Frax is a growing ecosystem of DeFi products built on Ethereum. This is a write up of my internal research notes, this is not a sponsored post and I have no stake currently in Frax or FXS.

- What Is Frax?

- FRAX Stablecoin

- FPI Frax Price Index

- frxETH sfrxETH Frax Ether

- FXS Frax Share

- Conclusion

What Is Frax?

Founded in 2019 by Jason Huan, Sam Kazemian & Travis Moore. Frax has a legal entity based in Grand Cayman.

Frax has created 4 Tokens:

- FXS – Governance Token

- FRAX – USD Stablecoin

- FPI – Consumer price index

- frxETH – Wrapped liquid staking token

Additional Products:

- FraxSwap – Decentralized Exchange AMM

- FraxLend – Lending markets

- FraxFerry – Bridge

Active governance forum at: https://gov.frax.finance/

Audited multiple times by Trail of Bits and has a Code4rena bug bounty programme.

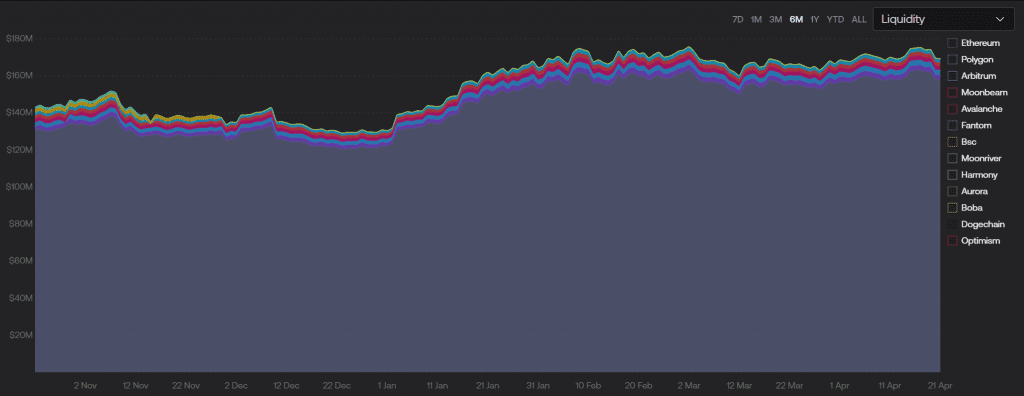

Frax products are rolled out across multiple chains with the vast majority of volume and liquidity on Ethereum mainnet

FRAX Stablecoin

Frax attempts to combine the design principles of over-collateralized and algorithmic stablecoins to create a scalable, trustless digital asset pegged to the USD. Frax has a two-token system encompassing a stablecoin and a governance token, with a pool contract that holds USDC collateral. The collateral ratio refresh function in the protocol can change the collateral ratio in steps of .25% if the price of FRAX is above or below $1, and the refresh rate and step parameters can be adjusted through governance.

FRAX can be minted by placing the appropriate amount of its constituent parts into the system. The protocol is designed to accept any type of cryptocurrency as collateral but mainly accepts on-chain stablecoins to smoothen out volatility.

FRAX is like an LP token which is always mintable/redeemable for $1 worth of collateral and the governance token FXS at the collateral ratio. The collateral ratio dynamically changes based on the price of the stablecoin and an arbitrage opportunity arises for people wanting to put in collateral into the pool at the new ratio for discounted FXS. The protocol incentivizes recollateralization through arbitrage swaps and redistribute excess value back to FXS holders through a buyback swap.

Frax v2 introduces the Algorithmic Market Operations Controller (AMO), which is an autonomous contract that enacts monetary policy without changing the FRAX stablecoin price from its peg. AMOs allow for constant upgrades and improvements with current modules for Curve Finance, Uniswap V3 & Frax Lending.

FPI Frax Price Index

FPI is pegged to the consumer price index which contains a basket of consumer items and is designed to maintain its purchasing power using on-chain stability mechanisms. This is like a inflation hedged stablecoin as it is designed not to lose purchasing power as fiat currencies devalue.

FPI has its own governance token, the Frax Price Index Share (FPIS), which is entitled to seigniorage from the protocol.

The CPI-U unadjusted 12 month inflation rate reported by the US Federal Government is managed via a Chainlink oracle which updates contracts on-chain immediately after it is publicly released. FPI uses the same AMOs as the FRAX stablecoin and is modeled to keep a 100% collateral ratio at all times.

frxETH sfrxETH Frax Ether

FrxETH and sfrxETH are the two forms of ETH in the Frax ecosystem, with sfrxETH earning staking yield and increasing in value over time.

The protocol is unique in that it consists of 3 moving parts:

- frxETH the stablecoin pegged to ETH, similar to other FRAX stablecoins. Marketed as an alternative to WETH

- sfrxETH Users can deposit frxETH to the ERC4626 vault and enable validators to earn staking rewards on their behalf. An equivalent amount of frxETH is minted and sent to the sfrxETH contract which accrues staking yield. sfrxETH is not pegged to the price of ETH because it’s value is ETH+Yield.

