become a trillion dollar asset and was seminal to what came next. It wasn’t a smooth ride however and the protocol has faced many challenges along the way. Before DeFi decentralized services for decentralized money there were only centralized exchanges to buy and sell digital assets.

7th February 2014

In late 2013 and early 2014 if you wanted to buy Bitcoin you did it on Mt. Gox, a collectibles marketplace that pivoted to a Bitcoin exchange. Based in Tokyo the exchange handled more than 70% of the total Bitcoin trading volume at its peak.

Mt.Gox allegedly discovers missing funds in it’s treasury of 744,408 BTC (3.5% of all Bitcoin) resulting from a bug that had been exploited for over two years. CEO Mark Karpeles held an emergency investor meeting where he “outlined the extent of the Mt.Gox losses” but investors refused to bail out the company.

Withdrawals in Bitcoin and cash were suspended and within a week the website was closed down and the company filed for liquidation. Karpeles was charged with a suspended sentence in 2019 for falsifying data.

The Mt.Gox failure slowed Bitcoin down but it didn’t stop the inevitable growth and powerful network effects. It was around this time that the original code for the Ethereum network was being developed.

“Make no mistake – Ethereum would never have existed without Bitcoin as a forerunner. That said, I think Ethereum is ahead of Bitcoin in many ways and represents the bleeding edge of digital currency.” – Vitalik Buterin

Ethereum | The Worlds Global Computer

30th July 2015

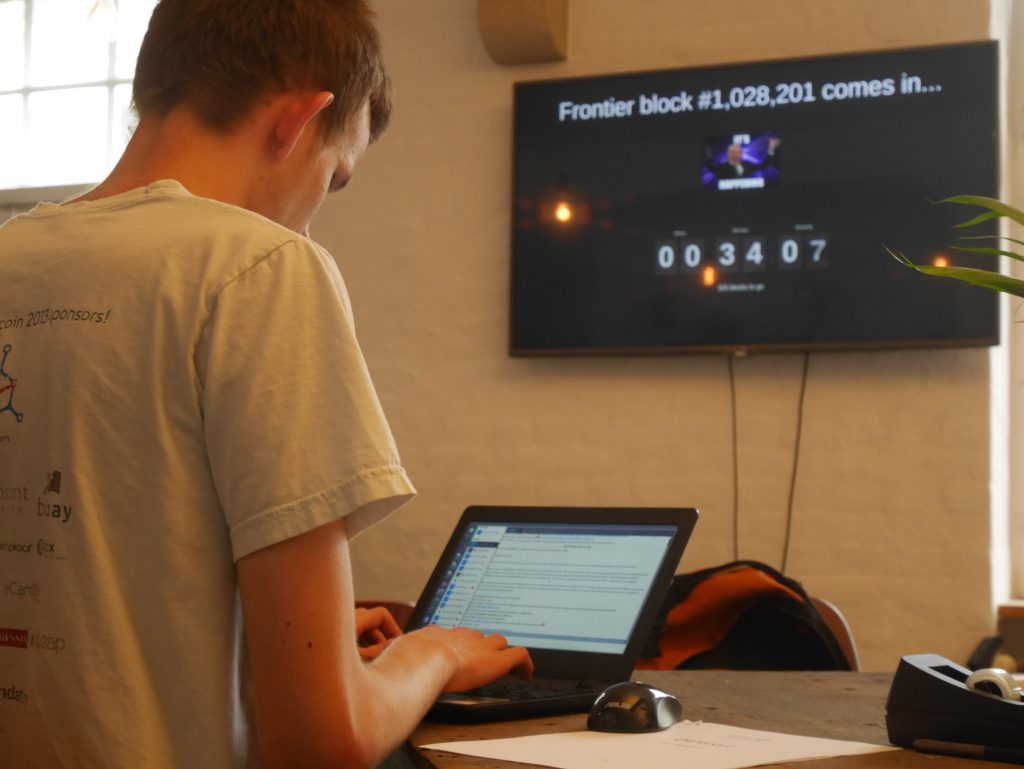

A monitor on the wall counted down as last minute checks were being anxiously executed. In 35 minutes the Ethereum frontier would launch to the public. The software had been in development for two years and the entire crypto community was watching.

