Hyperliquid is a decentralized exchange that specializes in perpetual futures contracts. It’s seen modest growth through a difficult bear market and has a frontend remarkably similar to FTX. Let’s dive in.

This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to HyperLiquid at time of writing. Do your own research, not investment advice.

How HyperLiquid Works

The exchange is built on smart contracts deployed to the Hyperliquid L1 appChain. The dedicated L1 provides subsecond confirmations, fast throughput and cost effective transactions. The consensus mechanism is based on Tendermint and involves staking/slashing similar to Cosmos chains.

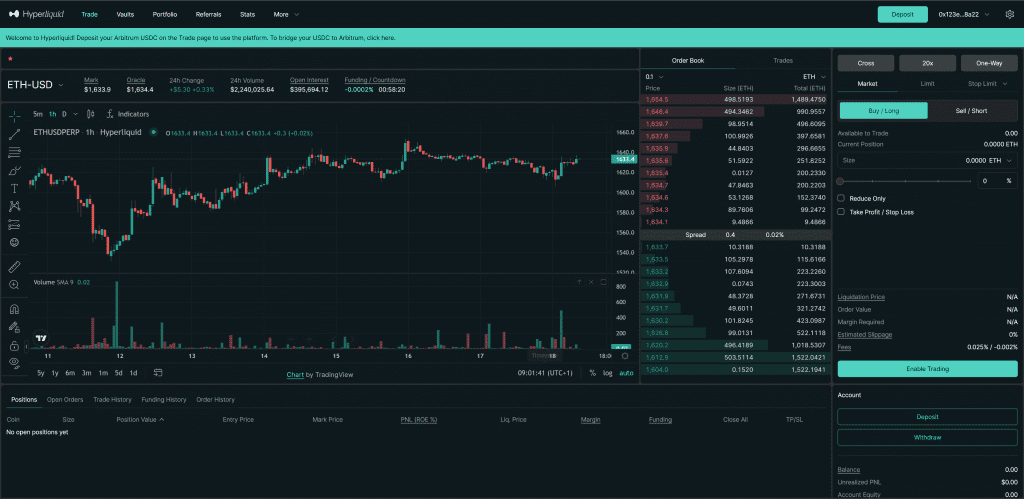

The user interface is familiar to anyone that has traded perps in the past. Deposit USDC funds into Arbitrum as collateral and you are good to go.

When an order is placed on the DEX, it is added to the orderbook and matched with any orders where there is price crossover. Margins are checked at both the opening and matching of each order to uphold risk tolerances. There is an in-house liquidation system built on a liquidity vault and insurance fund.

There are also protocol vaults which I believe works almost like a social trading platform where anyone can deposit collateral and create a vault which they use for trading, 3rd parties can deposit funds and pay a fee to the vault creator (leader) for managing their capital.

HyperLiquid Traction

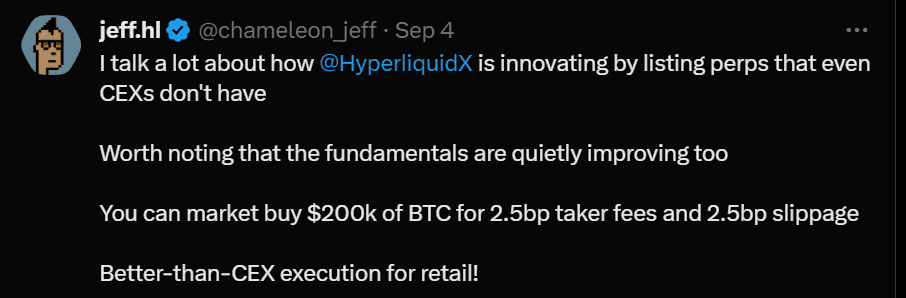

There are perpetual futures markets for around 50 markets with up to 50x leverage. There are a surprising amount of newly released tokens which is part of their value proposition.

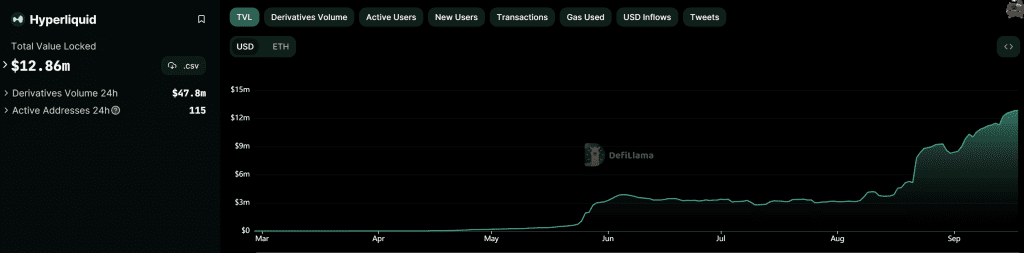

TVL while modest is seeing consistent growth which is encouraging considering the current market sentiment and difficulties in attracting users.

There is a Github repository but the contracts only have the bridging systems, I couldn’t find the main smart contracts for the perps or the frontend code. I would hope this will be open sourced in due course.

The docs suggest that an audit has been carried out by Cyfrin but again this hasn’t been published publicly. There is a hack mentioned on DeFillama dating back to June based on price manipulation.

Dev team is anon but apparently a Harvard duo who are expanding their team in the US. Being a US team I would expect there will be considerable regulatory risks and challenges ahead.

It would be an interesting protocol to do DeX arbitrage trading on. Given the listing of highly volatile assets I expect there is probably an opportunity for sophisticated traders to execute at speed for profit.