- frxETHMinter Sends 32 ETH deposit along with the credentials to the ETH 2.0 deposit contract, enabling a new validator

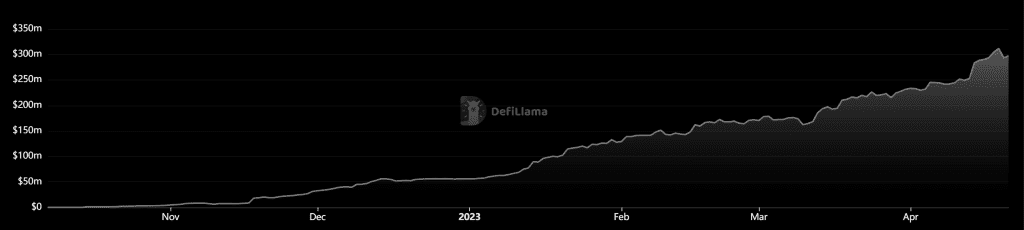

Using a liquid ETH staking derivative instead of staking ETH directly simplifies the staking process and allows for greater composability in DeFi. This has proven to be a popular product which is gaining traction at a rapid rate:

FXS Frax Share

FXS is the governance token for the Frax Finance ecosystem. It has a total supply cap of 100m circulating supply of 71m, market cap of ~$643m and FDV of $898m. At time of writing the token is priced at $9.

The token distribution is divided into three main categories: 60% of FXS tokens are distributed to users through yield farming, liquidity and governance incentives. 5% is for the treasury, which is entirely community and team governed and is used for making grants. 20% for team/founders/early project members, 3% for strategic advisors/outside early contributors and 12% for accredited private investors.

8% of $frxETH staking revenue will be directed towards buying back $FXS from the open market.

A rough calculation of $300m frxETH earns 5% ($15m) in staking rewards which generates 8% fees for FXS buy backs = £1.2m annually.

The use of fees to buy back tokens should act as positive market force but only if frxETH can scale up and become a significant player in the liquid staking sub sector.

Conclusion

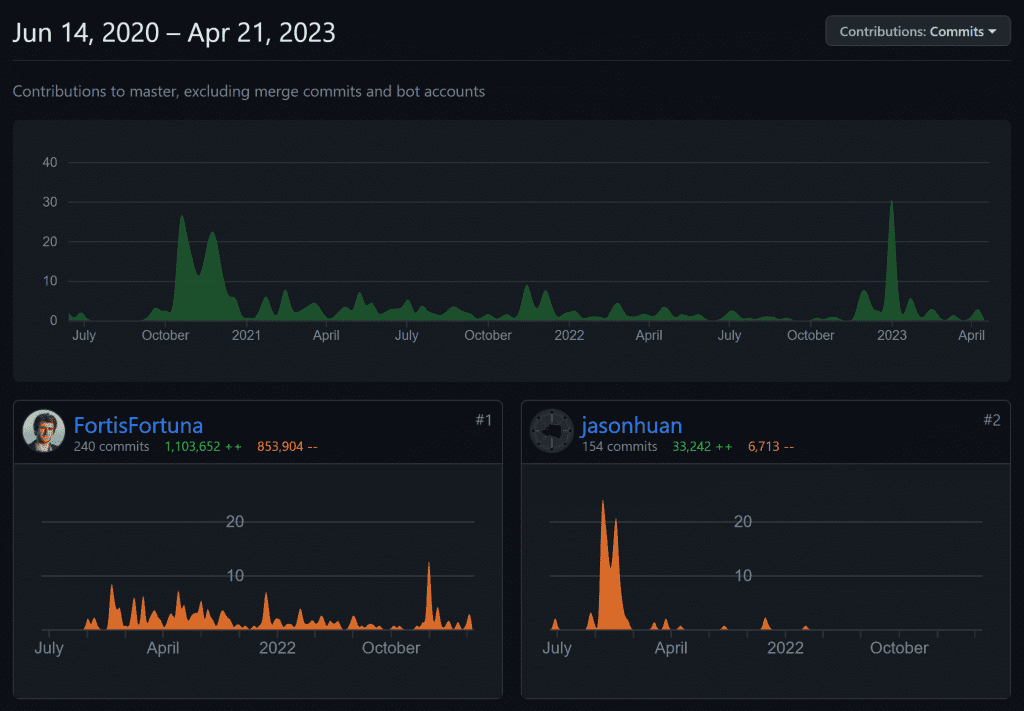

Frax continues to impress with it’s launch of new products and building an entire ecosystem of DeFi products.

FortisFortuna is CTO and seems to be the most active developer and a investment in FRAX is perhaps an investment in their continued development of new products to capture market share and attention.

FXS will benefit directly if sfrxETH can scale up and compete with the likes of Lido Finance and Rocketpool. While the $300m TVL currently only generates $1.2m in fee buybacks if this scaled 10x it would become a significant market force and long-term catalyst for price appreciation.

One to watch…