This article is derived from a chapter in the free eBook explaining DeFi technologies:

DeFi Demystified | An Introduction To Decentralized Finance

DeFi derivatives are financial contracts which track or provide exposure to an underlying asset.

The most common derivatives products in crypto markets are futures and options. In crypto markets derivatives are traded at greater volumes than the underlying spot markets. This means there is more buying and selling of Bitcoin futures than there is of actual Bitcoin.

Here are 13 DeFi derivatives products that are establishing themselves as market leaders in their niche within decentralized finance.

Futures

Futures are a form of derivative that tracks the price of a underlying asset. The contract allows traders to bet on the price going up (long) or to bet on it going down (short). In crypto markets perpetual futures products which don’t expire are very popular and are traded at higher volumes than the underlying base assets.

Made popular by Bitmex and finessed by Binance and FTX these products are only just starting to be traded on DeFi trading platforms and volumes on centralised exchanges remains the bulk of the market.

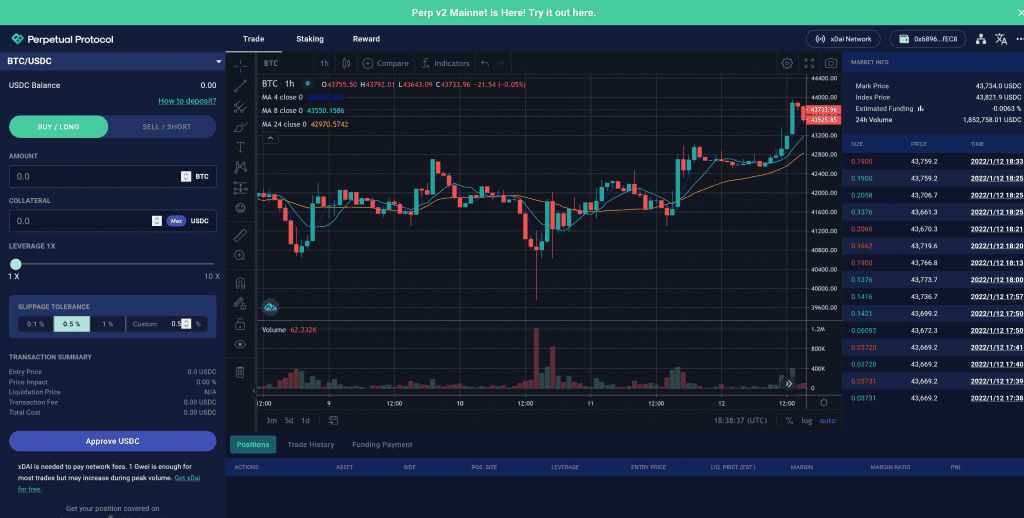

Perp Protocol

Perpetual Protocol offers a decentralized exchange and protocol to trade perpetual futures contracts with up to 10x leverage. It uses the xDai sub chain currently which reduces fees compared to Ethereum mainnet.

Perpetual futures contracts continuously track the price of an underlying asset. They do this by adjusting a funding fee inline with demand. If demand is high the protocol will charge anyone that wants to go long (buying the asset) a fee which will be paid to anyone who holds a short position (short selling the asset).

When demand is very high it’s possible for traders and DeFi yield aggregators to short sell the perpetual futures contract to gain a yield from the funding fee. Their position will be hedged by buying the underlying asset on spot markets, known as a cash and carry trade.

