Hop Exchange is a bridging protocol that facilitates cross-chain token transfers by utilizing a network of bonders. I first heard it mentioned in a keynote by Vitalik at ethGlobal Waterloo.

This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to Hop Exchange. Do your own research, not investment advice.

How Hop Exchange Works

This is a high level overview of how the Hop Exchange works when a user executes a cross-chain swap.

- Users begin by depositing their tokens into Hop’s smart contract on the source chain which records the amount of tokens and the destination address.

- Bonders run nodes locally to verify the state transitions on the source chain are accurate. Once they verify the transaction, they ‘bond’ it. During bonding, Bonders lock-up an amount equal to 110% of the token transfer as a form of collateral.

- This collateral allows them to mint equivalent hTokens on the destination chain, which are sent to the user almost instantly. hTokens are simply placeholders used by Hop Exchange. Users on the destination chain can convert these hTokens back to the original tokens they transferred.

- The Bonders then unlock their collateral after a 24 hour period, during which any discrepancies can be flagged and if any are found, the collateral is forfeited by the Bonder.

Hop Exchange has a built-in liquidity balancing mechanism. When there’s an imbalance of transfers between two chains, arbitrageurs are incentivized to bridge in the opposite direction, thereby automatically rebalancing the liquidity.

Hop Exchange employs a ‘Hub-and-Spoke’ model, with Ethereum as the hub and every other scaling solution as spoke. By routing everything through Ethereum, Hop can effectively bridge between any two chains.

In the unlikely occasion that all Bonders go offline, users can still withdraw their tokens once the blockchain processes and validates their transactions. This means, users’ funds are not at risk even if Bonders are unavailable.

How To Use Hop Exchange

The UI is familiar with a Uniswap-esque style frontend. I do wonder if Uniswap missed a trick in their launch plans for v4 with a router that executed cross-chain swaps.

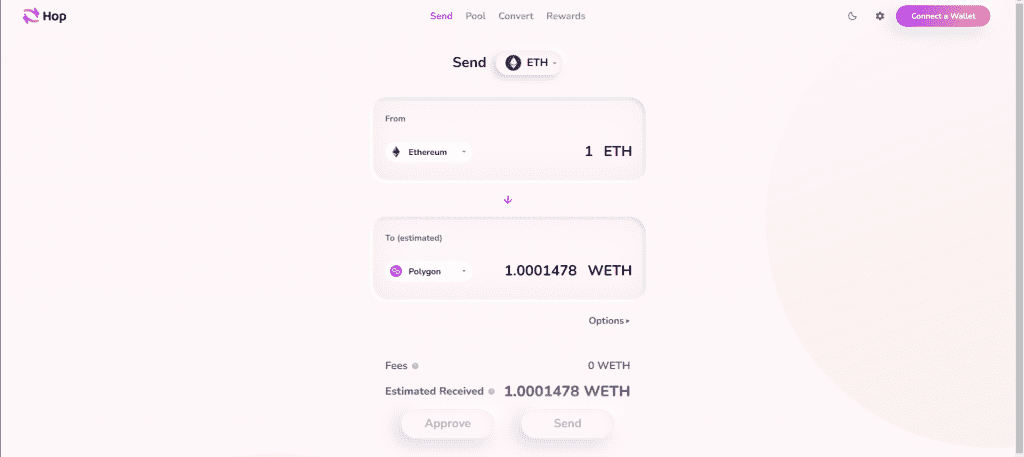

Step 1: Set Up Transaction

On the Hop interface, you’ll see options to select the ‘send’ feature, choose your desired token, specify the current and target chains, and input the quantity of tokens you’re transferring.

Step 2: Authorize Spend

If you’re using Hop for the first time with a certain asset, you need to approve the spend on the token. This means giving the permission to Hop’s smart contracts to take your tokens.

Step 3: Send Funds

Once you’ve authorized the tokens, hit the ‘send’ button to start the transfer. A modal window will be displayed showing the progress of your transaction.

Both the source and destination chains will be marked with a check mark once the transfer is complete. You can close the modal window at any point, it will not affect the transfer process.

HOP Tokenomics

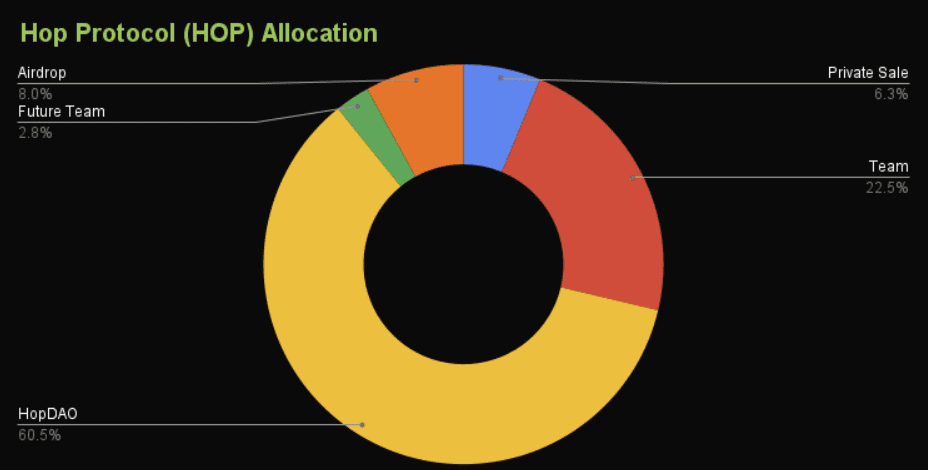

There are 64m Hop tokens in circulation out of a 1B total supply. The token price at time of writing is $0.05766 with a market cap of $3.6m. It’s had a bit of a rough time in the bear market down from it’s peak above $0.25

The HopDAO holds over 60% of the supply with the team holding a further 22.5%

The team and private sale have a 3 year vesting schedule with 1 year cliff from June 2022. This suggests a significant quantity of tokens will be coming into circulation over the next few years which could add to selling pressure on exchange.

Two funding rounds have taken place, both for roughly $1m USD. The first was lead by Coinbase Ventures in 2020 with an average price of $0.006, the second in January 2021 was mainly angel investors, including Stani from Aave, with an average price of $0.075.

There is the potential for cross-chain bridges to generate significant fee revenues however no market leader has yet emerged. Over the long term I would expect two factors to come into play which could negatively affect the HOP value proposition.

- Uniswap launches a cross-chain router, maybe backed by an independent app chain for settlement

- Ethereum mainnet enables cross-chain communications between L2 rollups, and/or there is an official Ethereum L2 network of zk rollups from the privacy and scaling explorations team

Hop exchange is currently only the 12 largest bridge by 1 month trading volume* with Stargate leading the market in this sub-sector. If Hop can attract the Ethereum community, which it seems to be doing, build volumes and generate fees for token holders then it could do well but breaking into this competitive market will be challenging.