eBTC is an over-collateralized digital asset pegged to the price of Bitcoin which can be minted using stETH as collateral.

This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to eBTC at time of writing. Do your own research, not investment advice.

How Does eBTC Work?

eBTC is backed entirely by Lido Finance’s stETH and is designed to be a fully permissionless synthetic Bitcoin derivative in the form of an ERC20 token on Ethereum.

eBTC offers borrowing of the asset through a Collateralized Debt Position, where a user is required to deposit collateral in stETH, and mint eBTC tokens up to slightly under the value of the collateral.

The price at which eBTC can be borrowed/redemed is based on the BTC and stETH Oracle spot price provided by Chainlink. To maintain it’s peg whenever eBTC trades below the price parity, an arbitrage opportunity arises, allowing traders to buy eBTC at a discount and redeem it for a higher value until the peg is restored.

The eBTC system is equipped with a liquidation mechanism for guarantying the solvency of the system. When a users position drops below the minimum collateral ratio, it becomes eligible for liquidation. Then, the outstanding debt can be repaid by any market participant, who receives surplus collateral as an incentive.

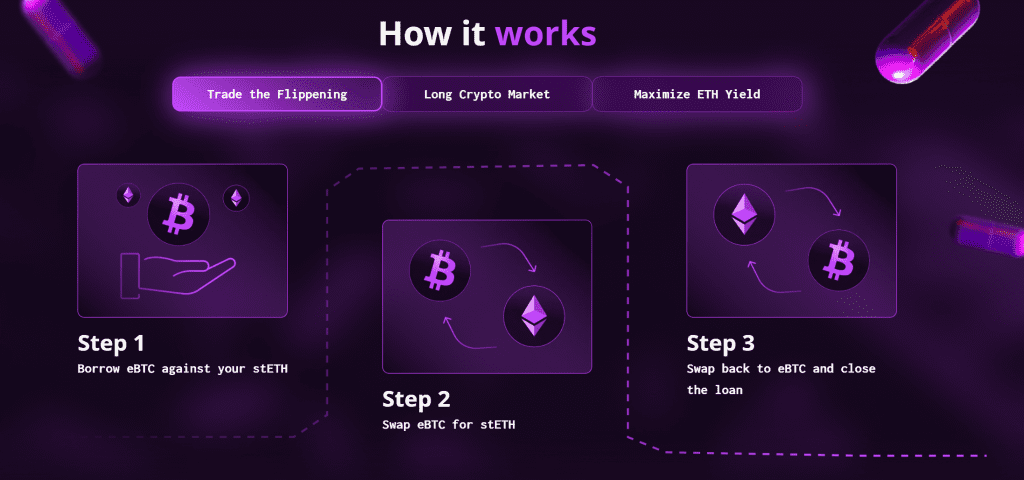

How To Trade The Flippening

The flippening is a theoretical point in the future where the market cap of Ethereum becomes greater than the market cap of Bitcoin. At time of writing Bitcoin has a $522B market cap and Ethereum has a $185B market cap.

This aligns with my own thesis is that Bitcoin and Ethereum are very different products and ultimately Ethereum creates more utility through it’s application layer for 3rd party developers to create smart contracts.

So if Ethereum is going to go up in price relative to Bitcoin how can we express that opinion as a trade?

eBTC allows us to long stETH and short eBTC through the borrowing mechanism. eBTC can then be traded for more stETH and potentially the whole process can be repeated to lever up the position.

Note that this isn’t a delta neutral trade as USD stablecoins aren’t involved, it carries massive exposure to the price of ETH relative to the USD. However it could be used as a pseudo delta-neutral strategy if you skip step 3 below. It’s possible to create a long stETH short eBTC type position which collects Ethereum staking rewards and has exposure to ETH/BTC.

The alternative to this trade would be to use a perpetual futures contract for ETH/BTC such as the Binance USD margin future. This would enable you to hold USD collateral and gain exposure to the direction of the market.

I think the eBTC flippening trade would appeal more to investors who are already holding staked Ethereum and want to take on additional risk. In the next section I’ll model the collateralization ratio and market timing.

Risks, Leverage & Timing

There are a few risks to beware of with the eBTC trade

- Smart contract hack risk (audits)

- Liquidation risk, being early is same as being wrong

- Depeg risk, eBTC is only soft pegged to price of BTC

As a trader increases the leverage by repeating the stETH > eBTC > stETH > more eBTC > stETH it increases their exposure and risk because the final stETH holdings is reduced relative to the collateralization ratio each time.

The minimum collateralization ratio is 110% so for every $110 of stETH you deposit you can borrow $100 of eBTC. If the collateralization ratio goes below 103% the position will be liquidated by MEV bots.

This makes timing the trade and the use of a safe collateral ratio critical.

This is the ETH/BTC chart since 2015. An optimist would say it’s been going sideways since the summer of 2021 and is now near support at the bottom of the range. A pessimist would say it’s been trending down since September 2022 and looks like it’s about to fall off a cliff. Both would probably be true.

There is a key level at 0.05 which it traded into in June 2022 and found significant volume and support. That might be one area where there is a risk defined trade.

eBTC is a complex product and trading derivatives using stETH as collateral is highly risky for the reasons outlined above. It’s not something I would allocate my entire staked Ethereum exposure to. However if ETH/BTC reaches the 0.5 level and eBTC is launched in time then a small, risk defined trade with collateral I’m willing to lose, might be compelling.

eBTC is built by the team at BadgerDAO and should be going live shortly as audits were completed in August 2023. You can find out more about the project at: https://www.ebtc.finance