Ethereum was revolutionary, it expanded Bitcoin’s blockchain technology to provide a peer to peer network of interconnected computers operating as one. Developers could execute code and store information on this network which no one had full control over.

In a small crowded office in Berlin Vitalik Buterin was nervously tapping away on a laptop. He was surrounded by colleagues who supported his vision for a decentralised virtual machine. But at this moment he was alone in his thoughts, it was down to him to launch the network and change the financial world forever.

Before DeFi there was Ethereum. It is the foundation network and protocol layer that decentralized finance is built on. Understanding Ethereum’s “world computer” is key to understanding what makes DeFi applications so disruptive.

If we think of a collection of computers on a peer-to-peer network all talking to each other in a group. There is no central server or data provider and data is communicated by whispers between the peers. Examples of peer-to-peer networks outside of the blockchain sector include Napster and Torrent networks where files are shared across peers. Each computer interlinks with multiple other computers on the network and broadcasts and relays messages to them. No single computer or central server is in charge of the network.

Transactions coming into the network are processed by the nodes and a consensus mechanism states that more than 50% of the nodes on the network have to agree on the results or state after the transactions are processed. Once the network reaches consensus it moves on to the next block of transactions.

Ethereum was born out of the idea that miners could process code as well as transactions. 3rd party code executing in a secure environment across a global network of machines to store and distribute data.

Whereas Bitcoin could only store transaction data relating to who sent who BTC, Ethereum could store anything you wanted.

This works by including a virtual machine in the code which executes user code in a secure, isolated environment. This code known as a smart contract has been used by developers to create the protocols that form today’s DeFi ecosystem.

A virtual machine is like a version of windows running in a window on your laptop. Think of it as a operating system running as an application on top of the main operating system. Ethereum’s virtual machine is designed to run across a network of nodes that agree on the persistent state of data on the network. It’s not just Ethereum that uses EVM, it’s also used by alternate chains like Binance smart chain, Polygon and HECO.

Ethereum still operates a blockchain which stores the transactions which execute interactions with smart contracts. These are hashed in much the same way as the Bitcoin network although block times are much faster and a new block is written approximately every 13 seconds.

The process of hashing is a cryptographic method used to verify data. All data can be broken down into binary ones and zeros. A hashing algorithm can be used to calculate a representative value for that data. The algorithm is one way meaning you can calculate the hash from the data multiple times but can not calculate the data from the hash. If just one byte of the data changes the hash will change completely. The most common hashing algorithm is known as SHA256, a 256-bit (32 bytes) hash usually printed out as a hexadecimal number of 64 digits.

Transactions need to be signed before they are sent to the nodes that form the Ethereum network. This is achieved via a private key, public key pair and is usually done in the background via a digital wallet such as metamask.

A private key is a random set of one’s and zero’s, you could create one by tossing a coin 256 times although more often it is managed by the wallet. Private keys, as the name suggests, should be kept private as anyone who knows the key can sign transactions and take any funds in the account. A public key is the same thing as your address. On ethereum both private keys and public keys will start with 0x… to show it’s a hexadecimal formatted address.

The public key is derived from an accounts private key however it is not possible to find the private key from a public key. When we want another user to send us funds we will share our public key and they will send funds to that address. When they send funds the transaction will be hashed and then signed using their private key and elliptic curve cryptography. This will then be sent to nodes along with their public key to prove the sender approves the transaction. The nodes have a cryptographic function to check if the signature matches the public key for the account.

The persistent storage or state of the network has limited capacity and is expensive to write. A gas fee is changed for transactions that store or modify data however there is no fee to read data. To pay the gas fee a developer needs some Ether or ETH which is the native asset of Ethereum. The fee varies widely depending on network congestion and usage. At times of peak demand it can cost in excess of $100 to make a simple token swap.

Two years after launch the Ethereum network was at a standstill, congested and unusable due to a new blockchain game. CryptoKitties were virtual pets, each one a unique graphical representation of underlying Ethereum code.

Cute cats on the internet are a thing and it took off in a big way highlighting the dire need for increased capacity on the Ethereum network.

Today that bottleneck in capacity is still an issue and Ethereum is gearing up for the long awaited release of version 2.0.

This article is derived from a chapter in the free eBook explaining DeFi technologies:

DeFi Demystified | An Introduction To Decentralized Finance