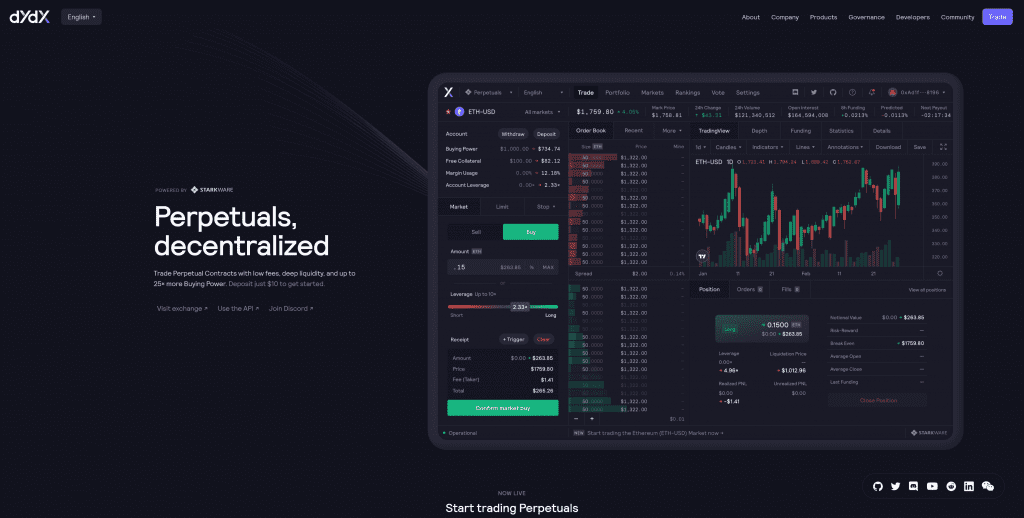

dYdX

dYdX is an open trading platform for perpetual futures. The protocol has $1B in TVL as of January 2022 and provides one of the best DeFi trading experiences.

GMX

More recently I’ve done a comparison of dYdX and GMX in an article on DeFi Futures

Options

Options provide the purchaser the option (but not obligation) to purchase an asset at a set price at a set expiry date. Options trading has gained a lot of traction with the Wall Street Bets movement in stocks and shares but we haven’t seen the same influx of retail driven options trading in crypto as of yet. Centralised exchange Deribit is the market leader but we are starting to see some DeFi competitors emerge.

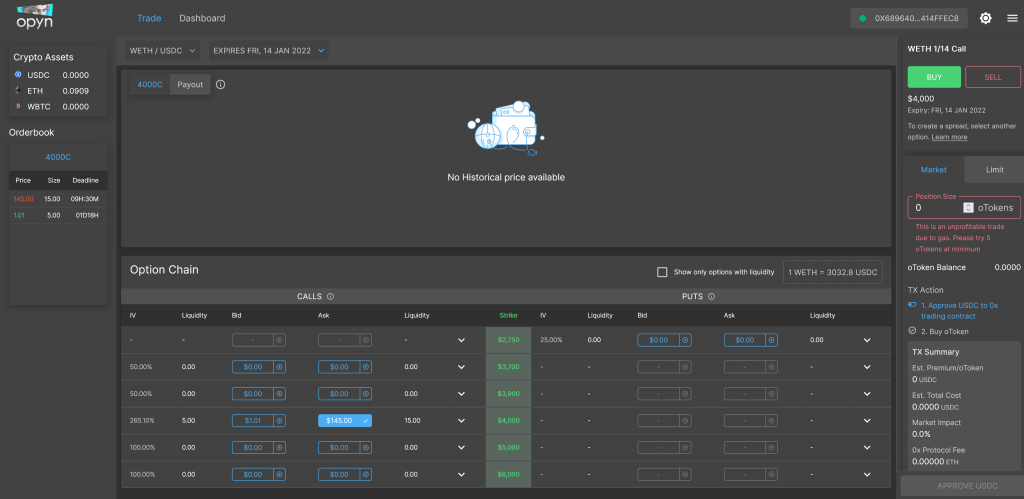

Opyn

Opyn is a options trading platform with weekly expiries. The team also collaborated with Paradigm in the release of Squeeth which is a tokenised perpetual options product.

