FTX 2.0 is a proposed relaunch of the cryptocurrency exchange FTX.com, which filed for bankruptcy in November 2022.

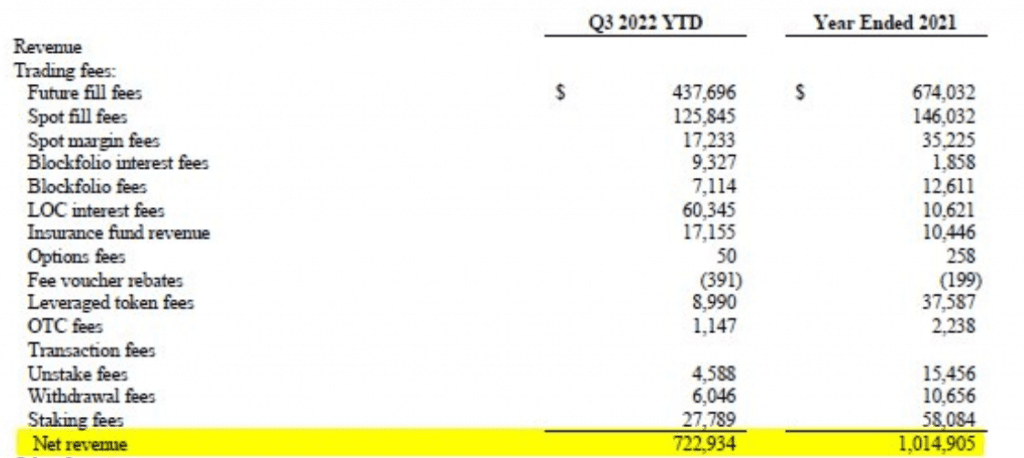

The FTX exchange was a profitable business, earning a small percentage from trading fees. However depositors funds were used to cover up losses from partner trading firm Alameda Research. Alameda also provided market maker services across all FTX markets and it remains to be seen if it would be possible to restart without that liquidity.

As of April, it was reported that FTX had recovered $7.3 billion USD in digital assets and the sale of portfolio companies.

It has been suggested that a relaunch may take place as early as the second quarter of 2024 however this seems very ambitious considering the legal and technical hurdles.

For the relaunch to happen the new CEO John Ray III would need to rebuild trust and demand for the exchange while satisfying creditors, lawyers and regulators. The technical requirements are significant as well and it’s not like they can just flick a switch, as care would need to be taken to ensure safe custody of assets and sufficient liquidity is in place.

The exchange tech, brand and domain will likely be auctioned off to the highest bidder. It would then be up to a 3rd party to decide how to take it forwards. A large crypto native fund, VC or a firm who is already carrying out market maker activities could be a good fit.

The exchange could then be funded by a combination of private investment and debt financing. The details of this are yet to be made public but potentially with new management and a well known, all be it tarnished, brand it’s likely some investors would be interested.

The exchange would need to repay its creditors in full either prior to relaunch or making a comprehensive and agreeable plan to do so at a point in the future. Note that these processes can take years, as we have seen with the MtGox reimbursement.

There is a claims portal at https://claims.ftx.com which is still under development but should go live shortly.

“This site will serve as the Debtors’ Customer Claims Portal which will be launched once the Court Order is signed related to the Motion on or around July 3, 2023”

For the exchange to reopen it would need to start accepting deposits of customers funds. This might be made more palatable by using a 3rd party trusted custodian.

Technically it will be no small feat to relaunch as the code was complex and the original developers will be long gone. There was also issues with hacks and backdoors in the final days of the exchange collapse. Most likely the frontend code would be reusable but the backend would need to be completely overhauled and rewritten which would take months and a talented team.

FTX was popular because it had markets for a vast selection of assets. This was possible because Alameda actively provided liquidity and market maker services for those pairs. It would not be possible to relaunch with the same quantity of digital assets and the exchange may be better off starting out with a smaller selection of assets that 3rd party market makers are comfortable quoting initially.

The trading fee structure on FTX was unsustainable with almost everyone doing serious volume on the exchange would get rebates rather than actually paying fees. This would need to be overhauled to make it competitive but viable.

FTX had 1.2m creditors and some prominent names in the space have publicly supported the potential relaunch including:

- @loomdart loomdart – (FTX 2.0 Advocate)

- @sunil_trades Sunil (FTX 2.0 Champion)

- @AFTXcreditor FTX 2.0 Coalition

Until it’s demise FTX was the leading destination for traders looking to take positions on crypto perpetual futures contracts. The platform was “built by traders, for traders” and there is still product market fit for this. However it will be an uphill battle for stakeholders to relaunch a successful exchange due to the legal and technical challenges. If there is any possibility in it’s success then it should be attempted as a digital asset trading platform could become a trillion dollar business in the future.

This would obviously need to be undertaken with new management and trusted parties with the utmost focus placed on transparency.