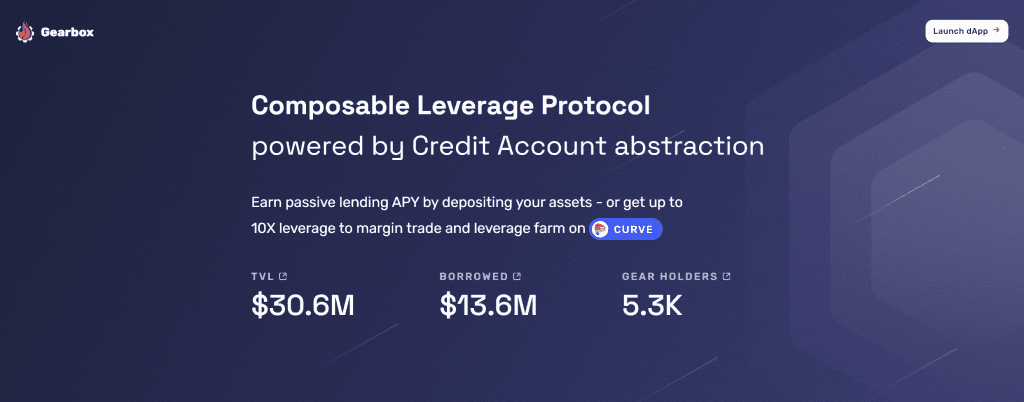

Gearbox Protocol introduces a framework for both passive lenders and active borrowers. It empowers traders with leverage that can be used to scale up trades and yield farming strategies on decentralized exchanges such as Unsiswap and Curve.

With an emphasis on composable leverage, zero funding rates, and permissionless strategies, Gearbox Protocol is an compelling microcap with a $3m market cap.

This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to GEAR at time of writing. Do your own research, not investment advice.

Lending & Borrowing Dynamics

Gearbox offers passive lenders a low risk yield through single-sided asset lending. Active traders borrow from the protocol with liquidity available up to 10x their collateral.

The core smart contracts are Credit Accounts, which act as isolated vaults managing funds, ensuring security and enabling complex strategies. This separation assures that liquidity providers are insulated, to an extent, from direct market volatility and borrower default risks.

DeX’s such as Uniswap and Curve have captured a significant share of the spot trading volumes but leverage trading is still rare within DeFi. It would be interesting to see if it’s possible to build a trading platform on top of Gearbox contracts.

Gearbox v2

The v2 contracts were completed in 2022 and are open source, available here: https://github.com/Gearbox-protocol/core-v2/tree/main/contracts

Gearbox Protocol’s v2 iteration brings substantial enhancements:

- Multicall capabilities allow for seamless transactions

- A router ensures optimal trade and deposit routing

- Integration with prominent protocols (Curve, Yearn, Convex, Lido)

The protocol operates without proprietary trading environments, relying instead on third-party protocols for asset exchange, thereby avoiding custody risks and funding rate dependencies.

The v2 contracts have been audited by ChainSecurity, Consensys Diligence & Sigma Prime.

Fee Structure

Gearbox Protocol implements a fee model that supports operational sustainability:

- Liquidation Fee Rewards third-party liquidators and the protocol itself.

- Current liquidation fee going to the liquidator: 4%

- Current liquidation fee going to the protocol: 1.5%

- APY Spread Fee 50% – Establishes a revenue stream from the spread between lender APY and borrower rates.