More info on Squeeth here: https://jamesbachini.com/squeeth/

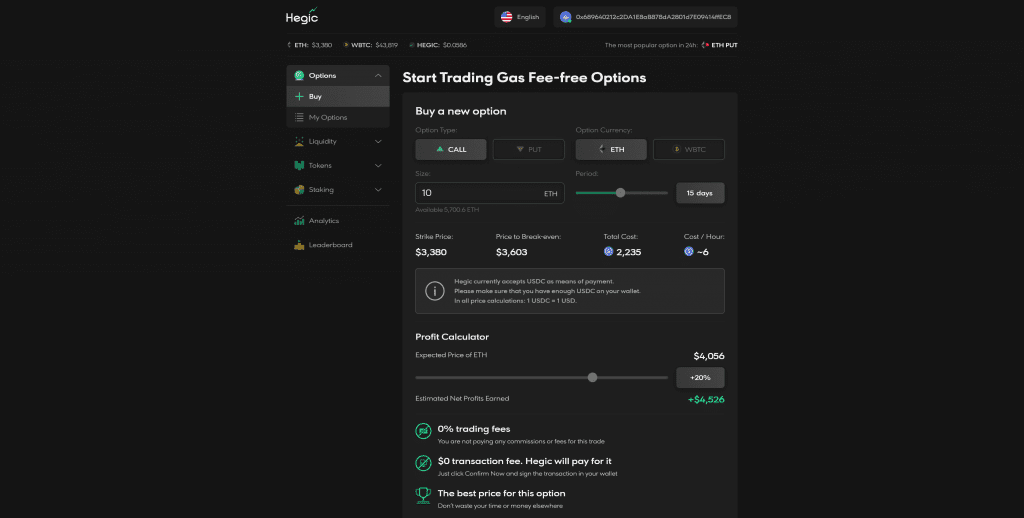

Hegic

Hegic was the undisputed market leader in decentralised options for a long time before Opyn came along and stole the mantle. The platform boasts 0% trading fees and $0 transaction fees.

Lyra Finance

Lyra Finance is another options trading platform. See the demo video I done on this last year.

