- The SEC & Securities Regulations

- Key Elements Of The Howey Test

- Howey Test For Digital Assets

- A Governance Token Howey Test Example

- Regulation Of Token Securities

- July 2023 Update In XRP Case

- Conclusion

The SEC & Securities Regulations

The Securities and Exchange Commission (SEC) is an independent agency of the United States federal government that is responsible for regulating securities and protecting investors. In practice they have done more to protect Wall Steet financial institutions than they have ever done for individual investors.

The SEC regulates securities through several key roles:

Gate Keeper

The SEC requires companies that offer and sell securities (including broker-dealers) to register their legal entity and those securities. This registration process involves providing detailed information about the company, its financial condition, business operations, and the securities being offered. The purpose is to ensure that investors have access to accurate and complete information before making investment decisions.

Once registered the SEC mandates that companies publicly disclose relevant information about their operations, financial condition and other aspects that may affect investment decisions. This includes regular filing of annual/quarterly reports and disclosure of significant events or material changes that may impact their business or securities.

Investigator

The SEC enforces laws and regulations that prohibit fraudulent activities in the securities markets. This includes investigating and prosecuting cases of insider trading, market manipulation, Ponzi schemes, misleading statements and other fraudulent practices that can harm investors. The SEC actively monitors the markets for suspicious activities and takes action against individuals or entities found to be engaging in fraudulent behaviour.

The SEC oversees the functioning and integrity of securities markets. This includes monitoring exchanges, alternative trading systems and other market participants to ensure fair and orderly trading. The SEC establishes rules and regulations governing the operation of these markets, including requirements for listing securities and trading practices.

Prosecutor

The organisation has the authority to take enforcement actions against individuals or companies that violate securities laws and regulations. This can involve civil actions seeking monetary penalties, injunctions, disgorgement of ill-gotten gains. In severe cases, the SEC may refer matters to the Department of Justice for criminal prosecution.

Over the last few years we have seen the SEC aggressively enter the blockchain sector with a stance of “prosecute first, provide clarity later”. This came to a head when they served a Wells Notice to US listed public company Coinbase.

“We asked the SEC for reasonable crypto rules for Americans. We got legal threats instead” *

Gary Gensler, head of the SEC, has made it clear that he wants to regulate the entire industry and have over-reaching authority to persecute whoever he sees fit. While this wont be palatable in the long run, it is the current regulatory environment that anyone operating in the industry has to work with.

Key Elements Of The Howey Test

So should you be concerned? Well that depends on what you are doing and how likely it is that you will come under the SEC’s radar. It seems likely that the SEC will target the low hanging fruit to make an example out of centralized legal entities that are operating without registration and offering services to US customers.

To deem if something is a security the SEC uses the Howey test. Let’s dive into how this works and how it has been used in the past.

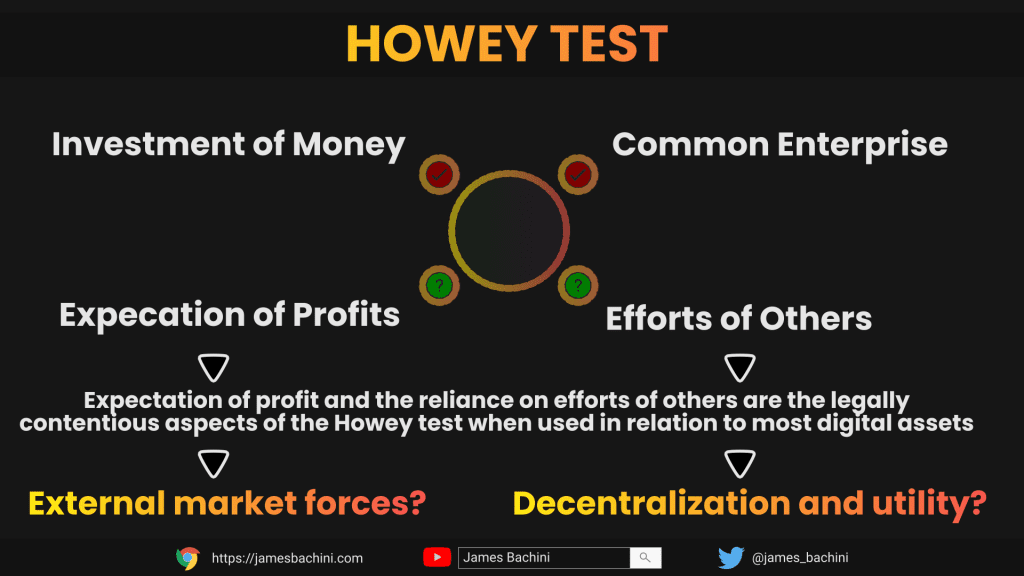

The Howey Test consists of four elements that must be met for an investment to be classified as a security:

- Investment of Money There must be an investment of money or value. This can include traditional currency, cryptocurrencies, assets, or other forms of consideration.

- Common Enterprise The investment must be in a common enterprise, meaning that investors pool their money or resources. A common enterprise typically involves a central entity or promoter that carries out significant managerial or entrepreneurial activities.

- Expectation of Profits Investors must have an expectation of profits from their investment. The expectation of profits can arise from dividends, revenue sharing, capital appreciation, or other financial benefits.

- Efforts of Others The profits expected by investors must result primarily from the efforts of others. This means that the success or failure of the investment depends predominantly on the efforts, skills, or expertise of individuals other than the investor. If the investor has substantial control or actively participates in the venture, the “efforts of others” element may not be satisfied.

If all four elements of the Howey Test are met, the investment is considered a security under U.S. securities laws.

Howey Test For Digital Assets

Generally speak the first two components of the Howey test are satisfied for digital assets. We invest funds to purchase cryptocurrency in one form or another so there is investment of money. We pool together as a community to invest in products and tokens, there is a common enterprise.

The main contentious factors are from parts 3 & 4 of the Howey test

Expectation of Profits For Digital Assets

While most of us invest in digital assets with a clear perceived expectation of future profit, not all profits are applicable to the Howey test. Price appreciation driven solely by external market forces, such as general inflation or economic trends, is not considered profit under the Howey test.

The presence of the following characteristics increases the likelihood of a reasonable expectation of profit:

- The digital asset grants holders rights to share in the enterprise’s income, profits, or capital appreciation

- Existence of a secondary trading market enabling holders to resell the digital assets and realize gains further strengthens this expectation

- The digital asset offers rights to dividends, distributions, or other forms of financial benefit

- Purchasers reasonably expect that the efforts of others will result in capital appreciation, allowing them to earn a return on their investment

- The digital asset is broadly offered to potential investors rather than being targeted exclusively to expected users of the network or those with a specific need for its functionality

- The digital asset is offered and purchased in quantities indicating investment intent, rather than quantities reflecting typical network usage which would make it a utility token

- There is little correlation between the purchase/offering price of the digital asset and the market price of the underlying goods or services it can be exchanged for

- There is little correlation between the typical trading quantities of the digital asset and the quantities a typical consumer would purchase for use or consumption

- The team has raised funds exceeding what is necessary for establishing a functional network or digital asset

- The team benefits from holding the same class of digital assets as those being distributed to the public

- Marketing the digital asset as an investment opportunity or suggesting specific returns. Communicating a expectation of future profits 🚀

Efforts of Others For Digital Assets

When determining whether a purchaser of a digital asset is relying on the efforts of others, there are two key factors to consider.

The first issue is whether the purchaser reasonably expects to rely on an Associated Person (AP).

The second issue is to assess whether the efforts in question are significant managerial efforts that impact the success or failure of the venture, rather than more routine tasks.

While none of the following characteristics are definitive, their presence strengthens the likelihood that reliance on the efforts of others exists:

- The AP is responsible for the development, improvement, operation or promotion of the network or protocol.

- Is the digital asset still in development and not fully functional at the time of the offer or sale, purchasers would reasonably expect the AP to continue developing its functionality to enhance its value.

- Essential tasks or responsibilities related to the network or digital asset are performed by the AP rather than a decentralized network community or DAO

- The AP creates or supports a market for the digital asset, influencing its price through actions like controlling its creation, limiting supply or market making with exchanges

- The AP plays a leading or central role in the ongoing development of the digital asset. This includes decisions on governance, code updates etc.

