EigenLayer is a protocol which allows Ethereum stakers to restake their ETH. This is a write up of my internal research notes, this is not a sponsored post and I have no stake currently in EigenLayer.

EigenLayer is being developed by EigenLabs which is headed by CEO Sreeram Kannan. Sreeram has an academic background and is an associate professor at the University of Washington. They recently launched on testnet and raised $50 million in a Series A round led by Blockchain Capital.

How EigenLayer Works

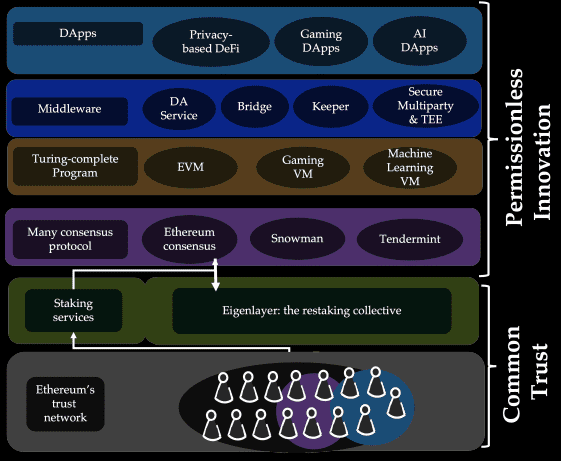

EigenLayer is a proposed restaking collective for Ethereum that enables consensus layer Ether (ETH) stakers to validate new software modules built on top of the Ethereum ecosystem. Stakers can opt in to EigenLayer by granting the smart contracts additional slashing conditions on their staked ETH, increasing cryptoeconomic security. EigenLayer allows validation for various types of modules:

- Consensus protocols for L2’s & appChains

- Data availability layers (Cross chain communications)

- Virtual machines & application layers

For stakers it brings the potential to earn more on staked ETH positions aggregating ETH security across the modules and making Proof of Stake capital more efficient. By relying on the security and decentralization provided by EigenLayer, innovators can implement new distributed validation modules without building their own trust networks.

EigenLayer introduces two novel ideas, pooled security via restaking and free-market governance, that provide a new mechanism for pooled security. This enables modules to be secured by restaked ETH, rather than their own tokens. It also provides an open market mechanism that governs how its pooled security is supplied by validators and consumed by auxiliary verification systems (AVSs). By combining these ideas, EigenLayer serves as an open marketplace where AVSs can rent pooled security provided by Ethereum validators.

EigenLayer provides multiple pathways for yield stacking, which allow stakers to earn additional yield from securing new AVSs (Autonomous Validation System). These pathways involve different types of restaking, such as:

- Native restaking

- LSD (liquid staking derivative) restaking

- ETH LP (liquidity provider) restaking

- LSD LP restaking.

Each pathway comes with different types of risks, and EigenLayer outsources the management of these risks to module developers, who choose which tokens to accept as stake for their AVS and whether there is preferential weighting for rewards they distribute to different types of staked tokens.

EigenLayer operators receive fees from both the Ethereum beacon chain and the modules they participate in via EigenLayer. They keep a portion of those fees and send the remainder to the delegators.

Solo stakers can participate in EigenLayer either by opting in to provide validation services directly or by delegating their stake to a different entity while continuing to validate for Ethereum themselves. However, before delegating to any operator, restakers must do extensive due diligence on the operator to whom they are delegating since their deposited stake will be subject to slashing if the operator doesn’t fulfil their obligations in the EigenLayer modules they are participating in.

EigenLayer Risks

EigenLayer manages risk by analyzing and addressing risks related to operator collusion and by mitigating unintended slashing vulnerabilities.

EigenLayer’s approach to operator collusion is to restrict the cost of corrupting any AVS built on EigenLayer to be proportional to the total amount of stake in EigenLayer, which maximizes the cost of corruption. However, in a realistic scenario where only a subset of operators opt-in to a given AVS, some set of operators may collude to steal funds from a set of AVSs. To address this, EigenLayer has a mechanism to determine whether an operator or a set of operators are potentially at risk of creating a security vulnerability via some collusion or not.

By creating an open-source cryptoeconomic dashboard, EigenLayer allows AVSs built on it to monitor whether the set of operators participating in their validation tasks is entrenched across many other AVSs or not. If so, the AVS can put a specification in its service contracts that incentivizes only EigenLayer operators who are participating in only a low number of AVSs, thus increasing the CoC for corrupting AVSs.

EigenLayer proposes two lines of defense against unintended slashing vulnerabilities, security audits and the ability to veto slashing events. AVS codebases must be audited just like smart contracts are audited, and the governance layer in Eigenlayer, which is comprised of prominent members of the Ethereum and EigenLayer community, has the ability to veto slashing decisions via a multisig. This slashing veto process is considered as training wheels that will be eventually removed.