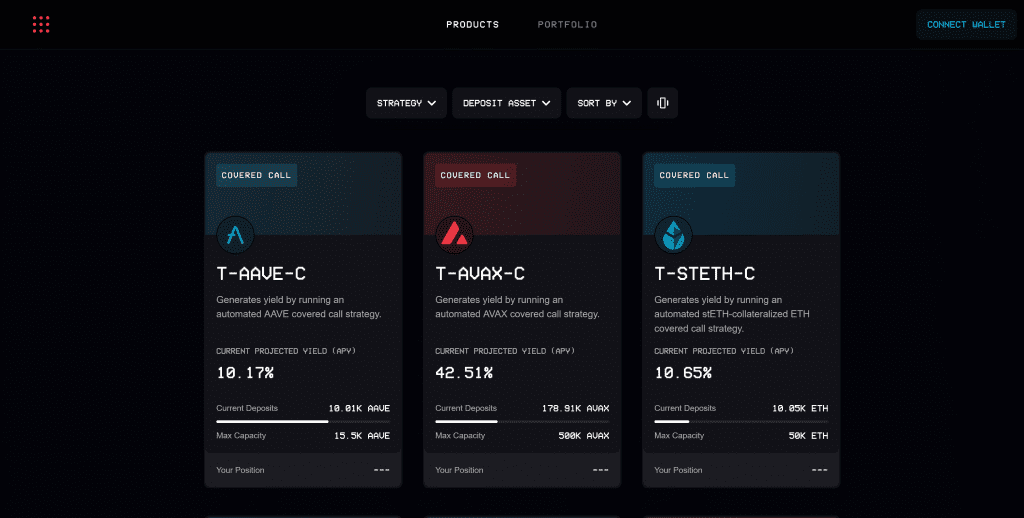

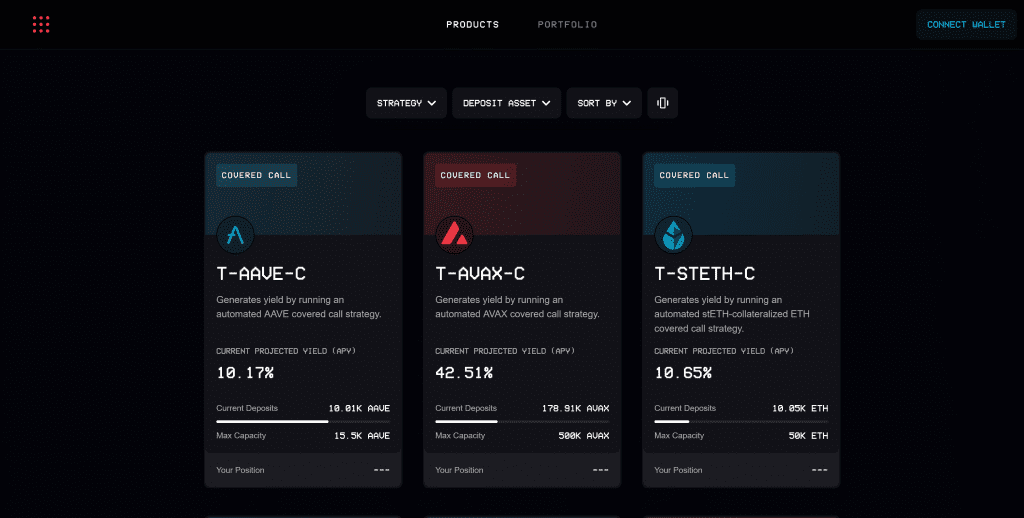

Ribbon Finance

Ribbon finance builds options strategies on top of decentralised options protocols. They run strategies like covered calls to generate yield on selected assets.

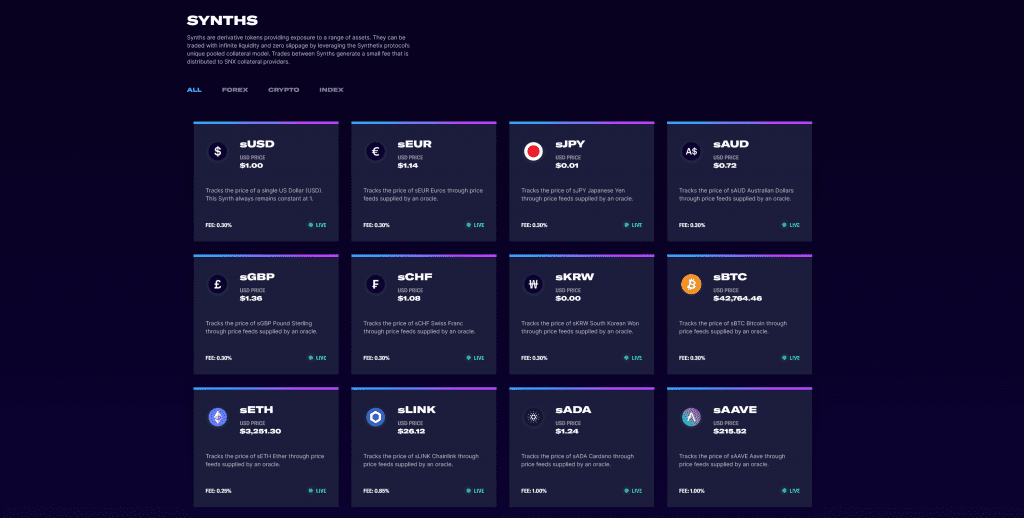

Synthetic Assets

Synthetic assets are tokenised versions of stocks, indexes and commodities. Basically anything with a price feed can be tokenised on a synthetic asset platform because traders trade against a shared liquidity pool. These DeFi derivatives have unique advantages over traditional markets because they can be traded 24/7, moved and transferred at ease. In the future we may see tokenised stocks used as collateral in other areas of DeFi.