Governance and Tokenomics

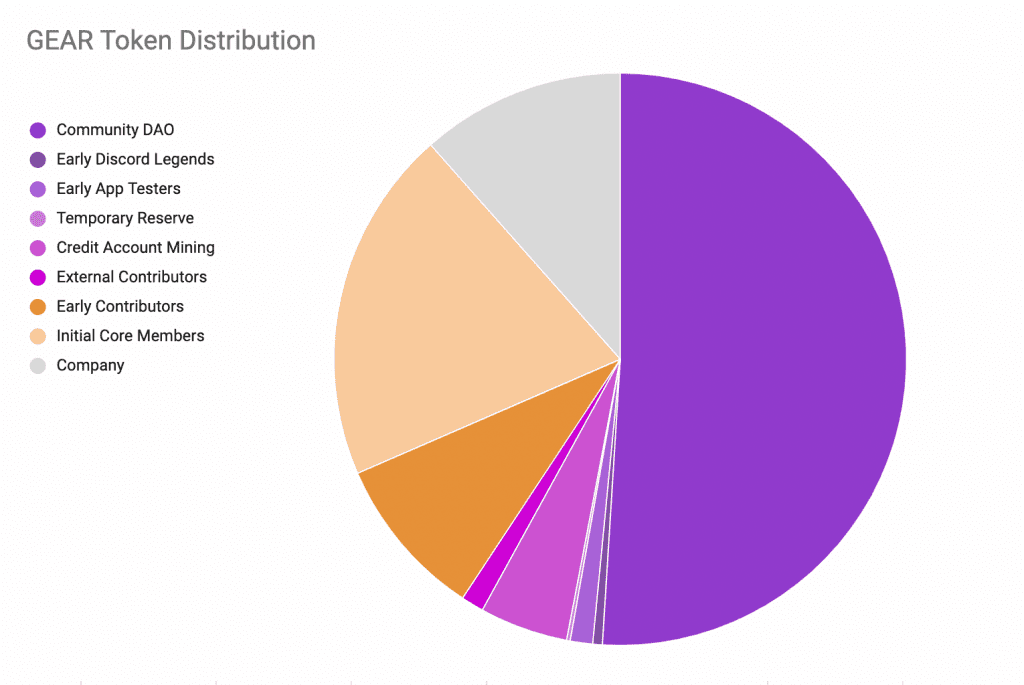

Governance operates via a DAO first approach, negating a central authority from inception. The GEAR token, capped at 10 billion, fulfills governance roles, with potential for future utility expansion. Token distribution emphasizes community and DAO treasury control, ensuring broad decentralized decision-making.

| Price @ 2023/11/04 | $0.004272 |

| Market Cap | $3.18m |

| Circulating Supply | 7.5m GEAR (7.5%) |

| Total Supply | 10B GEAR |

| Fully diluted valuation | $42.7m |

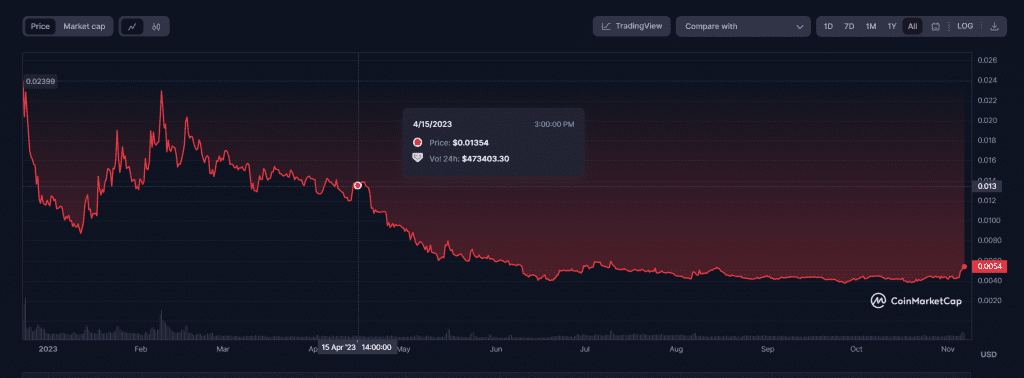

The GEAR token has had a hard time like many altcoins in the bear market. Significant potential upside if the project can gain traction with their trading platform release.

GEAR Token Distribution

- DAO Treasury Holds the majority share, with various vesting schedules and earmarked allocations for community initiatives.

- Insiders Company, initial core members and early contributors make up the significant rest of the distribution. Assumably these are the same people?

- Community Receives the largest token portion, emphasizing user-centric development.

- Contributors Both core and external, are rewarded with vested tokens, aligning long-term interests.