- The AP undertakes efforts to promote its own interests and enhance the value of the network or digital asset. This can be observed through retaining a stake in the digital asset or compensating the founders/team with continued supply the digital asset.

A Governance Token Howey Test Example

Let’s look at how these two legally contentious aspects of the Howey test would be implicated by a DeFi protocol governance token that returns fees to holders.

Expectations of Profits – A governance token that returns protocol fees to users or buys back shares is in it’s very nature redistributing funds to holders. There is a clear expectation of profit by purchasers of the governance token both in price appreciation of the token itself and through the fee distribution mechanism. Utility through voting rights is hard to argue as this is similar to shares/stocks which are by very definition the reason we have security regulators.

Efforts of Others – This is where decentralisation becomes very important. A truly decentralized DeFi protocol wont have a legal entity to target. It is impossible to legislate against code that lives on decentralized network. However in practice most large DeFi projects have a legal structure and entity. The entity is responsible for managing and upgrading the network and often get’s rewarded with a distribution of the governance tokens or fees to align incentives. When you purchase a governance token you in essence become a shared owner of that protocol.

Decentralization exists on a spectrum

The degree of decentralization within a protocol directly influences the level of shared ownership and the shift in expectations from relying on the efforts of others to taking responsibility for one’s own actions. In a highly decentralized protocol, where decision making power is distributed among a wide range of participants, the reliance on the efforts of others diminishes as individual token holders actively engage in shaping the future of the project. In this context, the efforts of others become less significant compared to the efforts of token holders themselves.

In cases where there is a greater centralization of control or decision-making power within the protocol, the reliance on the efforts of others becomes more prominent. Token holders may expect the entity or a select group of individuals to drive the protocol’s success through their managerial, developer and entrepreneurial efforts.

The concept of shared ownership and expectations can be influenced by various factors. For instance, the token’s governance rights and voting power can shape the extent to which token holders have a say in protocol decisions. The distribution of governance tokens and the associated incentives can also impact the level of participation and commitment from token holders.

Regulation Of Token Securities

As the DeFi landscape continues to evolve, striking a balance between legal compliance and operational security becomes an ongoing challenge for builders. While the nature of decentralization poses certain regulatory complexities, the presence of legal entities associated with DeFi protocols offers potential avenues for regulatory oversight and accountability.

If you are building something that has the potential to be widely used in DeFi and you are governing the project as a non-anonymous developer you are taking a legal risk due to regulatory uncertainty.

No legal professional can say for sure if a token is or isn’t a security, though many do take payment to put this in writing if you want it for exchange listings. If the SEC can’t make up it’s mind and offer clear guidance then what chance do the rest of us have?

The SEC will continue to push the boundaries of their reach in to the blockchain sector. They will target large centralized entities that are big players in the game. Exchanges, stablecoin issuers, staking products all seem like obvious targets.

There is some push back from the industry but with Binance withdrawing their US exchange and Coinbase looking to setup an off-shore futures exchange it doesn’t look promising from the people in the know.

Can you just ignore the US? It’s difficult because it’s such a large market. We’ve seen a migration of teams to setting up offshore companies and operating out of crypto friendly jurisdictions but this doesn’t offer protection if there is any link to US investors or infrastructure. It’s even been suggested that just accepting USD based stablecoins within a protocol can bring it under the regulatory scrutiny of the SEC.

Conclusion

For developers these are concerning times. Following the do no evil mantra, developing anonymously and reaching as far up the decentralization spectrum as possible seems sensible.

If you are operating a ponzi scheme and promoting it to US investors with guaranteed 20% APR then it’s more likely to get flagged and investigated.

It’s unlikely your anonymous pseudonym operational security is good enough to avoid American three letter agencies finding you if they really want to. By using aliases it helps devs in a number of ways discussed here, including making yourself a target for regulators.

Perhaps our best defence against unjust regulation and litigation is through true decentralization. By creating protocols that incentivise users to contribute and share in the successes and failures of a project we can break the Howey test and create legally justifiable deniability.

The Howey test will become a hot topic over the next few years as founders and regulators battle it out in courts. For blockchain developers having this understanding of the regulatory landscape will hopefully help you make better decisions which may one day become important.