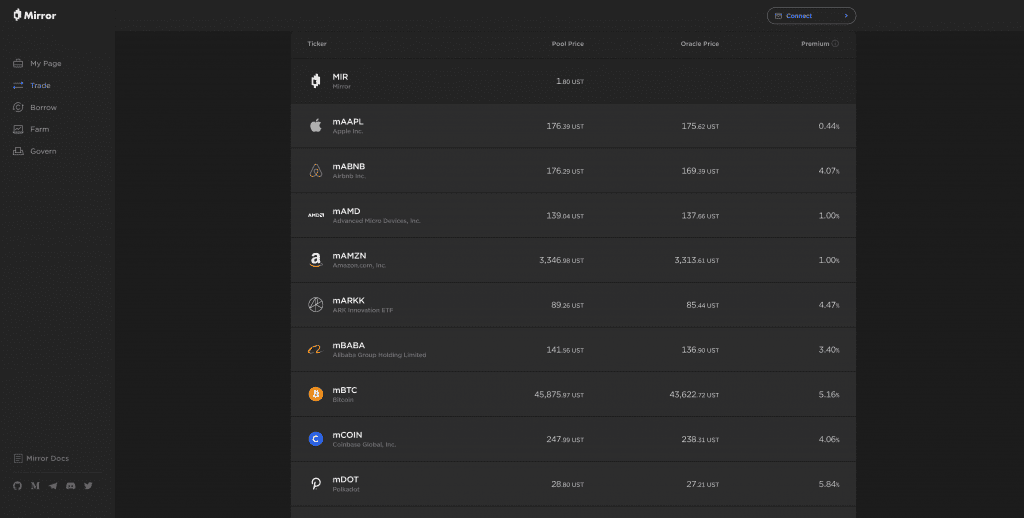

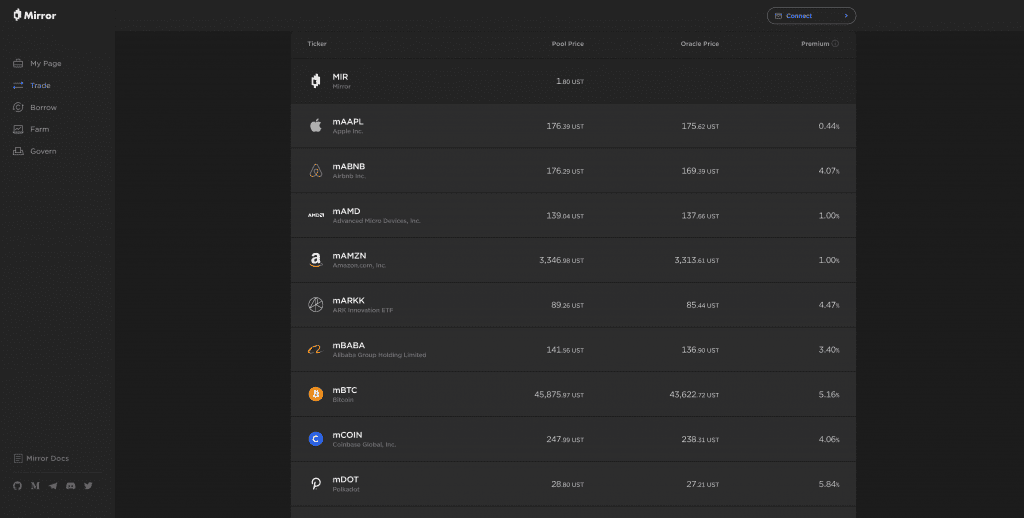

Mirror Protocol

Mirror protocol incentivises trading on both long and short sides of synthetic assets including:

- Stocks

- Indexes

- Cryptocurrencies

- Commodities

Synthetix

Synthetix was the original synthetic product which has struggled to gain traction due to high gas fees on Ethereum.

Indexes

Over the last 30 years we have seen a migration from managed funds to passive index funds in stock markets. In crypto it’s been much easier to “beat the market” but at some point this will likely change and we will see more Top100Coins type index products. Currently there are volatility products and token funds which aren’t gaining huge amounts of traction. As markets mature I would expect to see more market trackers gain traction as DeFi derivatives.

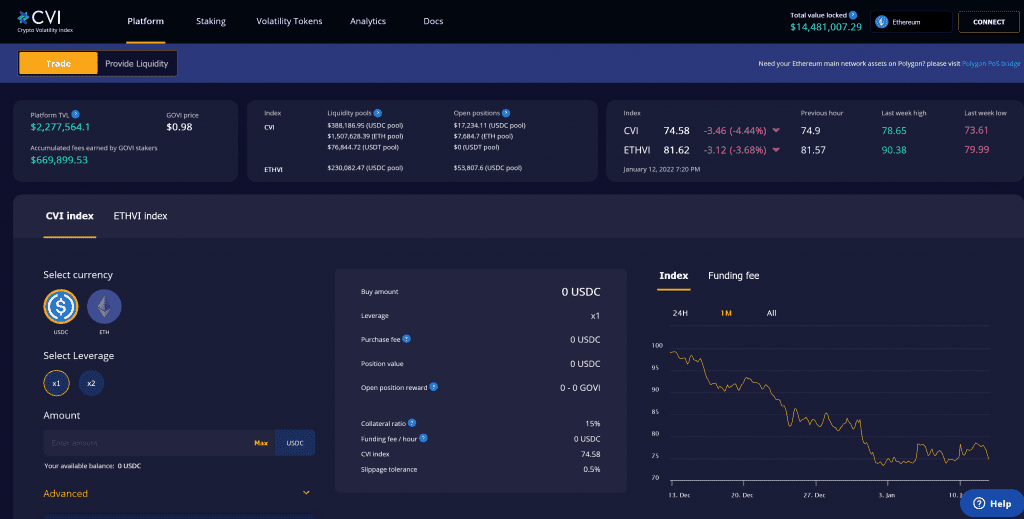

Crypto Volatility Index

CVI aims to be the VIX of crypto. It’s a DeFi protocol with trading platform running on Ethereum that tracks the volatility of the crypto markets.