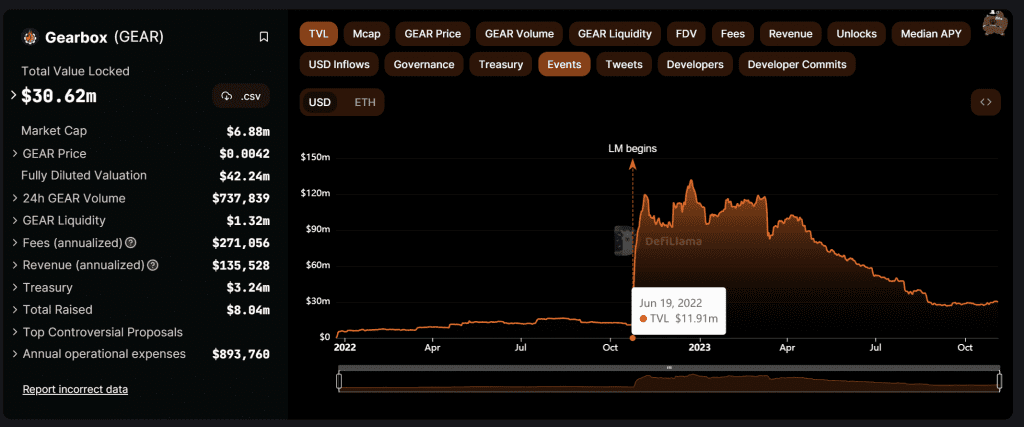

Market and Traction

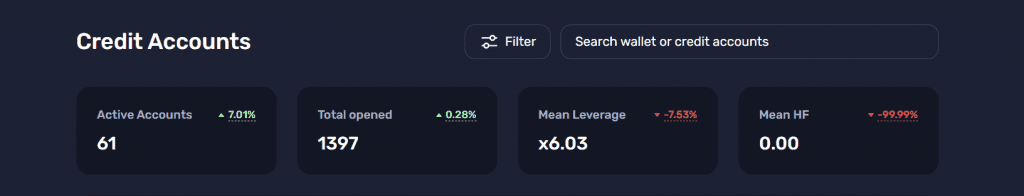

The protocol hasn’t gained significant traction to date. While margin trading on DeFi is appealing I think end users will need a trading platform frontend and perhaps additional smart contract logic on top of the GEAR lending systems.

The project has a strong following within the crypto community. One signal metric I look at frequently is the number of people I follow that follow a particular person or account on Twitter.

I’ve been reviewing DeFi trading platforms for the last month and there are significantly more devs building trading venues than there are users trading on them at present. There’s currently just over 60 active credit accounts.

Hopefully this will change over time and Gearbox can capture some of what I expect to be a growing sub-sector over the next few years.

Conclusion

Gearbox Protocol has invested heavily in security audits by some of the top firms. I’d expect their audit bill to exceed $250k since inception. They also have a $200k bug bounty on Immunefi. With a market cap of $3m it sees like a significantly undervalued project.

The big question is can they create a viable product, generate demand and grow TVL. If the answer to that question is anything other than an absolute no then it’s probably +EV. The bigger question is what are the chances that this outperforms a staked Ethereum position over a holding term?

I’m quite interested in the GEAR token but timing is awkward because there is a significant unlock in December 2023 and a smaller one in June 2024. There is a list of addresses which will receive the distribution here: https://docs.google.com/spreadsheets/d/1udMZbVffB2anCKlrL90ZbcuHzuILkSkcTZbg1u-bUiE/edit#gid=743142986

I had a look at the Vesting.sol contract @ 0xEF686707193AF7406f40CBd7A39ba309Da5aD4Ec

Started + Cliff Duration = Unlock Timestamp

1639590673 + 31536000 = 1671126673

So the cliff ended on April 15th 2023 which if we look at a chart seemed to have a significant price impact over the next few months accelerating the sell off.

I plan to monitor the situation over the next few months and keep it on the shopping list in case there is a buying opportunity. Much will depend on market conditions and external factors I expect.