This article is derived from a chapter in the free eBook explaining DeFi technologies:

DeFi Demystified | An Introduction To Decentralized Finance

Synthetic assets are a form of derivative product in decentralised finance. Synths are created which follow the price of an underlying asset. For example sTSLA will follow the stock price of Tesla and can be traded on decentralized exchanges.

Synths are tokens minted via a DeFi protocol such as Synthetix. Liquidity providers contribute to an underlying asset pool in return for fees and native tokens.

When a trader purchases a synth they are effectively trading against the underlying asset pool as any gains will be taken from it. If all the synthetic assets go up at the same time then the liquidity pool diminishes in value. In practice the diversified nature of the assets works well to keep things in balance.

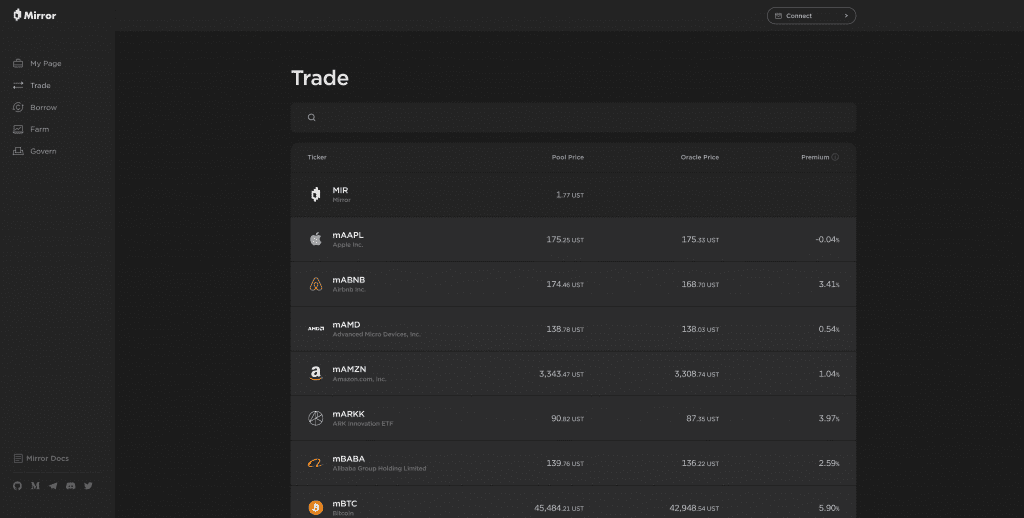

Not everyone is happy about the move to digital assets including US & UK regulators. The SEC & FCA are currently imposing regulations to prevent the trading of securities on DeFi. Uniswap was forced to conform by blocking a number of synthetic assets on their frontend in July 2021.

Mirror protocol is also under active investigation by the SEC. Mirror provides the ability to take long and short position on synthetic stocks like Tesla or commodities like gold.

A concern for regulators is the ability of these protocols to hold their pegs to the underlying assets. DeFi has only been around a couple of years and we haven’t seen a deep bear market where token prices depreciate and pressure is put on protocol economics.

Synthetic assets are a interesting addition to the DeFi landscape. If they can overcome the regulatory hurdles then it could provide a short cut to the eventual tokenisation of all assets.

Currently there isn’t high volumes being traded in Synthetic tokens however if the benefits do start to attract trading volumes away from the big stock exchanges around the world then we will likely see further crackdowns from regulators.

This article is derived from a chapter in the free eBook explaining DeFi technologies:

DeFi Demystified | An Introduction To Decentralized Finance