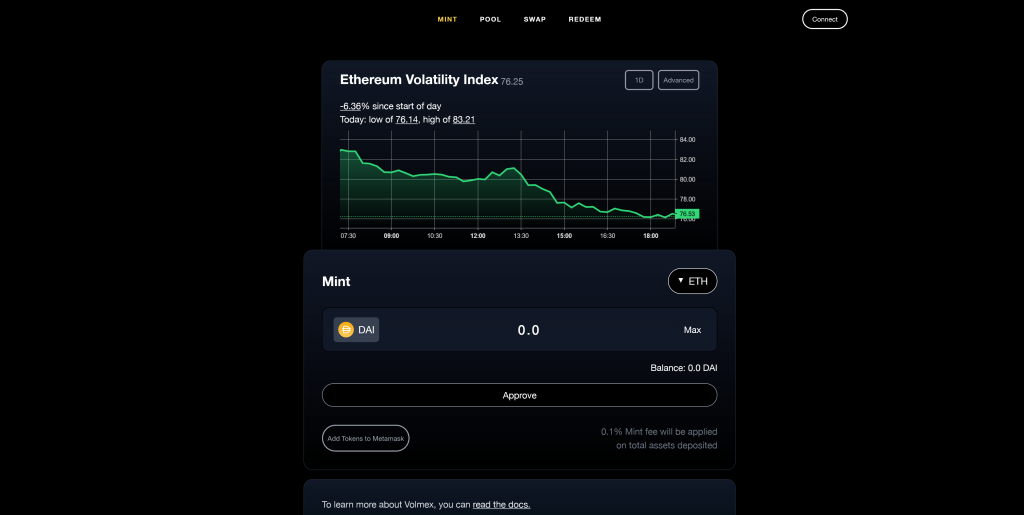

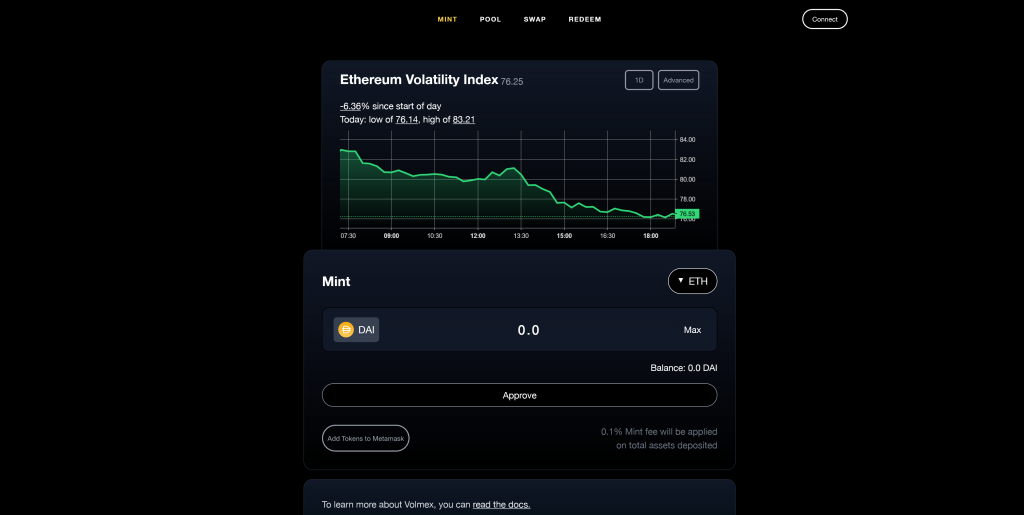

Volmex

Volmex is another volatility index which offers tokenised volatility products that trade on Uniswap

Set Protocol

Set protocol provides user managed indexes or sets as they are known. These contain a portfolio of digital assets which are managed by a fund manager.