EigenLayer Use Cases

Here are some example use cases from the EigenLayer whitepaper.

- Hyperscale Data Availability Layer A layer that provides high data availability at a low cost using EigenLayer restaking and advanced ideas developed in the Ethereum community.

- Decentralized Sequencers Sequencers for managing rollups that can be built on EigenLayer using a quorum of ETH stakers.

- Light-Node Bridges Bridges to Ethereum that can be built using EigenLayer, allowing for off-chain verification of bridge inputs.

- Fast-Mode Bridges for Rollups Operators on EigenLayer can participate in off-chain verification of ZK rollup proofs, allowing for faster confirmation guarantees.

- Oracles Oracles that provide price feeds or other data can be built on EigenLayer using ETH restaked with EigenLayer.

- Opt-in Event-Driven Activation Event-driven activations such as liquidations and collateral transfers can be built on EigenLayer with strong guarantees of inclusion.

- Opt-In MEV Management MEV management methods become feasible under EigenLayer, including Proposal-Builder Separation, MEV smoothing, and threshold encryption for transaction inclusion.

- Settlement Chains with Ultra-Low Latency Restaked sidechains can be created on EigenLayer for fast settlement with high economic finality.

- Single-Slot Finality Nodes can attest to the finality of a block via an opt-in mechanism on EigenLayer, creating a potential finality pathway.

EigenLayer Testnet & Roadmap

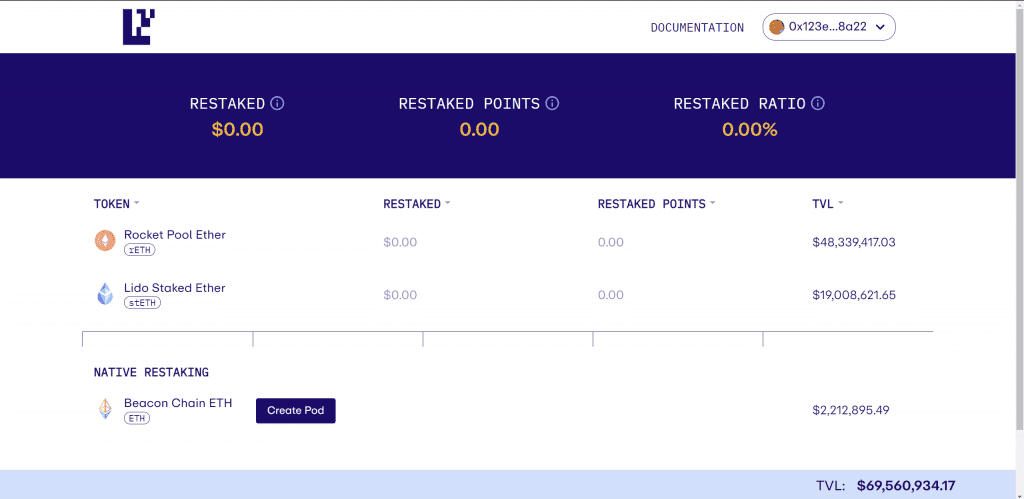

The testnet launch is phased in three stages to onboard various participants into the ecosystem.

The first stage focuses on stakers, where they will deposit assets into EigenLayer. Currently supported are rETH, stETH, and native beacon chain ETH on Goerli.

The second stage focuses on operators, who are nodes that run EigenLayer services. Operators will register and opt-in to any mix of services built on top of EigenLayer. Each service that an operator chooses has its slashing conditions.

The third stage focuses on services, where software built on top of EigenLayer will pay operators to provide economic security.

EigenLabs is also currently working on a new component called Watchers, which will submit fraud proofs if a claim is disproven. Strategies is another new component where strategy contracts may perform targeted management of restaked assets to earn returns outside of EigenLayer. Strategies will ensure that collateral can be used in DeFi instead of just waiting to be slashed. LSTs are also supported out of the gate, in addition to native ETH.

Conclusion

EigenLayer is an innovative protocol middleware which has the potential to make capital locked in Ethereum staking more efficient. For stakers using liquid staking derivatives a lot of this will take place behind the scenes and will likely result in a modest boost to APR’s.

The ability to reuse staked ETH to provide consensus mechanisms and cross chain communications provides an expandable new field of blockchain applications which could potentially pick up traction.

In the future a 3rd party may be able to build an application on a appChain which has consensus achieved via the EigenLayer and funds are bridged in from Ethereum using cross-chain comunications also provided by EigenLayer.

The project is still new and there are risks involved which need to be considered and mitigated. It will be interesting to follow how the EigenLayer project develops and what opportunities it will provide in the future.