Liquid Staking

Liquid staking enables holders to deposit their native assets on a platform which will then stake them and return the rewards to tokenised version of the base asset. It makes staking easy and with the rollout of Ethereum 2.0 this year I think it’s going to gain a lot of attention.

Lido

Lido is the leading liquid staking protocol on Ethereum, Solana and Terra. It provides tokenised assets that represent a underlying base asset + staking yield. For example stETH is staked Ethereum and holders see their balance increase every day as rewards from staking are distributed.

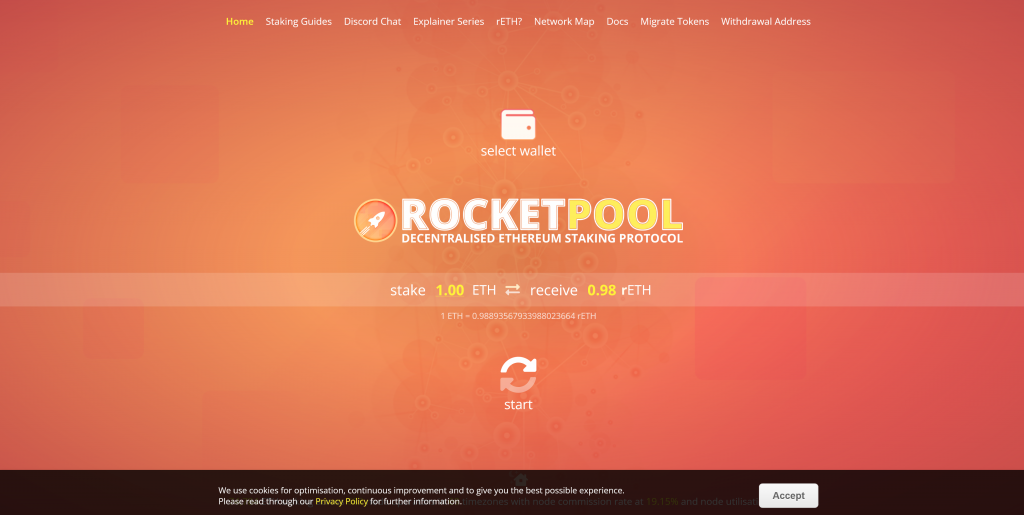

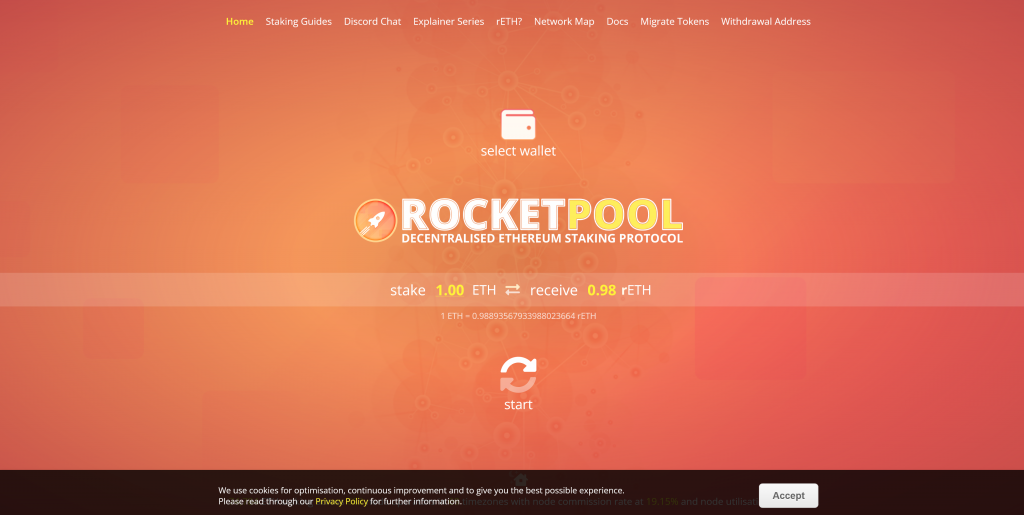

RocketPool

Rocket pool is a direct competitor to Lido with their rETH staked Ethereum token which is currently trading below the base asset.

This article is derived from a chapter in the free eBook explaining DeFi technologies:

DeFi Demystified | An Introduction To Decentralized Finance